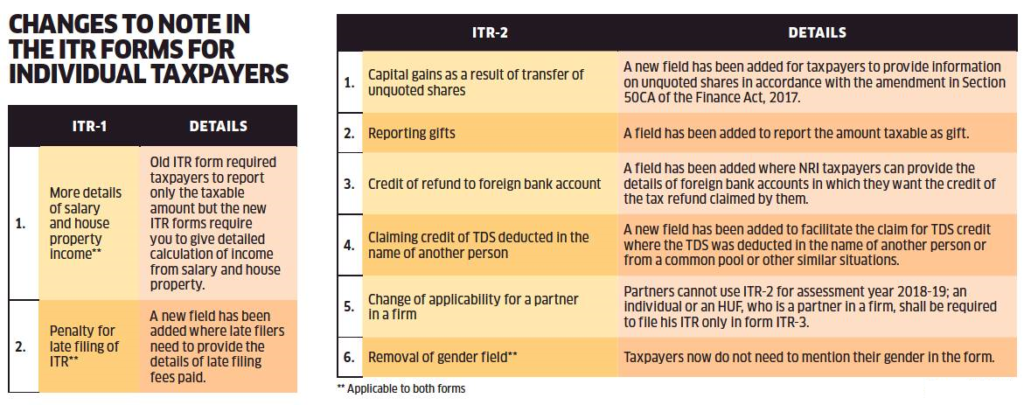

The last day for filing the income tax return without penalty for AY 2018-19 is July 31, 2018. The good thing is most of things are similar to last year. However, as it happens every year, there are some changes in these forms and information sought. Overall income tax department wants to know more details about your salary structure, house property and GST. We list down the most important changes below:

NRIs cannot file ITR 1 (Sahaj):

In AY 2018-19 only resident Indians with income less than Rs 50 Lakhs and one house property can file returns using ITR 1. NRIs are NO more eligible to use ITR 1. They would need to use ITR 2 which requires much more details and much more complicated compared to ITR 1.

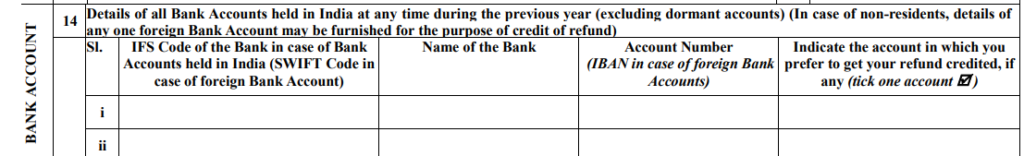

Foreign bank Account for NRIs:

In case of non-residents, the requirement of furnishing details of any one foreign Bank Account has been provided for the purpose of credit of refund. Earlier, they could only provide details of bank accounts held in India.

Download: Ultimate Tax Saving ebook with tax calculator FY 2018-19

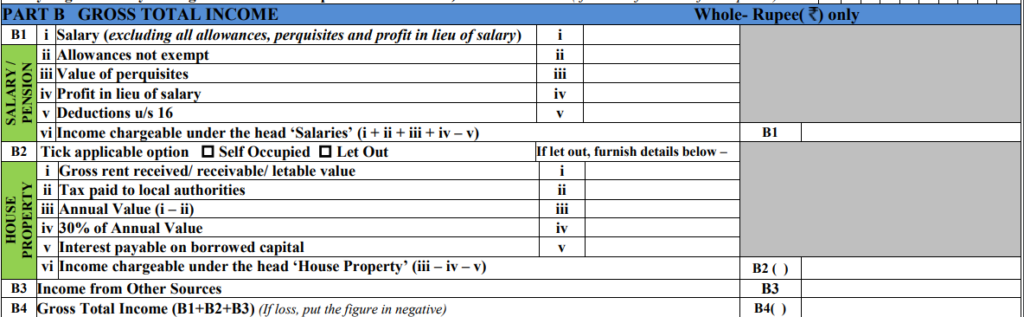

More details about Salary:

The ITR forms now ask for more details regarding the salary structure such as Allowances not exempt, Value of perquisites, Profit in lieu of salary & Deductions u/s 16. These details are available in Form 16 but now need to be provided in the tax return form too.

