In an earlier Post regarding Communication u/s 143(1)(a) for PAN XXXxxxxxXX for the A.Y. 2017-18 we had asked readers to wait for further clarity from Income tax department as was communicated by them through their helpline number – 18001034455.

But it’s more than 10 days now and there have been NO further clarification coming from department, we thought we should start responding to Proposed adjustment u/s 143(1)(a) of Income Tax Act, 1961 Notice.

Why taxpayers are getting Notice u/s 143(1)(a)?

The Section u/s 143(1)(a) existed earlier too but has not been used extensively by tax department. What has happened this time they are sending out notices even if there is slightest mismatch between Form 16, Form 16A and Form 26AS versus the return filed.

Even for deductions u/s 80TTA which exempts interest income up to Rs 10,000 in savings bank account which mostly do no figure out in Form 16 are receiving notices. The problem is we still do NOT know what proof tax department would require for this exemption.

Download: Ultimate Tax Saving ebook with tax calculator FY 2017-18

All pensioners who do not have to submit their investment declaration u/s 80C too are receiving this notice.

Other than that salaried employees who have not submitted their investment proofs or rent receipts to their employers and claimed such deductions at the time of filing the return are getting these notices.

How to respond to Notice u/s 143(1)(a)?

The notice mentions that you should respond to the same within 30 days of receiving it. We list down steps you should follow to respond to the notice.

Step 1: Login to the efiling portal – incometaxindiaefiling.gov.in

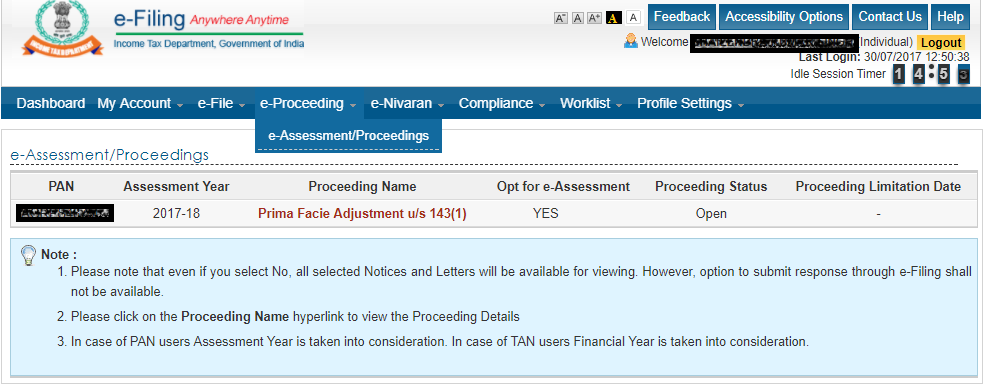

Step 2: Goto e- Proceeding > eAssessment menu

For some tax payers this section may show nothing even if they have received notice. This is because it takes 2 to 3 days for the details to appear.

This is what is visible on clicking the above menu options.

Also Read: How are your Investments Taxed?

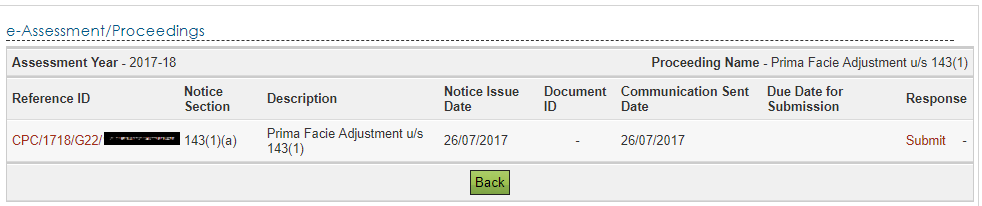

Step 3: Click on Prmia Facie Adjustment u/s 143(1)

