In an earlier Post regarding Communication u/s 143(1)(a) for PAN XXXxxxxxXX for the A.Y. 2017-18 we had asked readers to wait for further clarity from Income tax department as was communicated by them through their helpline number – 18001034455.

But it’s more than 10 days now and there have been NO further clarification coming from department, we thought we should start responding to Proposed adjustment u/s 143(1)(a) of Income Tax Act, 1961 Notice.

Why taxpayers are getting Notice u/s 143(1)(a)?

The Section u/s 143(1)(a) existed earlier too but has not been used extensively by tax department. What has happened this time they are sending out notices even if there is slightest mismatch between Form 16, Form 16A and Form 26AS versus the return filed.

Even for deductions u/s 80TTA which exempts interest income up to Rs 10,000 in savings bank account which mostly do no figure out in Form 16 are receiving notices. The problem is we still do NOT know what proof tax department would require for this exemption.

Download: Ultimate Tax Saving ebook with tax calculator FY 2017-18

All pensioners who do not have to submit their investment declaration u/s 80C too are receiving this notice.

Other than that salaried employees who have not submitted their investment proofs or rent receipts to their employers and claimed such deductions at the time of filing the return are getting these notices.

How to respond to Notice u/s 143(1)(a)?

The notice mentions that you should respond to the same within 30 days of receiving it. We list down steps you should follow to respond to the notice.

Step 1: Login to the efiling portal – incometaxindiaefiling.gov.in

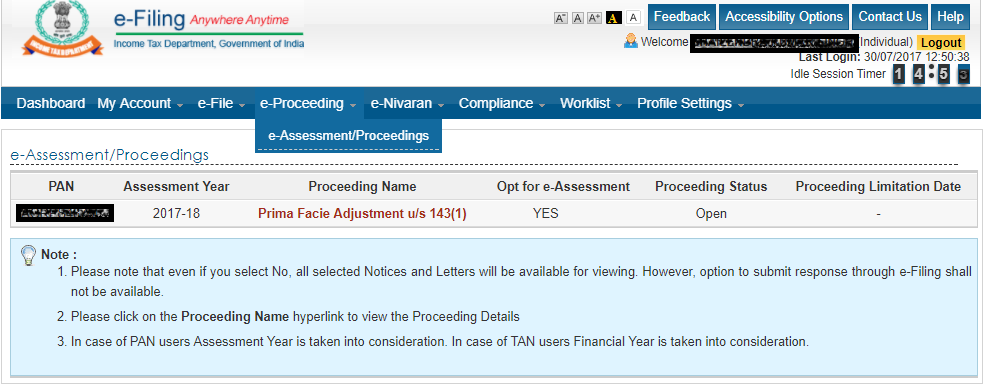

Step 2: Goto e- Proceeding > eAssessment menu

For some tax payers this section may show nothing even if they have received notice. This is because it takes 2 to 3 days for the details to appear.

This is what is visible on clicking the above menu options.

Also Read: How are your Investments Taxed?

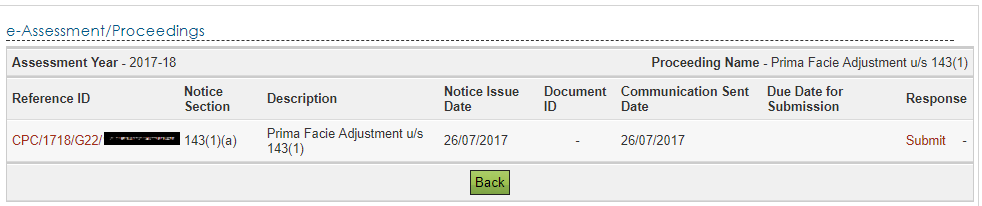

Step 3: Click on Prmia Facie Adjustment u/s 143(1)