More details about House Property:

The new ITR 1 (Sahaj) also asks for more details on “Income from House Property” such as Gross rent received, Tax paid to local authorities, Interest payable on borrowed capital.

[box type=”info” size=”large” style=”rounded” border=”full”]

Here are some posts which can help you with e-filing of ITR 2018:

1. Which ITR form to fill for Tax Returns for AY 2018-19?

2. Calculate your Tax liability for FY 2017-18 (AY 2018-19) using Income Tax Calculator

3. How to Claim Tax Exemptions while filing ITR?

5. Use Challan 280 to Pay Self Assessment Tax Online

6. Form 26AS – Verify Before Filing Tax Return

7. 5 Ways to e-Verify your Income Tax Returns

8. What if You DO NOT file your Returns by due Date?

9. Can I file my Last Year Tax Return?

10. Why and How to Revise Your Tax Return?

11. What does Intimation U/S 143(1) of Income Tax Act mean?

[/box]

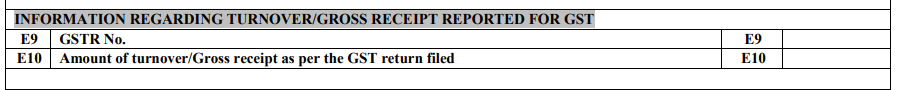

GST registration number:

The assesses who would file income tax returns presumptive income from business and profession using ITR 4 or ITR 3 would have to provide GST registration number and its turnover. This is to corelate the direct and indirect taxes and check for any possible tax evasions.

Furnishing details of cash deposit NOT required:

Last year ITR forms had fields to capture details of cash deposited during the year (due to demonetization). This years ITR Form has done away with this requirement.

Also Read: 25 Tax Free Incomes & Investments in India

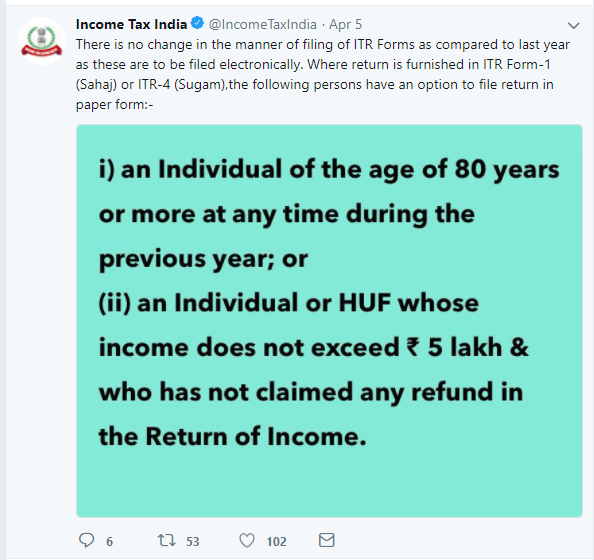

ITR to filed Online except in certain cases:

All the tax returns have to filed online as was the case last year. However, there are certain exceptions where the ITR can be filed in paper/physical form.

If the individual is of age 80 years or more and the tax return is furnished using in ITR Form-1 (Sahaj) or ITR-4 (Sugam)

Individual or HUF whose income does not exceed five lakh rupees and who has not claimed any refund in the Return of Income and the tax return is furnished using in ITR Form-1 (Sahaj) or ITR-4 (Sugam)

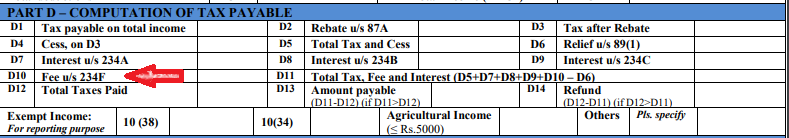

Penalty for not Filing Tax Returns on Time:

The below provision of Penalty for not filing tax returns on time was proposed in Budget 2017 and would be effective from AY 2018-19:

As per Section 234F, if the income tax return is filed after the due date (July 31) but on or before the December 31 of the assessment year, there will be a fine of Rs 5,000. If the return is filed after December 31, there would be fine of Rs 10,000. After March 31, the returns cannot be filed. However, in case the total income is less than Rs 5 lakh, the penalty should not exceed Rs 1,000.