This will open the next screen

Also Read: Best Tax Saving Investments u/s 80C

Step 4: Choose “Submit” to Direct to the next page

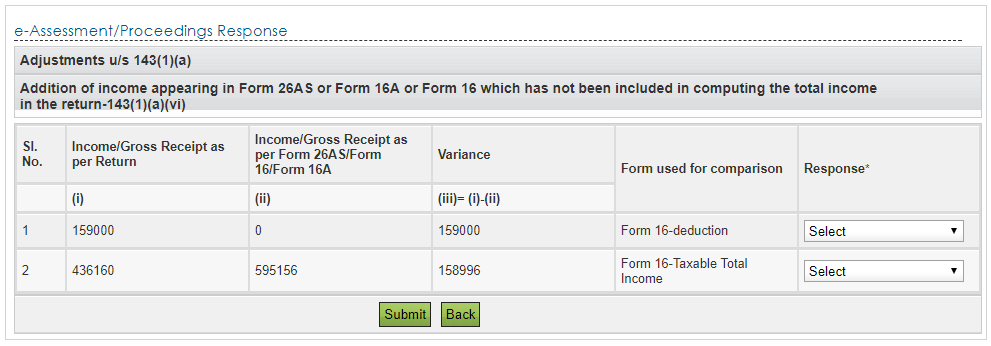

Step 5: Choose to Agree or Disagree

The details show the same details as present in the notice. Now you have to choose from “Response” – Agree or Disagree.

In case you agree which means the tax department was right in its calculation, you should submit the response and file a revised return within 15 days after paying additional taxes.

Also Read: How to file Revised Income Tax return?

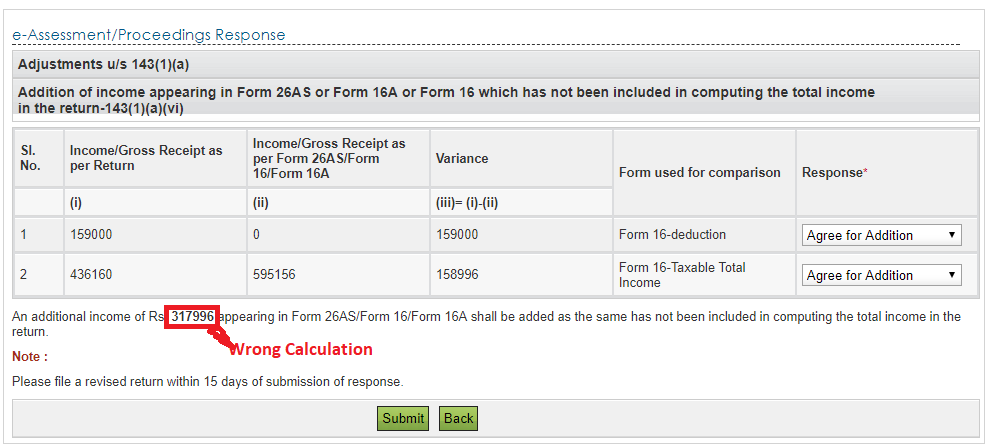

Another thing to notice is if you agree it sums up the Variance – which is a bug in the system. Both the rows question the same exemption and hence it should have shown addition of Rs 1,59,000 only (as in the above example).

Also Read: How to pay additional Self-Assessment Tax Online?

