The post lists down the rate of interest on Bank fixed deposits for Senior Citizens as of June 1, 2019.

You might want to bookmark this page as the FD interest rates would be updated every month. Would help you in better decision making.

Fixed Deposit Highlights:

- Most banks offer FDs for tenure of 7 Days to 10 Years.

- The Ratnakar Bank & IDBI Bank do offer fixed deposits up to 20 years too.

- For very short Term Deposits the interest rate is similar to that of Savings Account and so you should not worry about FD. Also Interest up to Rs 10,000 in Saving Account is Tax free.

- Most banks compound interest quarterly

- Banks offer Loan/Overdraft against the amount available in Fixed Deposit. The interest is generally 0.5% to 1% more than that offered to FD.

- TDS (Tax deduction at source) at the rate of 10% is deducted, if the interest income is more than Rs 40,000 in financial year per bank (changed from Rs 10,000 limit in Budget 2019)

- In case of Senior citizens TDS would be deducted at the rate of 10%, if the interest income exceeds Rs 50,000

- You can fill Form15G/H if you want to avoid TDS.

- There might be penalty for pre-mature withdrawal of Fixed Deposits

Also Read: How SWP in Debt Funds generate higher returns than FD

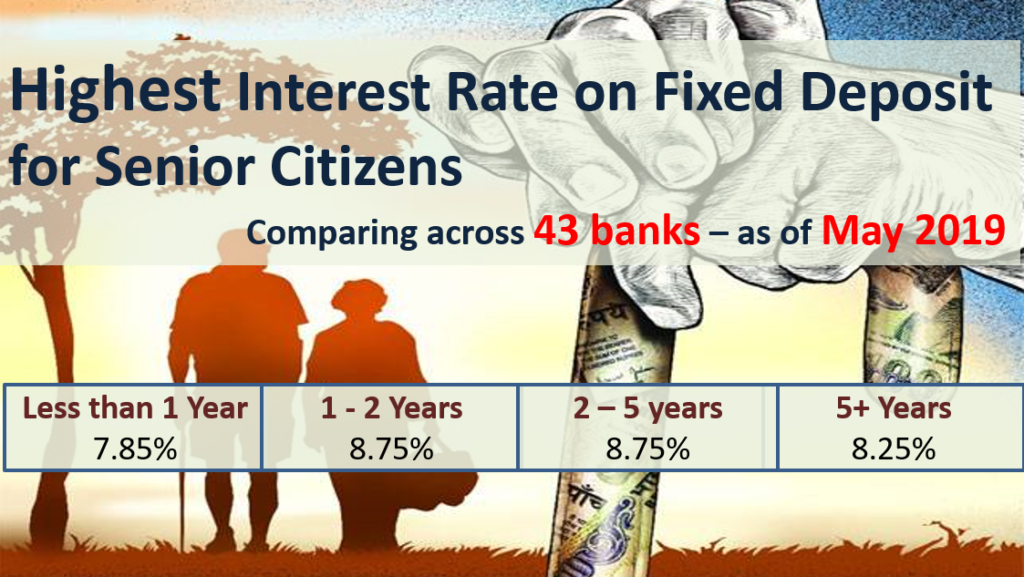

Fixed Deposit Interest Rates:

The highest interest rate is offered by IDFC First Bank (731 days) & DCB Bank (36 months) at 8.75%.

For comparing the best interest rates on fixed deposits over different duration of investment, we have it divided into following 5 slabs:

- FD for Less than 1 Year

- FD for 1 to 2 years

- FD for 2 to 5 Years

- FD for 5 to 10 years

- FD for More than 10 years

Also Read: 7 High Rated Companies Offering more than Bank Fixed Deposits

We show the highest interest rates on fixed deposits for the above duration buckets. We have also compared the best interest rates on offer by that being offered by State Bank of India (SBI), ICICI Bank and Post Offices.

