The last date for filing income tax return is fast approaching (July 31, 2019). In case you have any tax due, you need to pay the same as Self Assessment Tax. The payment can be done both online and through offline mode.

Paying Offline:

For paying offline, you need to download challan 280, fill it and submit it to the authorized bank branch with accompanying cheque.

Pay Online:

You can pay online through any of the following authorized banks:

| Allahabad Bank | Corporation Bank | Oriental Bank of Commerce |

| Andhra Bank | Dena Bank | Punjab and Sind Bank |

| Axis Bank | HDFC Bank | Punjab National Bank |

| Bank of Baroda | ICICI Bank | Syndicate Bank |

| Bank of India | IDBI Bank | UCO Bank |

| Bank of Maharashtra | Indian Bank | Union Bank of India |

| Canara Bank | Indian Overseas Bank | United Bank of India |

| Central Bank of India | Jammu & Kashmir Bank | Vijaya Bank |

[box type=”info” size=”large” style=”rounded” border=”full”]

Here are some posts which can help you with e-filing of ITR 2019:

1. 9 Most Important Changes in ITR Forms for AY 2019-20

2. Calculate your Tax liability for FY 2018-19 (AY 2019-20)

3. Download 44 page slideshow showing all tax exemptions

4. Which ITR form to fill for Tax Returns for AY 2019-20?

5. How to Claim Tax Exemptions while filing ITR?

6. Use Challan 280 to Pay Self Assessment Tax Online

7. Form 26AS – Verify Before Filing Tax Return

8. 5 Ways to e-Verify your Income Tax Returns

9. What if You DO NOT file your Returns by due Date?

10. Can I file my Last Year Tax Return?

11. Why and How to Revise Your Tax Return?

12. What does Intimation U/S 143(1) of Income Tax Act mean?

13. What happens after you file your ITR?

[/box]

Steps to Pay Self Assessment Tax Online:

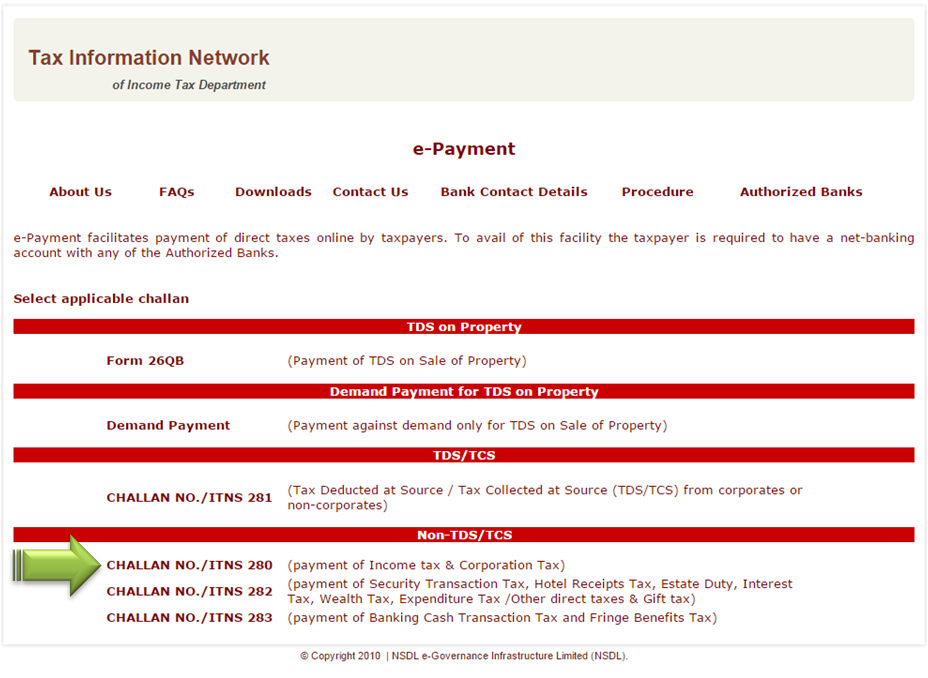

Step 1 – Go to NSDL-TIN website

Also Read: How to Reprint or Regenerate Challan 280 Receipt?