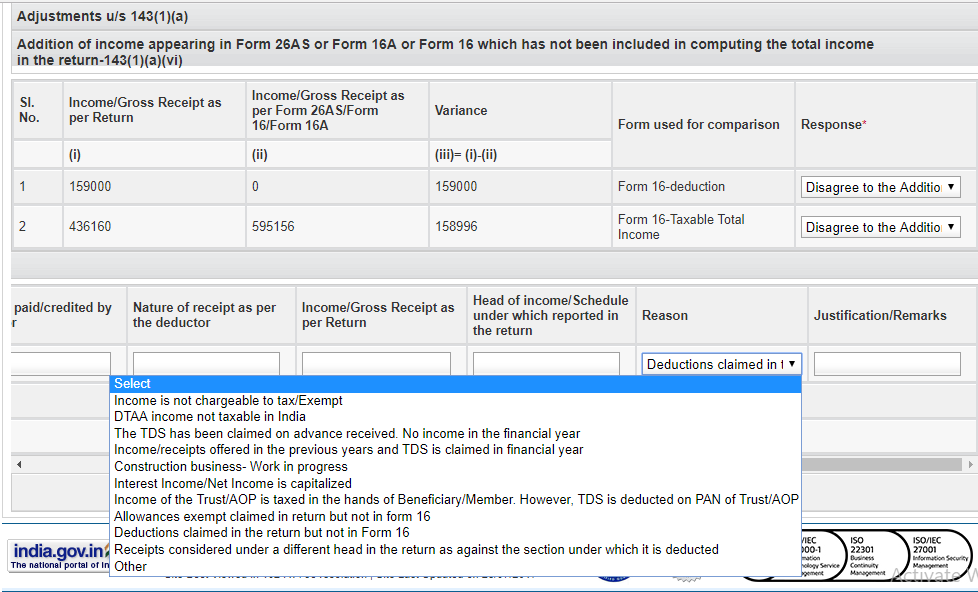

However in most cases Taxpayer would disagree to the addition. So if you respond by choosing Disagree, an additional response table opens up at the bottom asking for more details.

The Form for reply is shown below:

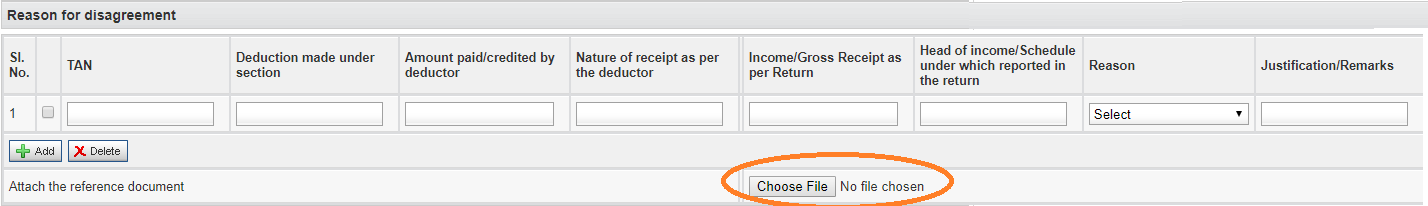

The form has the following fields. Read carefully on what needs to be filled:

TAN

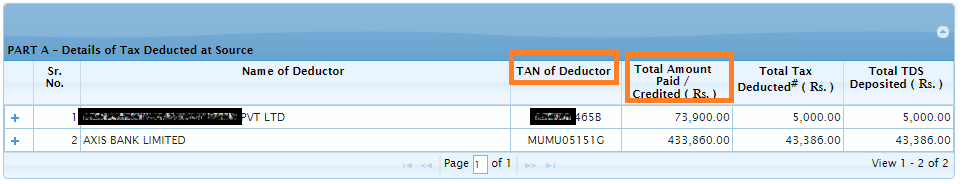

- Enter the TAN of the employer (available in the Form 16 or Form 26AS) for salary income

- If you have income from interest etc, put TAN of bank/company (available in Form 16A or Form 26AS)

Deduction made under section

- Mention 80C (for investment in PPF, Tax Saving Fixed Deposit, etc),

- 80CCD(1), 80CCD(2) or 80CCD(1B) for NPS as the case may be,

- 80TTA for taking deduction of Rs 10,000 on interest from savings account

- 10(13A) for HRA

- 80D for medical insurance

- 80E for education loan

- 80G for donation made to charity/NGOs, etc

You’ll get the complete list from the ITR form you filled

Also Read: 21 changes in Income Tax laws in FY 2017-18

Amount paid/credited by deductor

Put the amount paid – you’ll get this from Form 16 or 26AS (shown below) for salaried and Form 16A or 26AS for interest income, etc.

Nature of receipt as per the deductor

This would be any of five types of income defined by income Tax – salary (Pension is salary income), Business, Capital Gains, income from house and other income (includes interest income)

Income/Gross Receipts as per the return

Enter the amount after taking on account the above deduction.