[button link=”https://www.apnaplan.com/highest-tax-saving-bank-fixed-deposit-rates-us-80c/” size=”large” style=”tick” color=”orangered” text=”light”]Click for Best Tax Saving FDs u/s 80C[/button]

Interest Rate (Senior Citizens) for FD – Less than 1 Year:

The highest interest rate is offered by Lakshmi Vilas Bank (331-364 days) at 8.25%.

| Bank | Description | Interest Rate |

| Lakshmi Vilas Bank | 331-364 days | 8.25% |

| Lakshmi Vilas Bank | 181 – 330 days | 8.15% |

| Ratnakar Bank | 241 days to 364 days | 7.85% |

| Axis Bank | 9 months < 1 year 25 days | 7.75% |

| Ratnakar Bank | 181 days to 240 days | 7.75% |

| Indus Ind Bank | 270 days to below 1 years | 7.75% |

| Ratnakar Bank | 91 days to 180 days | 7.65% |

| Yes Bank | 9 months to < 1 Year | 7.65% |

| Kotak Mahindra Bank | 364 Days | 7.60% |

| HDFC Bank | 9 mnths 1 day < 1 Year | 7.60% |

| Bandhan Bank | 6 months to less than 1 year | 7.55% |

| J&K Bank | 271 days to less than 1 year | 7.55% |

| DCB Bank | 6 months to less than 12 months | 7.50% |

| IDFC First Bank | 181 – 365 days | 7.50% |

| Lakshmi Vilas Bank | 151-180 days | 7.50% |

| Ratnakar Bank | 46 days to 90 days | 7.50% |

| Standard Charted Bank | 181-364 days | 7.50% |

| Indus Ind Bank | 181 days to 269 days | 7.50% |

| Yes Bank | 6 months to < 9 months | 7.35% |

| Tamilnad Mercantile Bank | 271 days – < 12 months | 7.30% |

| Allahabad Bank | 333 days | 7.25% |

| DCB Bank | 91 days to less than 6 months | 7.25% |

| IDFC First Bank | 91 – 180 days | 7.25% |

| Kotak Mahindra Bank | 271 Days to 363 Days | 7.25% |

| Repco Bank | 90 days – 364 days | 7.25% |

| Union Bank of India | 10 Month to 14 Month | 7.25% |

| Tamilnad Mercantile Bank | 180 days – 270 days | 7.25% |

| City Union Bank | 181 days to 364 days | 7.15% |

| Allahabad Bank | 155 days | 7.00% |

| City Union Bank | 91 days to 180 days | 6.90% |

| Karur Vysya Bank | 91 Days to 180 Days | 6.90% |

| South Indian Bank | 91 days to less than 1 year | 6.80% |

| Karur Vysya Bank | 181 Days to less than 1 year | 6.75% |

| State Bank of India | Government Bank Benchmark | 6.25% – 6.90% |

| ICICI Bank | Private Bank Benchmark | 4.50% – 7.25% |

Also Read: 21 Hidden Charges in Saving Bank Account

Interest Rate for FD (Senior Citizens) of 1 – 2 Years:

The highest interest rate is offered by Lakshmi Vilas Bank (450 days) at 9.00%.

