As of today most big banks like SBI, ICICI Bank, Union Bank of India, Punjab National Bank (PNB) offer less than 3% interest on savings account. Until October 2011, all banks had to offer minimum interest of 4%. However Reserve Bank of India deregulated the interest offered on Savings Account by banks in October 2011 with the expectation that it would make market more competitive. However with falling interest rates, almost all big banks have slashed their interest rate on savings account to below 3%.

The highest Saving Account interest is being offered by Ratnakar Bank & Bandhan Bank at 6% for balance of more than Rs 1 lakh.

Most of small finance banks also offer a higher interest on savings account. Utkarsh Small Finance Bank offers 7.25% on balance of above Rs 10 Lakhs. Utkarsh Small Finance Bank and Ujjivan Small Finance Bank offers 7.00% interest on savings account for balance of more than Rs 1 Lakh.

Get Highest Fixed Deposit Interest Rates

Fixed Deposit with Banks is one of the most popular and convenient investment option. To help you choose the best, we compare the interest rates on fixed deposit across all major 48 banks in India including government, private, foreign and small financial banks in India every month. This may prove to be quite handy for you in choose the Best Bank FD scheme.

Highest Interest on Savings Account

The table below shows the interest rate offered by banks on its saving account across different balances. We have highlighted banks which offer more than 4% .(X means no info was available on the bank’s website as of research date)

Government Banks Interest on Savings Account

None of the government owned banks offer more than 4% interest on savings account.

| Bank | up to 1 Lakh | 1 – 5 Lakhs | 5 – 10 Lakhs | 10+ Lakhs |

|---|---|---|---|---|

| Bank of Baroda | 2.75% | 2.75% | 2.75% | 2.75% |

| Bank of India | 2.90% | 2.90% | 2.90% | 2.90% |

| Bank of Maharashtra | 2.75% | 2.75% | 2.75% | 2.75% |

| Canara Bank | 2.90% | 2.90% | 2.90% | 2.90% |

| Central Bank of India | 2.90% | 2.90% | 2.90% | 2.90% |

| Indian Bank | 2.90% | 2.90% | 2.90% | 2.90% |

| Indian Overseas Bank | 3.05% | 3.05% | 3.05% | 3.05% |

| J&K Bank | 2.90% | 2.90% | 2.90% | 2.90% |

| Post Office Savings Account | 4.00% | 4.00% | 4.00% | 4.00% |

| Punjab and Sind Bank | 3.10% | 3.10% | 3.10% | 3.10% |

| Punjab National Bank | 3.00% | 3.00% | 3.00% | 3.00% |

| State Bank of India | 2.70% | 2.70% | 2.70% | 2.70% |

| UCO Bank | 2.50% | 2.50% | 2.50% | 2.50% |

| Union Bank of India | 3.00% | 3.00% | 3.00% | 3.00% |

Should you Invest in Gold?

We looked at more than 55 years history of gold to see if its a good idea to invest in Gold. We concluded that its more volatile than perceived but investing in long term may provide you with more stable returns. You can look at the complete analysis and our conclusion here – Looking at Gold Price History in India – Should you Invest in Gold?

Private Banks Interest on Savings Account

A few private banks offer more than 4% on their savings account:

- Bandhan Bank

- IDFC First Bank

- Indus Ind Bank

- Ratnakar Bank

- Yes Bank

| Banks | up to 1 Lakh | 1 – 5 lakhs | 5 – 10 Lakhs | 10+ Lakhs |

|---|---|---|---|---|

| Axis Bank | 3.00% | 3.00% | 3.00% | 3.00% |

| Bandhan Bank | 3.00% | 6.00% | 6.00% | 6.00% |

| Catholic Syrian Bank | 2.10% | 2.75% | 2.75% | 2.75% |

| City Union Bank | 3.50% | 3.75% | 3.75% | 4.00% |

| DCB Bank | 3.25% | 3.25% | 3.25% | 3.25% |

| Dhanalakshmi Bank | 3.00% | 3.00% | 3.00% | 3.00% |

| Federal Bank | 2.50% | 2.50% | 2.50% | 2.50% |

| HDFC Bank | 3.00% | 3.00% | 3.00% | 3.00% |

| ICICI Bank | 3.00% | 3.00% | 3.00% | 3.00% |

| IDBI Bank | 3.00% | 3.00% | 3.00% | 3.00% |

| IDFC First Bank | 4.00% | 4.50% | 4.50% | 5.00% |

| Indus Ind Bank | 4.00% | 5.00% | 5.00% | 6.00% |

| Karnataka Bank | 2.75% | 2.75% | 2.75% | 2.75% |

| Karur Vysya Bank | 2.75% | 2.75% | 3.25% | 3.50% |

| Kotak Mahindra Bank | 3.50% | 4.00% | 4.00% | 4.00% |

| Nainital Bank | 3.00% | 3.00% | 3.00% | 3.00% |

| Ratnakar Bank | 4.75% | 6.00% | 6.00% | 6.50% |

| South Indian Bank | 2.35% | 2.75% | 2.75% | 2.75% |

| Tamilnad Mercantile Bank | 3.00% | 3.00% | 3.00% | 3.25% |

| Yes Bank | 4.00% | 4.75% | 4.75% | 5.50% |

25 Best Tax Free Income & Investments in India

Everyone hates Taxes and go out in full force to save it – sometime legally and sometimes beyond the law. Fortunately there are still some tax Free incomes & investments. Learn about them here and use it to your advantage.

Small Financial Banks Interest on Savings Account

Almost all Small Finance Banks except Capital Small Finance Bank offers more than 4% on their savings account.

| Banks | Up To 1 lakh | 1 – 5 Lakhs | 5 – 10 Lakhs | 10+ Lakhs |

|---|---|---|---|---|

| AU Small Finance Bank | 3.50% | 5.00% | 6.00% | 7.00% |

| Capital Small Finance Bank | 3.75% | 3.75% | 3.75% | 3.75% |

| ESAF Small Finance Bank | 4.00% | 5.50% | 5.50% | 6.50% |

| Fincare Small Finance Bank | x | x | x | x |

| Jana Small Finance Bank | 3.50% | 6.00% | 6.00% | 7.00% |

| North East Small Finance Bank | 4.00% | 4.00% | 5.00% | 5.00% |

| Suryoday Small Finance Bank | 4.00% | 6.25% | 6.25% | 6.00% |

| Ujjivan Small Finance Bank | 4.00% | 7.00% | 7.00% | 7.00% |

| Utkarsh Small Finance Bank | x | 7.00% | 7.00% | 7.00% |

| Utkarsh Small Finance Bank | 5.00% | 6.00% | 6.00% | 7.25% |

How to Pay 0 Income Tax on Salary of Rs 20+ Lakh (FY 2020-21)?

As you can see with the above income tax calculation, salary components and salary structure plays a very important role in how much income tax you pay. We have come up with some optimised salary structure using which you pay NO income tax even with CTC of more than Rs 20 Lakhs.

Payment Banks Interest Rate on Savings Account

Payments banks are allowed to hold deposit up to Rs 1 Lakh in their savings account. All of them offer very low interest rate:

- Airtel Payment Bank – 2.50%

- Fino Payments Bank – 2.75%

- PayTm Payment Bank – 2.75%

- Post Office Payment Bank – 2.75%

Updated on April 11, 2021

How is Interest on Saving Account Calculated?