So for the case above I would put Rs 4,36,160 (5,95,156 – 1,59,000) which was the income filed in actual tax return

Head of Income/Schedule under which reported in the return

This should be same as “Nature of receipt as per the deductor” until you have put it differently in income tax return. For e.g. Pension income should be treated as salary income but someone unknowingly has put in other income. So in this case he has to fill “Other Income”

Head of Income/Schedule under which reported in the return IS ACCEPTING ONLY NUMERIC VALUE BUT YOU SAID IT IS SAME AS NATURE OF RECEIPT. So you’ll have to put following numbers (Sections) as the case may be:

- Salary/Pension – 17

- Capital Gains – 54

- House Property – 24

- Business/Profession – 28

- Other Income (includes interest) – 56

This idea came from comment from Sagar (Thanks Sagar)!

Also I am surprised how tax department thinks all taxpayers would know these sections. If it was just 5 they should have given a drop down rather than fill numbers only!

Also Read: When and How can Tax Benefits Claimed Earlier be Reversed?

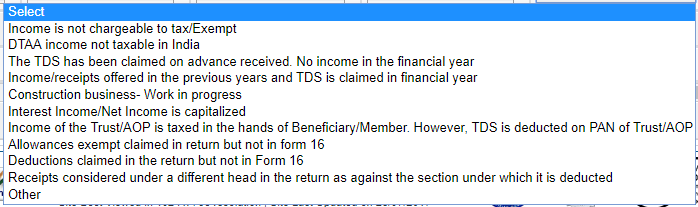

Reason

There are 10 reasons to choose from as shown below:

In case you claimed HRA which was not present in Form 16 then select reason as “Allowance exempt claimed in return but not in Form 16”

Also Read: How to claim Tax Benefit on both HRA & Home Loan?

For all deductions under chapter VIA (includes 80C, 80D, 80E, NPS related etc) which you claimed but were not part of Form 16 select “Deductions claimed in the return but not in Form 16”

In case everything was present in your Form 16 but still you got notice select “Others” and mention in Justification that the deduction already present in Form 16. Also attach the Form 16.

Justification/Remarks

Briefly state why your Allowance or deduction was not in Form 16. It could be “employer did not consider this deduction” or “investment was made after proof submission to employer” etc.

And most important DO NOT forget to attach relevant documents.

- For 80C investments you can attach the investment proof.

- For HRA you can submit rent receipt, etc.

- I am still not sure what proof to attach for 80TTA!

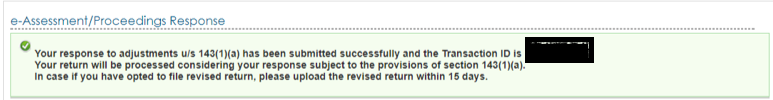

Section 143(1) Acknowledgement

After all the process is complete you get the following acknowledgement:

Disclaimer: Please remember this post is best to my understanding and I am not a tax expert. You might want to consult a qualified tax consultant or CA for your specific case!

To Conclude:

This action was initiated by income tax department as some tax payers misused the “proof not required while filing tax return” part and used to claim deductions they were not eligible for. For e.g. with more strict polices at employer end many people could not claim HRA with fake receipts as rent receipt without landlord PAN in not accepted. But they claimed while filing ITR as this is allowed. We all know there are a lot of genuine tax payers who are not able to claim HRA as landlords DO NOT share their PAN number. Also some tax payers took advantage of 80C without making actual investment.

The intent of income tax department was good – to weed out such events. But unfortunately as we have seen with mot government initiatives – the plan is good on paper but execution is very poor. Same is the case here.

Even tax helpline is NOT able to guide people and telling them to wait. Also this should be stated while filing returns and not sending a notice after that. This would badly hurt people who are not tech savvy and do not check emails frequently & this means a lot of housewives, senior citizens on pension income.

Also sending notice for Section 80TTA – deduction up to Rs 10,000 for interest earned in savings account is ridiculous because I do not understand what proof would be required for the same.

