For tax payers with income from salary, the ITR (Income Tax Return) Forms applicable for AY 2018-19 (FY 2017-18) asks for salary details and breakup. Until last year the ITR forms only asked for the taxable part of salary but this year it asks for following 5 salary details:

- Salary excluding allowances, perquisites and profit in lieu of salary

- Allowances not tax-exempt

- Valuation of perquisites

- Profits in lieu of salary

- Deductions under section 16

Until last year, it was very easy to just pick up numbers from Form 16 and put it in the ITR form. But this year most salaried are confused on what to put in these 5 fields. In this post we give an explanation of all the five salary heads and then with a sample Form 16 explain which number goes where. We would do a bit of calculation and hence you may need pen & paper or excel sheet, whatever you are comfortable with.

[box type=”info” size=”large” style=”rounded” border=”full”]

Here are some posts which can help you with e-filing of ITR 2018:

1. 7 Most Important Changes in ITR Forms for AY 2018-19

2. Calculate your Tax liability for FY 2017-18 (AY 2018-19)

3. Which ITR form to fill for Tax Returns for AY 2018-19?

4. How to Claim Tax Exemptions while filing ITR?

5. Use Challan 280 to Pay Self Assessment Tax Online

6. Form 26AS – Verify Before Filing Tax Return

7. 5 Ways to e-Verify your Income Tax Returns

8. What if You DO NOT file your Returns by due Date?

9. Can I file my Last Year Tax Return?

10. Why and How to Revise Your Tax Return?

11. What does Intimation U/S 143(1) of Income Tax Act mean?

[/box]

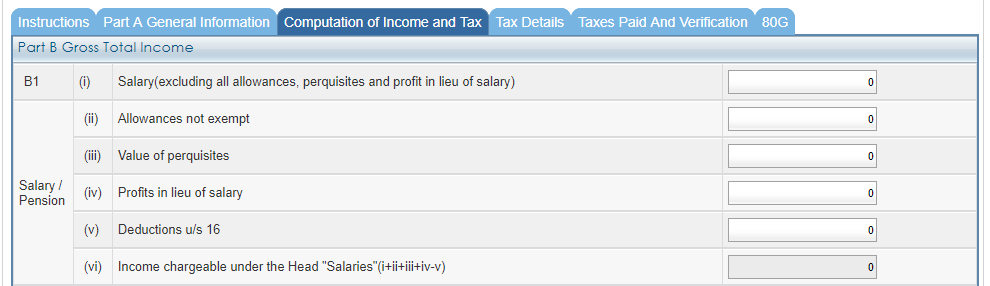

Salary Breakup Details as per ITR:

Before we focus on salary details we need to understand typical salary structure. The salary of an employee usually consists of following components:

- Basic Salary

- Dearness Allowance

- House Rent Allowance

- Special Allowance

- Transport Allowance

- Leave Travel Allowance (LTA)

- Other allowances & reimbursements

1. Salary excluding allowances, perquisites and profit in lieu of salary:

As the header states this asks for excluding of all allowances, perquisites and profit in lieu of salary. In this column you need to put your basic salary, any pension you receive and leave encashments. You’ll need to add all these in case you have income on multiple heads. For example, if the basic salary is Rs 25,000 per month. The annual basic salary would be Rs 25,000 X 12 = Rs 3,00,000. This is the figure that goes in this column. In case you had change in basic salary or change in employment in the financial year just add the basic salary each month to arrive at this figure.

2. Allowances not tax-exempt

In this case we need to put all non-tax-exempt allowances. This could be special allowance, dearness allowance and other allowances which are taxable.

House Rent Allowance can be put here if you do not pay rent. In case your HRA is only partially taxed due to rent paid being lower than HRA received, you can put the taxable amount here.

LTA is taxable in case its not reimbursement of travel expenses, i.e. you have not submitted relevant proof to your employer.

