Form 15G and Form 15H are self-declaration forms which can be submitted to banks and other institutions to avoid Tax deduction at source (TDS) by banks on fixed and recurring deposit. The good news is now most big banks like SBI, ICICI, HDFC, Axis bank etc allow depositors to submit Form 15G or Form 15H online through their net-banking interface.

In this post we would tell you who is eligible to fill Form 15G/15H and how it can be done online for SBI, ICICI Bank and HDFC Bank (with screenshots).

Who can submit Form 15G and Form 15H?

Form 15H is meant for senior citizens while Form 15G is meant for all other individuals and HUFs.

Form 15G eligibility:

- You are individual below 60 years of age or a HUF

- You must be Indian resident

- The total interest income for the financial year is less than the minimum tax exemption limit for the year. For FY 2018-19 this limit is Rs 2.5 lakhs.

- The total tax calculated after taking all the deductions and exemptions is NIL for the financial year.

Form 15H eligibility:

- Your age is 60 years or more

- You must be Indian resident

- The total tax calculated after taking all the deductions and exemptions is NIL for the financial year.

- The figure below gives example when people are eligible to file Form 15G/H.

Also Read: Highest Interest Rate on Fixed Deposits across 46 banks

Examples:

The figure below gives some examples to check the eligibility to fill Form 15G and Form 15H.

How to Fill form 15G/15H Online?

We tell you how you can fill Form 15G or Form 15H online for SBI, ICICI Bank and HDFC Bank (with screenshots).

Also Read: How to Fill Form 15G and 15H (With sample filled form)?

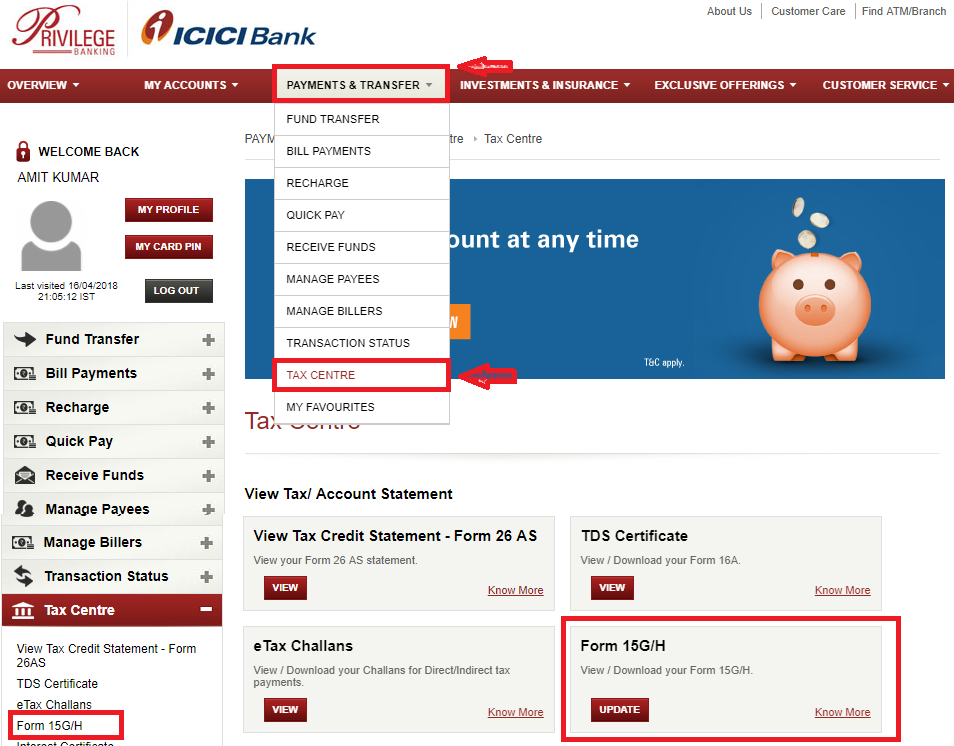

Fill Form 15G/15H Online in ICICI Bank:

Follow the following steps:

Step 1: Login to ICICI Net Banking

Step 2: Go to “Payments & Transfer” in Menu >> Tax Centre

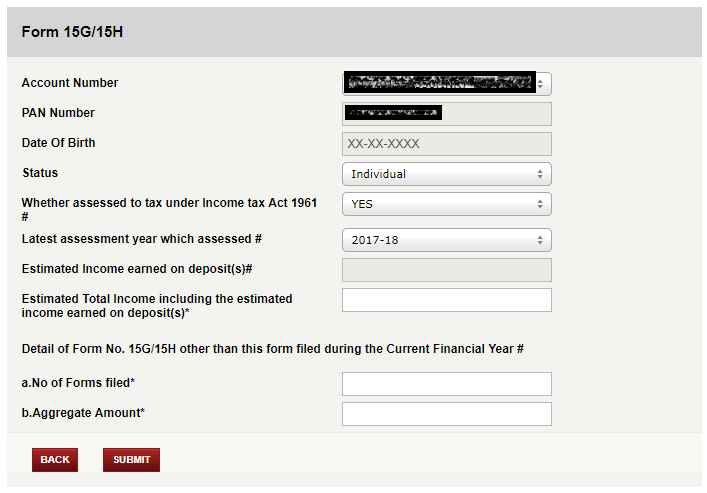

Step 3: On the page select “Form 15G/H” Update

Step 4: Fill the Form as applicable – Form 15G or Form 15H

You are done – keep the acknowledgment for future reference!