Also Read: 25 Tax Free Incomes & Investments in India

The e- Proceeding form has bugs and it adds income across rows – as shown above. The department has still not corrected these and neither sent further communication. On one hand they want more and more people to file returns by telling it’s simple and then bowl a googly by sending such notices. Hopefully the tax department is working on it and would create more awareness on how to reply to these notices or at the end its tax payer would be sufferer.

I have submitted response, last week, as you suggested. Now what….I am waiting for something to happen, but nothing seems to be moving ahead. DO you have any idea on that?

Processing takes time…. have patience!

Hello Amit,

I have purchased a flat in 2016-17 which was cost to me >50 lakhs. As per IT rules i have deducted 1% TDS and deposited the same to ITD. I have filed my ITR and got a intimation under 143(1)1(a) to add the cost of flat in my gross name. I have talked to TRACES they have also confirm that this is due to system error from TRACES end itself.

But i have to respond on e-proceeding.

Kindly advice course of action.

Would recommend you to use your employer TAN and give a response. As the comments space is not enough just frame a letter and attach it. I have seen similar questions earlier means its happening with others too and Income tax department would be aware of the same!

Hi Amit,

Need your valuable inputs to my specific but interesting queries; this info might also help others :-

I have got adjustment notice for amount 10800 – 10000 for Sec-80TTA + 800 my mistake of not declaring my correct salary of employer 1 to employer 2; now Form-16 of employer 2 shows 800 more in employer 1 income section, though Form-16 of employer 1 shows correct income.

1. Looks like IT Deptmt is only looking at my Form-16 of employer-2; In case of employer change, any idea, do they just look at the final Form-16 (what happens if that doesn’t contain previous employer incomes ? ) ?

2. My wife’s return was processed by AO without any notice though we availed 10k deduction under 80 TTA in that return as well; this is suggesting that if I file revised return adding only 800 to my income and again considering 80TTA, it might be fine this time. Do you have any such updates that IT deptmt is not sending notices now for just 80TTA or this mismatch catching mechanism is not catching all returns ?

3. If I ‘Agree to addition’ in response, and still I file revised return with only 800 additional income instead of 10800, can they still send me a notice again ? I mean is it mandatory to match the system calculated additional income in the revised return or we can use our judgement ?

Thanks,

Gaurav

1. There are a lot of tax payers who do not declare income from previous employer (in most cases deliberately to save TDS). Income tax department should have information about all Form 16/16A. Even if your new employer doe not have earlier employer income, tax payer is suppose to handle it at his end and pay taxes accordingly. If not he/she will definitely get caught!

2. As far as I know the notices were issued to salaried/pensioners due to Form 16 mismatch. However I have even heard returns getting processed even before replying to the notice. But to be on the safe side, do fill in your reply.

3. I think IT Department has got the hint and it may no more be checking for 80TTA (just my guess). So ideally you should file revised return with additional 800 and also show saving account interest and 80TTA exemption as that is the right thing to do!

hello every one..

actually deduction u/s 80TTA which proof iam submitted.. confusion.?

just you taken from the bank interest income from bank pass book or bank statement. this income is shown under other income head.

same way you can submit bank pass book or bank statement as proof for claiming deduction u/s 80TTA.

you think so many pages for interst income. but you do this for this deduction. unfortunately incometax department doesnot restrict file size which you can upload.

Dear Amit ji, I have gone through your clarification which are helping the taxpayer but still i am not agree with you and have some doubts on some point. I received the notice as i could not inform my 80 c deduction in time and this is not reflecting in my form16. the notice reads as follow.

Adjustments u/s 143(1)(a)

Addition of income appearing in Form 26AS or Form 16A or Form 16 which has not been included in computing the total income in the return-143(1)(a)(vi)

1.Sl.

No.

