Equity Mutual Funds are one of the best investments to generate wealth in the long run while Debt mutual funds are more suited to park money for the short term (as an alternative to fixed deposits). But as in case of any investment, the final returns are determined on the way these Mutual Funds are taxed. This post discusses tax on mutual funds for FY 2021-22 [AY 2022-23].

Types of Mutual Funds

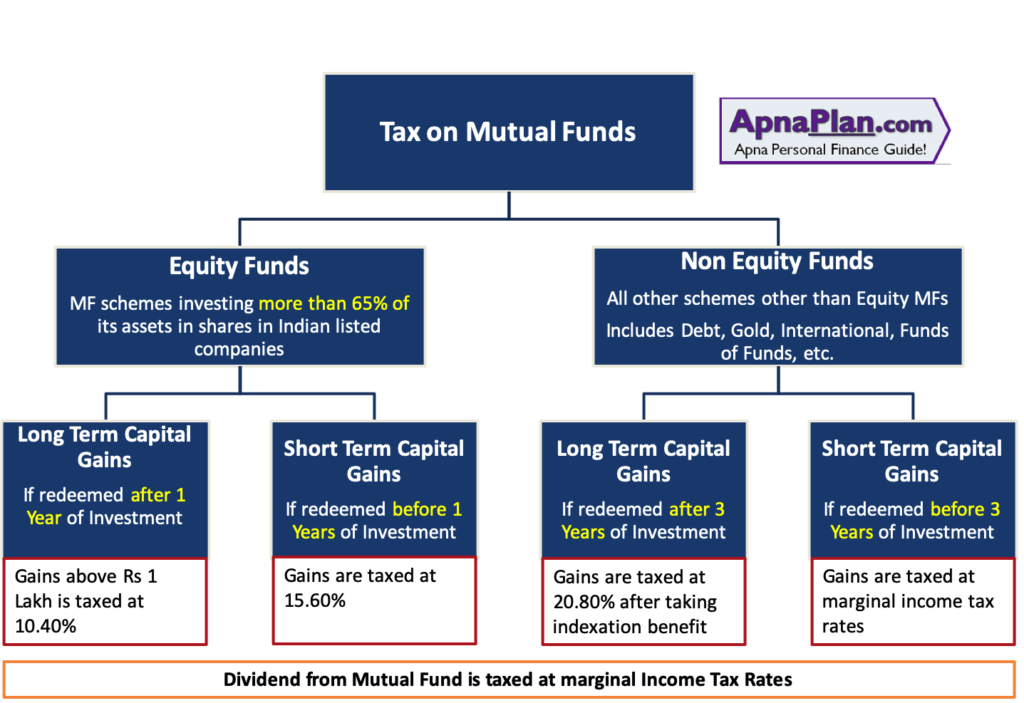

For Taxation purpose the Mutual Funds can be divided into Two categories:

- Equity Mutual Funds – Schemes investing more than 65% of its assets in shares of Indian Listed companies

- Non Equity Mutual Funds – All other Schemes which do not qualify as Equity Funds by above definition. This includes Debt Funds, International Funds of Funds, Gold Funds, Monthly Income Plans (MIP) etc

Capital Gains Tax on Mutual Funds

From tax perspective the tax on mutual funds fall under “Income from Capital Gains”. This would be useful information when you have to decide which ITR Form to use to file income tax returns.

The gains that are generated on redeeming the Mutual Fund units can be classified as Short Term or Long Term Capital Gains depending on period of holding which is different in case of equity Vs non-equity mutual Fund. We cover both types of funds one by one.

SIP Vs. Lumpsum – Which is the Best way to Invest in Mutual Fund?

There is always a debate on what is the right way to invest in Mutual Funds – SIP or lumpsum? We give you examples and situations on which of the investment method outperforms. Do read SIP Vs. Lumpsum – Which is the Best way to Invest in Mutual Fund?

Additionally Read about common myths about SIP investment in Mutual Funds

Tax on Equity Mutual Fund

Long Term Capital Gains/Losses: If the redemption of mutual fund happens after 1 year of investment, the gains or losses are classified as long term capital gains/losses in case of equity mutual fund.

Short Term Capital Gains/Losses: If the redemption of mutual fund happens with-in 1 year of investment, the gains or losses are classified as short term capital gains/losses in case of equity mutual fund.

The tax treatment on both types of capital gains are different.

Starting April 1, 2018 Long Term Capital Gains of more than Rs 1 Lakh would be taxed at the rate of 10.4% (including cess). This was introduced in Budget 2018. Until last financial year (FY 2016-17) the long term capital gains from equity funds were tax free.

There is NO complication in calculation if you purchased the fund after February 1, 2018 i.e. after Budget 2018. However if your purchase was on or before January 31, 2018 you would be eligible for grandfathering of capital gains till January 31, 2018 for calculation of long term capital gains.

