In an earlier Post regarding Communication u/s 143(1)(a) for PAN XXXxxxxxXX for the A.Y. 2017-18 we had asked readers to wait for further clarity from Income tax department as was communicated by them through their helpline number – 18001034455.

But it’s more than 10 days now and there have been NO further clarification coming from department, we thought we should start responding to Proposed adjustment u/s 143(1)(a) of Income Tax Act, 1961 Notice.

Why taxpayers are getting Notice u/s 143(1)(a)?

The Section u/s 143(1)(a) existed earlier too but has not been used extensively by tax department. What has happened this time they are sending out notices even if there is slightest mismatch between Form 16, Form 16A and Form 26AS versus the return filed.

Even for deductions u/s 80TTA which exempts interest income up to Rs 10,000 in savings bank account which mostly do no figure out in Form 16 are receiving notices. The problem is we still do NOT know what proof tax department would require for this exemption.

Download: Ultimate Tax Saving ebook with tax calculator FY 2017-18

All pensioners who do not have to submit their investment declaration u/s 80C too are receiving this notice.

Other than that salaried employees who have not submitted their investment proofs or rent receipts to their employers and claimed such deductions at the time of filing the return are getting these notices.

How to respond to Notice u/s 143(1)(a)?

The notice mentions that you should respond to the same within 30 days of receiving it. We list down steps you should follow to respond to the notice.

Step 1: Login to the efiling portal – incometaxindiaefiling.gov.in

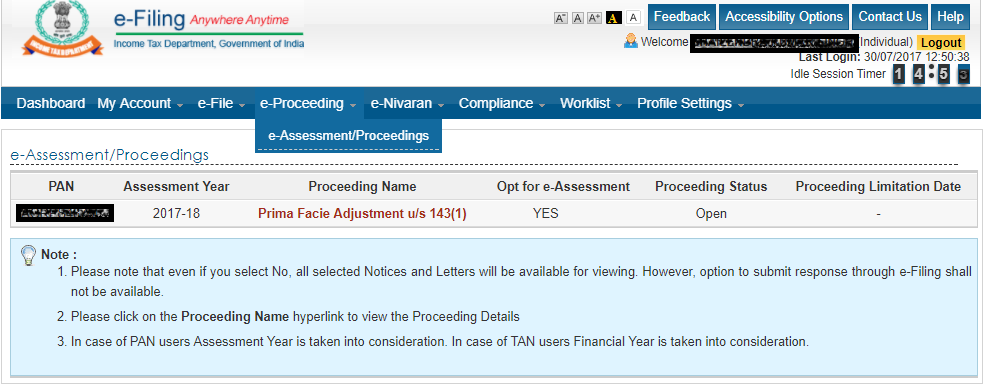

Step 2: Goto e- Proceeding > eAssessment menu

For some tax payers this section may show nothing even if they have received notice. This is because it takes 2 to 3 days for the details to appear.

This is what is visible on clicking the above menu options.

Also Read: How are your Investments Taxed?

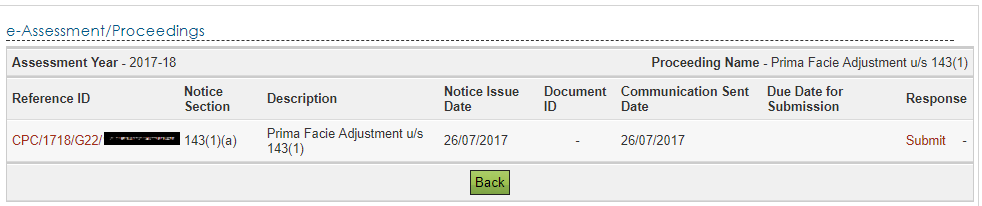

Step 3: Click on Prmia Facie Adjustment u/s 143(1)