2. Income/Gross Receipt asper Return -150000

3. Income/Gross Receipt asper Form 26AS/Form16/Form 16A- 0

4.Variance- 150000

5.Form used for comparison Response* – form 16 deduction

in the notice as above at S.No. 2 income gross receipt as per return is 150000

I opted Disagree to the Addition then the below window option appears at S. No. 5 Income/Gross Receipt as per Return.You has advised that at S. No. 5 you enter( your Income as per form16- deduction made under 80c). Which creates doubts. In my opinion at s.No. 5 i should enter 150000 and at S.No. 3 i should enter 0 as deductor has not credited any amount of 80c in form 16. please clear my doubts so that i may file my reply. whith thanks. Brijendra Singh . Divisional engineer Telecom(Retd)

1. TAN

2.Deduction made under section

3.Amount paid/credited by

deductor

4.Nature of receipt as per

the deductor

5.Income/Gross Receipt as

per Return

6.Head of income/Schedule

under which reported in

the return

7.Reason

8.Justification/Remarks

I have suggested the particulars as per my understanding. The opinions may vary as there are NO fixed guidelines from Income tax department to fill this form. The idea is to upload income tax exemption proof which the assessing office may look in case of any doubt. SO go ahead and fill the form as you think right!

Can i file revised return even after receiving 143 intimation letter?

Just check if your return has been processes in case not you can file revised return

Thanks for your reply Amit. Return is not process as they have issued 143 intimation letter and 30 days has been given for reply. So i was thinking to revise the return instead of replying to that letter. Does it make sense?

In case you want to revise based on there findings, you should ideally agree to that and then pay taxes due and revise your returns. However even if you do file revised return without answering I don’t think there should be any issue!

i received 143 1a from IT dept.

have shown FD intrest income in other income field. TDS is deducted from bank for the same.

its present in Form 26As but not in Form 16.

How to submit this e assessment for this ?

Please help

Just give the details of bank TAN and corresponding FD

For FD interest what section needs to be entered ? as i have mentioned it in other income field.

and what about following fields :

2.Deduction made under section

3.Amount paid/credited by

deductor

4.Nature of receipt as per

the deductor

5.Income/Gross Receipt as

per Return

6.Head of income/Schedule

under which reported in

the return

FD interest income is other income for tax filing. Other fields you can pick as stated in post/comments

Could you please clarify the ITR submitted for this year is showing me my new car purchase as an income and hence a tax has to be deducted for the same. Is this correct ?

if so what is the procedure to update the correct details in ITR. Also let me know is there any FORM which i need to submit to waive of the tax or prove the TDS is already collected?

For the new car i already paid tax as TDS, so i have to pay tax again.

Please advice

I think you might have paid 1% TCS for car purchase (if it was priced > 10 lakhs). While filing return you can use this as advance tax paid. You can contact income tax department helpline and see if they can help.

I have got a same notice under section 143(1)(a) stating Addition of income appearing in Form 26AS or Form 16A or Form 16. When i checked Form 26AS i found that my saving bank account has deducted TAX for interest credited; which i didn’t mention while filing the IT return. As per my understanding IT department has received the TAX already. Now please suggest how should i respond to it?

Agree to the same and file a revised return!

Thanks Amit, shall file a revised return.

Meanwhile, there are 3 rows showing the same amount as follows:

Form 16A/16-Other Income

Form 16-Gross Total Income

Form 16-Taxable Total Income

If I agree to all the 3 rows, the amount gets added. Which row should I agree and the other 2 disagree? What should I specify for fields in “Disagree” section? Please clarify.

It does not matter if its adding up for all 3 rows. Its a computation error. Just fill the right details in your revised return!

Thank you Amit for clarifying, appreciate your timely response. Shall file accordingly.

Syndicate Bank credit Quarterly interest to S.B.a/cs on 31 March, 30 June, 30 Sept., and December. However, SBI credit Quarterly interest on 25 March, 25 June, 25 Sept., & 25 December. The logic of SBI to follow this system is not clear in the view that in India Individual tax payers as well as companies etc. Take into account incomes earned in a financial ending on 31st March.

We may approach concerned Bank to issue Interest certificate for the S.B.accounts. Interest from SBI for the period 26 to 31 March is included in the next financial year.

Interest Certificate from the Bank(s) may be uploaded for claiming deduction under section 80(TTA) while replying to CPC.

Thank you for information! I never noticed the interest credit date for SBI earlier.

