As the last date of filing Income Tax Return is fast approaching, most tax payers would have filed their ITR. However the filing is only complete if it has been verified by the tax payer. Until a few years back there was just offline mode to verify your returns – making it a cumbersome process and not truly digital. You had to download ITR V from income tax website, print it, sign it and then post it to the central processing center in Bangalore within 120 days.

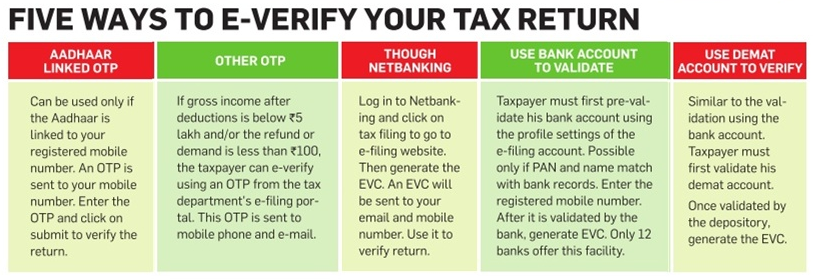

The good news is Income Tax Department now offers multiple ways to e-verify your tax returns. This has made the ITR filing process truly online and paper-free. All you need to generate a Electronic Verification Code (EVC) for every return that you e-file. This EVC can be generated in the following 5 ways:

- Directly through income tax return filing website – incometaxindiaefiling.gov.in

- By linking Aadhar to PAN Number and verifying it with one time password

- Through Net banking of all major banks

- Through Bank Account

- Through Demat Account

In next few paragraphs we look each of the above method in details and then you can decide which method suits you best.

[box type=”info” size=”large” style=”rounded” border=”full”]

Here are some posts which can help you with e-filing of ITR 2019:

1. 9 Most Important Changes in ITR Forms for AY 2019-20

2. Calculate your Tax liability for FY 2018-19 (AY 2019-20)

3. Download 44 page slideshow showing all tax exemptions

4. Which ITR form to fill for Tax Returns for AY 2019-20?

5. How to Claim Tax Exemptions while filing ITR?

6. Use Challan 280 to Pay Self Assessment Tax Online

7. Form 26AS – Verify Before Filing Tax Return

8. 5 Ways to e-Verify your Income Tax Returns

9. What if You DO NOT file your Returns by due Date?

10. Can I file my Last Year Tax Return?

11. Why and How to Revise Your Tax Return?

12. What does Intimation U/S 143(1) of Income Tax Act mean?

13. What happens after you file your ITR?

[/box]

1. Through income tax return filing website – incometaxindia.gov.in

You can use this method only if Total income after deduction as per ITR is less than Rs 5 Lakh and the Refund claim or Tax due is less than Rs 100.

Steps:

- Login to Income tax Website: incometaxindiaefiling.gov.in

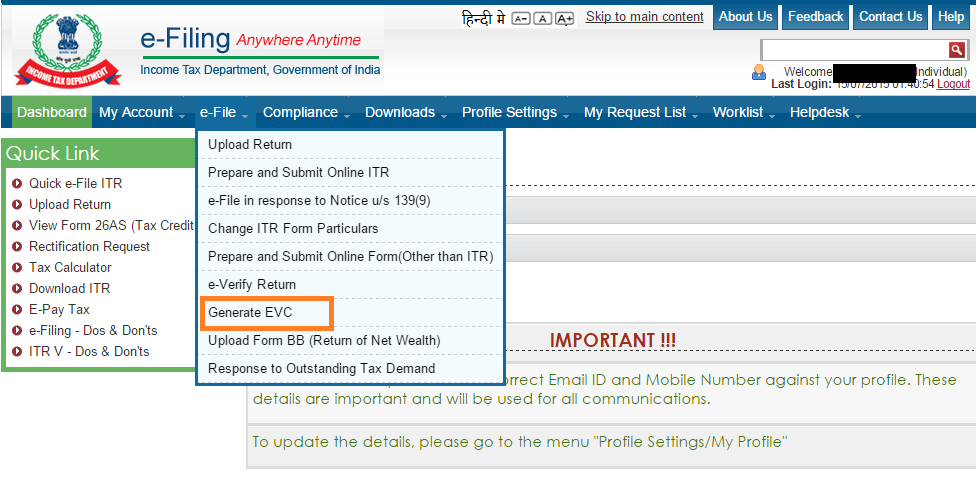

- Click on efile >> generate EVC

- The EVC code would be sent to your registered mobile number and e-mail id

- You can enter this code in the space provided against the ITR you have e-filed and e-verify your returns.

- This code is valid for 72 Hours

This option may further be restricted to individuals based on other risk criteria that may be determined from time to time.