This will open the next screen

Also Read: Best Tax Saving Investments u/s 80C

Step 4: Choose “Submit” to Direct to the next page

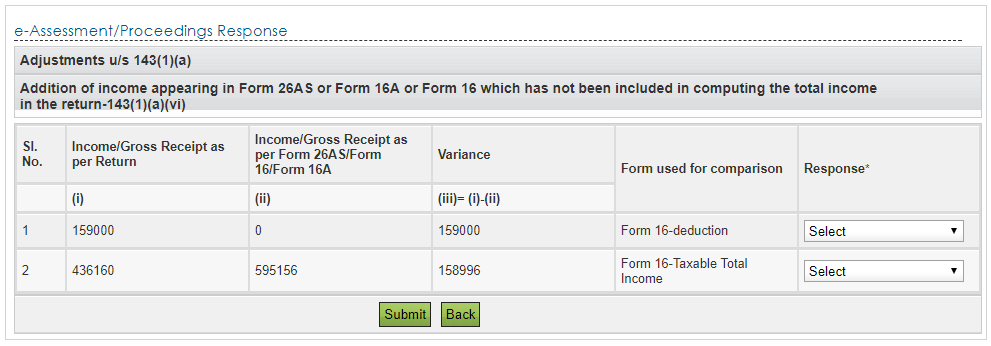

Step 5: Choose to Agree or Disagree

The details show the same details as present in the notice. Now you have to choose from “Response” – Agree or Disagree.

In case you agree which means the tax department was right in its calculation, you should submit the response and file a revised return within 15 days after paying additional taxes.

Also Read: How to file Revised Income Tax return?

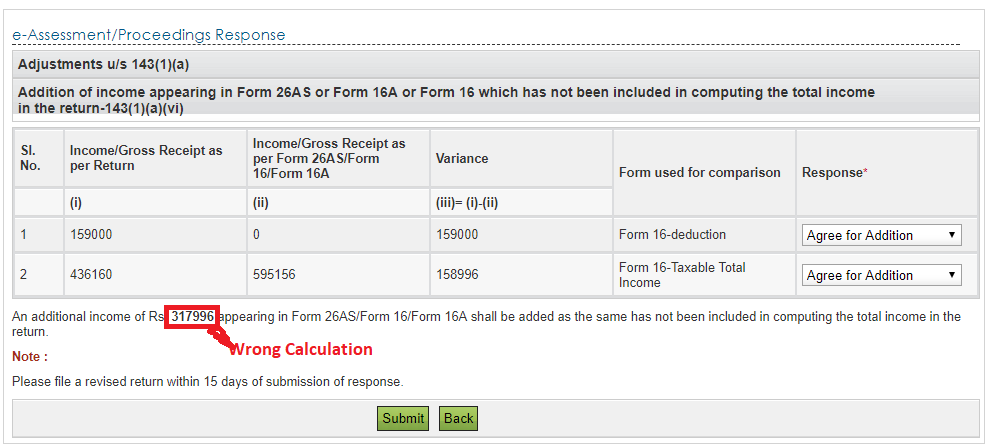

Another thing to notice is if you agree it sums up the Variance – which is a bug in the system. Both the rows question the same exemption and hence it should have shown addition of Rs 1,59,000 only (as in the above example).

Also Read: How to pay additional Self-Assessment Tax Online?

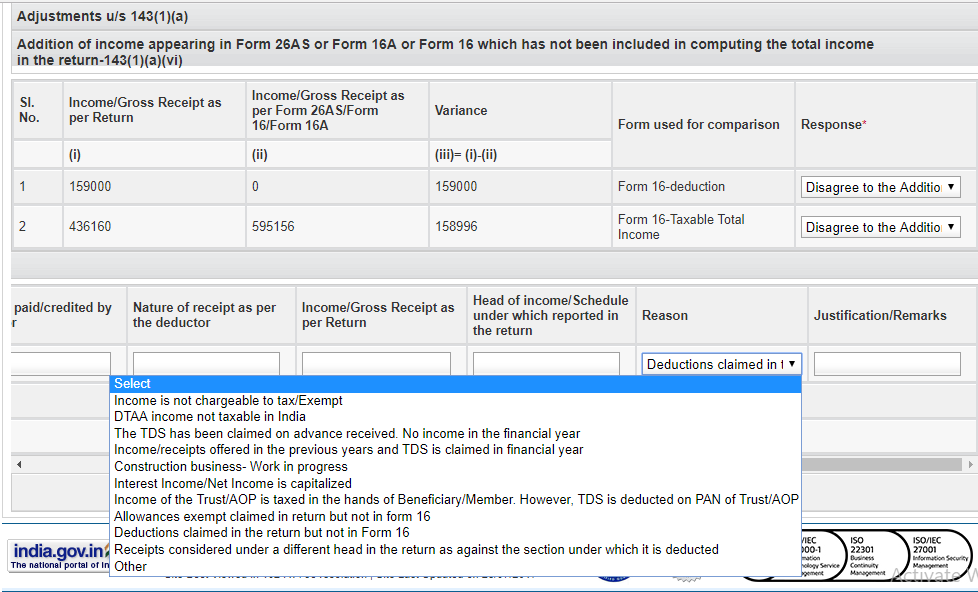

However in most cases Taxpayer would disagree to the addition. So if you respond by choosing Disagree, an additional response table opens up at the bottom asking for more details.