This will open the next screen

Also Read: Best Tax Saving Investments u/s 80C

Step 4: Choose “Submit” to Direct to the next page

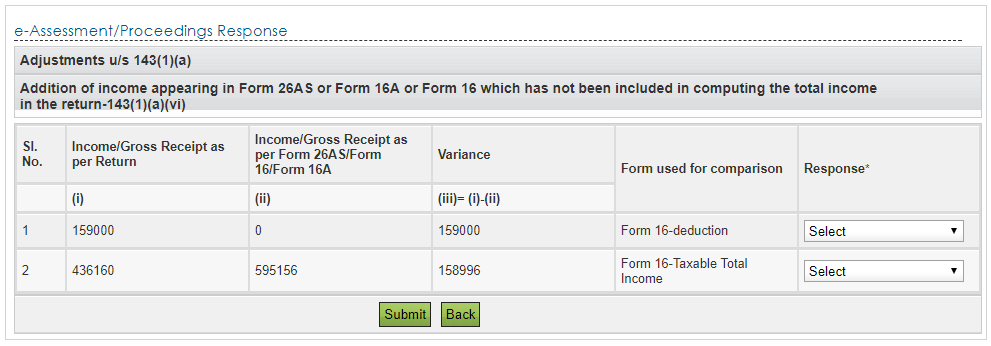

Step 5: Choose to Agree or Disagree

The details show the same details as present in the notice. Now you have to choose from “Response” – Agree or Disagree.

In case you agree which means the tax department was right in its calculation, you should submit the response and file a revised return within 15 days after paying additional taxes.

Also Read: How to file Revised Income Tax return?

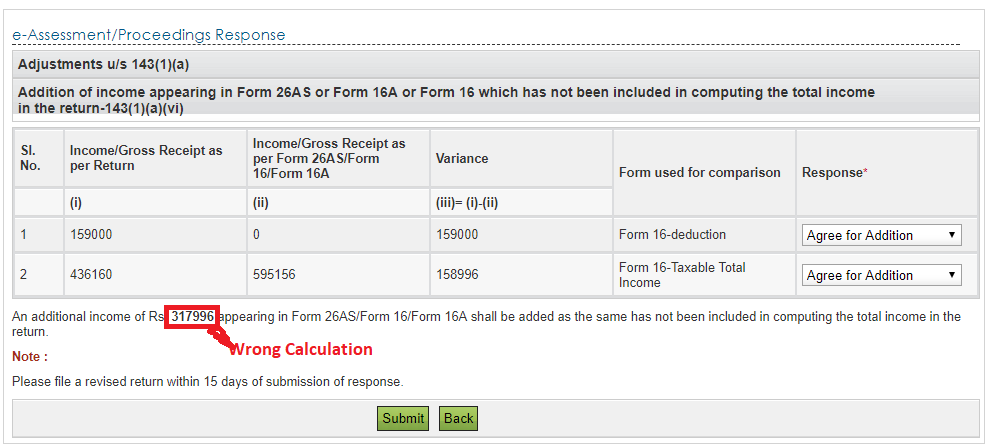

Another thing to notice is if you agree it sums up the Variance – which is a bug in the system. Both the rows question the same exemption and hence it should have shown addition of Rs 1,59,000 only (as in the above example).

Also Read: How to pay additional Self-Assessment Tax Online?

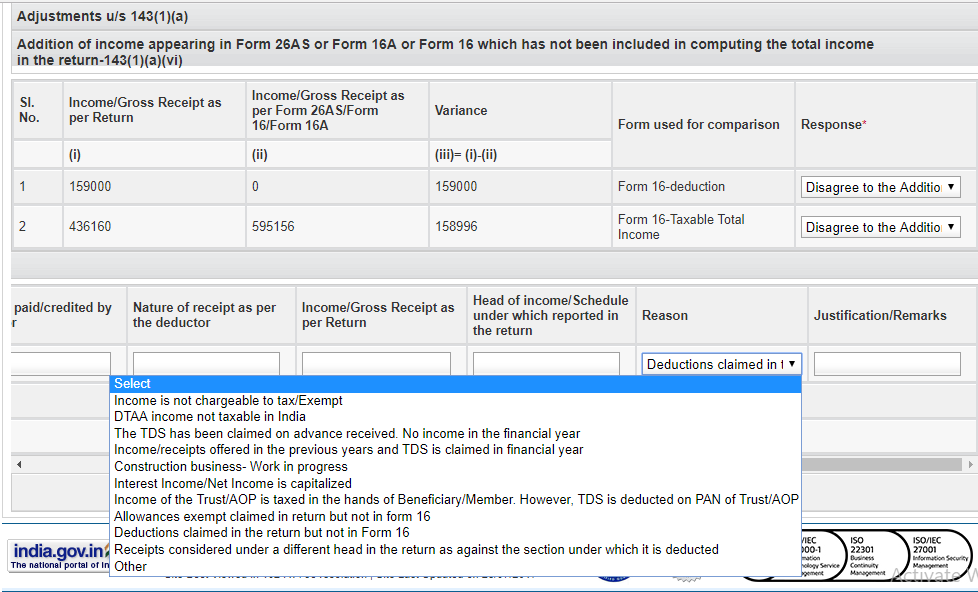

However in most cases Taxpayer would disagree to the addition. So if you respond by choosing Disagree, an additional response table opens up at the bottom asking for more details.

