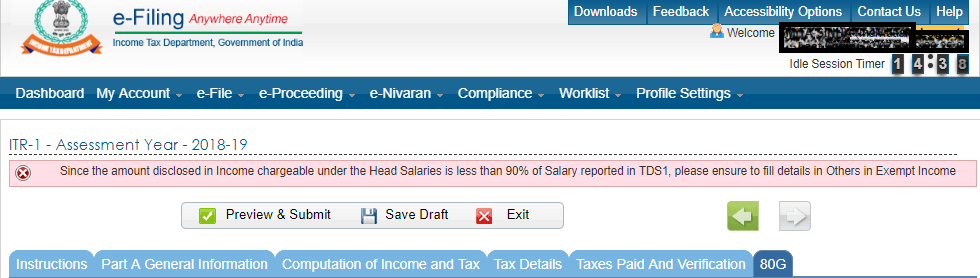

Since the amount disclosed in income chargeable under the head salaries is less than 90% of Salary reported in TDS 1, please ensure to fill details in Others in Exempt Income – an error that many of salaried tax payers are facing while filing their income tax returns. In this post we tell you why you get this error and the way around.

How to Pay 0 Income Tax on Salary of Rs 20+ Lakh?

Salary components and salary structure plays a very important role in how much income tax you pay. We have come up with some optimised salary structure using which you pay NO income tax even with CTC of more than Rs 20 Lakhs.

Why the Error?

This error occurs when your gross salary as reported by your employer in Form 26AS is higher than the one quoted by you from Form 16 while filing your tax return.

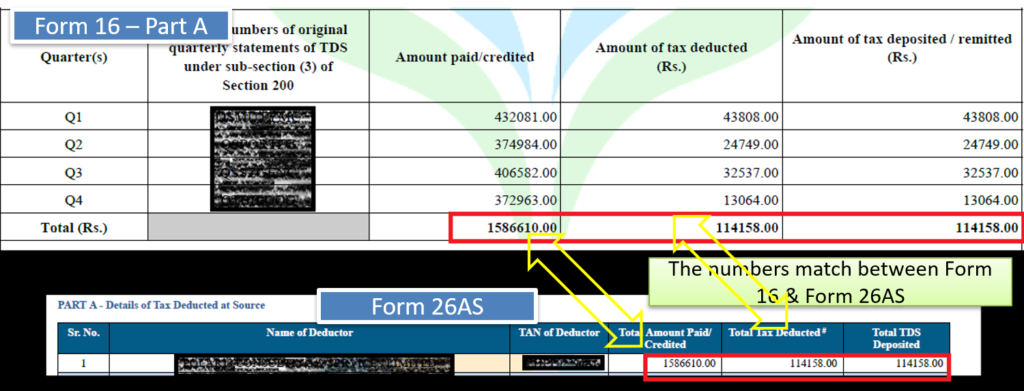

Your Form 26AS numbers matches with what is quoted in Form 16 – Part A by your employer. Below is a sample:

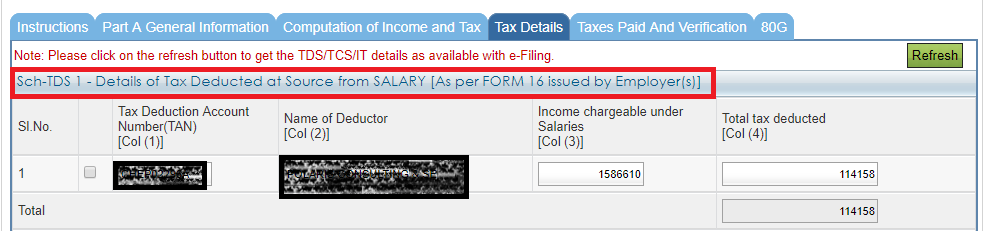

While filing the return online, the ITR Form automatically picks up data from Form 26AS. You can check the same in Tax Details tab >> Sch TDS 1 as shown below