The Form for reply is shown below:

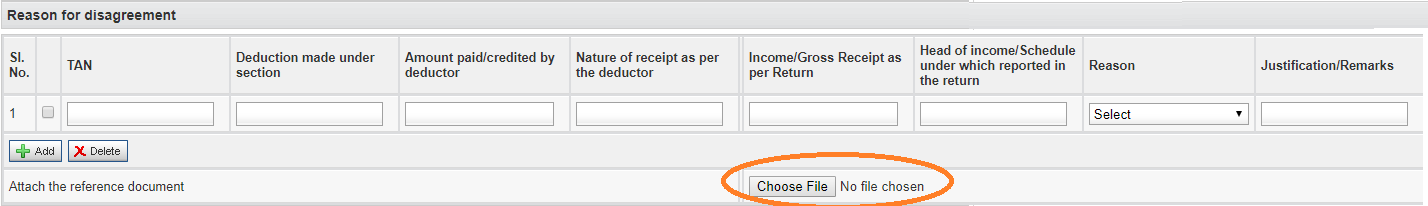

The form has the following fields. Read carefully on what needs to be filled:

TAN

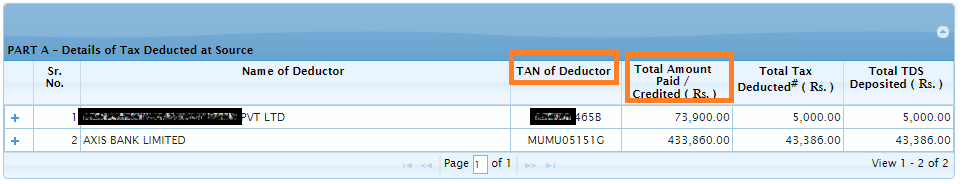

- Enter the TAN of the employer (available in the Form 16 or Form 26AS) for salary income

- If you have income from interest etc, put TAN of bank/company (available in Form 16A or Form 26AS)

Deduction made under section

- Mention 80C (for investment in PPF, Tax Saving Fixed Deposit, etc),

- 80CCD(1), 80CCD(2) or 80CCD(1B) for NPS as the case may be,

- 80TTA for taking deduction of Rs 10,000 on interest from savings account

- 10(13A) for HRA

- 80D for medical insurance

- 80E for education loan

- 80G for donation made to charity/NGOs, etc

You’ll get the complete list from the ITR form you filled

Also Read: 21 changes in Income Tax laws in FY 2017-18

Amount paid/credited by deductor

Put the amount paid – you’ll get this from Form 16 or 26AS (shown below) for salaried and Form 16A or 26AS for interest income, etc.

Nature of receipt as per the deductor

This would be any of five types of income defined by income Tax – salary (Pension is salary income), Business, Capital Gains, income from house and other income (includes interest income)

Income/Gross Receipts as per the return

Enter the amount after taking on account the above deduction.

So for the case above I would put Rs 4,36,160 (5,95,156 – 1,59,000) which was the income filed in actual tax return

Head of Income/Schedule under which reported in the return

This should be same as “Nature of receipt as per the deductor” until you have put it differently in income tax return. For e.g. Pension income should be treated as salary income but someone unknowingly has put in other income. So in this case he has to fill “Other Income”

Head of Income/Schedule under which reported in the return IS ACCEPTING ONLY NUMERIC VALUE BUT YOU SAID IT IS SAME AS NATURE OF RECEIPT. So you’ll have to put following numbers (Sections) as the case may be:

- Salary/Pension – 17

- Capital Gains – 54

- House Property – 24

- Business/Profession – 28

- Other Income (includes interest) – 56

This idea came from comment from Sagar (Thanks Sagar)!

Also I am surprised how tax department thinks all taxpayers would know these sections. If it was just 5 they should have given a drop down rather than fill numbers only!

Also Read: When and How can Tax Benefits Claimed Earlier be Reversed?