The Form for reply is shown below:

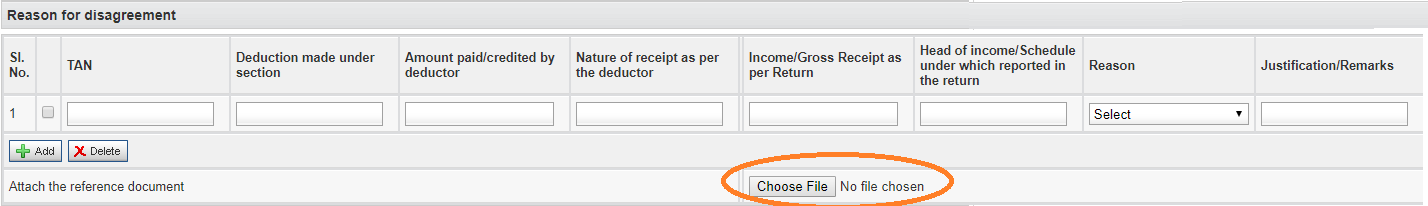

The form has the following fields. Read carefully on what needs to be filled:

TAN

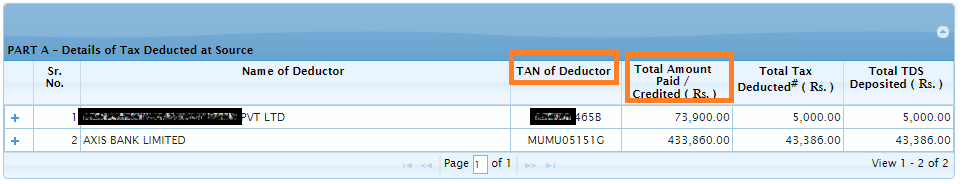

- Enter the TAN of the employer (available in the Form 16 or Form 26AS) for salary income

- If you have income from interest etc, put TAN of bank/company (available in Form 16A or Form 26AS)

Deduction made under section

- Mention 80C (for investment in PPF, Tax Saving Fixed Deposit, etc),

- 80CCD(1), 80CCD(2) or 80CCD(1B) for NPS as the case may be,

- 80TTA for taking deduction of Rs 10,000 on interest from savings account

- 10(13A) for HRA

- 80D for medical insurance

- 80E for education loan

- 80G for donation made to charity/NGOs, etc

You’ll get the complete list from the ITR form you filled

Also Read: 21 changes in Income Tax laws in FY 2017-18

Amount paid/credited by deductor

Put the amount paid – you’ll get this from Form 16 or 26AS (shown below) for salaried and Form 16A or 26AS for interest income, etc.

Nature of receipt as per the deductor

This would be any of five types of income defined by income Tax – salary (Pension is salary income), Business, Capital Gains, income from house and other income (includes interest income)

Income/Gross Receipts as per the return

Enter the amount after taking on account the above deduction.

So for the case above I would put Rs 4,36,160 (5,95,156 – 1,59,000) which was the income filed in actual tax return

Head of Income/Schedule under which reported in the return

This should be same as “Nature of receipt as per the deductor” until you have put it differently in income tax return. For e.g. Pension income should be treated as salary income but someone unknowingly has put in other income. So in this case he has to fill “Other Income”

Head of Income/Schedule under which reported in the return IS ACCEPTING ONLY NUMERIC VALUE BUT YOU SAID IT IS SAME AS NATURE OF RECEIPT. So you’ll have to put following numbers (Sections) as the case may be:

- Salary/Pension – 17

- Capital Gains – 54

- House Property – 24

- Business/Profession – 28

- Other Income (includes interest) – 56

This idea came from comment from Sagar (Thanks Sagar)!

Also I am surprised how tax department thinks all taxpayers would know these sections. If it was just 5 they should have given a drop down rather than fill numbers only!

Also Read: When and How can Tax Benefits Claimed Earlier be Reversed?

