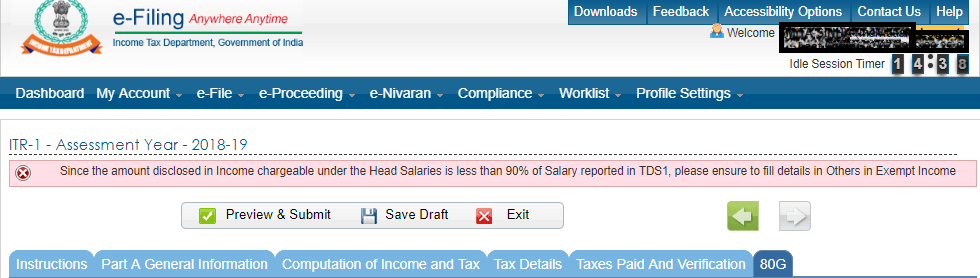

Since the amount disclosed in income chargeable under the head salaries is less than 90% of Salary reported in TDS 1, please ensure to fill details in Others in Exempt Income – an error that many of salaried tax payers are facing while filing their income tax returns. In this post we tell you why you get this error and the way around.

How to Pay 0 Income Tax on Salary of Rs 20+ Lakh?

Salary components and salary structure plays a very important role in how much income tax you pay. We have come up with some optimised salary structure using which you pay NO income tax even with CTC of more than Rs 20 Lakhs.

Why the Error?

This error occurs when your gross salary as reported by your employer in Form 26AS is higher than the one quoted by you from Form 16 while filing your tax return.

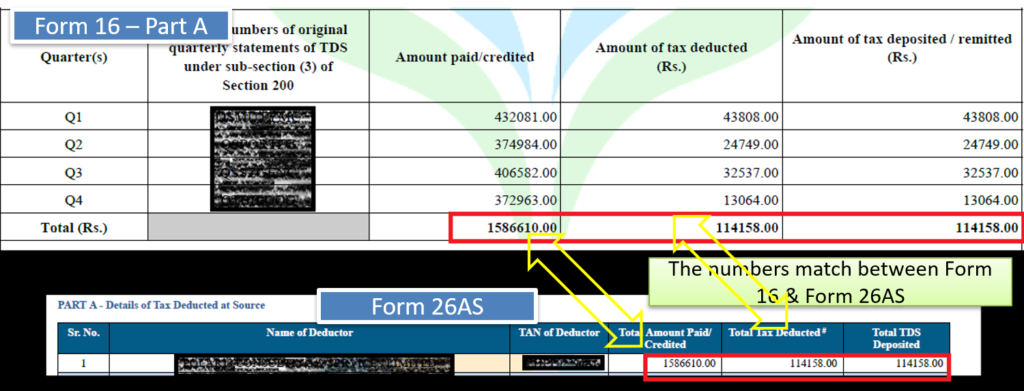

Your Form 26AS numbers matches with what is quoted in Form 16 – Part A by your employer. Below is a sample:

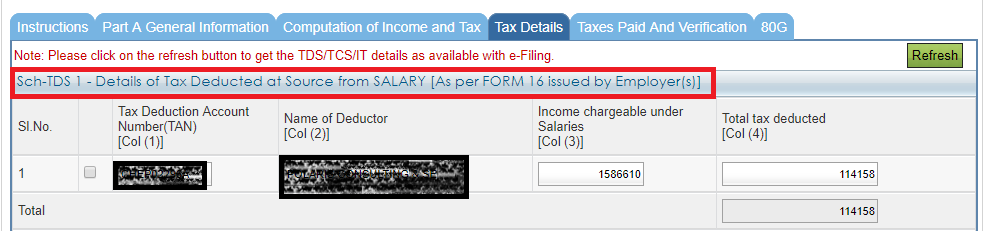

While filing the return online, the ITR Form automatically picks up data from Form 26AS. You can check the same in Tax Details tab >> Sch TDS 1 as shown below