Purchase price is to be considered higher of (a) and (b). (the idea is that only gains made after Jan 31 are taxable)

- Actual purchase price

- Closing NAV as on January 31, 2018

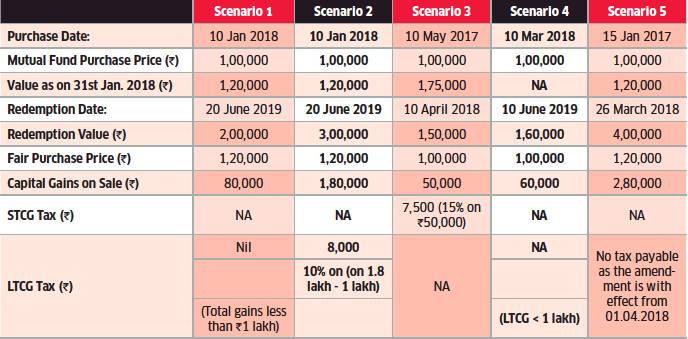

Below are different scenarios and how LTCG would be calculated:

The Short Term Capital Gains are taxed at 15.6% (including cess).

How to Pay 0 Income Tax on Salary of Rs 20+ Lakh (FY 2021-22)?

As you can see with the above income tax calculation, salary components and salary structure plays a very important role in how much income tax you pay. We have come up with some optimised salary structure using which you pay NO income tax even with CTC of more than Rs 20 Lakhs.

Tax on Non-Equity Mutual Funds (includes Debt, Liquid, International Funds, etc):

Long Term Capital Gains/Losses: If the redemption of mutual fund happens after 3 year of investment [Changed in Budget 2014], the gains or losses are classified as long term capital gains/losses in case of equity mutual fund.

Short Term Capital Gains/Losses: If the redemption of mutual fund happens with-in 3 year of investment, the gains or losses are classified as short term capital gains/losses in case of equity mutual fund.

The tax treatment on both types of capital gains are different.

Long Term Capital Gains are taxed at the rate of 20.8% (including cess) after taking indexation benefit.

The Short Term Capital Gains are added to the total income and taxed at the marginal income tax slabs.

How to generate Regular Monthly Income?

There can be several situations when we look for regular income. This is especially true for people after retirement without any pension. Also there would be new entrepreneurs who need regular income until their start-up stabilises. We tell you 13 investments which can generate regular income for you along with their pros and cons.

The info-graphic below summarizes the capital gains tax on Mutual Funds:

Tax on Mutual Funds Dividend

Budget 2020 has made dividend income taxable as income from other sources and is taxable at the applicable income tax slab. Also Mutual funds have to deduct 10% TDS (tax deduction at source) if the dividend paid is more than Rs 5,000.

Eligible person can submit Form 15G/H to the concerned mutual fund to prevent TDS.

STT on Mutual Funds

In addition to above there is 0.001% Securities Transaction Tax (STT) (changed from 0.25% from June 2013) is levied on redemption of Equity Mutual Funds irrespective of the holding period

There is no STT for non-Equity mutual Funds

Dividend Distribution Tax on Mutual Funds

The Dividend Distribution Tax (DDT) has been abolished in Budget 2020 and is effective from April 1, 2020.

How much Taxes you Need to Pay this Year? Download Our Income Tax Calculator to Know your Numbers

Do you know how much tax you need to pay for the year? Have you taken benefit of all tax saving rules and investments? Should you use the “NEW” tax regime or continue with the old one? In case you have all these questions just Download the Free Excel Income Tax Calculator for FY 2021-22 (AY 2022-23) and get your answers.

Wealth Tax on Mutual Funds

There is no Wealth Tax on Mutual Fund Investments

TDS on Mutual Funds

There is no TDS (tax Deduction at Source) for Domestic Investors on redeeming any Mutual Fund. However there is TDS of 10% for dividend payment.

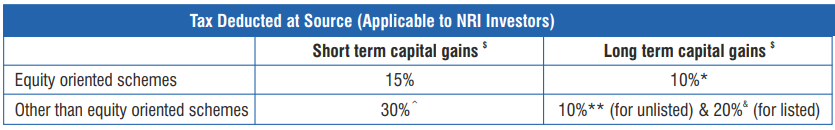

However NRI investors are subjected to TDS as follows:

We hope the post would have cleared your doubts on various taxes (like Long Term or Short Term Capital Gains Tax, Dividend Distribution Tax, STT) associated with the Equity and Debt Mutual Funds.

Tax on Mutual Funds FAQs

✅ Is there tax on mutual funds dividend?

Budget 2020 introduced tax on dividends of mutual funds. Now dividend income is taxed at your income tax marginal rates.

✅ How to Calculate Tax on Mutual Funds?

You should follow following steps to calculate tax on mutual funds:

1. Classify the fund in – equity or non-equity funds.

2. Check Investment Duration to check if the gains are short term or long term capital gains

3. Long Term capital gains are taxed as follows:

i> Equity Fund – 10.4%

ii> Non Equity Fund – 20.8%

3. Short Term capital gains are taxed as follows:

i> Equity Fund – 15.6%

ii> Non Equity Fund – as per income tax slab

✅ Is there tax on mutual funds withdrawal?