Step 2.- Select CHALLAN NO. /ITNS 280 (payment of Income tax & Corporation Tax)

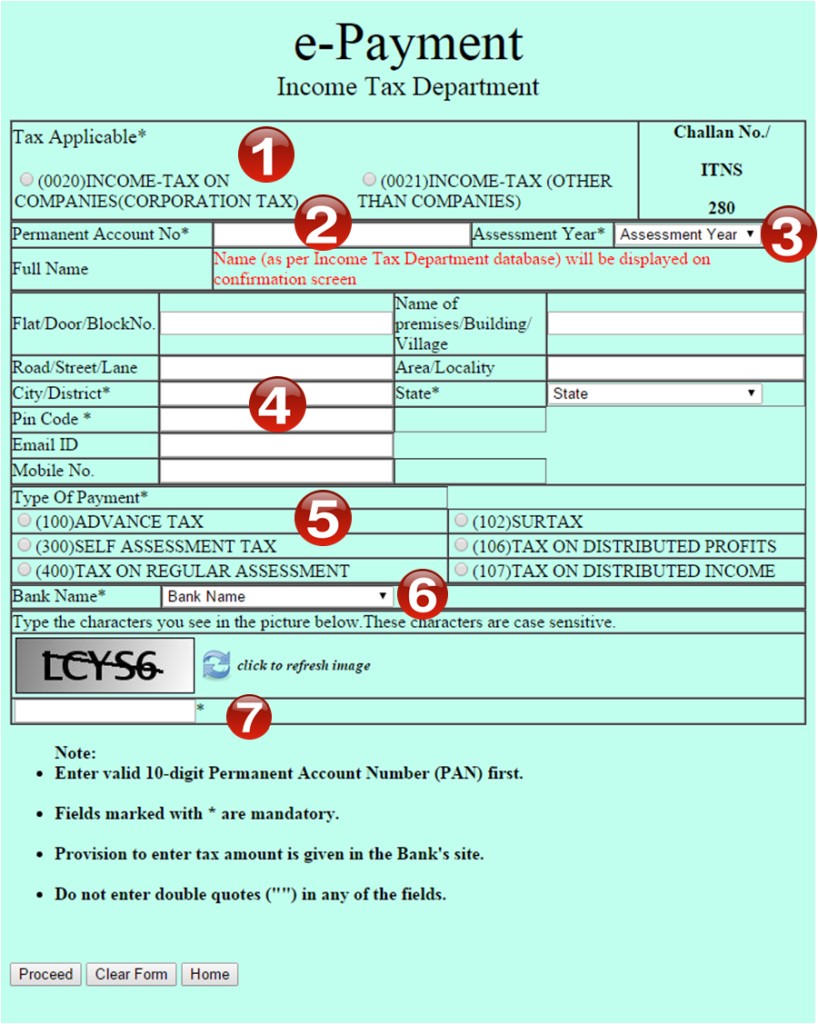

Step 3– Fill the Challan 280 as below

- Select (0021) INCOME-TAX (OTHER THAN COMPANIES) for individual tax payers

- Enter your PAN Card Number

- Select Assessment Year (2017-18) for this year tax return

- Fill up your Address, email & phone number

- Select (300) SELF ASSESSMENT TAX

- Select from List of Banks

- Fill the Captcha code and click Proceed

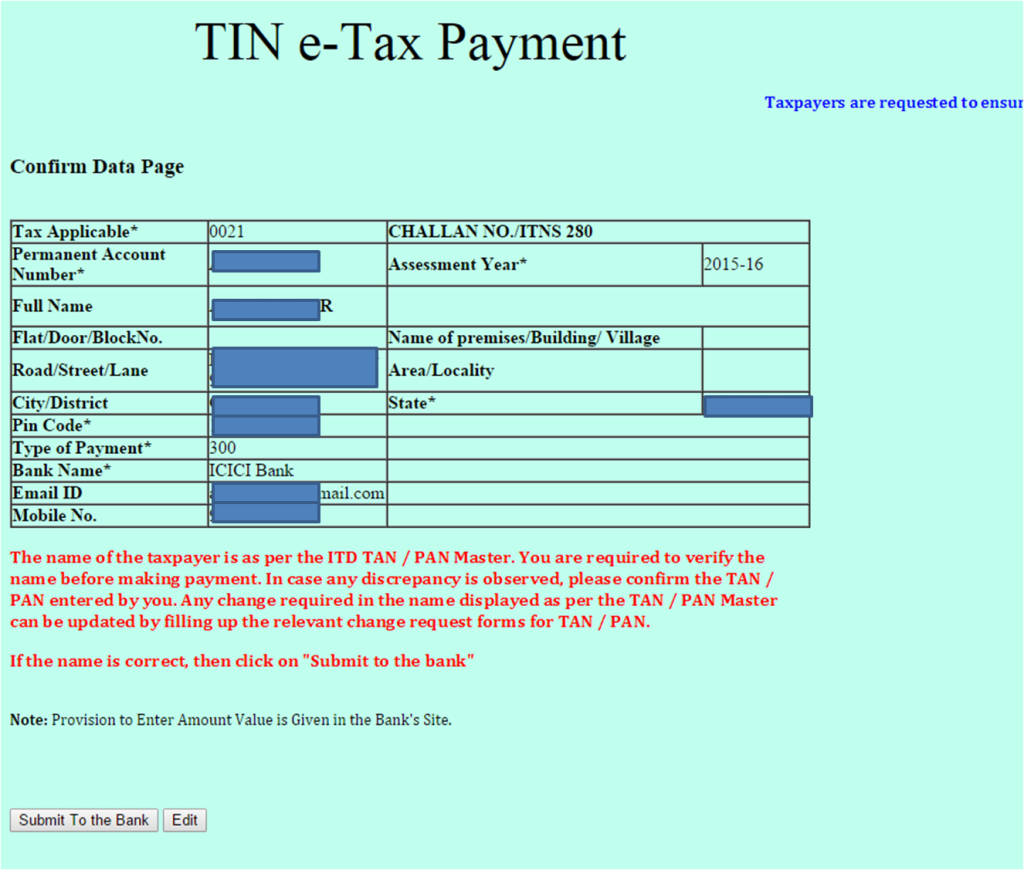

Step 4 – On the next screen Check the details you filled. In case everything is OK select “Submit to Bank” else select Edit. On Selecting Edit will take you to previous screen. On “Submit to Bank” will take to the bank’s net banking login screen.

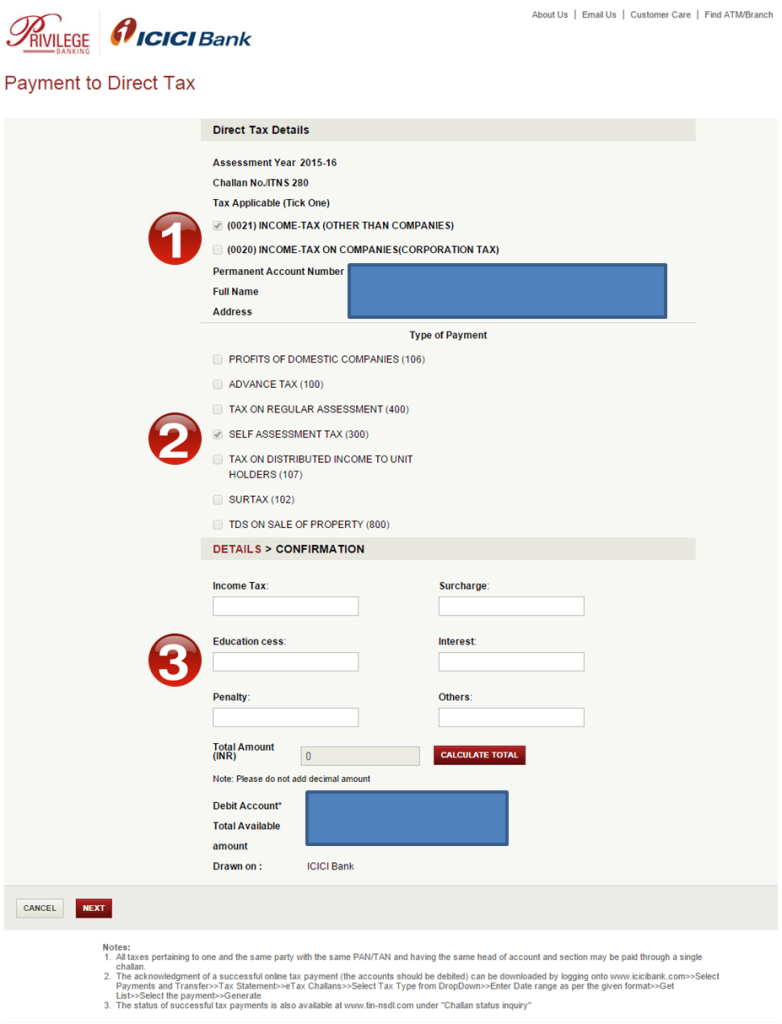

Step 5 – Login to your net banking. In the example we have shown ICICI Bank screen, it would be similar in all banks.

1/2 – Check the details already pre-filled as in the form

3 – Fill the details of the tax to be paid

- Income Tax – the amount of tax due (excluding education cess)

- Surcharge – applicable for income more than Rs 1 crore. For all others keep it as 0

- Education cess – the education cess on the above amount

- Interest – Any interest payable for late tax payment. You can keep it as 0 and add the amount in the “Income Tax” above

- Others – fill it as 0

On successful transaction, a challan counterfoil is generated. This contains CIN, payment details and bank name. You should save it as it is the proof of payment being made.

The above challan payment can be verified in “Challan Status Inquiry” at NSDL-TIN website using CIN within a week of making payment.

sir whether epayment of defective return for the ay 2015-16 can be made in ay 2017-18?