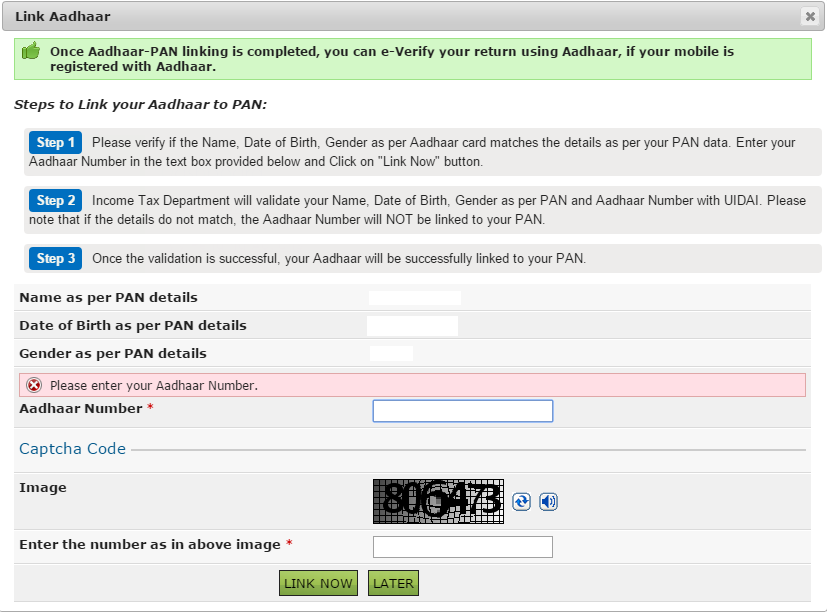

2. By linking Aadhar to PAN Number and verifying it with one time password

Also Read: Name Mismatch in Aadhaar & PAN – Now you can Link both easily

Anyone who has a valid Aadhar Number and the mobile number provided in the same is correct can use this method.

Steps:

- Login to Income tax Website: incometaxindiaefiling.gov.in

- Link your Aadhar number to your PAN number by filling this form

- The Aadhar Number and PAN card can be linked if Name, Date of Birth and Gender are same on both the records

- Once both are linked the EVC would be generated by UIDAI and sent to the registered mobile number.

- This EVC is valid for 10 minutes only

Download: Ultimate Tax Saving ebook with tax calculator FY 2019-20

3. Through Net banking of all major banks

This can be used if the bank account has validated PAN Card linked to it as part of KYC.

Steps:

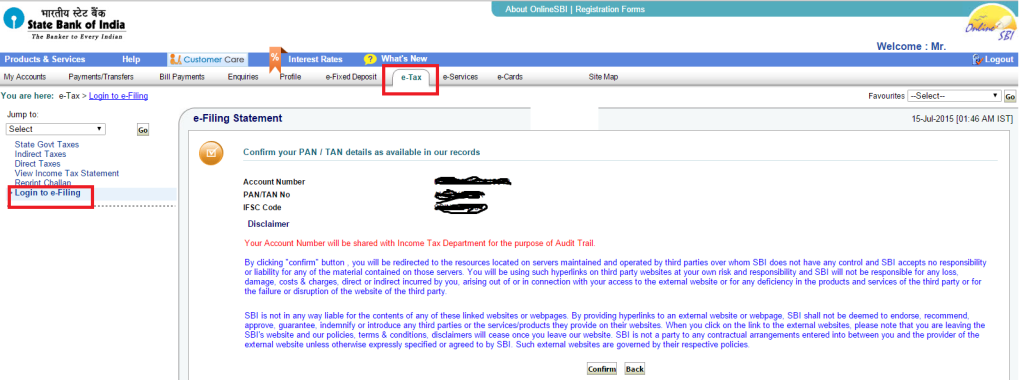

- Login to your bank account through internet banking

- Click on “Login to e-Filing”

- The screen will show your PAN card number and asked to confirm

- Once confirmed you would need to give transaction password and then you would be redirected to Income Tax filing website

- You need to generate EVC from there.

