Taxation plays a very important role in the returns generated by your investment and so you should know how India tax investments before you choose one. We list down the most common investments and how they are taxed?

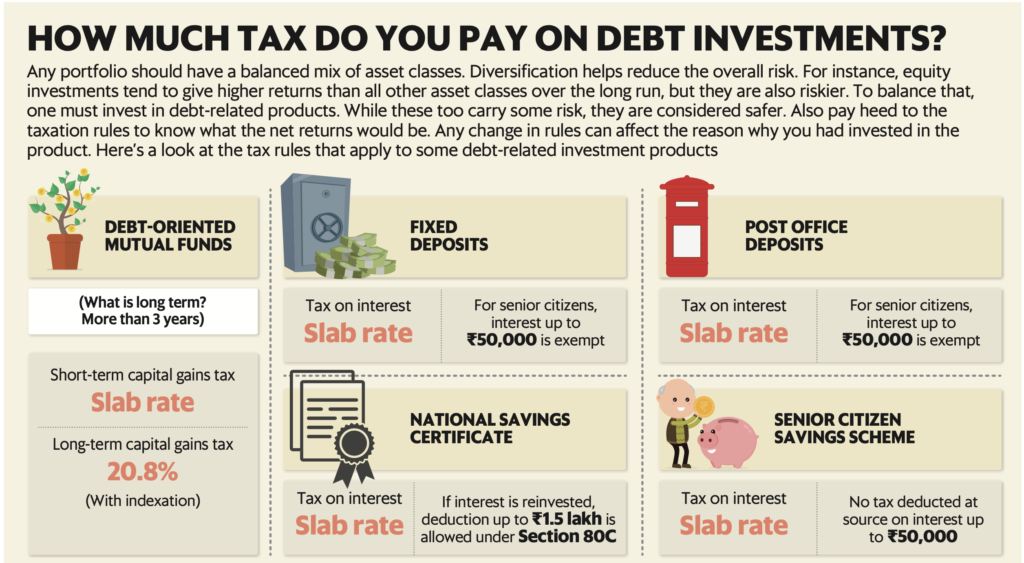

Fixed Income/Debt Investments

Saving Bank Account

- Interest earned in Saving bank account up to Rs 10,000 is exempted from tax u/s 80TTA. Any interest more than Rs 10,000 is added to your income and taxed at income tax slab rates.

- Senior citizen can claim tax exemption up to Rs 50,000 on interest income from bank/ post office fixed deposit, recurring deposit or savings account up to Rs 50,000 u/s 80TTB (applicable from April 1, 2018)

- There is NO TDS on interest earned on saving bank account.

- This is also applicable for Post Office Savings Account.

Which bank pays highest interest on Savings Account?

Most banks today pay interest in the range of 2% to 3% on their savings account. However there are banks who can pay up to 7%. We have compared the interest rate offered by all banks in India across different balances here.

Bank Fixed Deposits

- The entire interest earned on Bank FD is added to the income and taxed according to the income tax slab rates.

- However from FY 2018-19 interest income received from Bank/post office FD/RD is tax exempt up to Rs 50,000 under new Section 80TTB.

- TDS of 10% is deducted if the annual interest exceeds Rs 40,000 (changed in Budget 2019) and Rs 50,000 in case of senior citizens. Interest across all Fixed Deposit/ Recurring Deposit accounts across all branches of a bank is taken into consideration to arrive at the total annual interest figure for TDA.

- If NO PAN is linked to the FD account the TDS rate is 20%.

Get Highest Fixed Deposit Interest Rates

Fixed Deposit with Banks is one of the most popular and convenient investment option. To help you choose the best, we compare the interest rates on fixed deposit across all major 48 banks in India including government, private, foreign and small financial banks in India every month. This may prove to be quite handy for you in choose the Best Bank FD scheme.

Bank Recurring Deposits

- Budget 2015 made the tax and TDS structure for Recurring Deposit same as Fixed Deposit.

- Earlier no TDS was deducted for RD deposits.

Company Fixed/Recurring Deposit

- The entire interest earned is added to the income and taxed according to the income tax slab rates.

- TDS of 10% is deducted if the annual interest exceeds Rs 5,000.

How to fill Form 15G and Form 15H?