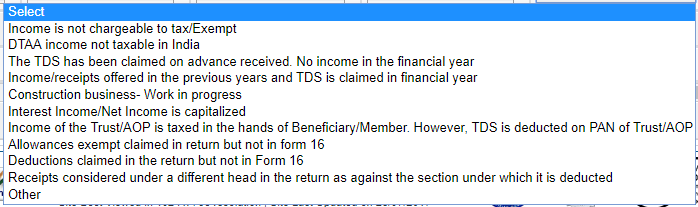

Reason

There are 10 reasons to choose from as shown below:

In case you claimed HRA which was not present in Form 16 then select reason as “Allowance exempt claimed in return but not in Form 16”

Also Read: How to claim Tax Benefit on both HRA & Home Loan?

For all deductions under chapter VIA (includes 80C, 80D, 80E, NPS related etc) which you claimed but were not part of Form 16 select “Deductions claimed in the return but not in Form 16”

In case everything was present in your Form 16 but still you got notice select “Others” and mention in Justification that the deduction already present in Form 16. Also attach the Form 16.

Justification/Remarks

Briefly state why your Allowance or deduction was not in Form 16. It could be “employer did not consider this deduction” or “investment was made after proof submission to employer” etc.

And most important DO NOT forget to attach relevant documents.

- For 80C investments you can attach the investment proof.

- For HRA you can submit rent receipt, etc.

- I am still not sure what proof to attach for 80TTA!

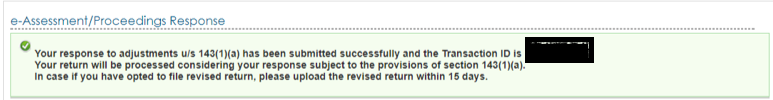

Section 143(1) Acknowledgement

After all the process is complete you get the following acknowledgement:

Disclaimer: Please remember this post is best to my understanding and I am not a tax expert. You might want to consult a qualified tax consultant or CA for your specific case!

To Conclude:

This action was initiated by income tax department as some tax payers misused the “proof not required while filing tax return” part and used to claim deductions they were not eligible for. For e.g. with more strict polices at employer end many people could not claim HRA with fake receipts as rent receipt without landlord PAN in not accepted. But they claimed while filing ITR as this is allowed. We all know there are a lot of genuine tax payers who are not able to claim HRA as landlords DO NOT share their PAN number. Also some tax payers took advantage of 80C without making actual investment.

The intent of income tax department was good – to weed out such events. But unfortunately as we have seen with mot government initiatives – the plan is good on paper but execution is very poor. Same is the case here.

Even tax helpline is NOT able to guide people and telling them to wait. Also this should be stated while filing returns and not sending a notice after that. This would badly hurt people who are not tech savvy and do not check emails frequently & this means a lot of housewives, senior citizens on pension income.

Also sending notice for Section 80TTA – deduction up to Rs 10,000 for interest earned in savings account is ridiculous because I do not understand what proof would be required for the same.

Also Read: 25 Tax Free Incomes & Investments in India

The e- Proceeding form has bugs and it adds income across rows – as shown above. The department has still not corrected these and neither sent further communication. On one hand they want more and more people to file returns by telling it’s simple and then bowl a googly by sending such notices. Hopefully the tax department is working on it and would create more awareness on how to reply to these notices or at the end its tax payer would be sufferer.

As my income falls under 3 groups,Salary/Bank FD Interest 2 Nos. I may use 3 rows.My deductions claimed under 80 C and 80CCD(1).My doubt is in ” Income /Gross recpt as per Return” coloumn can I deduct my total deductions under both sections from salary in 1st row itself and keep lower 2 rows ( FD Intrst) without any deductions.Here the amount calculated in 1st row ” Income/Gross Rcpt “cannot be directly readable from the return filed. Is it possible? Kindly help this specific problem.Thank You.

Yes you can

Hi. I have received an email from :

[email protected]

Form 16 taxable total income and the one filed as per form show a discrepancy of 10.000

My sources of income : 1. Salary 2. Fixed deposits in banks and primarily post offices.

Deduction in form 16 and filed return (thru a tax portal) show a difference of 10,000.

Is that the reason why I have been served this notice?. Has the portal given me deduction of additional 10,000 which do not reflect in form 16 due to my additional income from FD/post office deposits.

What is the step to be taken in this regard. Please help. Thanks

Dear Mr. Amit,

I think your website and comments are one of the clearest that I’ve read. And when one is distressed with the type of IT harassment that is going around, reading your counsel is wonderful. So many thanks.