| Bank | Description | Interest Rate |

| Lakshmi Vilas Bank | 450 Days | 9.00% |

| IDFC First Bank | 731 days | 8.75% |

| DCB Bank | 18 months | 8.65% |

| DCB Bank | 15 months to 24 months | 8.55% |

| Ratnakar Bank | 12 months to less than 24 months | 8.50% |

| Bandhan Bank | Above 18 months to less than 2 years | 8.40% |

| IDFC First Bank | 366 – 730 days | 8.25% |

| Indus Ind Bank | 1 Years 4 Months to below 3 Years | 8.25% |

| Lakshmi Vilas Bank | 1 Year to less than 3 years | 8.20% |

| Repco Bank | 1 Year & Above – 2 years | 8.20% |

| Yes Bank | 2 years to less than 3 years | 8.15% |

| Bandhan Bank | 1 year to 18 months | 8.10% |

| Indus Ind Bank | 1 Years to below 1 Years 4 Months | 8.10% |

| Yes Bank | 18 Months 8 Days to 18 Months 18 Days | 8.05% |

| DCB Bank | 24 months | 8.00% |

| Standard Charted Bank | 18 Months – 2 Years | 8.00% |

| Axis Bank | 1 year 25 days < 30 Months | 7.95% |

| DCB Bank | 12 months 1 day to less than 15 months | 7.90% |

| Standard Charted Bank | 1 Year – 375 days | 7.90% |

| Kotak Mahindra Bank | 390 Days (12 months 25 days) | 7.80% |

| Repco Bank | Repco Mahila (18 Months, Exclusively for Women) | 7.80% |

| Federal Bank | 550 days | 7.80% |

| Federal Bank | Above 1 year to 2 Years | 7.80% |

| HDFC Bank | 1 year – 2 Years | 7.80% |

| J&K Bank | 1 year to less than 5 years | 7.80% |

| Karnataka Bank | 1 year to 2 years | 7.80% |

| Axis Bank | 1 year < 1 year 25 days | 7.75% |

| Deutsche Bank | 1 Year to less than 1.5 Years | 7.75% |

| Karur Vysya Bank | 1 year to less than 2 years | 7.75% |

| Kotak Mahindra Bank | 391 Days – 23 Months | 7.75% |

| Yes Bank | 1 Year <= 10 years | 7.75% |

| Dhanalakshmi Bank | 500 Days | 7.75% |

| IDBI Bank | 1 year | 7.75% |

| Tamilnad Mercantile Bank | 1 Year | 7.75% |

| Kotak Mahindra Bank | 365 Days to 389 Days ; 23 months 1 Day- less than 2 years | 7.70% |

| South Indian Bank | 1 year | 7.70% |

| IDBI Bank | >1yrs to 2yrs | 7.70% |

| Syndicate Bank | Above 2 to less than 5 yrs | 7.65% |

| Kotak Mahindra Bank | 2 years- less than 3 years | 7.60% |

| Syndicate Bank | 500 days exact | 7.55% |

| Bank of Baroda | 444 days | 7.50% |

| DCB Bank | 6 months to 12 months | 7.50% |

| Standard Charted Bank | 376 days < 18 Months | 7.50% |

| Syndicate Bank | 400 days exact | 7.50% |

| City Union Bank | 365 days – 5 Years | 7.50% |

| Corporation Bank | 666 days only | 7.50% |

| Deutsche Bank | 1.5 Years to less than 5 Years | 7.50% |

| Dhanalakshmi Bank | 365 days and above upto & inclusive of 2 years | 7.50% |

| Digibank by DBS | 1 year to 15 months | 7.50% |

| Punjab National Bank | 1 year | 7.50% |

| Tamilnad Mercantile Bank | 1 Year to less than 3 Years | 7.50% |

| South Indian Bank | Above 1 year to up to and incl. 2 years | 7.30% |

| Digibank by DBS | 15 months 1 day to less than 5 Years | 7.00% |

| State Bank of India | Government Bank Benchmark | 7.50% |

| ICICI Bank | Private Bank Benchmark | 7.40% – 7.60% |

| Post Office FD (1 year) | Post Office | 7.00% |

| Post Office FD (2 years) | Post Office | 7.00% |

[button link=”https://www.apnaplan.com/highest-interest-rate-on-recurring-deposits-rd/” size=”large” style=”tick” color=”darkcyan” text=”light”]Click for Best Interest Rate on Recurring Deposits[/button]

Interest Rate for FD (Senior Citizens) of 2 – 5 Years

The highest interest rate is offered by DCB Bank (36 months) at 8.75%.

