Post Office along with providing postal services and also offer FD (Fixed Deposit) Scheme officially known as Post Office Time Deposit. We have designed a simple excel based Post Office FD calculator where you can input the investment amount, interest rate and it will calculate the interest earned and maturity value. This FD is similar to that offered by banks but has two advantages. The interest offered is generally higher than most government banks and its guaranteed by Government of India (and hence 100% safe from credit default).

Post Office FD Calculator

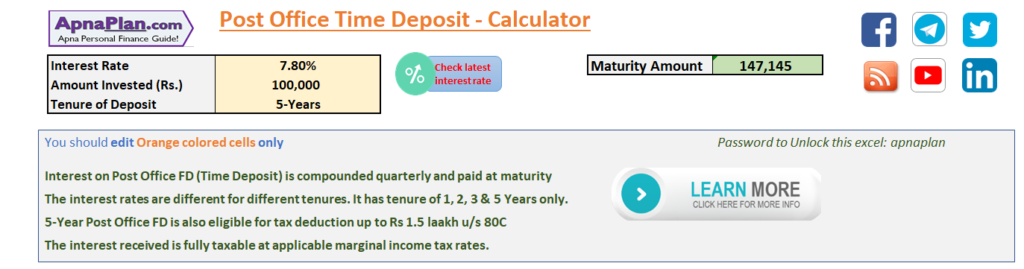

Calculating Post Office FD interest payout or maturity value is pretty simple using the compound formula below:

Maturity Value = Principal * (1 + Interest Rate/4)^(Tenure in Years*4) The above formula is for interest compounded quarterly.

Using this formula, if you invest Rs 1 Lakh at 7.8% interest for 5 years term, the maturity amount would be Rs 1,47,145 (1,00,000 * (1+7.8%/4)^(5*4))

How to use Post Office FD Calculator

The Post Office Fixed Deposit Calculator is simple and easy to use. You need to provide 3 inputs – The interest rate, the amount invested and the tenure which is 1,2,3 or 5 years. The FD calculator gives you the maturity amount.

Calculator for Small Saving Scheme – PPF, SCSS, Sukanya Samriddhi, NSC, Post Office FD/RD/MIS

Small saving scheme sponsored by Government of India like Sukanya Samriddhi Account, PPF, Senior Citizens’ Savings Scheme are quite popular and rightly so because of the safety, higher interest rate offered among other things. We have built calculator for each of them where you can check the maturity amount, loan eligibility, partial withdrawal and more. Click on the links to get the relevant calculator

Sukanya Samriddhi Yojana Calculator

Senior Citizens’ Savings Scheme Calculator

Post Office Fixed Deposit (Time Deposit) Calculator

Post Office FD Investment Rules

The Post Office FD is available for 1, 2, 3 & 5 Years tenure only.

As with all other Small Saving Schemes like PPF, SCSS, Post Office FD rates are also declared every quarter. The Post Office FD Interest Rate for FY 2021-22 (April to June) are as follows (Check latest Post Office FD Interest Rate)

- 1 Year FD – 5.5%

- 2 Year FD – 5.5%

- 3 Year FD – 5.5%

- 5 Year FD – 6.7%

Interests are compounded quarterly .There is no additional interest for senior citizens.

The minimum investment amount is Rs 200 and there is no maximum investment limit.

There is no limit to the number of FD accounts you can create in post office. Essentially each FD created is like different account.

On maturity the account can be renewed with the same tenure as it was initially opened. The applicable interest rate would be as available on the day of maturity.

Premature withdrawal is allowed only after the completion of 6 months of the FD tenure. There may be penalty for the same.

Tax on Post Office FD Scheme

The 5-year Post Office Fixed deposit is eligible for Tax benefit u/s 80C (up to Rs 1.5 Lakhs).

The interest earned is subject to TDS @ 10% if the annual interest paid is more than Rs 40,000 [Budget 2019]

You can fill Form 15G/H in case you are eligible to avoid TDS

The interest received is fully taxable at applicable marginal income tax rates.

Effective April 1, 2018 Interest income up to Rs 50,000 is exempted from tax for Senior citizens u/s 80TTB [Budget 2018]

How much Taxes you Need to Pay this Year? Download Our Income Tax Calculator to Know your Numbers

Do you know how much tax you need to pay for the year? Have you taken benefit of all tax saving rules and investments? Should you use the “NEW” tax regime or continue with the old one? In case you have all these questions just Download the Free Excel Income Tax Calculator for FY 2021-22 (AY 2022-23) and get your answers.

Post Office Fixed Deposit Calculator FAQs

✅How to use the Post Office FD Calculator?

Input your investment amount, deposit tenure and interest rate. The calculator would give you the maturity amount at the end of term.

✅What is investment limit for Post Office FD?

The minimum investment limit is Rs 1000 (increased from Rs 200 earlier). There is No maximum limit for investment in Post office fixed deposit scheme.

✅What is the maturity period for Post Office FD?

There are 4 options available:

1 Year

2 years

3 Years &

5 Years

✅Does Post Office FD give any tax benefit?

Investment up to Rs 1.5 Lakhs in 5 Year Post Office FD in eligible for tax deduction under Section 80C of the Income Tax Act, 1961. This tax benefit started from April 1, 2007.

✅Who can open Post Office FD?

Post Office FD can be opened by any resident Indian, single or joint (with up to 3 adults). Account can also be opened for minors above 10 years of age.

For minors and people with unsound mind, their natural or legal guardian can open the account.

✅What is the interest rate on Post Office FD?

As with all other Small Saving Schemes like PPF, SCSS, Post Office FD rates are also declared every quarter. As with all other Small Saving Schemes like PPF, SCSS, Post Office FD rates are also declared every quarter. The Post Office FD Interest Rate for FY 2021-22 (April to June) are as follows (Check latest Post Office FD Interest Rate)

1 Year FD – 5.5%

2 Year FD – 5.5%

3 Year FD – 5.5%

5 Year FD – 6.7%

✅Can NRIs invest in Post Office FD?

No NRIs are not allowed to open Post Office Fixed Deposit Account.

✅Can Post Office FD be closed prematurely?

Yes the Post Office Fixed Deposit can be closed after 6 months of opening. However if you close the FD account between 6 to 12 months, you only get the interest for Post Office Savings Account.

✅How many Post Office FD accounts can I open?

There is NO limit on the number of Post Office Time deposit accounts one can open.

✅Is Post Office FD Safe to Invest?

Post Office is one of the safest investment you can get. The amount is guaranteed by Government of India and hence there is no risk of getting your money back.

✅What is Post Office Time Deposit?

Post Office Time Deposit is the official name for Post Office Fixed Deposit.

Thanks Amit Bhai. It will be come more useful if you can club MIS + RD for 5 Years to get effective Yield OR FD + RD for 5 Years to get effective yield. In both cases the monthly or yearly interest paid will get credited to Post Office Savings account and after a gap of 3 days it will get transferred to RD automatically.