EPF (Employee Provident Fund) is one of the best retirement plans offered to salaried employees. The deduction happens automatically, the employer makes an equivalent contribution and above all the interest earned is tax free. If the EPF amount is never dipped into and is transferred every time job change happens it would result in substantial retirement fund.

But many employees willingly or by compulsion want to withdraw the EPF balance once they change job or have a longer break between jobs. However there is some confusion on taxation and TDS of EPF. In this post we would try to clear out the confusion.

How is EPF Taxed?

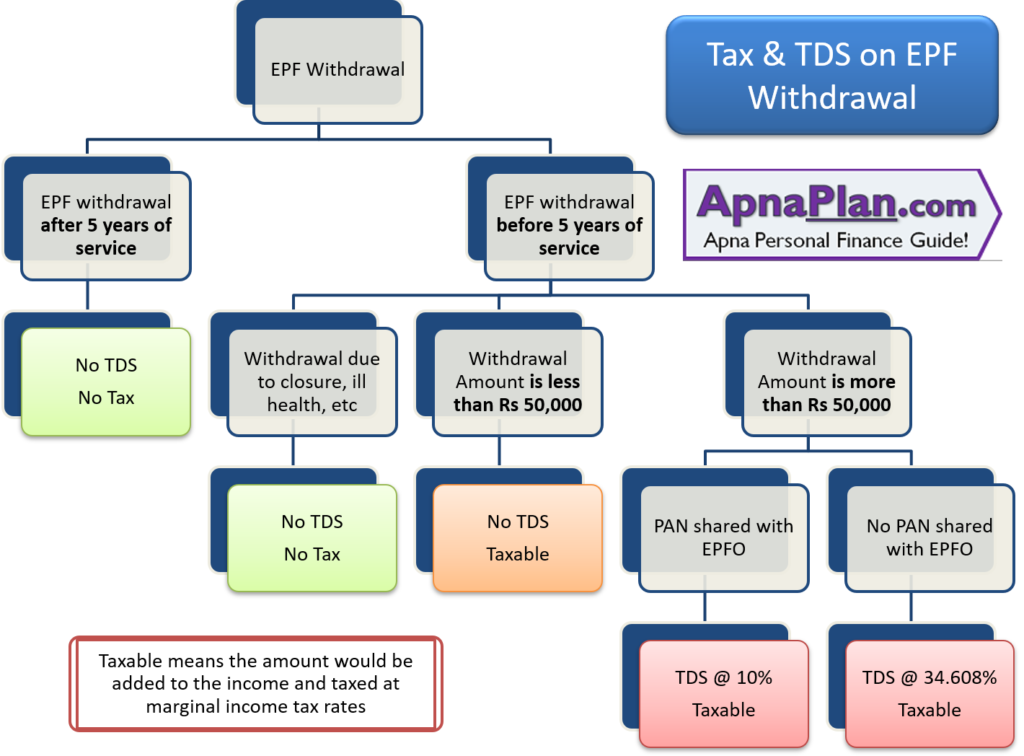

EPF can be taxable or tax free depending on the duration of your job.

EPF is tax free if it is withdrawn after 5 years of continuous service. Here continuous service can be across multiple organizations but you should have transferred the EPF balance from previous organization to the current one. In case you withdrew and did not transfer the earlier balance to current organization, it would not be considered service of 5 years. While filing income tax returns you need to put this income in exempt income.

For e.g. You have worked with your most recent employer “A” for 15 months, before that you worked with another employer “B” for 24 months and before that with employer “C” for 36 months. In case you had transferred your EPF from C to B while moving and then from B to A, then you satisfy the criteria of 5 Years (15 + 24 + 36 = 75 months). However if you withdrew your EPF while changing job, this would not be considered continuous service.

Also Read: 5 Ways to check EPF Balance

EPF is also tax free even if withdrawn before 5 years in case of any of following conditions:

- Employment is terminated due to employee’s ill health

- The business of the employer is discontinued

- or the reasons for withdrawal are beyond the employee’s control

In case the EPF is withdrawn before 5 years of continuous service (except as in the above cases), the amount becomes fully taxable as per income tax rate applicable to you.

The EPF has 4 components and they can be classified as follows from income tax return perspective:

- Employer contribution and interest earned on the same would be considered as “Income from Salary”

- Employee contribution to the extent of exemption claimed u/ 80C in earlier years (in case you did not use EPF contribution for 80C exemption earlier, this part would not be taxable)

- And the interest on Employee contribution would be considered as “Income from other Sources”

Also Read: Voluntary Provident Fund – A Good Tax Saving Retirement Option!

There is NO tax in case EPF is transferred from one organization to other while changing of job.

TDS on EPF?

Budget 2015 had introduced tax deduction at source (TDS) for payments on EPF withdrawals. Here are the rules:

In case the EPF withdrawal is not taxable (as explained above), no TDS has to be deducted.

If EPF is taxable but the amount is less than Rs 50,000 (changed from Rs 30,000 from June 1, 2016 on wards) NO TDS is deducted.

If EPF is taxable and amount is more than Rs 50,000 TDS at the rate of 10% is deducted in case PAN is submitted. In case PAN info is not provided TDS is done at the rate of 34.608%.

The TDS deducted would reflect in your Form 26AS and you can adjust the same when filing tax return next year.

In case your estimated annual income while withdrawing EPF is less than Rs 2.5 lakhs, you are eligible to submit Form 15G/H to avoid TDS.

Also Read: How to Fill Form 15G/15H Online? (with sample filled form)

There is no TDS or Tax when you transfer EPF from one employer to other while changing your job.

Some more Points:

You cannot close your EPF account when employed.

You can withdraw EPF completely only if you have been unemployed for 2 months or more.

While employed you can make partial withdrawals or take loan against EPF balance for certain things like buying house or illness or marriage.

What if I have a break between employment but never withdrawn the amount .will the same will be treated continuos 5 year service?

The 5 year period is counted across all employers you have worked for – with or without break – though only working period counts and not the break

ANUAL SALARY IS 8 LAKH…..GPF WITHDRAWL 590000/- ………26AS SHOWING INCOME 800000+590000=14 LAKH APROXMT….HOW TO DEDUCT GPFUND WITHDRAWL WHILE FILING RETURN..SYSTEM NOT ACCEPTING 8LAKH SALARY

Put GPF withdrawal in exempt income if it was tax free.