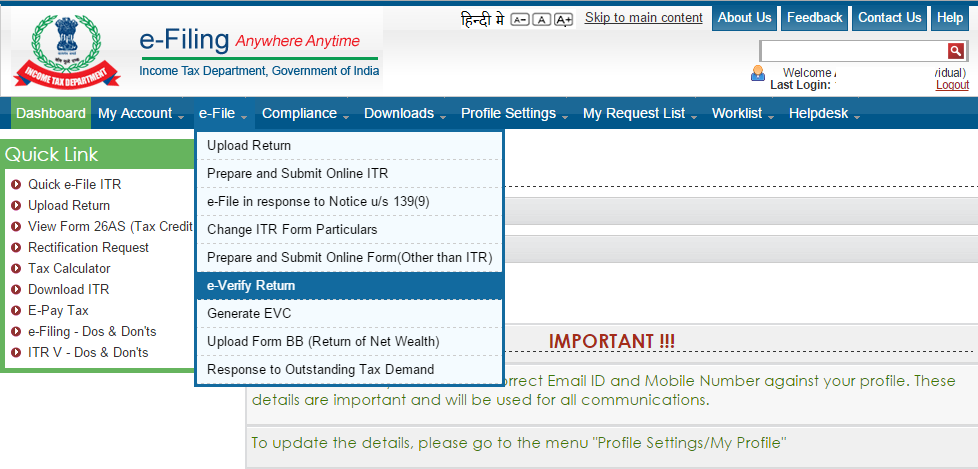

Once you have generated the EVC you can e verify your income tax return by following the screen below:

Also Read: 13 Important Changes in Tax Rules from FY 2018-19

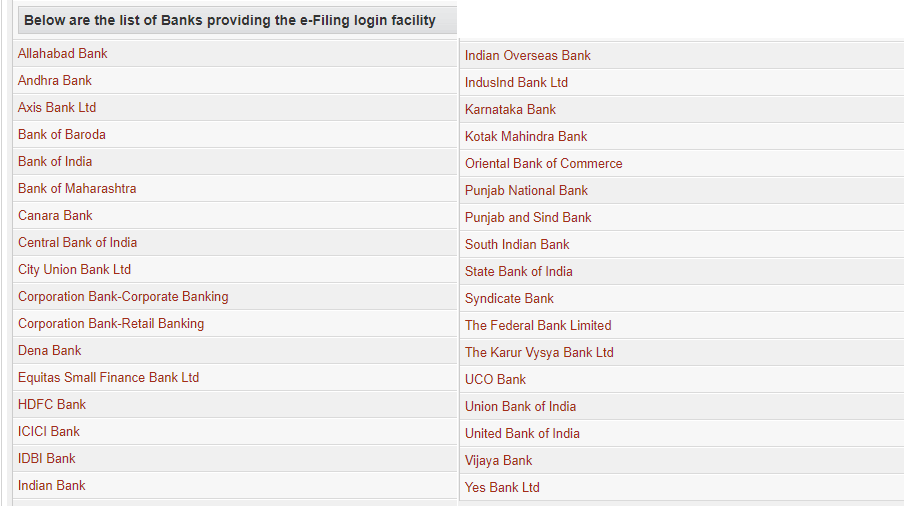

4. Through Bank Account

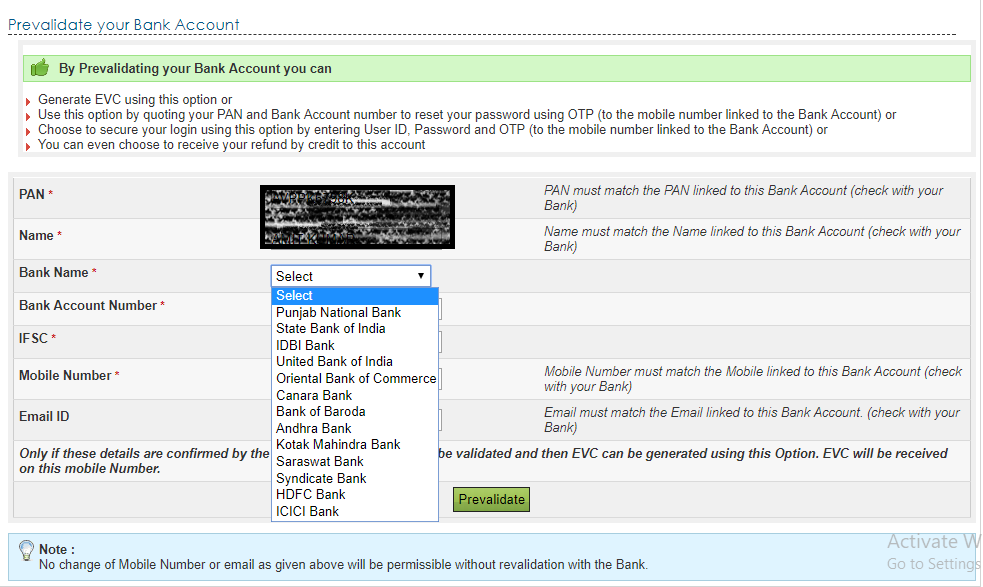

This method to generate EVC can be used if the PAN and Name match with the bank records.