My friend is a pensioner and has got notice u/s 143 1a, asking him to include his savings u/s 80C to gross income and send a revised return. The problem is that there is no provision to send his scanned documents of his savings to CPC. Since he is not tech savvy I tried to help him. Even under e-Nivaran, no file could be attached. And the employer has not even given part B of Form 16, leave alone uploading the same to be visible in Form 26AS. Can you tell me what the solution is?

You’ll have to upload the scanned or photo (through mobile) of investment proofs as stated in the post. If its difficult talk to the income tax helpline and ask what can be done!

Mr.Amit, I am a pensioner, having yearly pension of Rs.355024 and interest Income of Rs.372236. I have shown deduction of Rs.150000/- ( us/ 80c) plus Rs.60000/- (u/s 80 GG) as I am staying in a rented house,

plus Rs.10000/- (u/s 80 TTA). Above deductions were not reflected in form – 16 or 26AS.

Interest income of Rs.45966/- shown in form 26AS and pension amt. only shown in form 16 B. The notice I got under 143(1) (a) is showing a variance of Rs.220000/-

Now, please guide me whether I should split the amount of rs.220000/- and show in 3 different coloumns, in response to the notice under reference. I shall be thankful for your kind response.

_.

Yes split in 3 – one for 80C, 80TTA & 80GG each. Upload proof accordingly!

Hi Amit,

Thanks for the detailed clarifications which is only provided by you. I too have received the same notice. In my case i served in one Deptt from 01.03.2016 to 31.05.2016 and other Deptt. from 01.06.2016 to 31.03.2017. I asked the CA of the second Deptt to include my salary for the entire year in Form 16, which he did. And my first Deptt also issued Form 16 for three months (01.03.2016 to 31.05.2016).

I think the difference in amount is due to doubling of salary for first three months in Form 16 against my PAN.

How to resolve/reply for this. Kindly advise..

Just upload both the Form 16 and put details of 2nd department.

Hi , this is how i replied to a 143 (1) (a) tax mail.

TAN : Company TAN #

Deduction made under Section : 192 ( This is the # mentioned under your 26AS form ) under TDS for Salary

Amount paid by deductor : Tax deducted and paid by the company to the Tax Dept ( Form 16)

Nature of Receipt by the deductor : Tax deduction from Salary

Income/Gross Receipt as per return: Amount i reported as final ( after deduction of my investment i was not able to

submit to the company during the submission period)

Head of Income/Schedule under whichreported in the Return : 5a ( 5a = 80C – its in the ITR1 excel sheet)

Reason: Deduction claimed in Return but not in form 16

Reason Explanation: Put more details on the same.

Attached : the investment pdf file

I got the acknowledgement , Lets hope this works

Thanks for sharing

Hey Amit , an update , the refund came thru on 30th Sep.

This is good news. Thanks for the updates – will surely help readers!

As per form 26as ‘Total Amount paid/credited’ (by the deductor) is not the TDS on salary it is the amount paid to employee as salary.

See in red circle : https://s27.postimg.org/4br9mt1o3/tds.jpg

The info given is this article is correct I think.

Sir

I got a notice u/s 143(1)a for proposed addition of income

Form used for comparison 16

Income as per return as per form. Proposed

Salary income- 684518. 1371436. 686918

Gross total- 692181. 1379099. 686918

Taxable income- 494520. 1181436. 686918

While as per form 16 it is 683474

I add interest 7663 and deduct 7663 u/s80 TTA

WHAT SHOULD I DO NOW ??

PLZ HELP

Reply as others have done for 80TTA. Look at post & comments

i respond to 143(1)a. and attach a pdf file of all neccessary documents,but after submitting my response when i view my response then pdf file is not there. plz anyone tell me wheather it is not attached or it is attached (but cannot seen )

I faced the same problem & was going mad for last 3-4 days. Then written a tough mail to e-filling mail id. They replied’Do not use special characters (Example :~,@,#,$,%,^,&,*.(,),”) and Double Spaces. Copy and Paste option is not allowed in “Form filling”. & It worked. I have just submitted the response.