Talk to any expert on tax return filing and he would suggest you to “verify your Form 26AS”.

Form 26AS is consolidated statement of all your TDS, Self Assessment tax, advance tax, tax refunds, and high value transactions for relevant assessment years.

The post gives an overview and structure of Form 26AS, why it’s so important, what to verify and how to use it for Income Tax Return filing.

What is Form 26AS?

Form 26AS (also called the annual statement) gives you the following details for the associated PAN card:

- Salary Credited and the corresponding TDS

- Interest Credited and corresponding TDS by banks and companies

- Advance tax or self assessment tax paid

- TDS deducted in case of selling/buying of property of more than 50 lakhs value

- Any high value transaction done in the year like buying property, shares, mutual funds, etc

- Income tax refund paid, if any

How to view 26AS?

There are two ways to view your 26AS

- You can do it directly from Income tax Website – incometaxindiaefiling.gov.in

- You can do it through your net banking of authorized banks (with PAN card correctly linked to the account)

[box type=”info” size=”large” style=”rounded” border=”full”]

Here are some posts which can help you with e-filing of ITR 2019:

1. 9 Most Important Changes in ITR Forms for AY 2019-20

2. Calculate your Tax liability for FY 2018-19 (AY 2019-20)

3. Download 44 page slideshow showing all tax exemptions

4. Which ITR form to fill for Tax Returns for AY 2019-20?

5. How to Claim Tax Exemptions while filing ITR?

6. Use Challan 280 to Pay Self Assessment Tax Online

7. Form 26AS – Verify Before Filing Tax Return

8. 5 Ways to e-Verify your Income Tax Returns

9. What if You DO NOT file your Returns by due Date?

10. Can I file my Last Year Tax Return?

11. Why and How to Revise Your Tax Return?

12. What does Intimation U/S 143(1) of Income Tax Act mean?

13. What happens after you file your ITR?

[/box]

How to view information in Form 26AS?

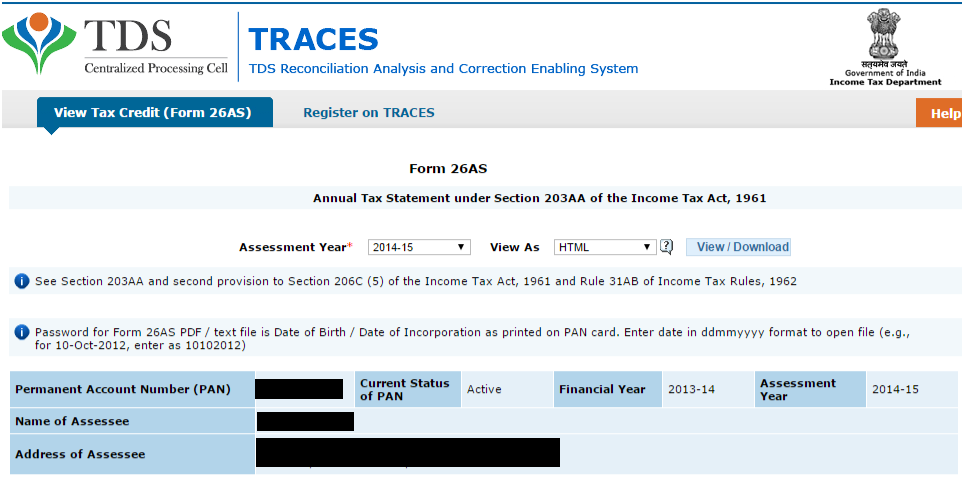

Once the Form is opened, you have option to select the Assessment year and the format “View as”. Select the relevant Assessment year and the format and click view.

Select ‘HTML” to view it online and “PDF” to download it.

Password for opening downloaded Form 26AS is date of birth of PAN holder in ddmmyyyy format as mentioned in PAN Card. So if your date of birth is January 1, 1980 then your password would be 01011980.

Download: Ultimate Tax Saving ebook with tax calculator FY 2019-20

Also remember the difference between Financial and Assessment year (for Financial Year 2016-17 the assessment year is 2017-18 and so on).

Interpreting From 26AS:

The 26AS is divided into 7 broad sections (A to G). Following are the details for each section.

