There are times when some salaried tax payers are not able to claim tax exemption as they were not able to submit the required documents within timelines. Generally companies start asking for the tax exemption documents like investment proof, rent receipt, Loan payment certificates etc from January on wards. But in case you were not able to submit the proof and your employer has deducted excess tax, you need not worry.

You can claim some of these exemptions while filing your income tax return (ITR).

House Rent Allowance (HRA)

You need to submit rent receipts, PAN card number of landlord (or declaration in case of no PAN card) and in some cases rent agreement to your employer to claim tax deduction against HRA.

In case you did not submit your documents before the deadline, your employer would not give tax exemption on HRA and deduct tax accordingly.

But the good news is you can claim HRA exemption even while filing your tax return.

You need to calculate the amount of HRA exemption which is minimum of

- Actual HRA Received or

- 40% (50% for metros) of (Basic + Dearness Allowance) or

- Rent paid (-) 10% of (Basic + Dearness Allowance)

You can use our HRA Tax exemption calculator for the same.

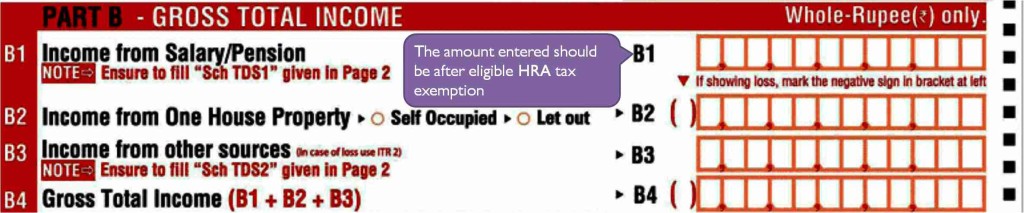

The next step is to subtract the above HRA exemption from the total taxable salary. This is the new “total taxable salary” to be used for filing your tax returns.

You need not submit any of the documents to the income tax department but will have to keep it safely with yourself in case your Assessing Officer asks for them.

[box type=”info” size=”large” style=”rounded” border=”full”]

Here are some posts which can help you with e-filing of ITR 2019:

1. 9 Most Important Changes in ITR Forms for AY 2019-20

2. Calculate your Tax liability for FY 2018-19 (AY 2019-20)

3. Download 44 page slideshow showing all tax exemptions

4. Which ITR form to fill for Tax Returns for AY 2019-20?

5. How to Claim Tax Exemptions while filing ITR?

6. Use Challan 280 to Pay Self Assessment Tax Online

7. Form 26AS – Verify Before Filing Tax Return

8. 5 Ways to e-Verify your Income Tax Returns

9. What if You DO NOT file your Returns by due Date?

10. Can I file my Last Year Tax Return?

11. Why and How to Revise Your Tax Return?

12. What does Intimation U/S 143(1) of Income Tax Act mean?

13. What happens after you file your ITR?

[/box]

Section 80C/80D Deductions:

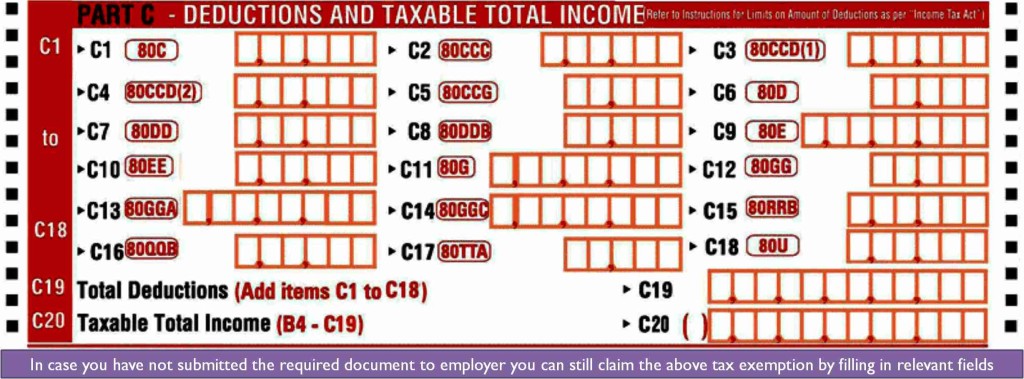

In case you did not submit your investment proof for eligible instruments under section 80C like PPF, ELSS, Insurance etc you can claim these exemptions while filing your ITR. You can also claim Section 80D Deductions for Medical Insurance Premium paid for self and parents.

All you need to do is mention the investments in ITR. Again you need not send any proof to income tax department but will have to keep it safely with yourself in case your Assessing Officer asks for them.

Also Read: Best Tax Saving Investments u/s 80C

Home Loan/ Education Loan Deductions:

Again fill the relevant details in corresponding sections to claim the deduction in ITR to claim exemption, in case you had not submitted the relevant proof to your employer.

LTA (Leave Travel Allowance):

LTA is tax free in case you submit relevant travel bills to your employer. In case you have not done so and the employer would pay it after deducting tax. You cannot claim tax benefit on LTA while filing ITR.

Points to Note:

For claiming any of the eligible tax exemption as above, you should not submit any document to Income tax Department. However keep the proofs safe with you as it may be asked by Income tax officer while scrutinizing your returns.

The IT Department can ask for above proofs up to six years from the year of assessment.

In case you were not aware of above provisions, you can file your revised return and claim tax refund. Both online and offline returns can be revised. An online return can be revised only online, and an offline one can be revised offline.

There is no limit on number of times you can file revised returns provided it is done within the prescribed time limit.

