The income tax return (ITR) forms were notified on April 5 by CBDT . Thankfully there is No change in the number and name of Forms as compared to last year.

In this post we tell you which is the right ITR Form for you for AY 2018-19 (FY 2017-18). The choice of ITR Form mainly depends on the source and amount of income. Let’s first look at the classification of source of income as per Income Tax laws.

Types of Income as per Income Tax:

As per income tax laws there can be following 5 types of income:

1. Income from Salary/ Pension:

This is income that an employee receives from his employer. Pension to ex-employee is also treated as salary for Income tax. However family pension (after ex-employee death) is considered as income from other sources as NO employee-employer relationship exists between family and employer.

Download: Ultimate Tax Saving ebook with tax calculator FY 2018-19

2. Income from Home/Real Estate:

This is the income from any property – residential or commercial by renting/leasing it out.

3. Income from Capital Gains:

The profits on selling of an asset like equity, mutual funds, gold, NCDs, Bonds or real estate. The capital gains are further classified as Short Term or Long Term depending on the time frame of transactions and asset under consideration.

Also Read: How to Save Long Term Capital Gains Tax from Property?

4. Income from Business/ Profession:

This is income for professional such as lawyers, doctors etc which they generate through freelancing or private practice. Income from running a business is profits that the business generates after deduction of expenses such as rent, salary to staff, etc.

5. Income from Other Sources:

All other income other than the above falls under this category. This might cover interest received on fixed deposits, gifts, winning of prize or lottery, etc

Also Read: 25 Tax Free Incomes & Investments in India

Based on the type of income above we can choose the right ITR Form.

[box type=”info” size=”large” style=”rounded” border=”full”]

Here are some posts which can help you with e-filing of ITR 2018:

1. 7 Most Important Changes in ITR Forms for AY 2018-19

2. Calculate your Tax liability for FY 2017-18 (AY 2018-19)

3. Which ITR form to fill for Tax Returns for AY 2018-19?

4. How to Claim Tax Exemptions while filing ITR?

5. Use Challan 280 to Pay Self Assessment Tax Online

6. Form 26AS – Verify Before Filing Tax Return

7. 5 Ways to e-Verify your Income Tax Returns

8. What if You DO NOT file your Returns by due Date?

9. Can I file my Last Year Tax Return?

10. Why and How to Revise Your Tax Return?

11. What does Intimation U/S 143(1) of Income Tax Act mean?

[/box]

Which ITR Form to use?

The table below gives a summary of which ITR Form to use with detailed explanation after that.

| ITR Forms -> | ITR 1 (Sahaj) | ITR 2 | ITR 3 | ITR 4 (Sugam) |

| Applicable to | Resident Individuals | Individual, HUF, Partner in a Firm | Individual, HUF, Partner in a Firm | Individual, HUF |

| Income/Turnover Limit | Income Less than Rs 50 Lakhs | No Limit | No Limit | Income Less than Rs 50 Lakhs / Turnover less than Rs 2 crore |

| Salary | Yes | Yes | Yes | Yes |

| House Property | Only One House/Property | One or More House/Property | One or More House/Property | Only One House/Property |

| Business Income | No | No | Yes | Only Presumptive Business Income |

| Capital Gains | No | Yes | Yes | No |

| Other Sources | All except Income from Lottery/Race Horse | Yes | Yes | All except Income from Lottery/Race Horse |

| Exempt Income | Yes if Agriculture Income less than Rs 5,000 | Yes | Yes | Yes if Agriculture Income less than Rs 5,000 |

| Foreign Assets/Foreign Income | No | Yes | Yes | No |

| Carry Forward Loss | No | Yes | Yes | No |

Further, in a case where the income of another person like spouse, minor child, etc. is to be clubbed with the income of the assessee, this Return Form can be used only if the income being clubbed falls into the above income categories.

Also Read: 13 changes in Tax laws from April 1, 2018

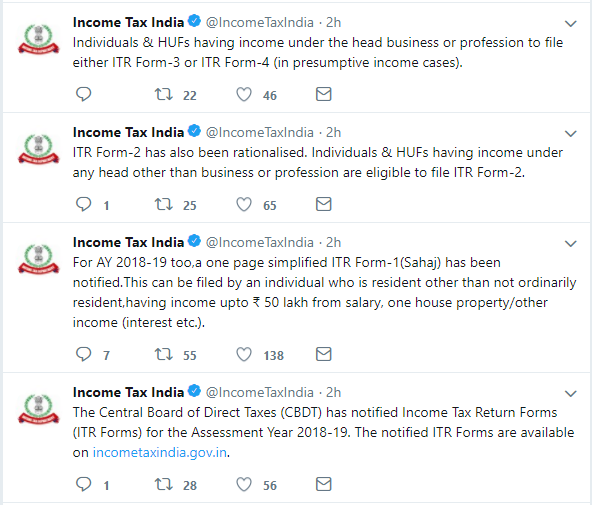

Tweets from Income Tax Department:

Who can use ITR 1?

