Fixed deposit with banks are the most popular investment option for regular income after retirement. But with interest rates going down retirees have started exploring other options. Systematic Withdrawal Plan (SWP) in debt fund is one such option which retirees and people looking for regular income must evaluate. As per your SWP instructions to mutual fund, a fixed amount is directly credited to your bank account on a particular date every month. In this post we give you details on how SWP in Debt Funds beats fixed deposit in terms of Post tax returns!

Types of Debt Mutual Funds:

Debt Funds invests in corporate and government Bonds, money market instruments and other fixed income instruments. There are various types of Debt Mutual Fund based on the duration of underlying investment.

- Liquid Funds – These debt MF invest in instruments with maturity of 91 days

- Ultra-Short Term Funds – invests in instruments with maturity up to 1 Year

- Short Term Funds – invests in instruments with maturity up to 4-5 Years

- Income Funds – invests in instruments with maturity up to 20 – 40 Years

The risk increases with the increase in maturity tenure. So for people looking to generate regular income liquid and ultra-short term debt mutual funds are the right choice.

Also Read: 13 Investments to Generate Regular Monthly Income

Returns Debt Fund Vs Bank Fixed Deposit:

The table below compares the average returns of liquid fund Vs One Year Fixed Deposit by SBI.

| Year | Liquid Mutual Fund | 1 Year Fixed Deposit @ SBI |

| 2005 | 5.27% | 5.50% |

| 2006 | 6.34% | 5.50% |

| 2007 | 7.40% | 7.50% |

| 2008 | 8.29% | 8.25% |

| 2009 | 4.73% | 8.50% |

| 2010 | 5.17% | 6.00% |

| 2011 | 8.56% | 7.75% |

| 2012 | 9.30% | 9.25% |

| 2013 | 9.06% | 8.50% |

| 2014 | 8.96% | 9.00% |

| 2015 | 8.21% | 8.00% |

| 2016 | 7.51% | 7.25% |

| 2017 | 6.46% | 7.00% |

| 2018 | 6.88% | 6.50% |

Source: Value Research for Liquid Fund and SBI Website for interest rates

As you can see for most years the returns from both are comparable.

Tax on Fixed Deposit Vs Debt Funds:

The interest received on fixed deposit is fully taxable as per the tax bracket of the investor. For debt funds, the taxation is in terms of capital gains. If the redemption of the fund is done within 3 years on investment, the gains are treated as short term capital gains while more than 3 years investment duration leads to long term capital gains. Short term capital gains are added to income and taxed according to the tax slab applicable while long term capital gains are taxed at 20.6% (including education cess) after taking indexation benefit.

Also Read: How are Mutual Funds taxed?

How SWP in Debt Fund beats Fixed Deposit?

Coming back to the point on how SWP in debt Fund beats fixed deposit, we start with a situation.

You have Rs 10 Lakh with you and want to generate regular monthly income. You have two options:

- Invest in Bank FD with 8% interest where the interest is payable monthly

- Invest in a Liquid Debt Fund and do monthly SWP (assumed return as 8% – similar to bank FD)

Investment in Debt Fund:

Assuming you invest Rs 10 Lakh in Debt fund with NAV of Rs 100. You would be able to buy 10,000 units. Now every month when you SWP instruction for Rs 6,667 is executed, some mutual fund units are redeemed.

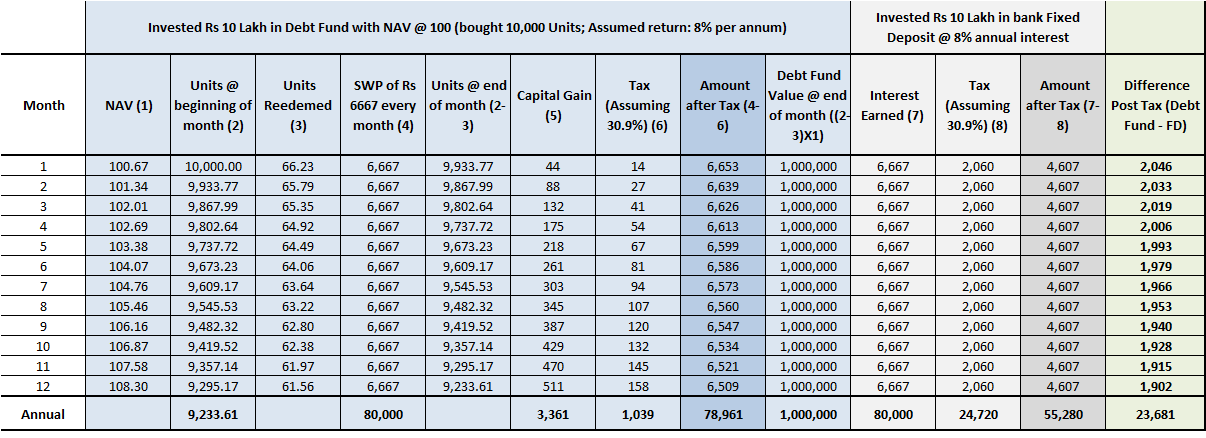

We do a simulation on which is better investment:

Also Read: Where to Park Money for Very Short Term [less than 6 Months]?

For 1 Year

As you can see in the table above:

- Both Fixed Deposit and Debt Mutual Fund generated Rs 6,667/month or Rs 80,000 for the year before tax.

- The total tax for debt fund comes out to be Rs 1,039 as compared to Rs 24,720 for fixed deposit. This is assuming taxation of 30.9%.