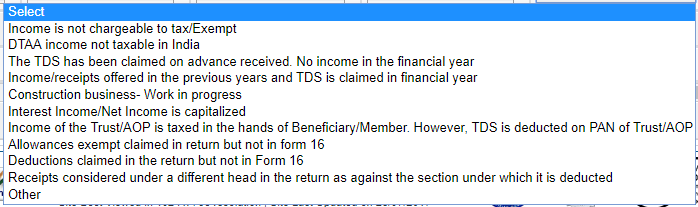

Reason

There are 10 reasons to choose from as shown below:

In case you claimed HRA which was not present in Form 16 then select reason as “Allowance exempt claimed in return but not in Form 16”

Also Read: How to claim Tax Benefit on both HRA & Home Loan?

For all deductions under chapter VIA (includes 80C, 80D, 80E, NPS related etc) which you claimed but were not part of Form 16 select “Deductions claimed in the return but not in Form 16”

In case everything was present in your Form 16 but still you got notice select “Others” and mention in Justification that the deduction already present in Form 16. Also attach the Form 16.

Justification/Remarks

Briefly state why your Allowance or deduction was not in Form 16. It could be “employer did not consider this deduction” or “investment was made after proof submission to employer” etc.

And most important DO NOT forget to attach relevant documents.

- For 80C investments you can attach the investment proof.

- For HRA you can submit rent receipt, etc.

- I am still not sure what proof to attach for 80TTA!

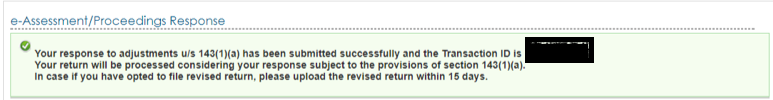

Section 143(1) Acknowledgement

After all the process is complete you get the following acknowledgement:

Disclaimer: Please remember this post is best to my understanding and I am not a tax expert. You might want to consult a qualified tax consultant or CA for your specific case!

To Conclude:

This action was initiated by income tax department as some tax payers misused the “proof not required while filing tax return” part and used to claim deductions they were not eligible for. For e.g. with more strict polices at employer end many people could not claim HRA with fake receipts as rent receipt without landlord PAN in not accepted. But they claimed while filing ITR as this is allowed. We all know there are a lot of genuine tax payers who are not able to claim HRA as landlords DO NOT share their PAN number. Also some tax payers took advantage of 80C without making actual investment.

The intent of income tax department was good – to weed out such events. But unfortunately as we have seen with mot government initiatives – the plan is good on paper but execution is very poor. Same is the case here.

Even tax helpline is NOT able to guide people and telling them to wait. Also this should be stated while filing returns and not sending a notice after that. This would badly hurt people who are not tech savvy and do not check emails frequently & this means a lot of housewives, senior citizens on pension income.

Also sending notice for Section 80TTA – deduction up to Rs 10,000 for interest earned in savings account is ridiculous because I do not understand what proof would be required for the same.

Also Read: 25 Tax Free Incomes & Investments in India

The e- Proceeding form has bugs and it adds income across rows – as shown above. The department has still not corrected these and neither sent further communication. On one hand they want more and more people to file returns by telling it’s simple and then bowl a googly by sending such notices. Hopefully the tax department is working on it and would create more awareness on how to reply to these notices or at the end its tax payer would be sufferer.

Dear Amit

Notices are being sent by IT dept u/s 143(1)(a) to salaried employees citing reason as inconsistency between salary income in ITR filed and Form 26AS. I would like to add Form 26AS states total amount paid or credited by the employer which includes allowances, perquisites etc whereas the total of salary income as asked for at the bottom of the salary Schedule S, ITR2 (pasted below) doesn’t include allowances exempt under Section 10. The ITR excel sheet doesn’t add Sno. 7 to Sno. 6 to arrive at total salary income. Even the description stated against Sno. 7 reads “Allowances exempt under section 10 (Not to be included in 6 below)”. Notices are being sent inspite of breakup of salary, allowances, perquisites etc shown in Form 16 from TRACES and issued by the employer. Perhaps this is due to auto-processing of returns by computer. Please guide how this should be responded. Should it be Disagree with reason as Other from drop down menu and attaching Form 16.