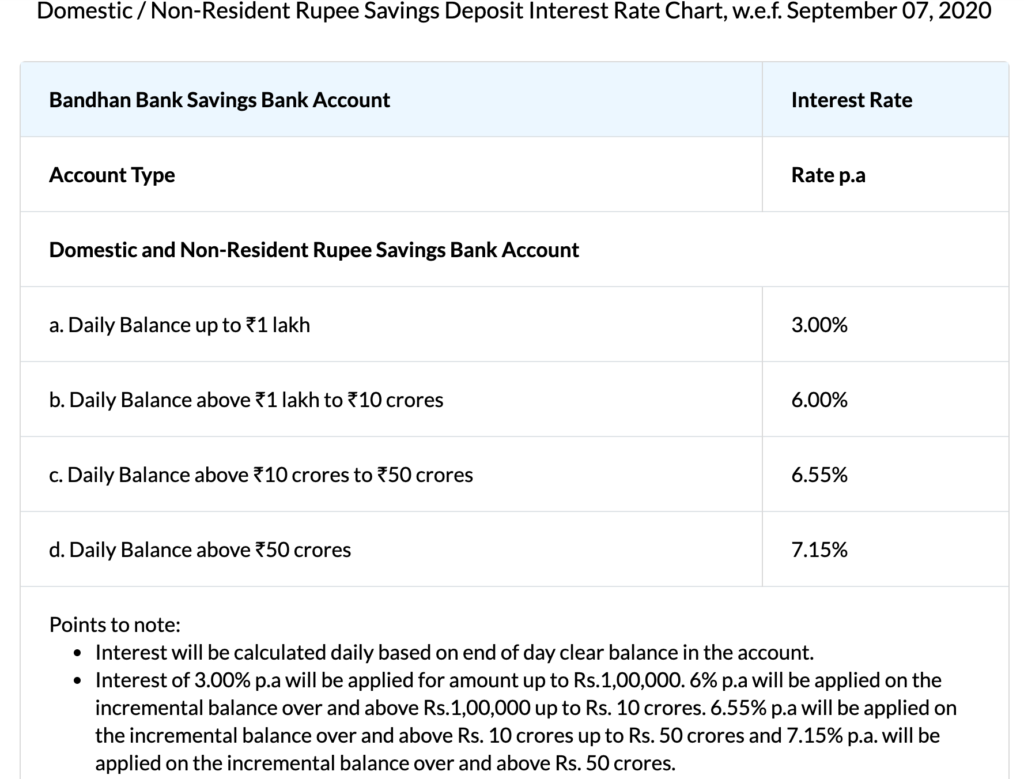

We tell you how the interest on saving account is calculated and when it’s paid. As an example we have the interest rate offered by Bandhan bank.

- If you have Rs 5 Lakh in your account this is how your interest would be calculated and paid.

- Interest on First Rs 1 Lakhs @ 3% for 1st Quarter = Rs 750

- Interest on additional 4 Lakhs @ 6% for 1st Quarter = Rs 6,000

- Total interest paid on 1st Quarter = Rs 750 + 6,000 = Rs 6,750

The interest is paid at every calendar quarter on 30th June, 30th September, 31st December and 31st March. Interest is calculated on daily basis, basis the end of day ledger balance in the account.

How much is the gain by higher Interest on Saving Account?

Additional Interest: If you keep 1 Lakh in your savings account, at 4% you would get Rs 333.33 as interest per month while with 7% you would get Rs 583.33. So you would earn additional Rs. 250 per lakh per month.

Tax Efficient: Also in Budget 2012 Finance Minister had exempted interest income up to Rs 10,000 from Savings Account every financial year under section 80TTA. So there would be situations where people in higher tax bracket would be better off by putting money in Savings Account than doing Fixed Deposit.

Budget 2018 introduced a new Section 80TTB. According to this Senior citizen can claim tax exemption up to Rs 50,000 on interest income from bank/ post office fixed deposit, recurring deposit or savings account.

Best way to Double your Money

Who does not want more and wouldn’t you love to Double your money? For sure we all would – we have listed 7 authentic investments which you can use to double your money. The post talks not only about the returns but also the risks associated with each investment.

Should You Get New bank Account?

The next question is should you go to these banks to get benefit of enhanced interest rates on savings account?

The answer depends on a few factors namely:

1. How much money do you keep in your savings bank account?

If you are someone who has a large balance in savings account you might want to opt for accounts offering higher interest rates. For everyone with not very significant balance an additional account does not make sense.