- Therefore you would gain Rs. 23,681 (almost 43% more) more post-tax if you choose Systematic Investment Plan or SWP in Debt Fund over Fixed Deposit.

Please Note the above calculation assumes that you do not redeem the left over mutual fund investment (Rs 10 Lakh) after 1 year as in that case there would be NO tax benefit. For any significant tax benefit, the redemption of fund should be after 3 years.

Also Read: Highest Interest Rate on Bank Fixed Deposits

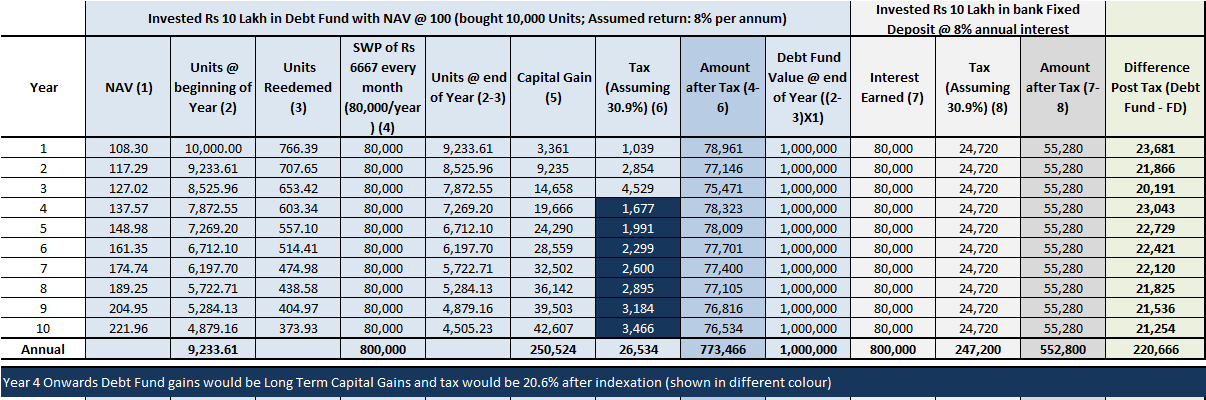

We now look at the simulation for long term of 10 years below.

For 10 years Investment:

As you can see in the table above:

Both Fixed Deposit and Debt Mutual Fund generated Rs 6,667/month or Rs 80,000 every year before tax.

The total tax for 10 years for debt fund comes out to be Rs 26,534 as compared to Rs 2,47,200 (10 times more tax) for fixed deposit. This is assuming taxation of 30.9%.As stated earlier debt fund investment for more than 3 years is considered as long term capital gains and taxed at 20.6% after indexation benefit. Therefore there is a decrease in tax outgo from 4th year (shown in different color in table)

Taking all the above in account you would gain Rs. 220,666 more post-tax if you choose Systematic Investment Plan or SWP in Debt Fund over Fixed Deposit in 10 Years.

As you can see these are significant saving in tax especially for people/retirees who depend only on monthly fixed income.

Also Read: 7 High Rated Companies Offering more than Bank Fixed Deposits

Note: We have assumed the debt fund is invested forever (like annuity). Because if you redeem the entire fund, you’ll incur capital gains. In the above calculation if you redeem your left over debt fund at the end of 10 years (amounting to Rs 10 lakhs), you’ll have to pay Rs 49,200 as long term capital gains tax. This is still better than Fixed Deposit.

Points to Keep in Mind:

The above calculation is shown for People in highest income tax bracket. However if you are in lower tax bracket, the savings in tax would be lower. Also people paying NO taxes, they would be better off with Fixed Deposit.

There may not be any significant difference in post tax return if you redeem the debt fund before 3 years. This strategy works for generating regular income over longer period of time!

Always use Growth option for SWP in Debt Funds.

Debt Funds are riskier than Bank Fixed Deposits and the returns are slightly unpredictable. You get assured return in fixed deposit while in case of debt funds the returns would vary. In rare circumstances liquid/Ultra-short term debt fund have given negative returns for few days. However on month on month basis they are positive.

Also Read: 25 Tax Free Incomes & Investments in India

Another advantage of debt fund is there is NO TDS deducted. The tax is payable on redemption which makes compounding gains more efficient. However as the gains are Capital Gains you’ll need to fill ITR 2 during tax returns which is more complicated. In case of fixed deposit, 10% TDS is deducted every year irrespective the deposit has matured or not.

You can redeem partial corpus in Debt Fund as and when required while there may be a penalty for pre-mature withdrawal from fixed deposit. Also most banks do not allow partial withdrawal i.e. Even if you need Rs 1 Lakh, you’ll need to break entire fixed deposit of Rs 10 Lakh.

You can do SWP in Arbitrage Funds too. Arbitrage Funds are treated as equity mutual fund for taxation and their returns are marginally lower than Debt Funds.

SWP or Systematic Withdrawal Plan in Debt Fund is more efficient way to generate regular income as compared to Annuity or Fixed Deposit. Retirees, Senior Citizens and people who need regular income must evaluate!

I understand that 10% of the tax will be deducted. Is it possible to claim this again if the total income for the year is less than 5L which attracts only 5% maximum tax?

how you have calculated the capital gain monthly

Nice information.. Now please also guide us how to file itr2 and where to show all details. Is it really complicated in comparison to Itr1? I fill itr1 my self @ home.

Amit, In Case of Fixed deposit income more than 10K per year. I understand that tax will be deducted at 10%. Can this be claimed back in case the total income is less than 5L for the year attracting 5% max tax only.

Yes any excess TDS can be claimed back by filing tax return.