The last date for filing income tax return is fast approaching (July 31, 2019). In case you have any tax due, you need to pay the same as Self Assessment Tax. The payment can be done both online and through offline mode.

Paying Offline:

For paying offline, you need to download challan 280, fill it and submit it to the authorized bank branch with accompanying cheque.

Pay Online:

You can pay online through any of the following authorized banks:

| Allahabad Bank | Corporation Bank | Oriental Bank of Commerce |

| Andhra Bank | Dena Bank | Punjab and Sind Bank |

| Axis Bank | HDFC Bank | Punjab National Bank |

| Bank of Baroda | ICICI Bank | Syndicate Bank |

| Bank of India | IDBI Bank | UCO Bank |

| Bank of Maharashtra | Indian Bank | Union Bank of India |

| Canara Bank | Indian Overseas Bank | United Bank of India |

| Central Bank of India | Jammu & Kashmir Bank | Vijaya Bank |

[box type=”info” size=”large” style=”rounded” border=”full”]

Here are some posts which can help you with e-filing of ITR 2019:

1. 9 Most Important Changes in ITR Forms for AY 2019-20

2. Calculate your Tax liability for FY 2018-19 (AY 2019-20)

3. Download 44 page slideshow showing all tax exemptions

4. Which ITR form to fill for Tax Returns for AY 2019-20?

5. How to Claim Tax Exemptions while filing ITR?

6. Use Challan 280 to Pay Self Assessment Tax Online

7. Form 26AS – Verify Before Filing Tax Return

8. 5 Ways to e-Verify your Income Tax Returns

9. What if You DO NOT file your Returns by due Date?

10. Can I file my Last Year Tax Return?

11. Why and How to Revise Your Tax Return?

12. What does Intimation U/S 143(1) of Income Tax Act mean?

13. What happens after you file your ITR?

[/box]

Steps to Pay Self Assessment Tax Online:

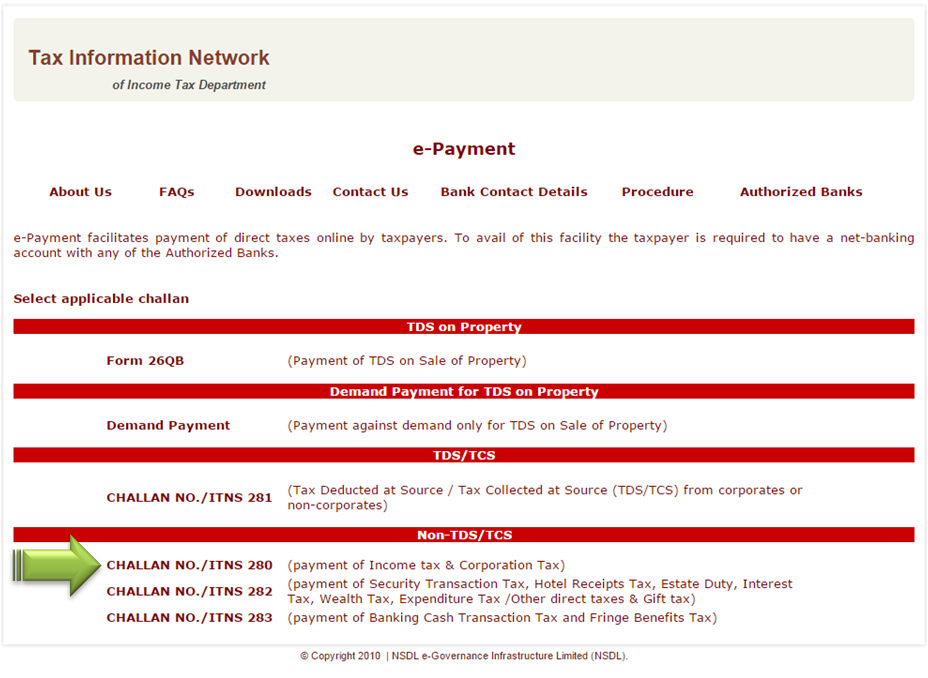

Step 1 – Go to NSDL-TIN website

Also Read: How to Reprint or Regenerate Challan 280 Receipt?

