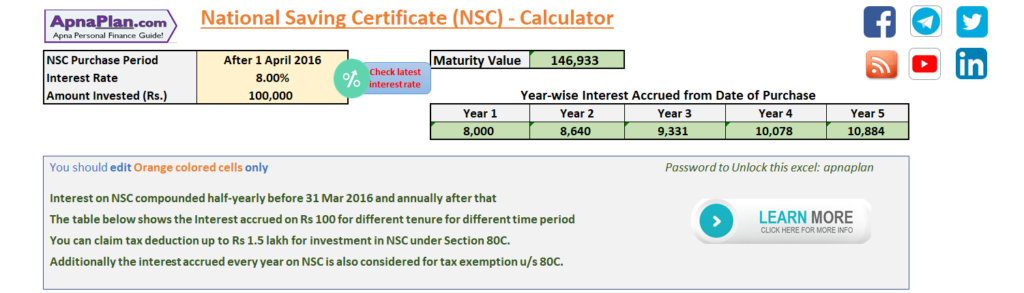

NSC (National Saving Certificate) is popular tax saving investment under section 80C. It has maturity of 5 years and is guaranteed by Government of India. Additionally, the interest earned every year on NSC is also eligible for tax deduction u/s 80C. We have designed a simple excel based NSC calculator where you can input the investment amount, interest rate and it will calculate the interest earned every year eligible for tax exemption and maturity value.

NSC Calculator (National Saving Certificate)

The interest earned on NSC is compounded annually and can be calculated using the compound interest formula:

NSC Maturity Amount = Amount Invested * (1 + Interest Rate) ^ 5Using above formula, if you buy NSC for Rs 1 Lakh paying 8% interest, the maturity amount after 5 years would be Rs 1,46,933.

Post Office NSC calculator

Earlier NSC was only available in Post offices but now you can buy it from most big banks.

Calculator for Small Saving Scheme – PPF, SCSS, Sukanya Samriddhi, NSC, Post Office FD/RD/MIS

Small saving scheme sponsored by Government of India like Sukanya Samriddhi Account, PPF, Senior Citizens’ Savings Scheme are quite popular and rightly so because of the safety, higher interest rate offered among other things. We have built calculator for each of them where you can check the maturity amount, loan eligibility, partial withdrawal and more. Click on the links to get the relevant calculator

Sukanya Samriddhi Yojana Calculator

Senior Citizens’ Savings Scheme Calculator

Post Office Fixed Deposit (Time Deposit) Calculator

NSC Investment Rules

NSC interest rates are market linked and are announced every quarter. As of 2020, NSC interest rates are 6.8% (Apr to Jun) (Click for latest interest rate for NSC)

The good thing about NSC is unlike PPF or Sukanya Samriddhi once invested the interest rate remains unchanged over the tenure of the deposit.

The minimum investment should be Rs 100.

The maturity period is 5 years from the date of investment. 10 Year NSC has been discontinued since December 20, 2015.

There is NO maximum limit for investment in NSC. However the maximum tax exemption is Rs 1.5 Lakh u/s 80C.

NSC can be purchased in multiples of Rs 100.

If you do not redeem your NSC on maturity the amount would earn interest of just 4%. This is applicable for two years from maturity. After 2 years there would be no further interest paid.

TDS & Tax on NSC

There is NO TDS on NSC.

The interest earned is taxed according to marginal income tax rates applicable to tax payer.

Best Investment to Save Tax

Section 80C offers more than 10 investments where you can invest to save tax, However many a times you need not actually do this investment as its already covered due to expenses like children tuition fee or automatic EPF deduction for salaried. In case you are new to taxes and investment do read our helpful guide on How to take maximum advantage of Section 80C and choose the best investment to save tax.

Tax Benefit on NSC

You can claim tax deduction up to Rs 1.5 lakh for investment in NSC under Section 80C. Additionally the interest accrued every year on NSC is also considered for tax exemption u/s 80C.

Here is an example.

| Date | Event | Interest Accrued | Comments |

|---|---|---|---|

| 1-Mar-17 | 1,50,000 (Investment Done) | Purchased to Save Tax | |

| 1-Mar-18 | 12,000 | Interest Accrued eligible for tax deduction u/s 80C | |

| 1-Mar-19 | 12,960 | Interest Accrued eligible for tax deduction u/s 80C | |

| 1-Mar-20 | 13,997 | Interest Accrued eligible for tax deduction u/s 80C | |

| 1-Mar-21 | 15,117 | Interest Accrued eligible for tax deduction u/s 80C | |

| 1-Mar-22 | 2,20,395 (Maturity Amount) | 16,326 | Redeem the Maturity Amount. Final Year interest is NOT eligible for tax benefit |

The final year interest is not considered as reinvestment for tax benefit.

Who can invest in NSC?

Only resident individuals can invest in NSC. You can invest jointly with another adult or purchase it on behalf of a minor.

HUFs and Trusts are NOT eligible to invest in NSC.

How much Taxes you Need to Pay this Year? Download Our Income Tax Calculator to Know your Numbers

Do you know how much tax you need to pay for the year? Have you taken benefit of all tax saving rules and investments? Should you use the “NEW” tax regime or continue with the old one? In case you have all these questions just Download the Free Excel Income Tax Calculator for FY 2021-22 (AY 2022-23) and get your answers.

Can NRIs Invest in NSC?

NRIs cannot invest in NSC. However if NRI can hold NSC if they had purchased it before becoming NRI.

How to buy NSC?

NSC can be bought across counters of most post offices.

You just need to fill up a one page form and attach relevant KYC documents (self-attested ID and address proof).

The payment can be made in any of the following modes:

- Cash

- Cheque or Demand Draft

- Withdrawal form from Post Office Savings Account

- In exchange of Old matured NSC

After due diligence and verification of KYC documents NSC is issued to the investor. The practice of giving NSC certificates have been discontinued since July 2016 and now investors are issued NSC Passbook (similar to bank account passbook) with the investment details.

You can also buy NSC online if you have net banking access of Post Office Savings Account!

NSC Calculator FAQs

✅ How to use NSC Calculator?

This is a simple excel based NSC calculator. You need to input the purchase amount and interest rate. The calculator computes the maturity amount and accrued interest every year.

✅ Which is better NSC or Fixed Deposit?

NSC is better choice than Tax Saving FD because of following reasons:

Higher Interest Rate: NSC offers higher interest rate than most banks

Safe: NSC is guaranteed by government of India is 100% safe

Additional Tax Benefit: The interest accrued on NSC also gives tax benefit u/s 80C which is not the case with Tax saving FDs.

✅ Is Interest received on NSC taxable?

The interest received on NSC is fully taxable as per you income tax slab.

✅ What is the compounding frequency of NSC interest?

The interest on NSC is compounded annually.

✅ What is full form of NSC?

NSC stands for National Saving Certificate. This is part of small saving schemes offered by Government of India for everyone to encourage savings.