One of my friends called me in a worrying voice telling me he had received an email from Income tax department with subject “Intimation U/S 143(1) for PAN ABCxxxxx4A AY:2019-20”. As with most of us, any communication from taxmen makes us worried and it was not much different for my friend.

Are you in the same boat and have you also received similar email from [email protected] with similar subject? And are you worried about what it means for you?

Well worry not! Intimation U/S 143(1) is sent by Income Tax department in response to the Tax returned filed by you. As the subject suggests “Intimation” – the communication intimates the tax payer about, any tax and interest payable or if you are eligible for refunds.

Also Read: 23 most common Investments and how they are Taxed?

This is done by the computer without any human intervention and checks for following two things:

- Any mathematical error or

- any incorrect tax claim

What you need to do is open the attached zip file. The zip file contains a PDF file which is password protected. To open this PDF following is your password.

The password is your PAN Number in lower case followed by your date of birth in DDMMYYYY format. So if your PAN Card Number is ABCDE1234A and date of birth is January 1, 1985, then your password would be abcde1234a01011985. The date of birth should be one which is mentioned on your PAN Card.

Download: The ultimate ebook guide to Save Tax

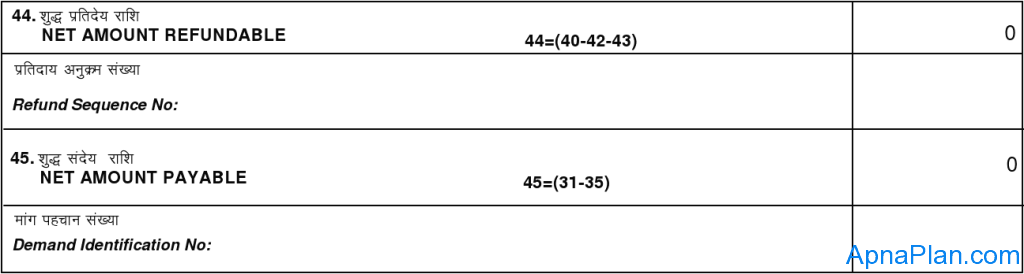

Just scroll down and at the end of all calculations you would see two headings.

- Net Amount Refundable

- Net Amount Payable

In case there is ‘0’ in front of both as in the picture above, it means that your tax return filing was perfect – you neither need to pay any more tax for the year nor you would get any tax refunds.

In case some amount is mentioned for “Net Amount Refundable” then its good news and you would soon get that amount in your bank account. And if “Net Amount Payable” has some amount mentioned, then you need to pay that much tax to Income tax department.

In case you think there is some error in the calculation sheet, you should consult a qualified CA or good tax expert for further action.

I have received a mail u/s 143(1).

As per income tax officer my net amount refundable is more than what I claimed.

Is this case do I need to respond anything to the income tax department or shall just wait for my refund to get credited?

Electronically filed returns are faster than manual filing as the tax data is transmitted directly into the computers. The income tax return e-Filing has made our life very easy. Now most of the taxpayer don’t need the service of the chartered accountant. A salaried person can easily e-file income tax return using his form 16. Government is also trying hard to 100% shift to e-Filing. In 2013-14 , 2.96 crore income tax return has been filed through the e-Filing facility. While in 2014-15 the number increased to 3.41 crore. A nice article provided on e-filing, appreciate the article.