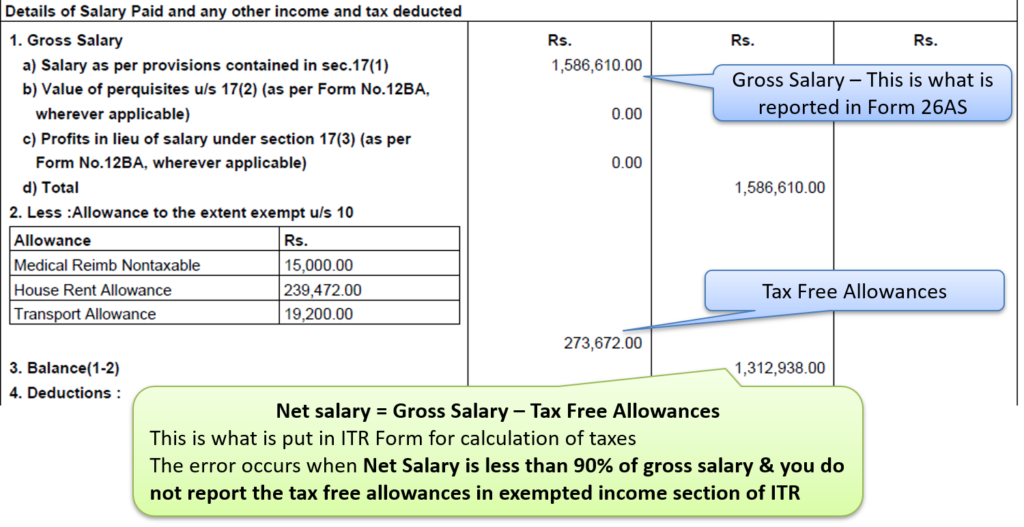

The above salary in the header “Income chargeable under salaries” is Gross salary (as can be seen in the Form 16 Part B below) but while filing your return, you need to put only your Net salary.

Net salary = Gross Salary – Tax Free Allowances

The error occurs when Net Salary is less than 90% of gross salary & you do not report the tax-free allowances in exempted income section of ITR

Like in this case the Gross Salary is Rs 15,86,610 and net salary is Rs 13,12,938. The percentage of Net to Gross salary is 83%. Since this is less than 90%, you get the error.

Here are some posts which can help you with e-filing of Income Tax Return:

- Calculate your Tax liability for AY 2021-22 (FY 2020-21)

- How to Claim Tax Exemptions while filing ITR?

- Use Challan 280 to Pay Self Assessment Tax Online

- Form 26AS – Verify Before Filing Tax Return

- 5 Ways to e-Verify your Income Tax Returns

- What if You DO NOT file your Returns by due Date?

- Can I file my Last Year Tax Return?

- Why and How to Revise Your Tax Return?

- What does Intimation U/S 143(1) of Income Tax Act mean?

to Correct the error?

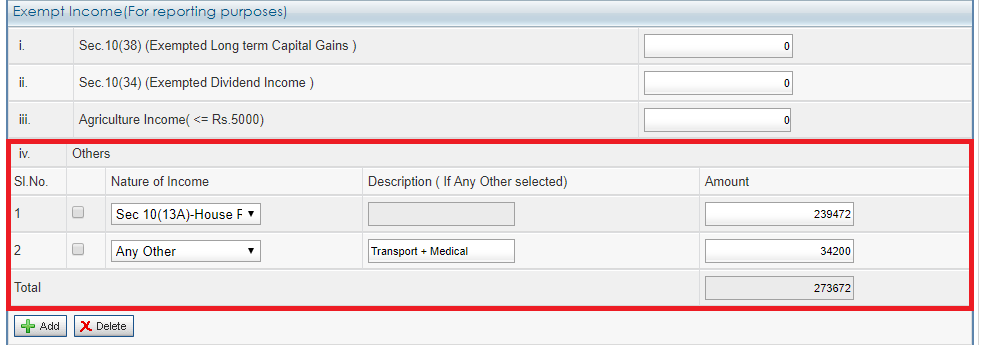

The error is easy to correct. All you need to do is report your tax-free allowances in the exempt income section. This can be done as follows for ITR 1.