The clarification I seek is after receiving the notice u/s 143(1)(a) for addition of income, you have stated that the separate rows are added up because of a bug. But because because it is a system error, not to worry. That is comforting. My question-when sending a revised filing after this communication what number should I put it in response to? There is no 143 in the drop down box.

Many thanks in advance.

You need to just choose “Revised filed under section” – Revised u/s 139(5). Refer this Why and How to Revise Your Tax Return? for more clarity.

The information given in your article is very useful , thanks for the same. I have also to respond to u/s 143(1)(a).

It is about absence 80 C and 80 TTA deduction in form 16 only.

In the response of this document,Can I put NA in all the columns : amt. paid, nature of receipt,income/gross receipt and head of income.

Kindly advise.

Try putting it – but why would you?

hi i got mail from tax department about intimation under 143(1).I have income from salary and income from other business.My form 16 prepared by employer was till february. i saved Rs 10000 in my PPF in march which was not their in form 16.But while filling ITR i have claimed Rs 10000 under 80C.

under notice 143(1)..there is one row which says B (income as per form 16/26AS) – A (income as per return) = Rs 10000

Now I am disagreeing to it. do I need to fill Tan of employer as well as Tan of business. Or i should only fill Tan of employer and claim the deduction under 80C.

Confusion is this.. My Form 16 does not include income from other business.

But in form 26AS income from both the sources are reflecting

TAN of employer would do

Thanks for all your help.

I will fill reply to 143 (1)a as below

I HAVE 80C DEDUCTION 1.5 LAKH AND 80TTA FOR 10000 . BOTH NOT INCLUDED IN FORM 16 THEREFORE I SHOWN UNDER DEDUCTION IN MY RETURN.

TAN—I HAVE 2 EMPLOYER AND I WILL SHOW 1 EMPLOYER TAN.

DEDUCTION MADE SECTION—80C

AMT CREDITED BY THE DEDUCTOR—HERE I WILL SHOW GROSS AS PER TOTAL OF BOTH FORM 16 TO AGREE WITH MY ITR 1

I WILL EXPLAIN THE SAME IN REMARKS COL AND ATTACH BOTH FORM 16

INCOME GROSS RECEIPT—HERE I WILL SHOW AFTER DEDUCTION OF 1.5 LAKH

I WILL ADD ANOTHER LINE TO SHOW 80TTA DEDUCTION ON THE ABOVE LINE AND ATTACH 24 FORM 16A AS I HAVE 6 DIFFERENT BANK FD AND EACH QTR 1 FORM 16A

PLEASE CLARIFY

SESHADRI S

go ahead!

Hi Amit,

I got Intimation 143(1) (a).

1. Variance 50000 – Deductions claimed in return but not in Form 16

2. Variance 50032- 29 Rs income and 7 Rs TDS mentioned in 26 AS form but not mentioned while filing return

I can response to first point by disagreeing and attaching saving proof.

But how can i response to second point.

what is Rs 29 income for? Ideally should have been included in return. But even if you don’t I think your return would be processed. You can disagree to both!

29 income is for Total Amount Paid/Credited present in Form 26 AS for SBI Bank.

Dear Amit,

I got a different scenario. In my Form 26AS, there are two TANs mentioned by the same employer with small changes in the name. So should I need to provide two rows while filling the form with those TANs. “Amount paid/credited by deductor” can be provided by looking the values in Form 26AS but what should I give for “Income/Gross Receipts as per the return” under each TAN since that value is the combination of both TANs. So can I provide the total income mentioned while filing the return.

If your employer has 2 TANs then for tax purpose its two different employer! So use any one TAN to reply

Hi Amit,

I got the same notice. In my case i forgot to add income from a Form 16A for my SBI FD. They sent me the form late.

But I too am getting three rows. So only the first one is correct and other 2 are just repercussion of that form 16A.

So how to respond agree to one and disagree to another 2? Or any other way?

Agree all, pay taxes due & file revised return

Hi,

If I agree all then it shows the additional income 3 times what it should be, my form 16A has 53913 as income. If I select all three it says “An additional income of Rs. 161738 appearing in Form 26AS/Form 16/Form 16A shall be added as the same has not been included in computing the total income in the return.” However it should only be 53913.