You’ll need to add all these allowances and put it here. You can get the details from your salary slip. However, it may be cumbersome to calculate these allowances for every month. A better idea is to calculate the allowances not tax-exempt using formula below:

Allowances not tax-exempt = Salary as per provisions contained in Sec 17(1) – Basic Salary – Allowance to the extent exempt u/s 10 (like transport allowance, HRA, LTA, etc)

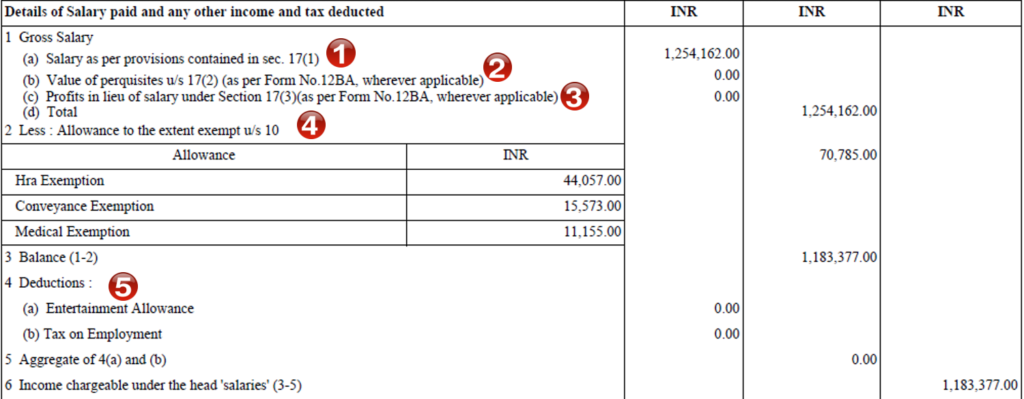

We will show this in the sample Form 16 above:

- Salary as per provisions contained in Sec 17(1) = Rs 12,54,162

- Basic Salary (computed in the section above) = Rs 3,00,000

- Allowance to the extent exempt u/s 10 = Rs 70,785

- Allowances not tax-exempt = 12,54,162 – 3,00,000 – 70,785 = Rs 8,83,377

3. Valuation of perquisites

In case you get certain perks like employees’ stock option plans (ESOPs), rent-free accommodation, motor car for official as well as personal use, club membership, interest free loan etc these would be chargeable as perquisites in your hands as per income tax rules.

For e.g. in case your employer has provided car for official as well as personal use, the perquisites value chargeable to you is Rs 1,200 per month for cars below 1600 cc and Rs 1,600 per month for cars above 1600 cc.

This is clearly mentioned in Form 16 under header Gross Salary > (b) Value of perquisites u/s 17(2). (also indicated by 2 in red in our sample)

4. Profits in lieu of salary

There are some payments received in addition to the salary. This is termed as ‘Profit in lieu of salary’ and comes under Section 17(3). This is not very common payment and includes the following:

- Voluntary retirement amount

- Retrenchment compensation

- Employer’s contribution to provident fund in excess of 12% of salary

- Interest received from a recognized provident fund in excess of 9.5% in a year

- Joining Bonus or Retrenchment compensation

The income tax rules are different for various payments. Amount up to Rs 5 lakh received on Voluntary retirement or Retrenchment compensation is exempted from tax. However, joining bonus is fully taxable.

This is clearly mentioned in Form 16 under header Gross Salary > (c) Profits in lieu of salary under section 17(3). (also indicated by 3 in red in our sample)

5. Deductions under section 16

Section 16 deals with certain deductions that are allowed from gross salary income. At present you can claim following two deductions from the salary income:

- Entertainment allowance

- Tax on employment

The entertainment allowance is only applicable for government employees and is minimum of the following 3:

- Rs 5,000

- 1/5th of salary (excluding any allowance, perquisite)

- Actual amount received

Some states levy professional tax or employment tax. This amount can be deducted from gross salary for computation of income tax. For e.g. Maharashtra levies Professional tax of Rs 200 per month if the salary is more than Rs 10,000.

These exemptions are mentioned in the Form 16 as (4) Deductions (also indicated by 5 in red in our sample Form 16).

Also Read: 13 changes in Tax laws from April 1, 2018

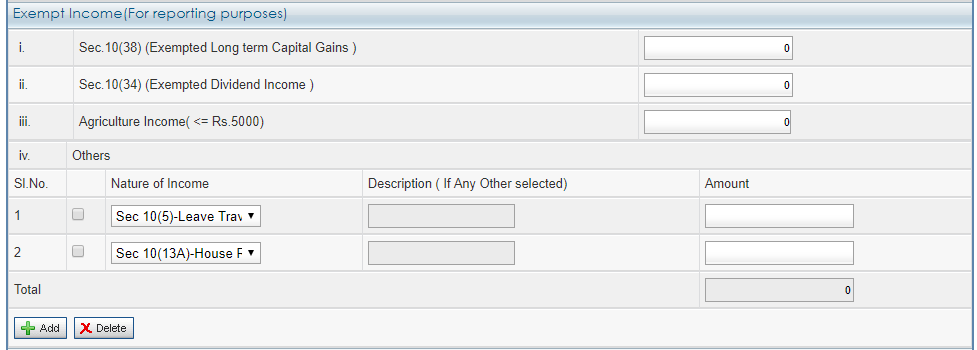

Reporting Exempt Allowances in ITR 1:

You should also report the allowances which are tax exempt in ITR 1. Go to the tab – “Taxes Paid and Verification” >> (27) Exempt Income (for reporting purpose) >> (d) others

You can find options in the form of drop down. In out sample we have 2 exempt incomes:

- Sec 10(5)-Leave Travel allowance

- Sec 10(13A)-House Rent Allowance

Also Read: 25 Tax Free Incomes & Investments in India

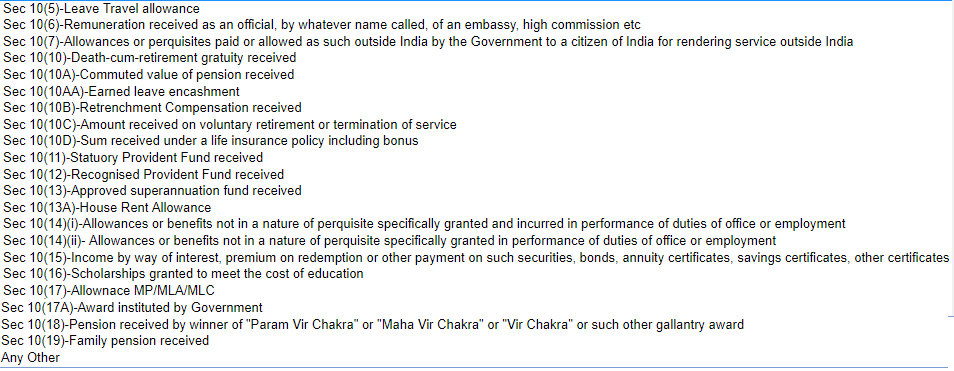

However, you can multiple headers as shown below and you can select accordingly.

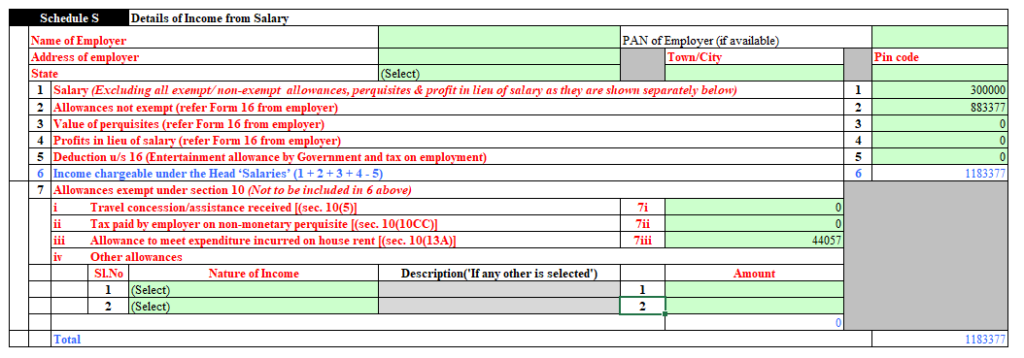

How to fill Salary details in ITR 2?

In case of ITR 2, you need to provide some more information including exempt allowance details.

- Travel Concession/assistance received under section (10(5)) (LTA)

- Allowance to meet expenditure incurred on house rent [(sec. 10(13A)] (HRA)

- Tax paid by the employer on non-monetary perquisite [(sec. 10(10CC)] (perquisites in kind such as rent free accommodation)

- All the other allowances have to be reported as Other allowances

Download: Ultimate Tax Saving ebook with tax calculator FY 2018-19

As we can see all salary details except Allowances not tax-exempt and Basic Salary can be directly picked up from Form 16 (part 2). We hope this post would help you fill Salary details in ITR.

A really great article today your article help me out, I filled my own ITR I today. Thanks 🙂

Dear Amit,

actually, I have been filled return AY 2018-19. But I am unable to submit section 80C details to the company. but during the it return, I have filled the details section 80c as per my insurance etc based on actual investment so there is some refund about generated. can it department validate for the same or ask additional document for the proof.