Are you worried about Tax Deduction at Source (TDS). In case you are eligible you can fill up Form 15G (if below 60 years of age) and Form 15H (if senior citizen). We show step by step instruction on how to fill up Form 15G/H and save TDS.

NCDs/ Bonds

- The interest earned on bonds/NCDs is fully taxable as per income tax slab rate.

- TDS of 10% is deducted if the annual interest paid exceeds Rs 5,000. However, there is NO TDS if the bond/NCD is held in Demat form.

Capital Gains Tax on Bonds:

- In case the bond/NCD is sold through exchange before maturity, it entails capital gains. If the holding period is less than 1 year, it is Short Term Capital Gains and taxed according to income tax slab.

- For holding period of more than 1 year, the gains are Long Term Capital Gains and are taxed at flat rate of 10%. There is no indexation benefit available.

Learn All about NCDs

NCDs or non-convertible debentures or more popularly known as Bonds are a bit complex investment products. You must understand the product, risk involved, the taxation on interest received and when you sale it. We have done a separate post regarding this titled – Know all about NCDs.

Also you can keep track of upcoming NCD issues here.

Tax Free Bonds

- As the name suggests the interest earned on tax free bonds is tax free.

- But if tax free bonds are sold before maturity, it leads to capital gains.

- Investment for less than 1 Year -> Short Term Capital Gains -> taxed according to income tax slab

- Investment for more than 1 Year -> Long Term Capital Gains -> flat rate of 10% (no indexation benefit)

Tax Investments – Small Saving Schemes

Post Office Saving Account

- Interest up to Rs 3,500 for single holder account and up to Rs 7,000 for joint account in Post Office Saving Account is tax free u/s 10(15)(i). The remainder interest will get added to your income and will be taxed at the applicable rate of income-tax.

- There is NO TDS on Post Office Saving Account.

- Also this exemption is over and above tax exemption offered by 80TTA.

Example: You have Rs 9,000 interest from Bank account and Rs 5,000 from Post Office Saving Account; you can claim Rs 3,500 tax exemption u/s 10(15)(i) for post office account and Rs 9,000 for bank account & Rs 1,000 for Post office account (total – Rs 10,000) u/s 80TTA separately.

PPF (Public Provident Fund)

- The interest received is tax free

Senior Citizen Saving Scheme

- The interest received is added to income and taxed at marginal income tax rates.

NSC/KVP

- The interest received is added to income and taxed at marginal income tax rates.

- There is NO TDS.

Sukanya Samriddhi Account + PPF + SCSS Calculator

Sukanya Samriddhi Account, PPF, Senior Citizens’ Savings Scheme are part of small saving scheme sponsored by Government of India. These schemes are quite popular and rightly so because of the safety, higher interest rate offered among other things. We have built calculator for each of them where you can check the maturity amount, loan eligibility, partial withdrawal and more. Click on the links to get the relevant calculator – PPF Calculator, Sukanya Samriddhi Yojana Calculator, Senior Citizens’ Savings Scheme Calculator, NSC Calculator.

Tax Investments – Retirement Plans

NPS

- 40% of corpus should be used to buy annuity. The monthly pay out received is fully taxable.

- Remaining 60% of the maturity corpus is tax free (effective April 1, 2019)

Pension Plans

- 1/3 of pension maturity amount can be commuted (withdrawn in lumpsum) and is tax free

- The rest 2/3 amount should be used to buy annuity. The monthly pay out received from annuity is fully taxable

EPF (Employee Provident Fund)

- Maturity amount received form EPF is fully tax free if you have continuous service of more than 5 years.

- In case the service period is less than 5 years, the amount is taxable as per income tax slab rates.

- TDS at 10% is deducted for premature and taxable withdrawal of funds from EPS, if the payment is more than Rs 50,000.

- In case the PAN information is not furnished the TDS would be deducted as 20%.

How much Taxes you Need to Pay this Year? Download Our Income Tax Calculator to Know your Numbers

Do you know how much tax you need to pay for the year? Have you taken benefit of all tax saving rules and investments? Should you use the “NEW” tax regime or continue with the old one? In case you have all these questions just Download the Free Excel Income Tax Calculator for FY 2021-22 (AY 2022-23) and get your answers.

Tax Investments – Mutual Funds

For tax purpose Mutual Funds are of two types:

- Equity Mutual Fund and

- Non-Equity Mutual Fund.