Hi,

This is certainly very informative. I have received a similar notice where my Salary income is approx 3.8 lakhs whereas “income as per form” is approx 5.8 lakhs. This is incorrect as I have got a confirmation from my employer too. How should I fill this? What do I put in the deduction section?

Further my 80TTA of approx 5,000 Rs has not been considered and that variance is also showing in the total income. How would you advise me to send a response to this? Please do reply urgently.

Thank you

This action was initiated by income tax department as some tax payers misused the “proof not required while filing tax return” part and used to claim deductions they were not eligible for.

Even for claiming deduction u/s 80G (Donations) where all the required particulars were given at the time of claiming itself, they disallow the same which is a blender actually. Moreover they should have asked for the sufficient information (like the nature of investment, unique reference no / document no. etc) as required for 80G at the time of filing itself instead of sending intimations like this. This kind of action by IT department seems to be a harassment on the part of regular tax payer particularly senior citizen and super senior citizen.

Dear amit,

I am very greatfull to you a this is the only blog online which is accurate and correct. I have one query.

I posted a comment / query yesterday but till today it is showing comment pending for moderation. So i am again pisting my query.

Apart from salary income i have got rs 15000 as fd interest and 5000 as saving bank interest. In my return i have shown rs 20000 as income from other sources , but claimed rs 5000 as deduction u/s 80TTA. I have got notice u/s 143 (1)a for this rs 5000. Now when i disagree with it what value should i fill in the reply in the colume of ” income / gross receipt as per return”. Please help me in this matter

Thanking you

H. Kumar

Gross receipt is 0 (5000 – 5000)

Hi Amit,

While filing the response I am not able to attach all the documents. It is only accepting 1 file. What needs to be done. Please help

Please zip and attach

Dear Amit,

This is the only article which has explained very nicely. Lot of people like me are facing issues in responding to Prima Facie adjustments 143(1). After reading your blog i am in a much better position now but some confusion is still there. Please help on this.

My notice is for 160000 = 150000 (ELSS) and 10000 (80TTA).

(i) (ii) (iii)= (i)-(ii)

1 160000 0 160000 Form 16-deduction

2 471940 631941 160001 Form 16-Taxable Total Income

I am disagreeing to the demand. While filling the response what should be below?

I am using 2 rows to respond.

A)

1. TAN – Employer TAN

2. Section – 80C

3. Amount paid/credited: ??

4. Nature of receipt: Pension

5. Income/Gross receipt as return: ??

6. Remarks: Rs. 150000 invested in ELSS – Investment proof attached

B)

1. TAN – Any one Bank TAN

2. Section – 80TTA

3. Amount paid/credited: ??

4. Nature of receipt: Other

5. Income/Gross receipt as return: ??

6. Remarks: Rs 10,000 deduction claimed under 80TTA.

thanks

Thanks for appreciation.

Amount Paid/Credited – same as entered by you in salary income/ for bank it would be interest credited

Income as return – Deduct 80C from employer/ 80TTA from bank

WHICH DOCUMENT NEED TO ATTACHED FOR 80TTA DEDUCTION?

I do not see any need of document for 80TTA but if its not cumbersome attache saving bank statement

What to add as TAN for BANK in which I have saving bank account?

Hello Mr. Amit. Thank you very much for this post, as it helped me to file response.

I have received intimation Adjustment u/s 143 (1) (a) for section 80 DDB. My company doesn’t consider section 80 DDB, so i had claimed it while filing my tax returns. In this case what should be the following fields:

TAN : What should be the TAN number

Deduction made under section : 80DDB

Amount Paid/Credited by deductor : ??? ( What to enter here )

Nature of receipt as per deductor : ??? ( What to enter here )

income/Gross Receipt as per return : ??? Should i enter my gross total taxable Income ?

Head of Income/Schedule under which reported in Return : may be 80DDB?

Reason : with choose one of the reason from Dropdown

Justification/Remark : Have attached all releveant documents

Can somebody tell me what should i enter here (???) for above columns

Put all employer details. For reason Not in form 16 but claimed

Sir,

Apart from salary income i have got rs 15000 as fd interest and 5000 as saving bank interest. In my return i have shown rs 20000 as income from other sources , but claimed rs 5000 as deduction u/s 80TTA. I have got notice u/s 143 (1)a for this rs 5000. Now when i disagree with it what value should i fill in the reply in the colume of ” income / gross receipt as per return”.

The gross would be 0