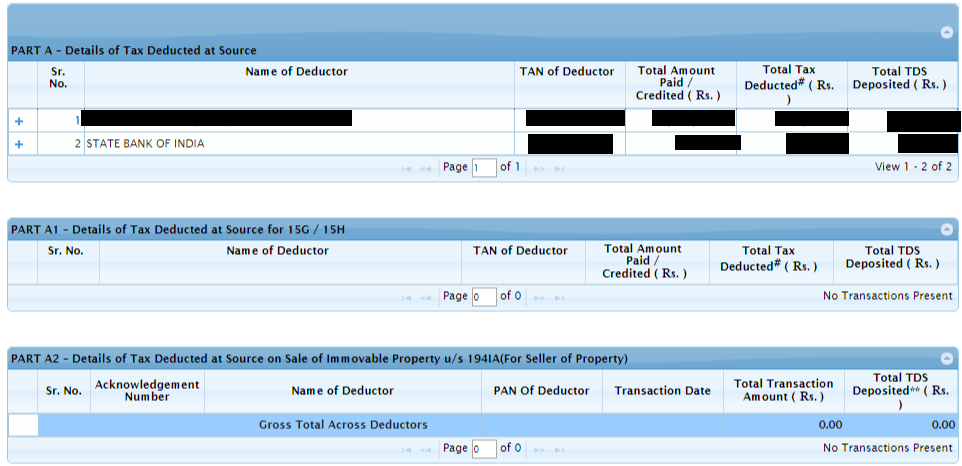

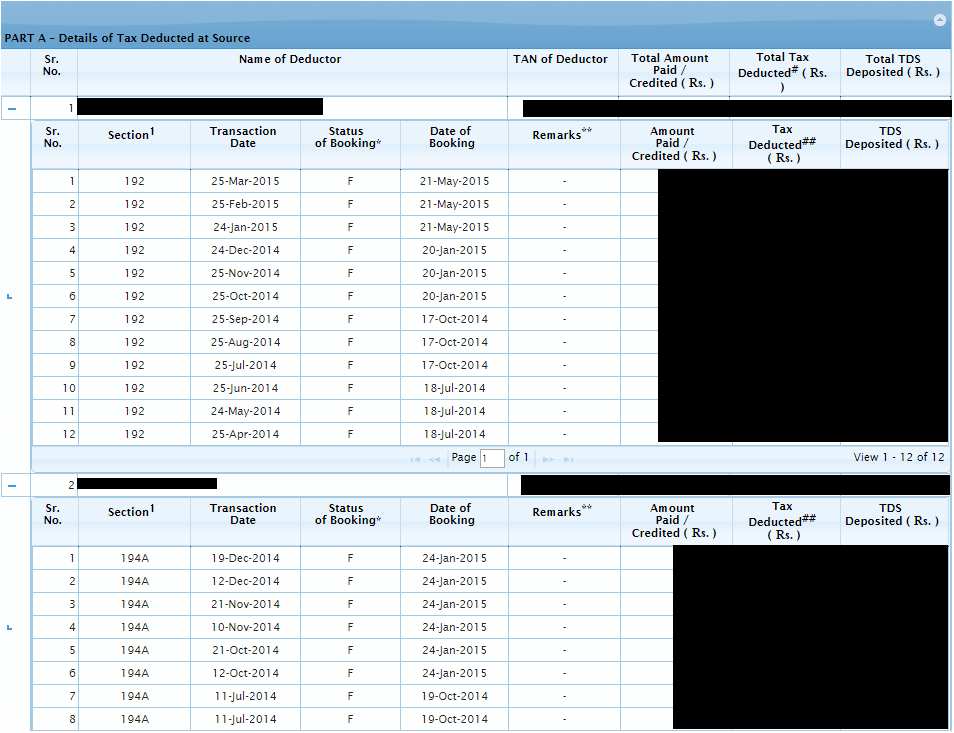

PART A – Details of Tax Deducted at Source.

This section is most common and has details of Tax deducted by your employer or TDS deducted by banks on interest on Fixed Deposits, etc. TDS deducted by each source is shown as a separate table.

PART A1 – Details of Tax Deducted at Source for 15G / 15H

This section shows details of the income where tax was not deducted as you had submitted form 15G or 15H. The TDS will always show “0” because you have submitted Form 15G/H for not deducting TDS. It helps in tracking the interest you received.

Also Read: 25 Tax Free Incomes & Investments in India

PART A2 – Details of Tax Deducted at Source on Sale of Immovable Property u/s 194IA (For Seller of Property)

PART B – Details of Tax Collected at Source

This is tax that is collected by seller from buyer on sale of certain goods like liquor, timber, minerals, etc. This would be mainly populated for people involved in such trades.

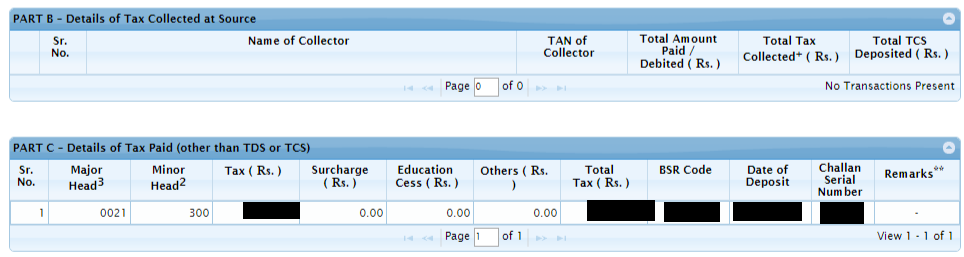

PART C – Details of Tax Paid (other than TDS or TCS)

This part shows any “Advance Tax or Self Assessment Tax” paid during the financial year. The banks generally upload this information after clearing of the cheque.