Any scheme which has more than 65% invested in equities is treated as Equity Mutual Fund.

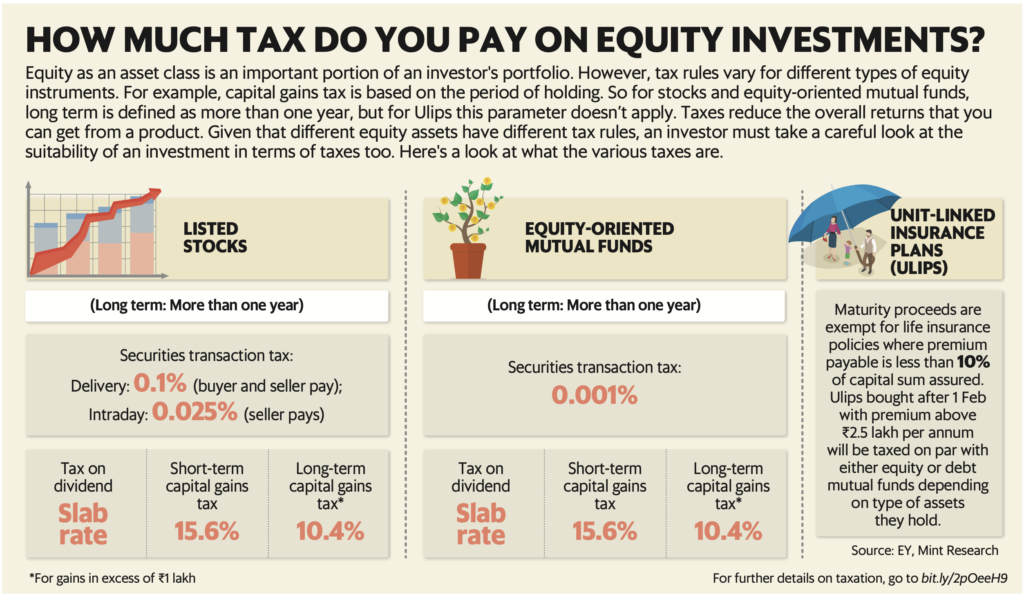

Equity Mutual Fund/Equity Oriented Balanced Fund/Arbitrage Fund

- If the investment is held for more than 1 year, the gains are classified as Long Term Capital Gains and are taxed at 10.4% (changed in Budget 2018 and effective from April 1, 2018).

- In case the investment duration is for less than 1 year, the gains are Short Term Capital Gains which are taxed at the rate of 15.6%.

- Dividends are taxed at the income tax slab rate

Debt Mutual Fund/ Balanced Fund/MIP/ Gold Fund/ International FoF

- If the investment is held for more than 3 years the gains are classified as Long Term Capital Gains and are taxed at 20% after indexation.

- Short Term Capital Gains are added to the income and taxed at marginal tax rates.

- Dividends are taxed at the income tax slab rate

How Tax on Mutual Funds Impact your Returns in FY 2021-22?

Equity Mutual Funds are one of the best investments to generate wealth in the long run while Debt mutual funds are more suited to park money for the short term (as an alternative to fixed deposits). But as in case of any investment, the final returns are determined on the way these Mutual Funds are taxed. We discusses tax on mutual funds for FY 2021-22 [AY 2022-23] in all details.

Equity

- If the investment is held for more than 1 year, the gains are classified as Long Term Capital Gains and are taxed at 10.4% (changed in Budget 2018 and effective from April 1, 2018).

- In case the investment duration is for less than 1 year, the gains are Short Term Capital Gains which are taxed at the rate of 15.6%.