ITR 1 can be used by resident individuals who fulfill following conditions in FY 2017-18 (AY 2018-19):

- Total income from all sources is less than Rs 50 Lakhs

- Have income from Salary/ Pension or

- Income from only ONE House Property (excluding cases where loss is brought forward from previous years) or

- Income from Other Sources (excluding Winning from Lottery and Income from Race Horses)

Who cannot use ITR 1?

Following conditions make you ineligible for ITR 1 (Sahaj)

- If you are NRI (Non-Resident Indian)

- Income is more than Rs 50 Lakhs

- Have foreign assets

- Have capital gains

- Have income from business or profession

- Have agriculture income more than Rs 5,000

- Have income from more than one house property

- If you have income from winning from Lottery or Race Horses

ITR 1 Form covers almost 90% of tax payers.

Who can use ITR 2?

ITR 2 can be used by individuals who fulfill following conditions in FY 2017-18 (AY 2018-19):

- Have income from Salary/ Pension or

- Income from one or more House Property or

- Income from Capital Gains or

- Income from Other Sources or

- Income of a person as a partner in the firm

- Foreign Assets/Foreign income

Who cannot use ITR 2?

- You cannot use ITR 2 only if you have income from business or profession.

Who can use ITR 3?

The old ITR 4 has been classified as ITR 3 for this year. It can be used by individuals who fulfill following conditions in FY 2017-18 (AY 2018-19):

- Have income from Business or Profession or

- Have income from Salary/ Pension or

- Income from one or more House Property or

- Income from Capital Gains or

- Income from Other Sources or

- Income of a person as a partner in the firm

- Foreign Assets/Foreign income

Who can use ITR 4 or Sugam?

ITR 4S has been renamed as ITR 4. This is similar to ITR 1 with the additional condition that people with income from business & profession (opted for the presumptive income scheme as per Section 44AD ,Sec 44ADA and Section 44AE) can use this form.

ITR 4 can be used by individuals who fulfill following conditions in FY 2017-18 (AY 2018-19):

- Total income from all sources is less than Rs 50 Lakhs

- Have income from business & profession and opted for the presumptive income scheme as per Section 44AD ,Sec 44ADA and Section 44AE of Income tax Act. However if the turnover exceeds Rs 2 crore, ITR 3 has to be filed.

- Have income from Salary/ Pension or

- Income from only ONE House Property (excluding cases where loss is brought forward from previous years) or

- Income from Other Sources (excluding Winning from Lottery and Income from Race Horses)

Also Read: Calculate Tax on Arrears in 7 Easy Steps

Who cannot use ITR 4?

Following conditions make you ineligible for ITR 4

- Income is more than Rs 50 Lakhs

- Business turnover exceeds Rs 2 crore

- Have foreign assets

- Have capital gains

- Have agriculture income more than Rs 5,000

- Have income from more than one house property

- If you have income from winning from Lottery or Race Horses

ITR 5

This Form can be used by a person being a firm, LLP, AOP, BOI, artificial juridical person referred to in section 2(31)(vii), co-operative society and local authority.

Also Read: 4 Reasons to File ITR even if your Income is not Taxable

ITR 6

It is applicable to a company, other than a company claiming exemption under section 11 (by charitable/religious trust)

ITR 7

It is applicable for trusts, political parties, institutions, colleges, etc. covered under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D)

ITR – V

It is the acknowledgement of filing the return of income

You can download the ITR Forms for AY 2018-19 from Income Tax Department Website.

The above comparison of ITR Forms would help you to choose the right form to use for AY 2018-19 (FY 2017-18).

I am pharma distributor ,my annual turnover for 2018-19 is 65 lakh. Which itr will file and when? My gross profit margin is 5%

My former CA passed away, so I have filed ITR this year using a different CA. My primary source of income is Commission from Insurance Agency, so former CA always use to file under ITR-3 or ITR-4. But the new CA has filed under ITR-1. Will this cause any issues?

Sir, I’m a legal professional and also earn capital gains though selling equities within exempted limit (less than Rs. 100000). My total income even including the exempted capital gains does not exceed the basic exemption limit. Do I need to file IT return and if advisable or I wish, then which ITR form should I file and what supportive documents do I need.

good work done by you please send the income tax files to my mail id

Giri

Understanding which itr to file is a must before we file our IT returns. A very fantastic detailed account has been produced here on this link that details each ITR and its applicability. – https://www.hrblock.in/guides/which-itr-form-file/