The good thing about mutual funds is – its taxed only after you withdraw it (unlike Fixed deposits). So all tax calculation explained in above section comes in effect only after you withdraw mutual fund investment.

✅ How much tax is on mutual funds?

Tax on Mutual Fund depends on type of mutual fund and duration of investment. Its as follows:

Long Term capital gains are taxed as follows:

i> Equity Fund (invested for more than a year) – 10.4%

ii> Non Equity Fund (invested for more than 3 years) – 20.8%

Short Term capital gains are taxed as follows:

i> Equity Fund (invested for less than a year) – 15.6%

ii> Non Equity Fund (invested for less than 3 years) – as per income tax slab

✅ How to pay tax on mutual funds?

There is no TDS on Mutual Fund redemption. Hence you have to calculate the tax yourself and pay it as advance tax.

Good explanation. Never thought mutual fund is so beneficial for us.

I have started investing in mutual funds through Kotak Securities website.

My mother is Pensioner and used to file ITR-1 for income tax processing. In 2015 she had invested Rs. 25000 in a equity mutual fund and redeemed it last year (October 2019) with capital gain of Rs. 1514. My question is, how should she show this Long term Capital gain (of Rs. 1514) in ITR-1? Should it be under “Other income” head or under “Exempt Income”? OR Does she need to file ITR-2 for this partly amount altogether? Note that her Net Taxable income (after exemptions) is less than 2.2 Lakhs, but needs to file return to get refund back for TDS deducted on a term deposit).

For equity mutual fund purchased after 31 Jan 2018 and sold an year after the purchase, ITR 2 Schedule 112A column 10 can not be filled. If we fill it can give wrong result in some cases. But the software insists on entering numeric value in Column 10 to Validate. What can be done?

Please show calculations for NRI’s also. In above article for resident Indians for short term capital gain on equity oriented Mutual funds is not fully correct. If taxable income is less than exempt income than short term capital gain is to be included in the income and only after the free limit is exhausted then only he is required to pay tax at 15 %. Please clarify.

Also this facility is not available for NRIs for short term inclusion in taxable income free limit for equity oriented mutual funds while for debt funds NRIs can also claim this free taxable income limit. Please confirm on this.

There are currently 16 different categories of debt funds available. The regulator has segregated the schemes based on the modified duration of the underlying portfolio, while certain categories like Credit Risk Funds and Corporate Bond Funds are defined as per the credit quality of the underlying portfolio. Mutual fund are expected to generate the best risk-reward based on the scheme’s investment mandate and in ultimate good faith of the investor.

Nice post sir…plz also guide how to calculate return/profit on mutual fund.Casr and etc if possible with examples. As we founf 1 yr return @7% and after 5 yr @24% in paytm money…Thank u for reading.

sure will try

Nice article

Dear Amit, you are doing an absolutely fantastic job. Apnaplan.com is greatly useful even for chartered accountants! I have a couple of requests. 1) If you can add a Search box on the top of the website, it will be very useful. 2) I did not find anything on Section 89 [1]. Recently, all CG employees got some arrears on account of 7th CPC and they will be greatly benefited if you can please explain how to spread the arrears over the past years and save some decent amount in tax.

A mutual fund is a pool of money collected from multiple investors and is managed by a fund manager whose aim is to make gains by investing in securities such as equity and debt. Mutual funds give individual investors access to large, professionally managed portfolios.

nice information regarding tax on mutual fund

Please envisage a scenario where there is a capital loss – both short term as well as long term.

What is the treatment of capital loss – how to calculate (whether original acquisition cost or 1st February 2018 price to be taken into account – whichever is higher).

Please give a detailed post only on capital loss part including how to calculate and how to carry forward loss, if any.

More than 2 months have passed. It is requested to give a detailed post on capital loss – both short term and long term, how to calculate, how to adjust inter se / intra long term and short term losses, if any, whether losses from one “head of income” can be adjusted against “other heads of income”, how to carry forward losses, how to calculate final capital gains tax, etc.

There are various tricky and finer aspects of capital loss which needs very detailed and point wise reply.

vERY INFORMATIVE. Thanks!

But this is all theory!

Please write an article on how to fill the SCHEDULE CG of ITR 2, specifically the columns under which to show:

1. LTCG from Debt MF

2. STCG from |Equity MF

3. STCG from debt MF.

What’s important is how to fill the ITR correctly, such that the capital gains from mf gets reflected correctly.

A complete guide on how to fill schedule CG correctly, is the need of the hour.

With live examples.

Under what columns to drop the figure of capital gains for the LTCG, STCG from both Debt and Equity MF.

tHANKS !!!!~

Thanks for your suggestion, We would cover the same in a different post.

Thanks for accepting my suggestion.

Looking forward to such post.

Plz do use pictures of the columns of Schedule CG while making your post.

That would be most helpful.

Eagerly awaiting …..l