Schedule S Details of Income from Salary

Name of Employer PAN of Employer (optional)

Address of employer Town/City Pin code

State (Select)

1 Salary (Excl all exempt/ non-exempt allowances, perquisites ,profit in lieu of sal as they are shown separately below) 1

2 Allowances not exempt (refer Form 16 from employer) 2

3 Value of perquisites (refer Form 16 from employer) 3

4 Profits in lieu of salary (refer Form 16 from employer) 4

5 Deduction u/s 16 (Entertainment allowance by Government and tax on employment) 5

6 Income chargeable under the Head ‘Salaries’ (1 + 2 + 3 + 4 – 5) 6 0

7 Allowances exempt under section 10 (Not to be included in 6 below)

i Travel concession/assistance received [(sec. 10(5)] 7i

ii Tax paid by employer on non-monetary perquisite [(sec. 10(10CC)] 7ii

iii Allowance to meet expenditure incurred on house rent [(sec. 10(13A)] 7iii

iv Other allowances 7iv

Total 0

I got the notice stating there is inconsistency between salary income in return and form 26AS.

I calculated the difference and it is coming from Coveyance Allowance, Meal Voucher, HRA and Tax on employment.

When I am trying to disagree, I am able to find the option for HRA and Conveyance and HRA, but not sure where Meal Voucher and TAX on employment will go.

or do i need to get 26AS corrected ???

Do not worry as this notice has been received by several people. If you do not agree then fill the columns you get.

amit gupta ji namsakar

I have also gate notice 143 (1) a mismatch in form 16 and form 26as other income i am deside to agree with filiing revised return and i have plot registred in year 16-17 i want registry charge to put in 80c deduction but amount not mention in form 16,please guide me.

Hi Amit,

I have received intimation 143(1), i made a mistake while filing my itr that is instead of tds i filled advanced tax. what should be the next procedure to reply ?

-Nitin Harikant

Just file reply through income tax return portal and revise our returns if required.

Finally got a reply for income tax department that the refund is being processed.

Although there was mismatch in the amount of deductions I claimed and the proofs which I sent as pdf.

They’re not gonna check documents of each one of us. :p

Thats expected 🙂

Celebrate your refund

For Interest on saving Accounts (i.e. Section 80 TTA) you can attach an interest certificate taken from bank especially for this purpose.

I received a mail from Income Tax depart seeking 143 Adjustment. I missed to login and do the above elaborated procedures with the span of 30 days. Can I now send the hard copies of the proof substantiating the adjustments now?

I don’t think so. You can file revised return in case you agree with findings of IT department

My wife received notice for proposed adjustment u/s 143(1)(a) of Income Tax Act, 1961.

the date of notice communication was 26-07-2017.

I couldn’t respond to the adjustment notice within given time of 30 days due to some medical condition I didn’t check the mails.

The adjustment is for the discrepancy in the return filed and form-16. I had made some investment in last week on march 2017 and same is not reflected in form-16.

I am supposed to get some amt as return as the tax is calculated on the exempted income due to invesment I did which is not considered in form-16.

What shall I do to get the income tax processing corrected now?

You can contact the Income Tax Helpline Numbers. The other option is to file a revised return!

I am Maithili .shivaraman aged 65 years retired from bank.I filed my Itr1 form on 27.05.2017. My income is pension from bank and int on fixed deposit with bank. As I forgot to include savings bank in interest income I filed revised return on 16/07/2017.savings bank int figure of rs5880 was added in income from other sources and shown in sec tta as rs 5880. I got notice on 23.07.2017 from income tax under sec143(1)a for return filed on 27.05.2017. I had written letter to pension payingt branch to include rs 150000 deposited in ppf a/c on 01.04.2016. I forgot to mention my mediclaim premium of 40000 paid by me to debit of my a/c. some donation under sec 80g was rs1450. notice says that I have to pay tax on rs31450.00 as not mentioned in form 16 given by bank.I had mentioned under sec 80D rs 30000. in return

when my consultant went to submit response he could upload premium receipt of rs 20010.00 mediclaim.system closed. and response came in Email

my consultant has put under head of income as rs 181450 as no tutorial was acailable on 03.08.2017. I was panicky as I got notice.all columns filled wrongly as I studied your tutorial now.

In my premium receipt of rs 20010 uploaded date mentioned by bank is 20.10.2017 through oversight. what to do now.