Part D – Details of Paid Refund

This part shows any refund paid to you by Income tax department in that financial year

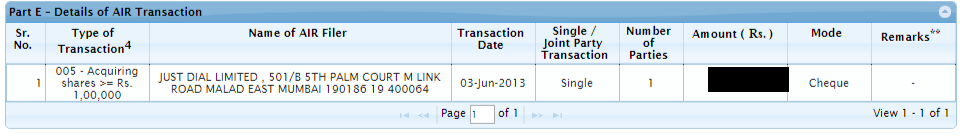

Part E: Details of AIR Transaction

It shows the details of any high value transactions such as purchase of property etc. These high value transactions are reported to income tax department by banks/ Registrar/ mutual Funds/ companies etc through Annual Information Return (AIR)

PART F – Details of Tax Deducted at Source on Sale of Immovable Property u/s 194IA (For Buyer of Property)

PART G – TDS Defaults (Processing of Statements)

What should be verified from 26AS?

As you can see it’s a long form but is visually easy to understand. The question is what should be verified in this form? The answer is EVERYTHING. Yes you should verify all the numbers and relevant details present there.

- Check the name, TAN of the deductor from FORM 16 (salary)/16A (banks)

- Check the section for each entry 192 is for salary and 194A is for interest income

- Check status of booking. It should be ‘F’ which means Final. This means that the TDS amount deposited to income tax authorities match with the TDS statement filed by deductor. In case its “U” meaning Unmatched, it means there is some issue either with the TDS statement or the amount deposited. You will need to check with the concerned deductor in this case.

What if entries do not match?

As stated above in case someone has deducted TDS but has not submitted or updated it wrongly to the income tax authorities, you might see wrong or missing entries. In that case you will need to contact that person/company.

- In case your advance tax or self assessment tax paid does not match, check with your bank.

- In case your Form 16 details do not match consult your employer.

- In case you find some entries missing consult with the relevant entities.

Also Read: Calculate Tax on Arrears in 7 Easy Steps

Why you should check 26AS before filing ITR?

Form 26AS can be compared to your resume while applying for any job. The interviewer knows everything mentioned in your resume – similarly, income tax authorities know about all the information present in 26AS. And as you would not mess up in interview by not preparing what’s on your resume, similarly you can mess your income tax returns by not verifying the entries in 26AS.

And the worst part if you have discrepancies in the 26AS and your income tax return, you might get notice from income tax for wrong returns or for scrutiny of documents.

Have you checked your Form 26AS while filing your ITR?

I have retired n 30/11/17 under VRS from Tamilnad Mercantile Bank Ltd a private sector scheduled commercial Bank. I have recieved Rs.15,00,000/- graduity. Bank has included Rs. five lacs as taxable income and deducted tax. But from newspaper I came to know that for private sector graduity ceiling has been increased to fifteen lacs. Please clarify Sir

Hello Sir

Just want to confirm where should I mention FD whose interest < 10000/- with Bank and which is not mentioned in TDS(from traces) while submitting ITR? Moreover, where we have to enter PO's NSC interest? If NSC is done in the Financial year(against whom ITR is filled), then, also it's yearly interest had to be displayed?

One more query, Suppose I do an FD on say 31 March 2018, then I have to add interest of that FD too(since it is done on last day of F.Y.)?

Thanks

Hi

I got intimation for difference in income between form16 and return filed. But, when I checked, I do not spot any difference. There is an entry for refund in the form26as and the amount mentioned is same as the difference highlighted by the IT department. Could that be reason? One tax expert was saying that the difference could be due to employer did not mention appropriate information for quarter 4, and the difference is due to this. Could you please provide your view?

Hello,

I paid TDS amounts for installments on construction of house property. These TDS payments are appearing in the section A2 (For seller of property) in my Form 26AS, leading to a mismatch in the IT return. How can this be rectified?

Thanks

You can contact TIN Call Centre, National Securities Depository Limited, 3rd Floor, Sapphire Chambers, Near Baner Telephone Exchange, Baner, Pune – 411 045 Tel: 020-27218080 Fax: 020-27218081

Sir please help me that my 3 month salary arears given by employers June 2017 .26 as form not sown 3 month salary when I m sabmitt full financial year 2016-17 salary in my income tax aagadan form .form 16 sow full income but 26as form sow 3 month less .that conditions I fill itr how?