| Bank | Description | Interest Rate |

| DCB Bank | 36 months | 8.75% |

| Ratnakar Bank | 24 months to less than 36 months | 8.55% |

| Lakshmi Vilas Bank | 3 Years to 10 Years | 8.35% |

| DCB Bank | 36 months to 60 months | 8.25% |

| Deutsche Bank | 5 Years | 8.25% |

| Bandhan Bank | 2 years to less than 7 years | 8.25% |

| Indus Ind Bank | 1 Years 4 Months to below 3 Years | 8.25% |

| Lakshmi Vilas Bank | 1 Year to less than 3 years | 8.20% |

| Yes Bank | 2 years to less than 3 years | 8.15% |

| DCB Bank | 24 months to 36 months | 8.10% |

| Ratnakar Bank | 36 months to less than 120 months | 8.10% |

| IDFC First Bank | 732 – 5 Years | 8.00% |

| Axis Bank | 1 year 25 days < 30 Months | 7.95% |

| Indus Ind Bank | 3 years to below 61 Months | 7.95% |

| Federal Bank | Above 2 years to less than 3 years | 7.90% |

| HDFC Bank | 2 years – 3 Years | 7.90% |

| Axis Bank | 30 months < 3 years | 7.80% |

| IDBI Bank | 1100 Days | 7.80% |

| J&K Bank | 1 year to less than 5 years | 7.80% |

| Axis Bank | 3 years < 5 years | 7.75% |

| City Union Bank | 1000 Days | 7.75% |

| South Indian Bank | 2 years to upto and incl. 3 years | 7.75% |

| Yes Bank | 1 Year <= 10 years | 7.75% |

| Federal Bank | 3 years and above | 7.75% |

| HDFC Bank | 3 years 1day – 5 years | 7.75% |

| Syndicate Bank | Above 2 to less than 5 yrs | 7.65% |

| Kotak Mahindra Bank | 2 years- less than 3 years | 7.60% |

| South Indian Bank | 3 years and above up to and incl. 10 years | 7.55% |

| IDBI Bank | >2 yrs to < 3 yrs | 7.55% |

| Karur Vysya Bank | 2 years and above | 7.50% |

| Kotak Mahindra Bank | 3 years and above but less than 5 years | 7.50% |

| Repco Bank | Above 2 years – 5 Years | 7.50% |

| Standard Charted Bank | 2 Years – 3 Years | 7.50% |

| City Union Bank | 365 days – 5 Years | 7.50% |

| Deutsche Bank | 1.5 Years to less than 5 Years | 7.50% |

| Oriental Bank of Commerce | 1 Year to less than 2 Years | 7.50% |

| Tamilnad Mercantile Bank | 1 Year to less than 3 Years | 7.50% |

| Tamilnad Mercantile Bank | 3 Years & above | 7.40% |

| Digibank by DBS | 15 months 1 day to less than 5 Years | 7.00% |

| State Bank of India | Government Bank Benchmark | 7.20% – 7.25% |

| ICICI Bank | Private Bank Benchmark | 7.75% – 8.00% |

| Post Office FD (2 years) | Post Office | 7.00% |

| Post Office FD (3 years) | Post Office | 7.00% |

| Post Office FD (5 years) | Post Office | 7.80% |

Also Read: Where to Park Money for Very Short Term [less than 6 Months]?

Interest Rate for Fixed Deposit (Senior Citizens) of 5 – 10 Years

The highest interest rate is offered by Bandhan Bank (2 years to less than 7 years) at 8.25%.

| Bank | Description | Interest Rate |

| Bandhan Bank | 2 years to less than 7 years | 8.25% |

| Lakshmi Vilas Bank | 12 Months to 120 Months | 8.10% |

| Ratnakar Bank | 36 months to less than 120 months | 8.10% |

| Indus Ind Bank | 3 years to below 61 Months | 7.95% |

| DCB Bank | More than 60 months to 120 months | 7.75% |

| IDFC First Bank | 5 years 1 Day – 10 years | 7.75% |

| Yes Bank | 1 Year <= 10 years | 7.75% |

| Federal Bank | 3 years and above | 7.75% |

| Indus Ind Bank | 61 month and above | 7.75% |

| South Indian Bank | 3 years and above up to and incl. 10 years | 7.55% |

| Axis Bank | 5 years to 10 years | 7.50% |

| Karur Vysya Bank | 2 years and above | 7.50% |

| Digibank by DBS | 15 months 1 day to less than 5 Years | 7.00% |

| State Bank of India | Government Bank Benchmark | 7.10% |

| ICICI Bank | Private Bank Benchmark | 7.50% |

Interest Rate for Fixed Deposit of more than 10 Years

The Ratnakar Bank and IDBI bank offers fixed deposit of up to 20 years.

| Bank | Description | Interest Rate |

| Ratnakar Bank | 121 months to less than 240 months | 7.70% |

| IDBI Bank | 10 Years to 20 Years | 6.50% |

Helpful Posts on Fixed Deposits

Which bank offers Highest Interest Rate on Bank FD?

13 Most Important things to know before investing in Bank Fixed Deposits

Section 80TTB: Senior Citizens can Save Tax on their Interest Income

TDS threshold on Bank FD increased to Rs 40,000 from April 1, 2019

Avoid TDS: fill Form 15G and 15H

Small Bank FDs offer interest up to 9% – Should you invest?

