What is the interest rate on NSC (National Saving Certificate) for 2020? How and when the interest rates of NSC set? How do we calculate the tax benefit on NSC interest? We try to answer these common queries about NSC in this post.

NSC is popular tax saving investment under section 80C. It has maturity of 5 years and is guaranteed by Government of India. 10 Year NSC has been discontinued since December 20, 2015.

How and when does the interest rates change?

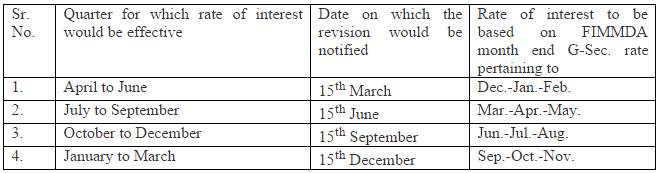

Starting April 2016, Government of India announces interest rate on small saving schemes including NSC, Senior Citizen Savings Scheme, PPF, Sukanya Samriddhi Account, , Post Office Fixed and Recurring Deposits every quarter. This is done to keep these interest rates in sync with the market rates.

The good thing about NSC is unlike PPF or Sukanya Samriddhi once invested the interest rate remains unchanged over the tenure of the deposit.

The table below shows the interest reset schedule:

Also Read: Best Tax Saving Investments u/s 80C

NSC Interest Rate:

NSC interest rates are market linked and are announced every quarter. As of 2020, NSC interest rates are 7.9% (Jan to Mar)

The table below gives the details of NSC interest rates over the years

| Financial year | Apr – Jun | Jul – Sep | Oct – Dec | Jan – Mar |

| 2019 – 20 | 8.00% | 7.90% | 7.90% | 7.90% |

| 2018 – 19 | 7.60% | 7.60% | 8.00% | 8.00% |

| 2017 – 18 | 7.90% | 7.80% | 7.80% | 7.60% |

| 2016 – 17 | 8.10% | 8.10% | 8.00% | 8.00% |

Also Read: All you wanted to know about NSC

Investment Limit for NSC:

The minimum investment should be Rs 100.

There is NO maximum limit for investment in NSC. However the maximum tax exemption is Rs 1.5 Lakh u/s 80C.

NSC can be purchased in multiples of Rs 100.

TDS & Tax on NSC:

There is NO TDS on NSC.

The interest earned is taxed according to marginal income tax rates applicable to tax payer.

Download: Excel based Income Tax Calculator

Tax Benefit on NSC:

You can claim tax deduction up to Rs 1.5 lakh for investment in NSC under Section 80C. Additionally the interest accrued every year on NSC is also considered for tax exemption u/s 80C.

Download: Latest Tax Planning Guide eBook

Here is an example:

The calculation is done taking interest rate of 8% and compounded annually.

Interest Accrued every year (except last year) is considered as fresh investment and is eligible for tax deduction u/s 80C. So in the table below, the investor would be eligible for Rs 12,000 (8% x 1,50,000) tax exemption u/s 80C.

| Date | Event | Tax Benefit u/s 80C |

| 01-Mar-19 | 1,50,000 (Purchased NSC) | 1,50,000 |

| 01-Mar-20 | 12,000 (Interest Accrued) | 12,000 |

| 01-Mar-21 | 12,960 (Interest Accrued) | 12,960 |

| 01-Mar-22 | 13,997 (Interest Accrued) | 13,997 |

| 01-Mar-23 | 15,117 (Interest Accrued) | 15,117 |

| 01-Mar-24 | 16,326 (Interest Accrued) | No tax benefit on interest in last year |

| Payment on Maturity | 2,20,399 |

What is the latest rate of interest on PMVVY, NSC, PPF, Senior Citizens Savings Scheme and Post office monthly savings scheme. Please also mention the duration of the schemes, the interest is yearly/qrtly/half yearly or monthly and also whether 80C benefit is available or not.

Half information what if it is worth ५० lakh rupees