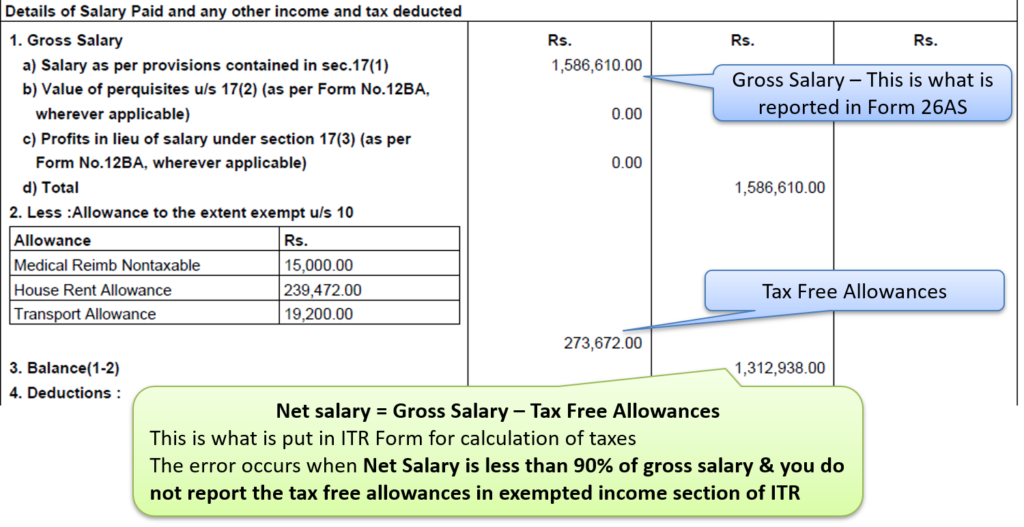

The above salary in the header “Income chargeable under salaries” is Gross salary (as can be seen in the Form 16 Part B below) but while filing your return, you need to put only your Net salary.

Net salary = Gross Salary – Tax Free Allowances

The error occurs when Net Salary is less than 90% of gross salary & you do not report the tax-free allowances in exempted income section of ITR

Like in this case the Gross Salary is Rs 15,86,610 and net salary is Rs 13,12,938. The percentage of Net to Gross salary is 83%. Since this is less than 90%, you get the error.

Here are some posts which can help you with e-filing of Income Tax Return:

- Calculate your Tax liability for AY 2021-22 (FY 2020-21)

- How to Claim Tax Exemptions while filing ITR?

- Use Challan 280 to Pay Self Assessment Tax Online

- Form 26AS – Verify Before Filing Tax Return

- 5 Ways to e-Verify your Income Tax Returns

- What if You DO NOT file your Returns by due Date?

- Can I file my Last Year Tax Return?

- Why and How to Revise Your Tax Return?

- What does Intimation U/S 143(1) of Income Tax Act mean?

to Correct the error?

The error is easy to correct. All you need to do is report your tax-free allowances in the exempt income section. This can be done as follows for ITR 1.

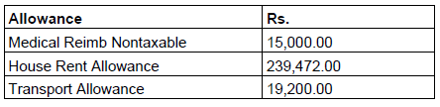

Go to Taxes Paid & Verification tab >> Exempt Income (For reporting purposes) >> fill (iv) others. As per the above Form 16, we have below 3 tax-free allowances

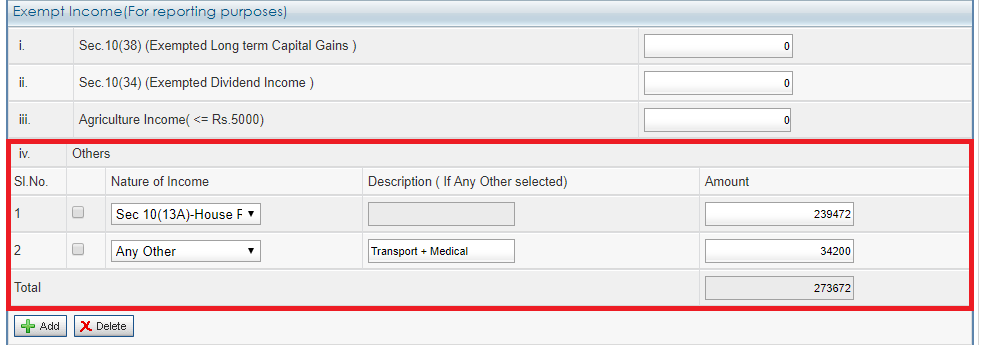

This is how we fill it in exempt allowance section:

