The ITR-1 and ITR-4 forms for filing income tax returns for AY 2020-21 have been released. This is rather very early as these forms used to be released in first week of April every year. This is good thing, however as has been the trend, the new form asks for more disclosures. The idea being more and more information about the tax payer would help the income tax department to come up with correct tax assessment and would increase compliance. This post explains the new disclosures asked for and additional changes.

Download ITR Forms:

The ITR-1 and ITR-4 forms for AY 2020-21 can be downloaded from the Income Tax Website. These are just the PDF formats and the tax utility in excel/java is still to be made available.

Changes in Who can fill ITR-1 for AY 2020-21

There have been changes in eligibility criteria of tax payers who can file their tax returns using the simple ITR-1 form. Following people can no longer use ITR-1 (for AY 2020-21):

- individuals who have deposited more than Rs 1 crore in bank account (savings or current)

- who have incurred expenditure of an amount or aggregate of amount exceeding Rs. 2 lakhs for travel to a foreign country

- who have paid more than Rs 1 Lakh in electricity bill

joint home owners

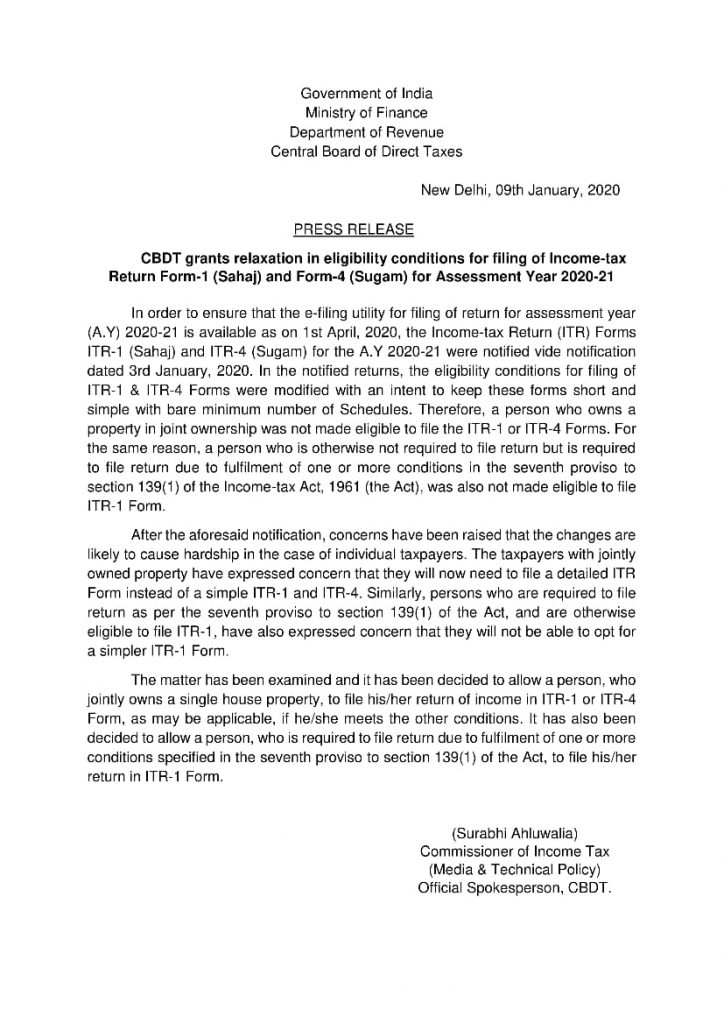

The announcement that people having joint home in their name must compulsorily file return using ITR-2 or ITR-3. This was a bad decision as most of times joint names include non-working spouses/relatives who have been added for security reasons. This would have complicated matters and thankfully Income Tax Department clarified that this is not the case anymore. As long as the joint holders meet the eligibility criteria of file returns using ITR-1 or ITR-4, they can do so. Below is the clarification given by IT-Department.

Also Read: What happens after you file your ITR?

New Disclosures:

Following are the new disclosures asked in ITR Forms:

1. Passport:

The tax payers need to mention their passport number in case they have one. The idea is to check for any foreign travel in the year.

2. Expenditure on Foreign Travel:

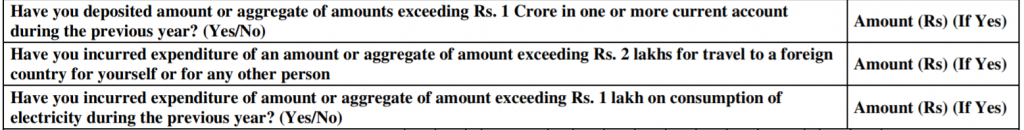

The ITR has the following question:

Have you incurred expenditure of an amount or aggregate of amount exceeding Rs. 2 lakhs for travel to a foreign country for yourself or for any other person? (Yes/No)

3. Current Account Details:

Have you deposited amount or aggregate of amounts exceeding Rs. 1 Crore in one or more current account during the previous year? (Yes/No)

Also Read: Best Tax Saving Investments u/s 80C

4. Electricity Bill Details:

Have you incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on consumption of electricity during the previous year? (Yes/No)

5. Employer Details:

The form asks for following details of Employer: TAN of Employer (mandatory if tax is deducted), Name of employer, Nature of Employer, Address of Employer, Town/City, State, PIN/ ZIP Code (If TAN is provided name and address will be pre-filed)

6. Tenant Details:

Enter Tenant details here If the property is Let out, Name and PAN or Aadhaar of Tenant, if available. This is optional as of now but as things stand it would be compulsory going forward.

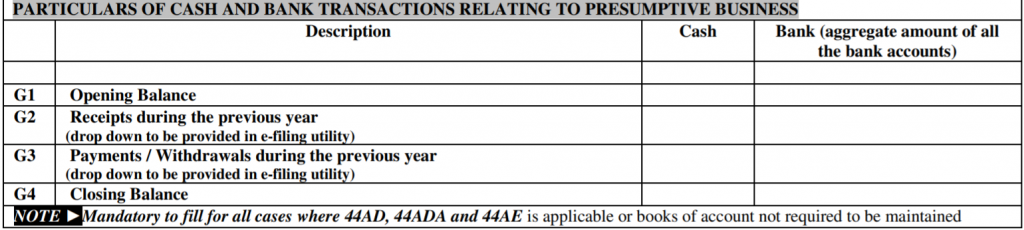

7. Presumptive Income Details:

Particulars of cash and bank transactions relating to presumptive business.

In the last few years the income tax department has made a lot of changes in the form of disclosures – with the idea of increased tax compliance. However, every new information that it asks complicates the filing for normal tax-payers.