With the wider acceptance of Credit cards and the convenience it offers, it sometimes become necessary to have credit cards. But not everyone is eligible to have one and banks may deny credit card due to reasons like poor credit score, no regular income, and low salary among many others. Credit card against Fixed Deposit is a product which is specially made for such people.

The product:

The banks ask the applicant to open a fixed deposit account with auto renewal feature in the bank. The bank marks lien over this fixed deposit and generally offers credit limit up to 85% of the FD amount. The credit card works like normal credit cards while the FD continues to earn interest. In case the customer defaults and does not pay his dues for 60/90 days, banks reserve the right to adjust the amount against the FD.

The FD amount can be as low as Rs 20,000 and varies as per banks and the credit card type (Gold, Platinum, etc) opted for. Also in most cases the tenure of the FD should not be less than 180 days. Tax Saver FDs, Flexi-Deposits (Auto-sweep FDs), FDs in the name of HUF/society/trust/companies do not qualify for credit cards.

Also Read: How RBI Rate Cut Impacts your Investments and Loans?

What’s on offer?

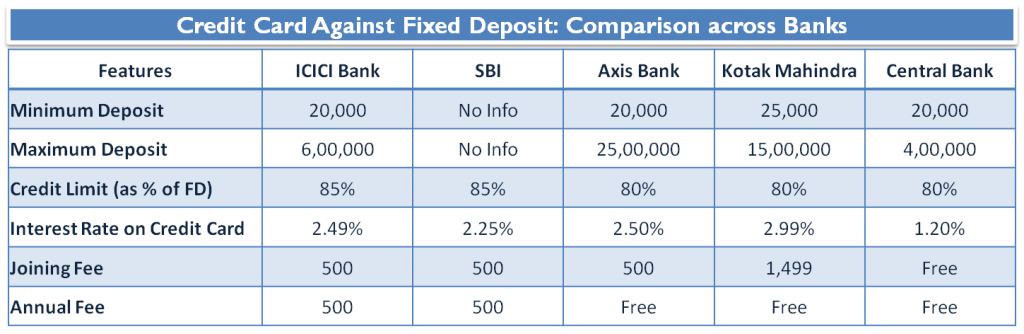

Most big banks are offering Credit card against Fixed Deposit in different names. We have listed features of some of the offerings:

- ICICI Bank Coral Credit Card Against Fixed Deposit

- SBI Advantage Plus Card

- Axis Bank Insta Easy Credit Card

- Kotak Mahindra Aqua Gold Card

- Central Bank Aspire Credit Card

- Bank of Baroda Assure Credit Card

The table below compares the features of these cards from different banks:

Also Read: Highest Interest Rate on Bank Fixed Deposits

The Good part:

- You can get credit card which you would not have in normal circumstances

- The processing for card is quicker than regular card. Also the documentation required is lesser

- Regular spending and payment on this card can help build/improve one’s credit score

- The fixed deposit continues to earn regular interest while you enjoy interest free credit for 45-55 days

- Get all the reward points, discounts valid for the card provider bank

Disadvantages:

- The fixed deposit is not liquid. You cannot break the FD until you have the card

- If you do not pay your dues till 60/90 days, the banks can adjust the balance against the FD

- Credit card is double edged sword – while it offers convince, if not handled carefully can let you to overspending resulting in debt trap.

- The interest on credit card varies from 18% to 36% per annum. So in case of default be ready to pay hefty interest along with other charges.

Conclusion:

Credit card against Fixed Deposit is a win-win product for both banks and customers. This is a great product for someone who is looking to build or improve his credit score and for people who would not be eligible for card in normal circumstances. But as stated earlier Credit card is double edged sword – if not handled carefully and can lead to over spending resulting in debt trap.

Hows does the 1-3% interest rate on credit card translates to 18-35% per nannum. Can you plz provide the basic maths in layman terms ?

If I’m open a FD of 100000 for 6 months in ICICI BANK, after 6 months my FD has completed and my FD amount cradit in my bank account.

After that, can I use my Cradit Card or not.

Yes once credit card is issued by bank you can use it until they cancel it. So if your card is still active go ahead and use it

Hi, great article.

Unfortunately I am also a victim of low cibil score and was looking measures to improve it. Will try the above actions. Thanks.

Hi,

Great article. I also want to get a credit card but cibil score scares me. This is because I have heard that non payment in credit cards due to any reason also lowers down your cibil score. Is that true?

Non Payment of any loan would impact your CIBIL score. So if you take a loan, including credit cards make it habit to have regular payment!