No while paying you should select the relevant assessment year!

I submitted my self assessment 2017-18 return without paying tax(10840-9800tds=1040balance). Now how can I pay balanced tax. I have to pay through challan 280 online Or they can adjust this tax with my last year refund.

The refunds for last year would have already been credited to your account, if you filed it within time limits. Also its always good idea to pay all balance taxes and file returns! If you have not paid pay it immediately using Challan 280.

Excellent article to help pay self assessment tax through online banking. Appreciate it. Thanks.

I have paid a total Self Assessment Tax of Rs 814/- (Basic Tax Rs 790/- + Education Cess Rs 24/-) for AY 2017-18. What amount should I put as Tax Paid (column 4 of IT Details of Advance Tax and Self Assessment Tax Payments) in ITR-1? If I input Rs 814/- in that column the system calculation is showing Rs20/- as Refund (item D13 of Part D). Do I then put Rs 790/- (basic tax) in the Tax Paid column? Moreover, do I have to pay any interest on the Self Assessment Tax?

Input the entire amount you have paid as self-assessment tax and let the ITR form do its calculation.

Very informative article but i am not able to get the answer to my query,

I had e verified the ITR and then realise that it still shows tax payable so i immediately paid the payable amount through challan 280.

How can i update my itr to adjust this tax amount.

If you want to show the tax paid after filing your ITR, you’ll need to revise your returns. Its simple – you can find step by step process to revise your ITR here.

Can we pay self assessment tax through other person debit card and paying him offline

yes you can. However its always good idea to use taxpayers own account!

I PAYED SELF ASSESSED TAX 30 ON 25/7/2017 WITH BELOW DETAILS

DATE OF TENDER 12072017

MAJOR HEAD 0021 – INCOME TAX (OTHER THAN COMPANIES)

MINOR HEAD 300 – SELF ASSESSMENT TAX

ASSESSMENT YEAR 2017-18

REFERENCE NUMBER 926435399

I NEED BSR CODE AND SERIAL NUMBER OF CHALLAN

I do not find BSR CODE AND SERIAL NUMBER OF CHALLAN in my net banking e tax menu , shall i get it after few days . can i get it immediately.

Read How to Reprint or Regenerate Challan 280 Receipt?

I have paid my tax through ICICI credit card and the transaction was sucess. But after filing my return for 2017-18 even after payment of the correct payable the return is showing tax payable for the amt which I paid kindly advise

After you paid you need to make an entry of the payment in ITR Form. Once you do it would not show “Tax payable”

Where we need to make entry of payment in the ITR Form.

In Tax Details -> Schedule IT – Details of Self-assessment and Advance tax

I am not having net banking facility to pay challan 280. please explain in details about filing and paying challan 280 by offline. what should do after this offline payment through bank whether do I have to update anything with this counter foil ( if yes give the link to update) or the bank would do this?

You’ll need to fill up the details in your return form. So keep the counter foil handy. Also the above payment would be reflected in your Form 26AS in a weeks time but you can file your ITR before that too.

what should do after this offline payment through bank whether do I have to update anything with this counter foil ( if yes give the link to update) or the bank would do this?

Bank would pass the information to income tax and subsequently get updated in Form 26AS. If you need the same to file returns note down the details.

Thanks a lot Amit for putting it across in easy format.

Good Wishes.

I have to pay balance tax on FD interest. Which challan no should i use for it?

Challan 280

After online payment of Self assessment tax do we need to wait for it to be updated on it website.

Or we can directly file the return by manual feeding of the challan details.

you can directly do it without it reflecting in 26AS

if i pay challan online via debit card how will i get the BSR code and other details that i need to fill in ITR?

The receipt has that!

I PAYED SELF ASSESSED TAX RS 30 ON 11/7/2017 WITH BELOW DETAILS

DATE OF TENDER 12072017

MAJOR HEAD 0021 – INCOME TAX (OTHER THAN COMPANIES)

MINOR HEAD 300 – SELF ASSESSMENT TAX

ASSESSMENT YEAR 2017-18

REFERENCE NUMBER 926435399

I NEED BSR CODE AND SERIAL NUMBER OF CHALLAN

Just login to your bank you paid this…. You’ll find the list of challans you used to pay taxes. Look into tax section part of internet banking

I paid my self assessment tax about 6 days ago, but while filling the e-return, the paid tax is not appearing in return, the advance tax which was paid in March appearing, how much time it takes to appear in return, pl. clarify.

The taxes paid are reflected in a week in form 26as. May be you should check in next few days

Hi,

I have not saved challan counterfoil..how do i get CIN in this case.

If you had paid it online you can find the same in internet banking. Look for Tax/challan in the menu.