2. Do you want to pay charges associated with the new savings account?

Even if you have higher balance in your account, do you want to get an additional account and keep a track of all the new charges banks impose on accounts. Also you’ll need to maintain minimum balance.

3. Your Tax Bracket?

If you are in 30% tax bracket then it makes sense to have some money in savings account yielding higher interest rates than rush for short term Fixed Deposit.

Do you Know about Hidden Charges in Banks?

Do you know you pay a few thousand rupees every year to hidden charges of banks. This could range from more known fines for not maintaining minimum balance amount to lesser know POSDEC charge of ICICI Bank. There could be charges for ATM usage, branch visits, cheque books and so on. Do read our article on Hidden Charges in Banks and what you can do about it?

Alternatives:

Most banks offer sweep in facility where the amount in excess of pre specified automatically goes into fixed deposit. So you might take advantage of the same rather than going for a new account. But remember the interest earned in sweep in account is fully taxable as your interest income from fixed deposit.

Saving Account Interest Rates Latest news

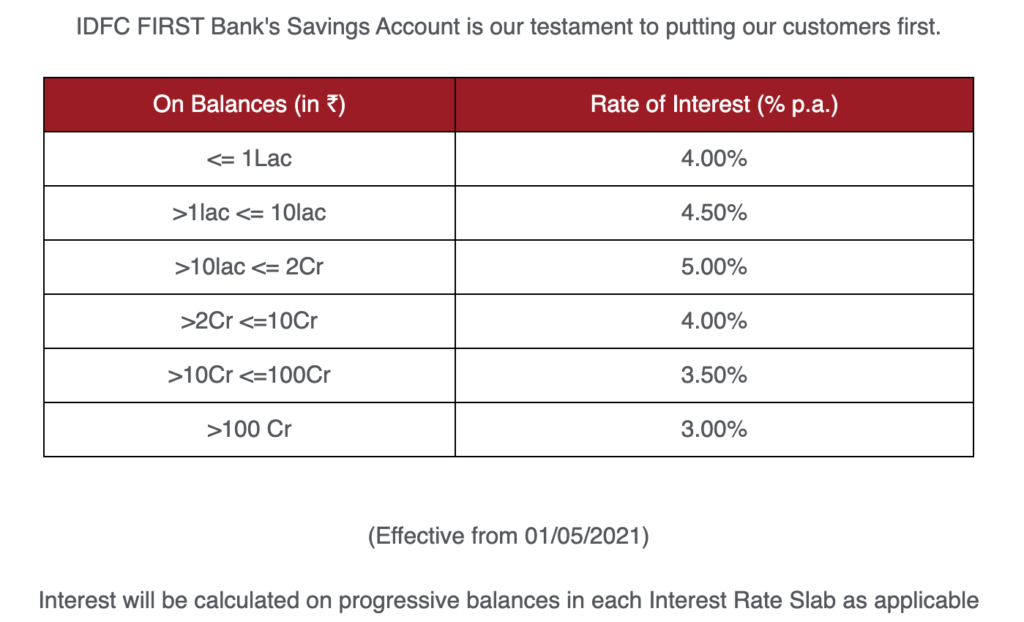

IDFC bank has reduced the interest rate from 6% to 4% to 5% as can be seen in the table below.

Good Post, thanks!

Very nice blog! Hat off to you for your efforts you put in preparing this long list. very informative.

Utkarsh Small Finance Bank is offering 7% interest rate on savings bank account across all segments.

Thanks have updated the post

The interest rate for IDFC Bank is revised upwards. Please update

Thanks have updated now

Excellent ! Some banks are offering good interest rates on saving accounts. Very helpful article.

Hi Amit, Very nice blog! Hat off to you for your efforts you put in preparing this long list.

Sir can I get 80TTA-10000+10(15)i 3500/- post saving interest = 13500/-

I have bank int -15000+ post office saving int 4500= 19500/-

Can I take benefit of both??

All banks interest rate are same below 4% below 1 lac deposit. DBS bank not available in all cities. I think sbi mod is best choice to invest money and get 6% interest.