How SWP in Debt Funds generate higher returns than FD

How to increase bank deposit insurance through Joint accounts?

How Safe is Your Fixed Deposit in Bank?

How you loose Money in Fixed Deposits?

Fixed Deposits that you can use to save Tax

Highest Interest Rate on Recurring Deposits

Understanding Compounding and Yield in Fixed Deposit

How to get Credit card against Fixed Deposit?

7 High Rated Companies Offering more than Bank Fixed Deposits

Small Banks FD Interest Rates for Senior Citizens:

RBI on September 2015 had granted licence to 10 Small Finance Banks. Lately these banks have been in news for offering higher interest rates on their fixed deposits as compared to regular banks. The table below compares the interest rate offered by Small banks. The difference is substantial for low tenure deposits – Fincare Small Finance Bank (2 to 3 years) offers 9.5% for 24 to 36 months deposit while SBI offers 7.2% only.

Additional Interest to Senior Citizens:

- Equitas Small Finance Bank offers additional 0.75% for Senior citizens.

- Jana Small Bank offers additional 0.60% for Senior citizens.

- All other small banks offer additional 0.5% to senior citizens.

| Banks | <1 year | 1 Year | 2 Years | 3 Years | 4 Years | 5 Years | 5 Year+ |

| AU Small Finance Bank | 7.51% | 7.51% | 8.37% | 8.60% | 8.27% | 8.27% | 7.80% |

| Capital Small Finance Bank | 7.65% | 8.30% | 8.30% | 8.30% | 8.30% | 8.15% | 7.90% |

| Equitas Small Finance Bank | 8.00% | 8.70% | 9.05% | 9.05% | 7.50% | 7.50% | 7.50% |

| ESAF Small Finance Bank | 8.00% | 9.00% | 9.00% | 7.80% | 7.80% | 7.80% | 7.80% |

| Fincare Small Finance Bank | 7.50% | 8.50% | 9.50% | 9.50% | 8.50% | 8.50% | 7.50% |

| Jana Small Finance Bank | 9.10% | 9.10% | 9.20% | 9.10% | 8.60% | 8.60% | 7.35% |

| Suryoday Small Finance Bank | 8.25% | 8.85% | 9.25% | 9.25% | 8.50% | 8.75% | 7.75% |

| Ujjivan Small Finance Bank | 8.00% | 8.80% | 9.10% | 8.00% | 7.50% | 7.50% | 7.00% |

| Utkarsh Small Finance Bank | 8.00% | 9.00% | 9.50% | 8.35% | 7.50% | 8.50% | 7.50% |

| SBI | 6.90% | 7.50% | 7.25% | 7.20% | 7.20% | 7.10% | 7.10% |

Source: Bank Websites Last Updated: July 1, 2019

Disclaimer: The Fixed Deposit Interest Rates keep on changing. You are advised to check the interest rates with banks before making your FD.

Also Read: 11 Investments to Generate Regular Monthly Income

Respected Sir ,

Kindly inform me , How much maximum amount can I invest in 5 year senior citizen saving scheme account in post office , in ICICI bank and SBI ?

I know , the maximum amount I can invest in 5 year senior citizen saving scheme account in post office is Rs. 15 lac , maximum amount I can invest in 5 year senior citizen saving scheme account in ICICI bank is Rs. 15 lac and maximum amount I can invest in 5 year senior citizen saving scheme account in SBI is Rs. 15 lac .

So , can I invest in 5 year senior citizen saving scheme account in post office , in ICICI bank and SBI Rs. 45 lac in total ?

Dear Tell us some good investment plan for NRIs please

You are doing a great job. Thanks a lot for your help.

But, I have a small concern. FD for Senior Citizen in Karur Vysya Bank (KVB) starts from 1 year (there is no scheme < 1 year) and interest rate is 7.25% (since 2017). I think most of the interest rates you mentioned in this blog are not matching with actual Interest rate from Bank portal.

As you mentioned, KVB – 91 Days to 180 Days, interest rate is "7.40%". KVB has never revised their Interest rates since 07.05.2017 as per their portal. I am not sure from where you got this info bec. this blog was last updated on 01 Apr 018.

http://www.kvb.co.in/global/resident_domestic_deposits.html

I/we usually follow your blog without cross checking, bec. we blindly believe in you. If possible, I would like to request you to ensure your data is correct and not misleading others.