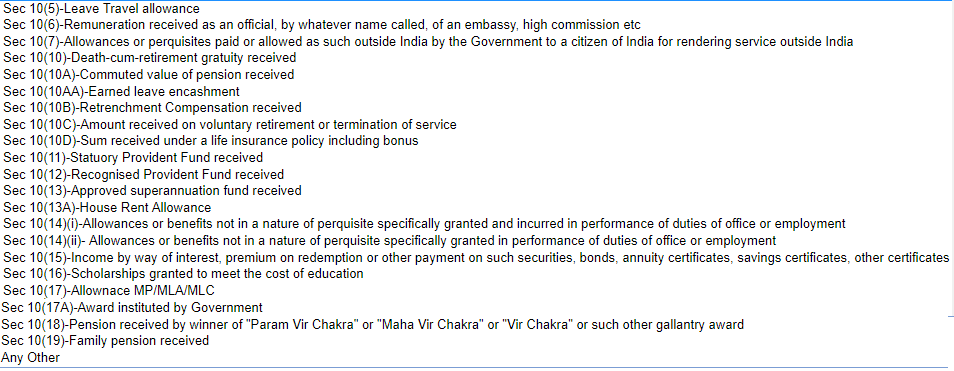

If you notice there are several headers under exempt allowance, which you can choose as per your requirement. Below is the list of exempt allowances header in ITR 1.

I hope this post would help you to understand and resolve the error in ITR “The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1”.

Thanks for publishing the detailed solution!!

Thanks a lot. This really helped!!

really very helpful. Thanks a ton !

Hi,

If I put my Net salary in ‘Income Chargeable under Head’ section, the income tax is showing the same.

But, after following the procedure (Keep the Gross salary in ‘Income Chargeable under Head’ and add HRS and conveyance in ‘Exempt Income’ Section), my income tax got increased.

Thanks a lot, it helped me.

because of this adjustment, It shows that I have to pay an extra tax because Gross salary is considered and tax free allowance is applied in exempt allowance..

plz change the gross income to reflect income under head salaries. U dont need to pay any extra tax, as u have already mentioned exempted income details

thanks a lot, really helped me lot..

Thank you so much, works like a charm! Just one thing, it’s not accepting the ‘+’ symbol for Any Other.

Hello Sir am not understanding some problems please can i contact you with a mobile number please contact me 9912945042 this my number other wise u can give a number i will call you sir please…

thank you so much it helped me.

Hi Amit,

I have donated $200 to CRY, USA & they given me receipt for it. It was wire transfer. On receipt it mentioned that under the 501(c)(3) section.

Can I use this details in my ITR to get some TAX benefits?

If yes, where should I mention it?

You cannot get tax benefit for donation to foreign NGOs

Thanks A lot for clarification.

Hi, I have filed wrong itr.please guide how to file revised itr as m not able to find any such option on editing.

Awesome, I just used the method you described and it worked with no further issues. Just that I had to remove the special character “+” from Description section and replaced with “and” coz it was giving me error as “taxes paid invalid character(s) in input”

Hi Amit,

Thank you very much.

it helped me a lot.

Thanks.

Hi Amit,

To avoid that error message, I entered in tab “Tax Paid and verification” as you mentioned.

do I need to change value in tab “Tax Details”, Income chargeable under Salaries [col(3)] by deducting

“Tax Paid and verification” total amount.

Please let me know.

Thanks,

Manjunath

Hi Amit,

In my case it is like this

tab “Computation of Income and Tax”, Income chargeable under the head “Salaries”(i+ii+iii+iv+v) = 7,00,000 ;

tab “Tax Details”, Income chargeable under Salaries [col(3)]= 8,00,000.

I am also getting same error

I entered in “Tax Paid and verification as you mentioned.

Now I am stuck up for next step , do I need to change value in tab “Tax Details”, Income chargeable under Salaries [col(3)]=7,00,000.

Please let me know.

Thanks,

Manjnath

Hi Amit,

Thank you very much.

Very nice illustrations.

Good.