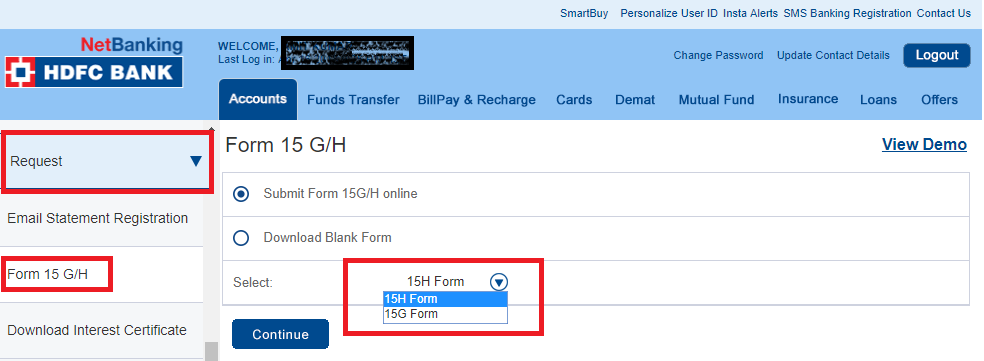

Fill Form 15G/15H Online in HDFC Bank:

Follow the following steps:

Step 1: Login to HDFC Bank Net Banking

Step 2: Go to Accounts >> “Request” >> Form 15G/H in Menu

Step 3: On the page select “Submit 15G/H Online”

Step 4: Fill the Form as applicable – Form 15G or Form 15H

Also Read: 13 Investments to Generate Regular Income

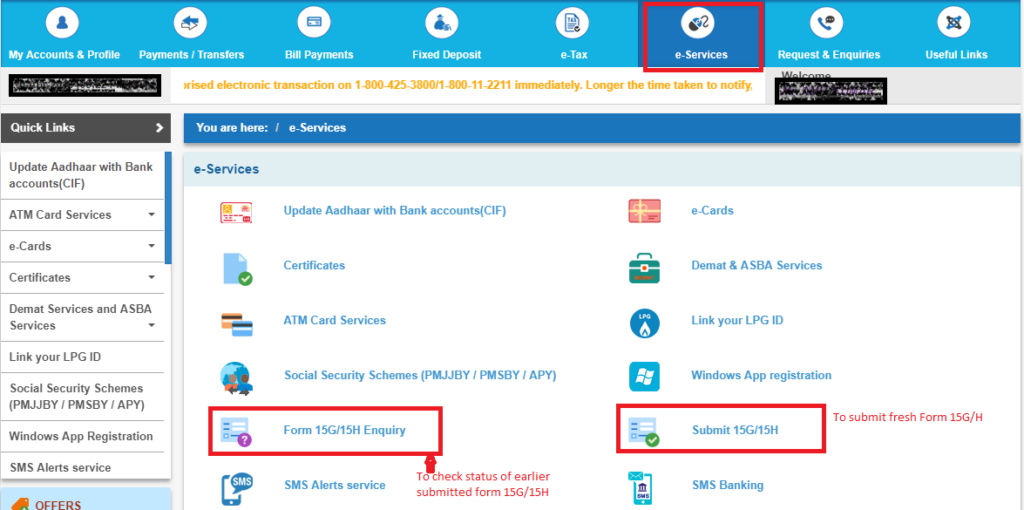

Fill Form 15G/15H Online in SBI (State Bank of India):

Follow the following steps:

Step 1: Login to SBI Net Banking

Step 2: Go to “eServices” in Menu

Step 3: On the page select “Submit 15G/H” (To check status of previous submitted form select “Form 15G/15H Enquiry”

Step 4: Fill the Form as applicable – Form 15G or Form 15H

Special Instructions:

The functionality for online generation of Form 15G/H is available between 08:00 AM to 8:00 PM IST only.

Also Read: 25 Tax Free Incomes & Investments in India

Penalty for False Declaration on 15G/H

If you are not eligible to file Form 15G or Form 15H, you should not do so just to evade TDS. Providing false declaration can lead to fine and imprisonment u/s 277

- For tax evasion of more than Rs 1 Lakhs, there can be rigorous imprisonment for 6 months to 7 years along with fine

- For all other cases, there can be rigorous imprisonment for 3 months to 3 years along with fine.

Also Read:21 Hidden Charges in Saving Bank Account

To conclude:

The Form 15G and Form 15H was revised from October 1, 2015 and has been simplified. Also the reporting to income tax department has become more robust. You must fill these forms and submit to relevant banks/institutions only if you are eligible. Do not make a false declaration as that might create problems.