I have a BRE component added to my CTC compensation (petrol bills, phone bills etc.).

if by some reason I am unable to submit the bills to my employer on time, can I submit these bills while filing ITR ?

Thanks

Dear Sir, in FY 2018-19 I migrated from Nagpur self occupied flat to Noida for job.

Nagpur flat rented out to a corporate employee for Rs. 271125/- FY-2018-19 and they transfer to my bank account after deducting TDS Rs. 27113/- FY 2018-19. i have paid rent in Noida Rs.180000/- FY 2018-19. What is tax liability on above or eligible for refund claim ? I have salary income from a private firm Rs.3 lac in FY-2018-19.

Appreciate your kind advise.

Dear Amit Ji,

My Family Member in State Government Job So i Know i Claim Rouse Rent yes or No.

And Also Clear me Regarding N.P.S, Government Employee fill 80 CCD (2) Employer Contribution show in ITR form Yes/No

Hi Amit,

Salaried employee – residing in rental house – no other sources of income –

ITR 1 insists for selection of self occupied property or let out property. In the above case the assessee has no self occupied property or let out property.

Which option should be selected in this case??

Its not compulsory field. Leave it as “Select”

My employer deducted 10800 as conveyance allowance while my tax sheet shows conveyance allowance given for the year was 26000.On enquiring they said as I have given two wheeler for official use I m eligible for 10800 while those who have not declared any vehicle are getting 19200 deduction.can I get refund from IT dept declaring 19200 as deduction.I HV already submitted itr.can i claim the above in revised itr.thanks.

HI Amit,

I have not claimed tax free 15000 Medical Reimbursement from employer. But now I want to claim the 15000 with tax free while filing ITR. Please where I have to add the 15000 in ITR 1.

Regards,

K.Kandaswamy

Dear sir,

I filed itr 1 having salary 4.5 lac per annum, after filing itr they order for again 7830, as our employer deduct 6600. How it possible, exemption of 2.5 lac comes in which section.

Pls reply

I have claimed LTA 2 times in the block of 1st January 2014- 31st December 2017. I had to travel on Emergency in Feb’18 for which i had to spent amount of the order of 1L. Is there a possibility to get it claimed while filing the ITR?

My employer is not able to accommodate this request and already provided form 16

LTA can only be claimed through employer. In case they cannot accommodate this you would not be able to claim LTA while filing ITR.

Hi Amit ,

Thanks for your generosity with which you are sharing your expertise. I got few questions-

1.Last year for AY 2017-2018, while filing tax I forgot to mention about my term plan which is exempted under section 80 D and I had paid tax of 9390. Please advise as to how to file for return of tax paid , which form to fill?

2. Also, last year I didn’t mention about capital loss status while filing taxes. Now I am thinking of showing my losses while filing for Income tax return.Please advise which from should I use for these 2 things . I heard about 139-5 form for Income tax return and ITR form 2 for capital loss status .

Please share valuable insights .

Thanks once again .

I have an LIC for which I am paying yearly premium of RS 40000 but by mistake while claiming for tax in the financial year 2017-18 the amount under 80C went as 4000 and because of which my employer deducted tax for me.Can you please help me out in knowing how to get back my refund while filing tax and I have the original receipt showing the full amount.

Just fill the right amount in ITR where you claim 80C deductions and the calculation will take care of the same. You’ll get your excess tax deducted.

Dear Amit Kumar,

Salaried employee – residing in rental house – no other sources of income –

ITR 1 insists for selection of self occupied property or let out property. In the above case the assessee has no self occupied property or let out property.

which ITR form to be filed for FY 2017-18.

Please guide.

Regards,

Nagarajan v

You need to fill ITR 1

Dear Amit,

While e filing the return in ITR 1, selection of self occupied property or let out propertyseems imperative. If the given option is not selected the page remains not validated. How to resolve this In the above where assessee has no self occupied property or let out property.

Correct, ITR 1 has to be selected.. But question is which option have to be selected .. In above case, its not Self Occupied Or let out…. ???

LTC/LTA is exempted from tax??If so under what sec,law or authority??

LTA/LTC is exempted under section 10(5) of Income-tax Act

Hi Amit,

i have two doubts..

1. I’m about to fill ITR for 17 -18, at the time of declaration my rent was 8000/- but before 3 months i got shifted to another house of rent 10000/-.. can i get that benefit while filling ITR now..? and if yes then under which section i have to put that amount and how much amount i have to put.?

2. Our Employer circulated one communication one month before that we can Claim Professional Development Allowance in TDS. in which section we can put it…?

1. You have to deduct the HRA eligible amount from salary and put it at “income from salary”

2. Ideally Professional Development Allowance should have been accounted in Form 16 by employer. If not you’ll have to deduct it from salary before putting it at “income from salary”

Hi Mr Amit

I am a pensioner with income of 4,32,000/- for FY 2016-17. Now I want claim House Rent of Rs 6500/- pm under 80GG. I have a doubt as to how much I need to mention in the Return.

Should I mention 6500×12 directly or need to check with three options ie 5000/- pm, 10% less income or 25% of total income.

Please advise and also let me know how much I can claim under 80GG.

Thanks

You’ll need to mention the final amount as follows:

Minimum of the below three amount:

Rs. 5,000 per month – Rs 60,000

25% of annual income – 25% * 432000 = Rs 108,000

(Rent Paid – 10% of Annual Income) = Rs 34,800 (78,000 – 43,200)

You’ll fill Rs 34,800 against 80GG row in your income tax returns!

You can get more details about Section 80GG here.

how to claim benefit under section 115h while preparing ITR2 as there is no place where we can give choice