- Dividends are taxed at the income tax slab rate

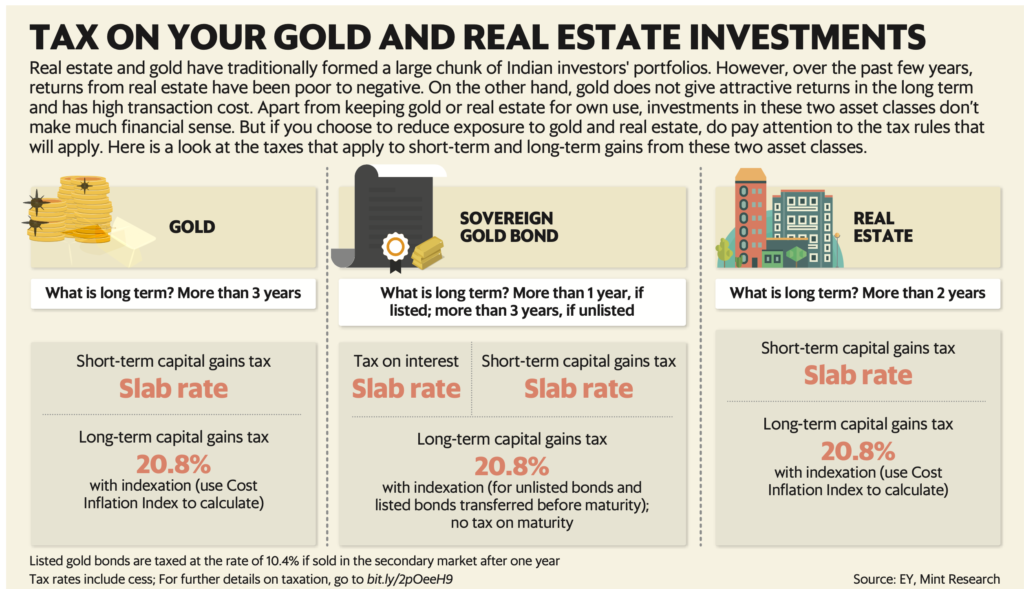

Tax Investments – Gold

Gold Jewelry/ Bullion/ Physical Gold

- If the investment is held for more than 3 years the gains are classified as Long Term Capital Gains and are taxed at 20% after indexation.

- Short Term Capital Gains are added to the income and taxed at marginal tax rates.

Sovereign Gold Bonds

- Interest received on sovereign gold bonds is taxed at income tax marginal rates applicable to you

- If bonds are held till maturity, the capital gains are tax free

- If the investment is held for more than 3 years but before sold maturity the gains are classified as Long Term Capital Gains and are taxed at 20% after indexation.Short Term Capital Gains are added to the income and taxed at marginal tax rates.

Should you Invest in Gold?

We looked at more than 55 years history of gold to see if its a good idea to invest in Gold. We concluded that its more volatile than perceived but investing in long term may provide you with more stable returns. You can look at the complete analysis and our conclusion here – Looking at Gold Price History in India – Should you Invest in Gold?

Gold Monetization Scheme

- The interest received is tax free.

- Also there is No Capital Gains Tax on the appreciation in the value of gold deposited.

Tax Investments – Life Insurance

Endowment/Money back Policies

- The final proceeds are tax free if the premium paid for all the years are less than 10% of the maturity amount.

- Surrender amount exempt from tax after 3 years

- TDS at 2% if the total receipts exceed Rs 1 Lakh.

- Service tax is applicable on premiums paid.

Are you Paying Too much Taxes? Download your free presentation

Are you worried that you are paying too much in income tax? Are you aware of all the changes in the tax laws? Where should you invest to save taxes? Do you know all tax sections that you can use to save your tax. Download a concise 43 page presentation free to answer all the above questions and save your taxes – legally.

ULIPs

- The maturity amount is tax free if the premium paid is less than Rs 2.5 lakhs every year

- However if the premium paid is more than Rs 2.5 lakhs per year, its taxed the same way as equity mutual funds [Budget 2021]

- Surrender amount, early partial withdrawals exempt from tax after 5 years

- TDS at 2% if the total receipts exceed Rs 1 Lakh.

Tax Investments – Real Estate

Rental Income

- A standard deduction of 30% is allowed on rental income. Thereafter the rent received is taxed at income tax slabs applicable to you.

- You can also claim deduction for interest paid on home loan.

There is no limit of interest deduction for rented home.Budget 2017 has limited the deduction to Rs 2 lakhs irrespective of property being rented or self-occupied. - Additional deduction can be availed for repairs, home insurance, property tax, etc.

Sell/Purchase of Property

- The gains are long term capital gains if the property is held for more than 2 years [Budget 2017 brought the holding time to 2 years]. In this case it’s taxed at 20% after indexation benefit.

- Tax payers can now buy two houses on sale of 1 house if the capital gains are less than Rs 2 crore. This benefit can be availed only once in lifetime. (proposed in Budget 2019)

- Short term capital gains is taxed at marginal tax rate applicable to you.

Complete article covering all investment avenues.