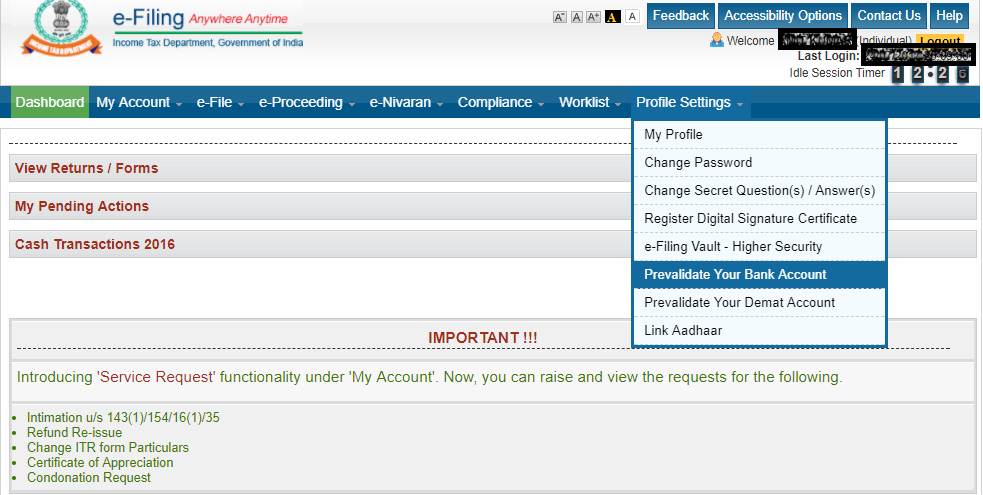

- The taxpayer first needs to pre-validate the bank account in the income tax efiling website using the profile settings (as shown below).

- EVC will be sent to the mobile number validated with the bank

- At present only 12 banks offer this facility (as shown below)

Also Read: How are your Investments Taxed?

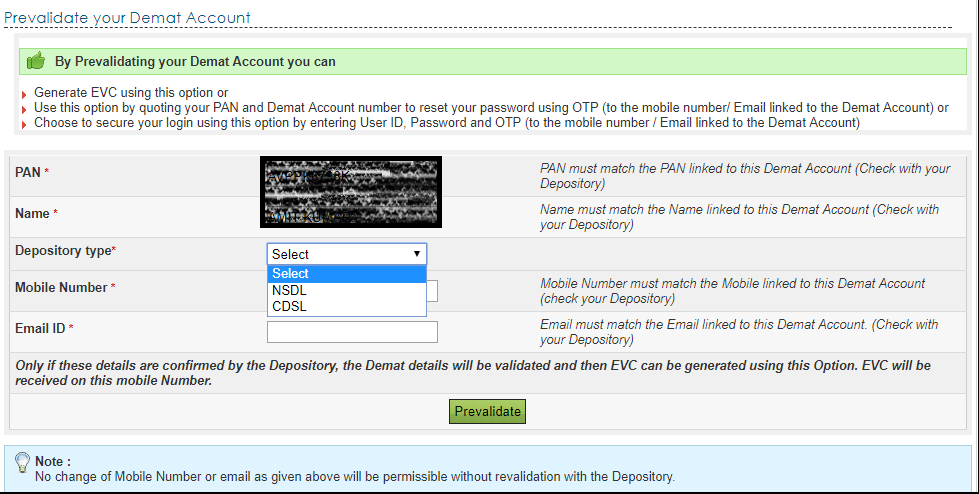

5. Through Demat Account

This is similar to EVC generation through bank account. The taxpayer first needs to pre-validate the Demat Account.

Once validated the depository, EVC is generated to the mobile number linked to Demat account.

6. Physical Form – ITR V

In case you are not able to generate EVC by any of the above methods, you will have to download the ITR V and send the physical copy to Central Processing Centre in Bengaluru at following address:

CPC, Post Box No 1, Electronic City Post Office, Bangalore 560100, Karnataka, India.

Keep in mind following points while using ITR V for Verification:

- Sign in blue ink and send via ordinary post or speed post. Do not use a courier to send the ITR-V.

- ITR-V is auto-generated and is emailed to you after you successfully uploade-file your income tax return. It can also be downloaded from the e-filing website under the ‘View ReturnsForm’ on the ‘Dashboard’.

- You are not required to send any supporting document along with the ITR-V. Just send the one page signed ITR-V.

- When your ITR-V is received at the CPC, you will receive an email and an SMS alert. Processing of your return will only start after verification

Regarding Generating EVC through Bank Account, can you confirm if Bank of Maharashtra is, at present, on the list of banks for pre-validating the bank account? Many Thanks!