Thanks!

Thanks for your appreciation and feedback!

We had automated picking up interest rates from bank websites recently and I think its not working the way it should. We will look into the same.

Also KVB does offer FD for all duration to senior citizens, its just that it does not offer any extra interest rate for other than duration mentioned! So for less than 1 year FD the interest rate would be same for general public & senior citizens.

Also as interest rates change frequently, you must check respective websites before investing (this is true for any website including ours).

We would make the required changes by next week when we put interest rates for May 2018.

Thanks again

Can my father get benefit of 80ttb?

He is 61 .. Getting 70000 interest from post mis

yes

I have a query as sr citizen. I have already invested in SCSS deposit with bank. Can interest on same be included under section 80TTB for exemption upto Rs 50,000 ?

Thanks in advance & best wishes

yes

Wow Nice information . Kindly request you to please update interest rate for co operative bank

IS IT SAFE TO INVEST IN FD IN KARNATAKA BANK LTD

yes

The interest rates are slowly going down to the lowest level every year. Number of senior citizens are fully depend on the income from their FDs only. I do not how the senior citizens are going to survive if the interest rate goes on reducing in the name improvement in the financial improvement to the country.

However requests to consider for the senior citizens case which should be increased to 9% minimum otherwise their survival will become a question mark .

Regards

I totally agree with you and know this would make many senior citizens retirement plan go awry. But this is the new reality and people have to adjust to the same. Government would really not do anything until people unite and it thinks that its impacting a major vote-bank.

However would recommend to put some money in long term equity funds and also start SWP in debt funds as its more efficient than Fixed deposits!

Dear Amit,

As a private employee retired,have no pension scheme.Using LIC various schemes and Senior citizen schemeFDs (maximum ltd to fifteen lakhs).I would like your advise on investing apart from Bank Fd(for senior citizen) where interest is drastically coming down,where can I invest so that you get reasonable return.please advise.

Explore SWP (Systematic Withdrawal Plan) in Debt Funds. This would give you higher returns post tax

Dear sir, my father is a senior citizen he want to invest scss in ( andra)bank & from the interest come from it he want to invest in a rd in same bank.Do you think it is a good decision. Or he invest rd in another bank which offer extra rate of interest.

Please suggest.

It would be better to invest in bank offering highest interest rate but the problem is SCSS interest would be auto-credited in Andhrabank savings account. So transferring the same to other bank and then investing in RD might be cumbersome (though its just 4 times a year). So yes go ahead with your plan of RD with Andhrabank.

Repco bank offers 8% for one year and above for senior citizens. Pl check up.

Thank you for pointing this out – have made the changes!

Thanks for the quick response

Thanks for sharing list.

Dear Amit, you are doing a great job. Keep it up. By the way, in the last table, the max. FD int. in Axis Bank is shown as 7.5%, but in an earlier table on this very page, the int. for FD of 14<15 m. is shown as 7.60%. Please correct it.

Dear Amit, sorry for that earlier post. Please treat it as withdrawn. I could not see your reply to m.k.jaura’s comment due to some glitch.

I am sorry to say that these are obsolete rates no longer valit. Latest rates are lower. Please up date your data so that the invester is not misguided.

Sorry for the inconvenience – we have updated the fixed deposit interest rates here.

I suppose there has to be an extensive study before stats are pur out esp. with reference to Ratnakar Bank. If you could check Varacha Bank, Surat Peoples Bank, Sutex Bank, Sarvoday Coop Bank ( all coop banks in Surrat) whose financials are available and NPAs are available for view. These give better returns than Ratnakar. Also, see Gujarat Rajya Karmachari Coop Bank. Investments upto Rs. 1 lac is insured. Also, the investor needs to be educated on the maneouveing of applicant names while opening accounts with coop banks, so that only the benefit of sr citizen is obtained, but the deposits are also insured.

I agree with your views and you can use various combinations of names of account holders to get benefit of deposit insurance. Historically co-operative banks have been riskier and so they offer higher interest rate. Also claiming insurance in case of default is not easy and it may take time. So it’s individuals call weather to take risk for slightly higher interest rates.