Take Form 16 as reference to file ITR. If you have received money, pay tax on the same weather its reflected in 26AS or not.

Hello Sir,

In Form 26AS, under PART A1 – Details of Tax Deducted at Source for 15G/15H, I have Paid / Credited(93500/-Rs) with the bank FDs as per section 194A. My question is whether I have to show in ITR-1 with bank details like Name of deductor, TAN of deductor ect…? or need not be shown. What can I do?

In case Form 15G/H is submitted, there would be NO TDS. SO you can skip the entry for tax paid section. But you’ll need to show the amound credited/paid to you as income from other sources and pay tax if applicable to you.

To be able to access 26AS on the TRACES website, is it necessary to register on that site first and then log in ? Or is the log in on the Income TAx e-filing website enough? I am asking because after logging in to the ITax website on which I am registered, the Income Tax website is directing me to TRACES but the message that appears is

“TDSCPC services for NRIs is available through https://nriservices.tdscpc.gov.in/nriapp/login.xhtml . Kindly register and access TDSCPC NRI services through same”.

However, this appears to be for NRIs. I am not sure if non-NRIs also have to access TRACES on the same link.

Could you please clarify, thanks.

Seems like you are trying to access site from outside India. Ideally you can go to Form 26AS from net banking or income tax return file website.

I filed my IT Return online after considering the form 26AS. However, after reading various comments, it seems that I have also to take consideration of the savings bank interest for which no TDS has been deducted. Can I now revised my IT Return ?

Yes please revise your returns

Sir,

The T.D.S. ( Tax deducted ) in 26 AS is correct but Tax credit in ITR form shown is less ( differ ). in assessment year 2017-18. I submitted my ITR as per 26 AS by filling I.T.R. form for FY 2017-18 ( by correcting T.D.S. as shown in form 26 AS ). a few days ago .

Now it is showing mismatch

But should I do now, please guide..

I am not sure why its showing mismatch as the comparison should happen with Form 26AS. Please check if the numbers have not changed in 26AS?

It has been informed by IT deptt…. that , ” There is some fault in system of I.T. Deptt. Many persons are feeling difficulty due to Mismatch in enteries shown in Form 26 AS and enteries shown in ITR. While enteries shown in form 26AS are correct and enteries shown in ITR are less. IT deptt. is looking in to this matter ie. for rectification of enteries.” ……IT deptt. has advised to wait for some time.

Thanks for sharing – will help readers!

hello Rajinder,

I am also facing the same issue for my AY2018-19 returns. All the tax credits entered by me in ITR returns were verified from 26AS but still getting tax credit mismatch. kindly guide if this was rectified automatically in your case or did you approach someone in IT to get it corrected

regds/navin

Hello sir,

Thank you very much for your valuable advice.Today i submitted efiling itr successfully. And without your guidance it was impossible for me.

Thanks again.

Hello sir,

In FY 2016-17, i received arrear on DA for five months of same FY. But in form 26AS ,the total amount shown under total amount paid/credited is without arrear.why is it so? During income tax assessment i have included amount of arrear for income tax deduction.should it be calculated separately?

What should i do?

You can calculate tax on arrears in easy steps!

Sir,i am confused.

In 26As form,amount from arrear is missing.but in self assessment of income tax,i included that amount and calculated taxable amount. And that amount has deducted in form 26as.

Now my question is that in efiling of itr,should i include arrear in my income or not?(arrear is not from previous FY, it is from same Fy.that is 2016-17)

Please, give me advice .

Yes you have to include arrears in your income tax calculation.

i am abroad in usa and I can’t access my form 26-AS.is there any other way to access?

Try this link – https://nriservices.tdscpc.gov.in/nriapp/login.xhtml

Hi Sir,

I am Kunal Bisen, I received mail from Income tax sept. of Intimation u/s 143(1), showing the Tax Credit mismatch of Rs. 5068 and also my Form 26AS showing Nil.

But TDS is deducted by my deductor.

What could be the reason behind it.

Please help sir.

Thank you.

You will need to contact your deductor as to why TDS has not been deposited to income tax department. You should always verify your Form 26AS before filing your return.

Sir thank you replying,

but my deductor gave me the Tax deposit receipt which he had received from bank.

TDS deductor has to file TDS returns. Ask him if he has done that. And if yes you need to check if the details like PAN number/name etc was entered correctly.

Very valuable guidance.

Hello

In form 26 for interest on FD/Savings account, section 194A, Total amount shown under “total amountpaid/credited” comprises of interest from both FD+savings interest ? or is it from FD only ?

Thanks

There is no TDS on interest paid on savings account. So the TDS shown in Form 26As is for fixed deposit and recurring deposit only.