Step 2.- Select CHALLAN NO. /ITNS 280 (payment of Income tax & Corporation Tax)

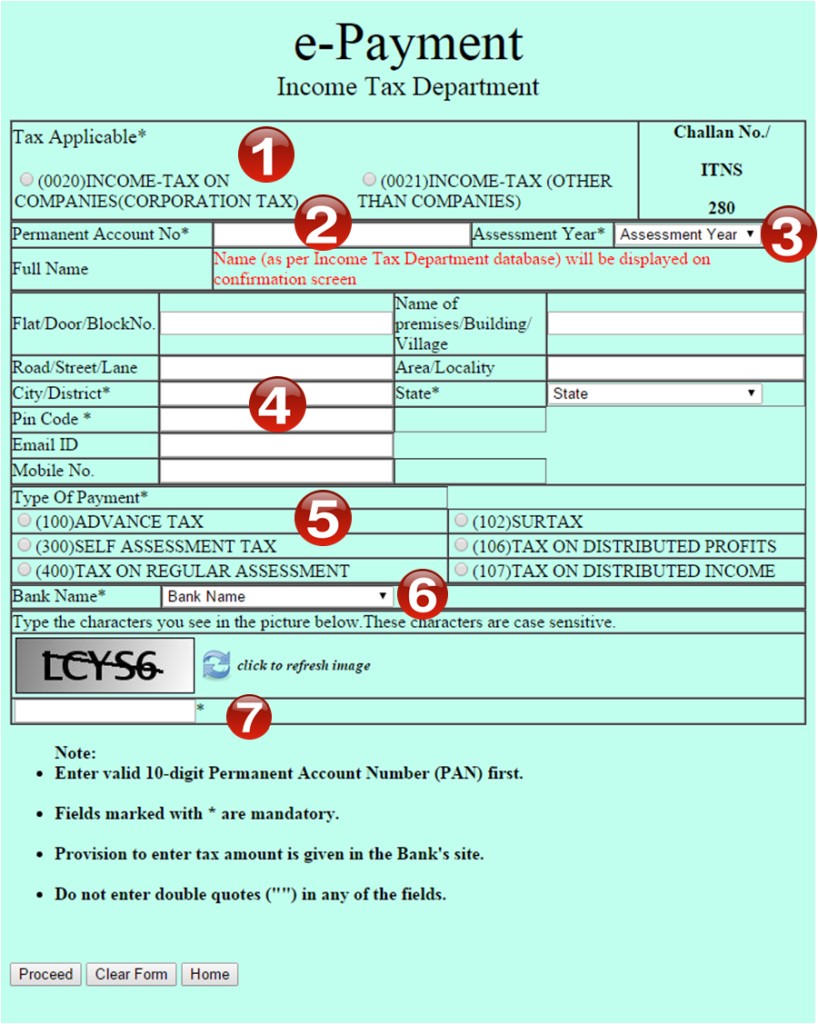

Step 3– Fill the Challan 280 as below

- Select (0021) INCOME-TAX (OTHER THAN COMPANIES) for individual tax payers

- Enter your PAN Card Number

- Select Assessment Year (2017-18) for this year tax return

- Fill up your Address, email & phone number

- Select (300) SELF ASSESSMENT TAX

- Select from List of Banks

- Fill the Captcha code and click Proceed

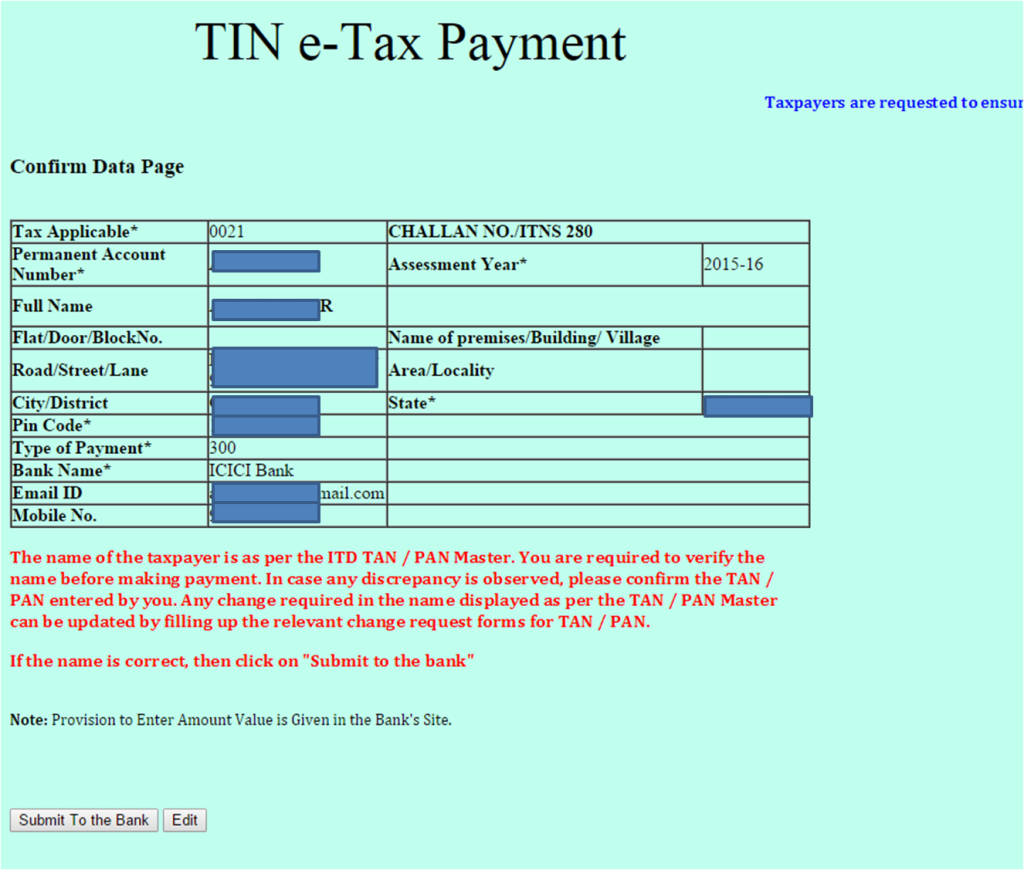

Step 4 – On the next screen Check the details you filled. In case everything is OK select “Submit to Bank” else select Edit. On Selecting Edit will take you to previous screen. On “Submit to Bank” will take to the bank’s net banking login screen.

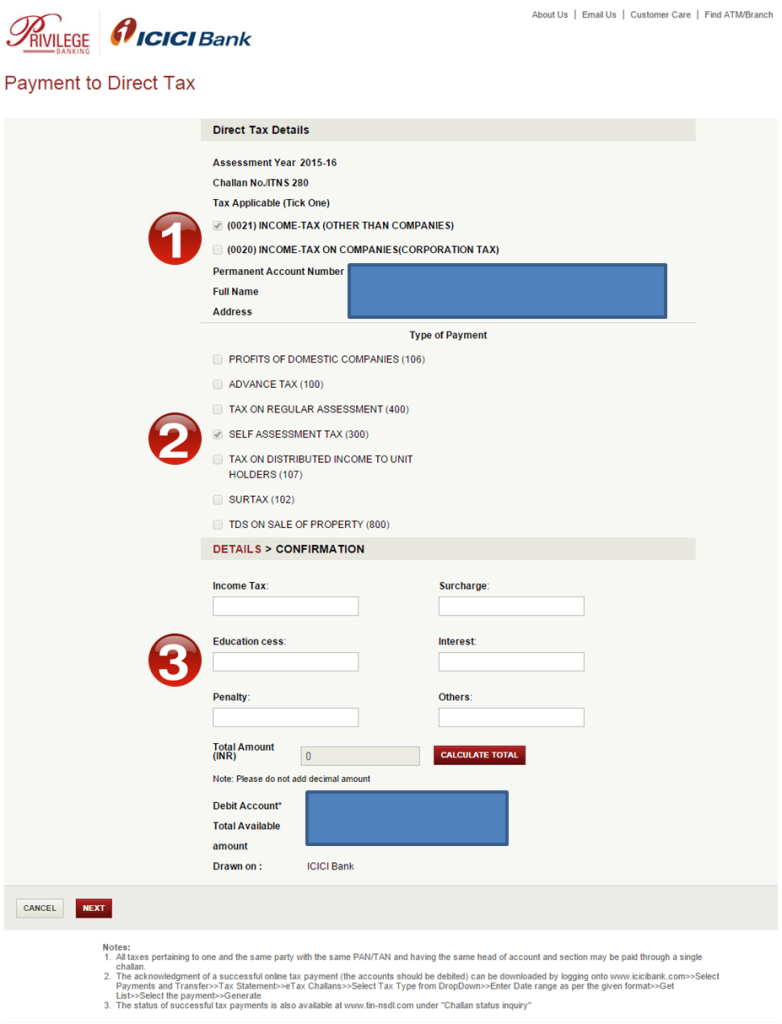

Step 5 – Login to your net banking. In the example we have shown ICICI Bank screen, it would be similar in all banks.

1/2 – Check the details already pre-filled as in the form

3 – Fill the details of the tax to be paid

- Income Tax – the amount of tax due (excluding education cess)

- Surcharge – applicable for income more than Rs 1 crore. For all others keep it as 0

- Education cess – the education cess on the above amount

- Interest – Any interest payable for late tax payment. You can keep it as 0 and add the amount in the “Income Tax” above

- Others – fill it as 0

On successful transaction, a challan counterfoil is generated. This contains CIN, payment details and bank name. You should save it as it is the proof of payment being made.

The above challan payment can be verified in “Challan Status Inquiry” at NSDL-TIN website using CIN within a week of making payment.

Very informative. Have a query – roughly calculated tax payable for AY2018-19 to be 45,000/-. TDS of about 20,000/- has been deducted so far. Should I pay 25,000/- as self-assessment tax – 300 (or, advance tax – 100) before March 31st? Thank you.

Pay as advance tax