This year might have been happy one for you if you received long pending salary dues as arrears. But we know receiving arrears makes everyone happy but pain of paying higher taxes makes them worried? We explain how to calculate tax on arrears and claim tax benefit u/s 89(1) in income tax return with example.

Tax Calculation on Arrears:

We take a simple example. Amit is a government employee and he has received his long awaited salary dues as arrears. Here are the numbers.

- Salary income for FY 2015-16: Rs 9,00,000

- Additional Arrears received: Rs 5,00,000

- Total income: 14,00,000

This arrears was due from last 3 financial years as follows:

- FY 2014-15: Rs 2,00,000

- FY 2013-14: Rs 1,75,000

- FY 2012-13: Rs 1,25,000

We use this example to illustrate tax calculation on arrears. For simplicity we would assume that Amit has not invested for any tax exemption, so his income stated above is “Net Taxable Income”.

Download:The ultimate ebook guide to Save Tax for FY 2018-19

Step 1:

Calculate tax for present year without considering arrears

So for FY 2015-16, the taxable income without arrears = Rs 9,00,000

Income Tax Payable = Rs 1,08,150

Step 2:

Calculate tax for present year after adding arrears payout

So for FY 2015-16, the taxable income without arrears = Rs 9,00,000 + Rs 4,00,000 = Rs 14,00,000

Income Tax Payable = Rs 2,52,350

Step 3:

Subtract income tax payable you get in step 2 from step 1

Additional tax due to arrears: Rs 2,52,350 – 1,08,150 = Rs 1,44,200

Also Read: Best Tax Saving Investments u/s 80C

Step 4:

Allocate the arrears components to the respective financial years. So in our case it’s as follows

FY 2014-15: Rs 2,00,000

FY 2013-14: Rs 1,75,000

FY 2012-13: Rs 1,25,000

Step 5:

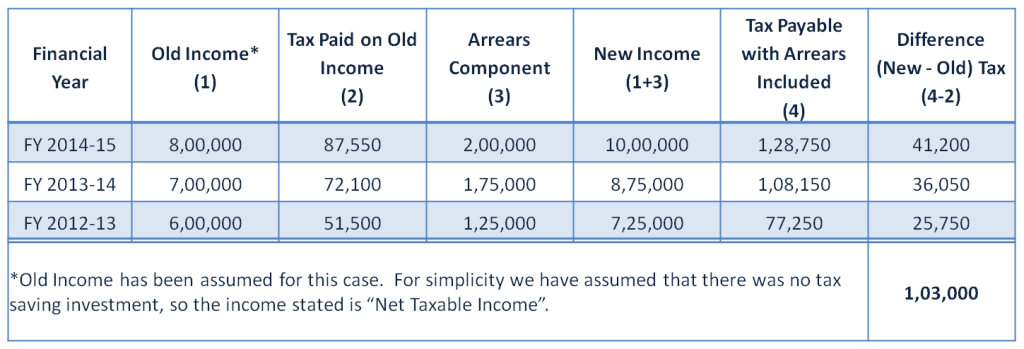

Calculate new tax payable for each financial year where the component of arrears is present i.e. adding arrears to the old income in respective financial years.

Add the excess tax payable across the financial years due to arrears. In our case it comes out to be Rs 1,03,000. This means that had the salary payout been on time you would have paid this amount as tax.

Step 6:

Subtract the excess tax payable due to arrears in Step 3 from the additional tax payable in Step 5.

Tax Difference: Rs 1,44,200 – Rs 1,03,000 = Rs 41,200.

If you consider arrears payment as income for only present financial year, you would be paying Rs 41,200 extra as taxes, without any fault of yours. Government thankfully understands the situation and has provided relief for tax payers under Section 89(1).

Also Read: Submit Income Tax Proof to Employer – How, When and Why?

Step 7:

Calculate your final tax liability for FY 2015-16

So for FY 2015-16, the taxable income with arrears = Rs 9,00,000 + Rs 4,00,000 = Rs 14,00,000

Income Tax Payable = Rs 2,52,350

Tax Deduction u/s 89(1) on account of arrears = Rs 41,200

Net Tax payable = Rs 2,52,350 – 41,200 = Rs 211,150

To claim the above tax benefit u/s 89(1), you need to fill up Form 10E. From FY 2014-15 (assessment year 2015-16), the income tax department has made it mandatory to file Form 10E if you want to claim relief under section 89(1). The form can be filled online on the Income Tax Website.

The question is what would have happened if there was no excess or lower tax as in Step 6?

There would be no special treatment. You just calculate your tax after adding arrears and pay our taxes. Section 89(1) would not be applicable!

Form 10E: How to fill?

The Form 10E can be filled online from Income Tax website. Here are the steps:

- Login to Income Tax efiling website.

- After you have logged in, click on tab named ‘e-File’ and select ‘Prepare & Submit Online Form (Other than ITR)

- On the next screen, select Form 10E and the Assessment Year from the drop down.

- The Form 10E would be displayed with instructions and annexure. Fill the relevant details and submit.

In case you do not submit Form 10E to take advantage of Sec 89(1), you might receive notice from income tax department saying: The relief u/s 89 has not been allowed in your case, as the online form 10E has not been filed by you. The furnishing of Online form 10E is required as per sec.89 of the Income Tax Act

Tax Calculators:

You can download the income tax calculator for past financial years here. Use them to calculate your taxes for the respective years.

sir, i received arrears since 2005 how calculate the amount To claim the tax benefit u/s 89(1),

SIR

i have got arrear on 30 th march 2020 without deducted tax now this time how can i pay tax

i can also try e pay tax under self assessment tax but could not pay screen show your transaction exceed pay limit

Thanks for explaining in detail how to calculate income tax

Hello Sir I had received my salary of 8month last year and paid tax on it. But arrear of last 4 month this year received. But this financial yr my salary is reduced .including arrear and this year salary my salary is not taxable. How can I calculate my tax. Previous year salary was 42800rs per month. This financial year it is 20000/ rs per month. Please clear

A person took housing loan in Fy 2016-17 and interest is abt 3 lacs ,but he doesn’t receive any salary in FY 16-17 OR 17-18. SO while computing relief under 89 can we deduct interest from arrear salary for FY 16 17

If arrear also includes NPS, then should be deduct

corresponding NPS amount while adding this arrears to that financial year?

For example, in FY15-16, I got 2lakh salary, now in FY 17-18, I got 2lakh arrear for FY15-16, which includes 1Lakh DA+1Lakh NPS.

Now what should be my net income includong arrears for FY15-16, 3 Lakh or 4Lakh? Can I get 1Lakh NPS as deduction under 80C?

I received my arrear salary for the last four years in the month of December 2018 after an administrative decision taken in the month of October 2018. However, my employer did not deduct any TDS on this amount. Now I have estimated my total tax liability for this financial year and deposited the entire tax as advance tax in the month of February 2019. My question is whether IT department will impose any penalty interest u/s 234C of IT act on me.

I do not think IT department would impose any penalty. If it does let them know the situation.