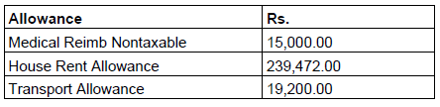

Go to Taxes Paid & Verification tab >> Exempt Income (For reporting purposes) >> fill (iv) others. As per the above Form 16, we have below 3 tax-free allowances

This is how we fill it in exempt allowance section:

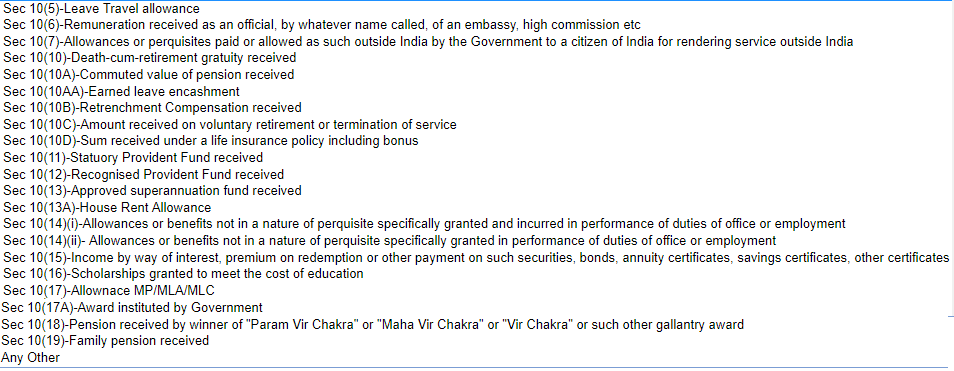

If you notice there are several headers under exempt allowance, which you can choose as per your requirement. Below is the list of exempt allowances header in ITR 1.

I hope this post would help you to understand and resolve the error in ITR “The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1”.

salary slip has 2 sides ; left side shows gross salary like basic , ta , da , hra , nps share by employer etc. right side shows deductions like leave recovery , tds , nps share by employer , nps share by emploee and welfare scheme defuction.

I want to ask that the gross salary shown in the very first line of form 16 is what ?

options are:-

a ) – gross salary in salary slip

b) – gross salary in salary slip minus right side deductions in salary slip i.e. net salary

c) – gross salary in salary slip minus nps share by employer

d )- any thing else

Straight to the point. Thank you!

Ads are annoying in the middle of the content. Please see if this could be improved.

I am still getting the same error after filling the details in exempt Income others.

Please suggest

Apart from salary, in TDS 2 section bank details is already updated with the income or interest. Again do i need to fill the exempt income information as the same. If yes then should we need to enter tax amount or interest amount in any listed category?

Hi Amit,

How can get to know the details of “Allowance to the extent exempt u/s 10”, as only the amount is mentioned in my Form 16 without any details.

Thank

Ramandeep

Hello Amit,

But my Gross salary in Form 16 and Form 26AS is different in that what i need to do.

If i fill that Exempt income after that i don’t get error. But I don’t understand why the Gross Income in Form 16 and form 26As is different.

Now i dont get any error but is there any possibility that i will need to pay extra tax after that.

Fill according to Form 16 as this is right thing to do

Thank you so much for publishing this helpful article. It’s very useful for me.

thanks a lot. it helped me

Great Article!!!

Accurate guidelines provided in this blog.. Thank you very much.

I could be able to submit my return today which was pending since 15th July 2018.

Thanks Amit. It really helped.

Every nice post. I saved 4000 INR. Thanks….