Section 80GG is one of lesser known sections which can be used by taxpayers to lessen their tax burden by claiming tax exemption for rent paid (in case HRA is not part of salary). This section can be used by be either salaried/pensioner or self-employed tax payers.

Conditions for Claiming Tax benefit u/s 80GG for Rent Paid

You can claim tax deduction on rent paid u/s 80GG at the time of filing tax return only if following conditions are satisfied:

- The deduction is available only for individuals & HUFs

- For salaried person to be eligible for tax benefit u/s 80GG, he should not receive HRA from his employer.

- Pensioners or Self employed do not have any HRA and so they can take advantage of 80GG

- No one in the family including spouse, minor children, self or HUF he is member of should own a house in the city you are employed or carrying your business.

- If you own a house in different city, you cannot show it as self-occupied. You have to consider it as deemed to let out – i.e. – you have to show rental income whether or not it’s actually put on rent.

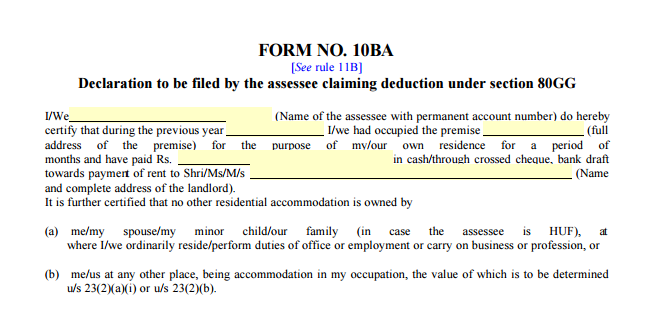

Additionally, you need to fill form no 10BA to claim tax benefit u/s 80GG. This form is NOT to be submitted anywhere but kept with you for records to show to I-T department in case of scrutiny.

Deduction allowed u/s 80GG:

The House Rent deduction is minimum of the below 3 numbers:

- Rs. 5,000 per month [increased from Rs 2,000 to Rs 5,000 in Budget 2016]

- 25% of annual income

- (Rent Paid – 10% of Annual Income)

Here Annual income refers to

- Gross Total Income

Minus

- Long Term Capital Gain,

- Short Term Capital Gain of 10% category,

- Deductions under sections 80C to 80U except section 80GG and income of foreign company

Also Read: Best Tax Saving Investments

Illustrative Calculation u/s 80GG

Assume that Amit has annual income of Rs 5 Lakhs and he pays rent of Rs 10,000 per month. Here is his tax benefit for rent paid.

- Rs. 5,000 per month – Rs 60,000

- 25% of annual income – Rs 1,25,000

- (Rent Paid – 10% of Annual Income) – Rs 70,000 (1,20,000 – 50,000)

The tax deduction would be minimum of above 3 numbers = Rs 60,000

80GG in Income Tax Return Form

Tax exemption under section 80GG is part of Chapter VI A and has to be filled as you do for Section 80C in the ITR Forms.

Can HRA & 80GG Tax benefit be claimed Together?

In case you were salaried receiving HRA for some part of the financial year but paid rent for the entire year, you can claim benefit under both HRA & Section 80GG. For the period you received HRA, you should claim tax benefit on that through your employer. For rest of months you would get tax benefit u/s 80GG.

I am a pensioner. Own a house and it is rented. I am showing rent as income. Also paying house rent as staying in a rented house. Rent paid 1.80 lac. Annual income from all sources 9.00 lac. What amount allowed under section 80GG.

Hi sir

My mother in law is pensioner and also getting family pension and also she is residing with us. Is she can claim benefits of 80GG for FY 2019-20

No, She can’t claim deduction U/S-80GG.

(Section applies where you are a tenant and paying Rent)

Hi Amit,

My mother is pensioner and having income from pension 500000 Per anuum. This income is from bank interest received on FDs. Can you confirm can she claim HRA ?

my pension is 480000 and interest from saving225000 and 20000 other income my gross income is 725000 my saving is 109000 asppf can i claim hra under sectiò80gg

Hi Amit

I am pensioner but idonot have any house in my name.My wife is homemaker.House is in her name. Am I eligible to claim under80gg house rent ?.pl comment.

hello amit i am pensioner my gross income from pension and interest and other income is rs 726000/_ and my saving is 109000 as ppf can i claim benfits of 80gg as house rent

Hi Amit,

My mother is pensioner and having income from pension 500000 Per anuum. Income from FDs is 320000 PA. Can you confirm can she claim HRA ?