I can not upload any other detail.

as my consultant not picking phone till 31st july I paid extra tax of 3180 rs on rs 31450 income reported by them in challan 280 by online. i mentioned under 300 self assessment rs 3180. this amt will go waste.my consultant says

he says they will send notice under sec143(1) to pay tax on rs 31450 as shown in notice under tax on regular assessment 400 in challan 280 online. all genius people whose comments are very knowledgable. I hope can throw some light in above. I am going out of india for 6 monthd on sep 20 th2017 to look after my grandchild of 2 months. int penalty all I have to pay. your site very good. my premium receipt of 11338 .00 mediclaim paid to new india assurance they have mentioned that they have received fron mrs and mr. v.i.shivaraman though I paid premium to debit of my a/c.v.i shivaraman is my husband and mediclaim for both myself and my husband. receipt mediclain co issue in name of 1st name in insurance form submitted before 10 years. all these very difficult to change as we with severe knee problems not going out can not do anything. all senior citizens staying alone face lot of problems. Income tax adding our problems. they should not harass senior citizens as mobility is not there. all on telephone we talk with consultant who never lift phone.

form 26as changes each week . that is my observation. If all wait to fill Itr return i n last week of july It causes tremondous pressure on consultants any remedy .

Hi Sir,

I filed wrong value in tax return and wanted to correct it anyway. I got a notice under 143 1(A) and meanwhile I filed revised return as well. But till now I have not replied to notice yet as I neither have to agree nor disagree since I already filed revised return.

Tomorrow is last day for response to notice.Please tell do I need and respond and what to respond?

Thanks

Thank you Amit Sir. It helped a lot regarding the reply to notice 143(1). It was typical task to a normal salaried person who was unaware of these economic things. It took me many days to search these things online and finally i got your post which was most helpful.

The e- Proceeding form has bugs and it adds income across rows – as shown above, What to do in this case ?

it add two times as my taxable income, if i agree .

What should one do when they have multiple sources of income: 1. Income from salary, 2. Income from interest on FDs and 3. Income from interest on Savings Bank Account? How should one fill the response form?

To give you the context, the deductions under 80D, 80G and 80TTA were not shared with the employer and therefore not reported on Form 16 but these have been claimed in the Return and therefore ended up as variance in Total Deductions and Total Taxable Income on 143(1)(a) communication from IT Dept.

Could you please confirm how to fill the following fields in the scenario mentioned above.

TAN:

Deduction made under Section:

Amount paid/credited by deductor:

Nature of receipt as per the deductor:

Income/Gross Receipt as per Return:

Head of Income/Schedule under which reported in the return:

Should I fill multiple rows OR mention the above mentioned deductions against just SALARY income?

You can have all the above deductions against salary. For 80TTA use savings account income.

Thanks Amit. Just to be sure I understood it right, are you saying that the response form will have 2 rows – one for salary and the other for Income from Savings Bank Account Interest?

If yes, for the 2nd row, what should I fill in the fields:

TAN:

Deduction made under Section:

Amount paid/credited by deductor:

Nature of receipt as per the deductor:

Income/Gross Receipt as per Return:

Head of Income/Schedule under which reported in the return:

if you have bank tan use that else employer tan

One of the item of notice 143(1)(A) pertains to PPF Account Interest of Rs.1,39,096 for the 2016-17, credited by SBI on 31.03.17.

I am in the process of making draft reply to this. For your comments please.

1. Sl.no.

2. TAN. DELS22720F. of SBI

3. Deduction made Section 10(11)

4. Amt paid/credited by deductor

Rs.1,39096

5. Nature of receipt as per the deductor

PPF Account Interest for 2016-17

6. Income/Gross receipt Rs.1,39,096

7. Head of income/schedule under which reported in the return

Exempt income(For reporting Purposes)

8. Reason Income is not chargeable to tax/exempt

9. Justification/remarks

Seems Ok. Go ahead and reply

I understand that there may not be any notice under 143(1)(A) in respect of Self employed Professional s(Doctors, Engineer, CAs, Tax Consultants, Architects etc.) as Form 16 (the basic document) is not applicable for them.

I have submitted my itr. But the taxable amount is about 10 lacs more in 26AS than form 16. The figures in form 26AS are erroneous. I have already requested them to get corredt the figures in 26as. Will I get the notice in lieu of such discrepancy. What I should do at present.

Just follow up to get 26AS corrected. You may receive notice but then you can reply that its an erroneous entry!