We would come out with more details on ITR Forms and tax filing in next few weeks.

I am a Senior citizen and also NRI ( American citizen). I have an account in India. Do I have to provide my Social Security number for filing tax return. Please advise soon.

Thanks

Sir,

I am a senior citizen. Can I claim deduction U/S 80TTB (upto Rs.50000) for the FY 2018-19 on my SAVINGS BANK INTEREST?

yes

My wife used to take private home tuition and used to file itr3 every year though her Total Income from all sources never crossed basic exemption limit.

Now that due to poor health condition she has left her profession more than one and a half years back and she does not have any income other than a meagre amount of S.B. Interest much below Rs. 10000 a year……does she still need to file any ITR?

No she need not file ITR

Sir,

My mother is a super senior citizen. She has income from Family Pension and Savings Bank Interest. But her Total Income including all sources never exceeded the basic exemption limit applicable to her. But she submits ITR every year.

Now that she is too aged and invalid and that her income is unlikely to exceed the Basic Exemption limit in foreseeable future, can she discontinue filing ITR any more? If yes whom to contact in IT Department to pray for exemption from filing ITR?……..Is it her AO(ITO) or any other authority? Can she submit her prayer to the nearest any ASK centre? Or can she submit it online and how?

2017-18 i worked abroad more than 7 month but due to delay payment i received by salary in april-may 2018. not i am confused if i give bank details there will be no much translation from abroad within the period of april 2017 to march 2018. so how can i show my income in assessment year 2018-19.

My husband is in USA and has filed USA joint return as a resident (USA) and declared me as a resident too. I stayed in India for 4 months. As per my understanding, in that case my status in India is NRI. I am unemployed in USA and I resigned from my India job in September 2017.

Kindly let me know if I need to use ITR I or ITR 2.

Thanks

Being NRI, I am filling ITR2, as I have salary income for 3 months in india. Do I need to give details of income from outside india and tax relief ? or it is only required for them who are resident but has global income ?

Being NRI which ITR forms needs to fill this time?

Income earned in India=0

could you suggest

If there is NO income in India you are not required to file ITR. However if you plan to do then you have to fill up ITR 2.

Dear Sir,

When to use section 10(12) and section 10(15) in ITR 1 for declaring exempt income.?

Please help.

Regards,

I am a govt. employee and a senior citizen. I want to deduct tax solely on my salary income by my deductor for the FY 2018-19. I intend to show the interest income in the itr1 and pay self assessment tax/advance tax as applicable after deduction of Rs. 50000 under 80TTB.

My question is……in that case the form 16 issued by my employer will not show the deduction under 80TTB. Can I claim that deduction in my ITR1?

To furnish the exempted income in ITR – 1, which of below section 10 is to be used for “PPF Interest” to be selected.

Section 10(12) – Recognised Provident Fund Received

or

Section 10(15) – income by way of interest, premium on redemption or other payment on such securities, bonds, annuity certificates, savings certificates, other certificates

Please guide.

Sir,

I used to take Home Tuition and filed my itr 3 upto AY 2017-18 as “profession (others”) SHOWING PROFIT AND LOSS A/C and maintained a book of A/C . Since last more than 1 and half years I have left my profession due to failing health and I have no sources of income other than a meagre amount of S/B interest <10000. Shall I have to continue submitting itr anymore? If yes , may I submit itr 1 to show the Income from S/B interest only? How to inform the Income Tax dept. if I want to discontinue submitting ITR further?

In ITR1, the field ‘Type of House Property’ is mandatory. So if a salaried assesse don’t have any house property then what he should select??

“Type of house” is not mandatory just leave it as it is (“select”) in case you have no house

In the ITR 2 for the AY 2018-19 for NRI it is indeed welcome the the Tax Dept has allowed to get refund if any into the foreign bank account.

Please advise whether an NRI has the option to give local bank account for refund.(or) NRI has to give only a foreign bank account for claiming refund.

The reason being if the refund is in foreign currency, there could be loss of exchange rate , transfer charges , time delays etc etc..

Thanks for your help. Regards

The foreign bank account is an option and not compulsory. You can give your Indian bank account