While filing Income tax return you might need to pay additional tax. We have stated in an earlier post about how to pay this Self-Assessment tax using Challan 280. The problem is sometimes people forget to save the Challan 280 receipt and later cannot find the details to fill up in the ITR Form. This is OK once the payment is reflected in your Form 26AS but in case of urgency like few days before ITR due date you cannot wait so long. In this post we have shown how you can reprint challan 280 in SBI, ICICI Bank & HDFC Bank.

How Long it takes Challan 280 to reflect in Form 26AS?

According to banks, they upload the Tax payment information to TIN within 3 working days after realization of tax payment. The TIN automatically updates this information in Form 26AS next day. So ideally your Self-Assessment or Advance Tax Payment should be reflected within 4-5 working days in Form 26AS. But it’s not an ideal world and at times and during high load times, this may extend up to 10 days.

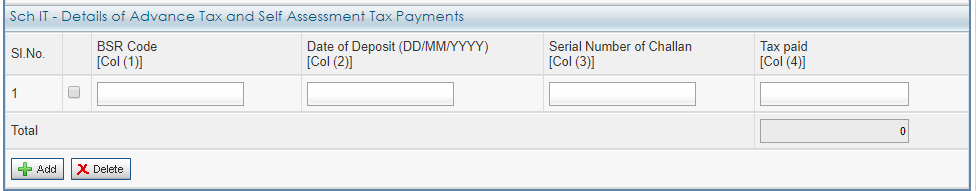

Challan 280 receipt Details for ITR:

You need the following details from Challan 280 receipt to fill up in ITR Form: BSR Code, Date of Deposit, Serial Number of Challan and Tax Paid

We tell you how you can Reprint or Regenerate Challan 280 used for Self-Assessment Tax or Advance Tax payment.

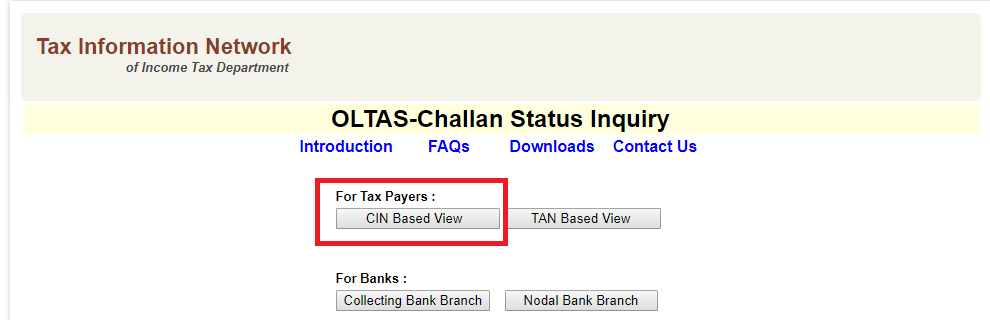

Challan 280 Receipt On TIN Website

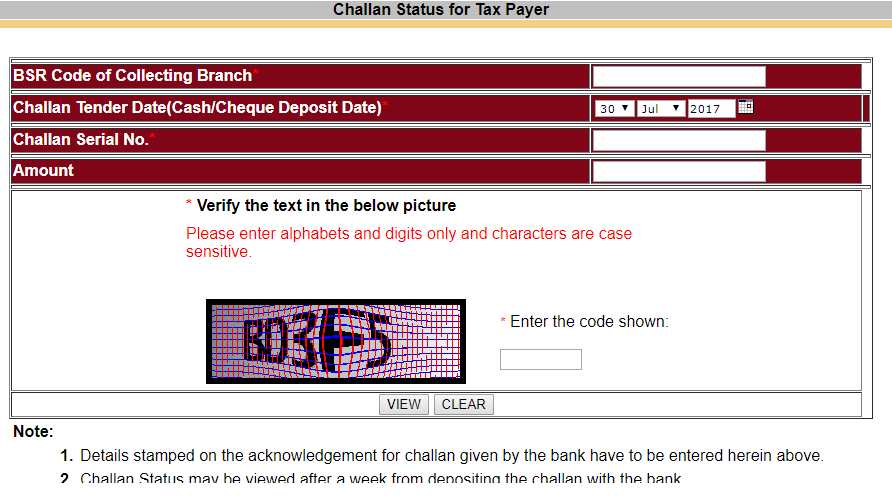

You can follow this link of TIN NSDL Website and get your challan receipt provided you have BSR Code of Collecting Branch, Challan Tender Date(Cash/Cheque Deposit Date) & Challan Serial No.

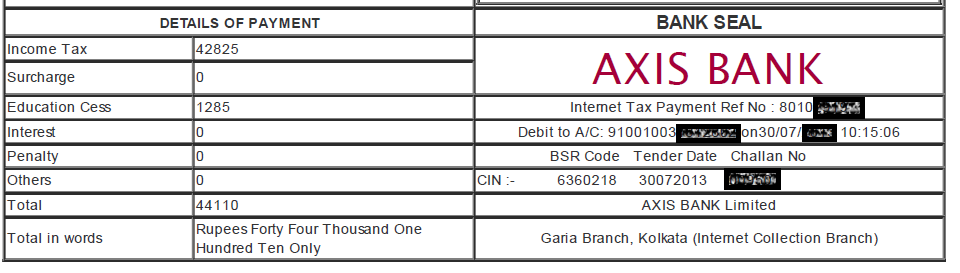

CIN or Challan Identification Number is combination of BSR Code, Date and Challan Number and is used to uniquely identify a challan receipt. The receipt below shows the CIN Number

Just fill up the form as shown below and your receipt would be generated.

In case you had paid the self-assessment tax using net banking, you can view the same through net banking. We show it for SBI, ICICI Bank & HDFC Bank.

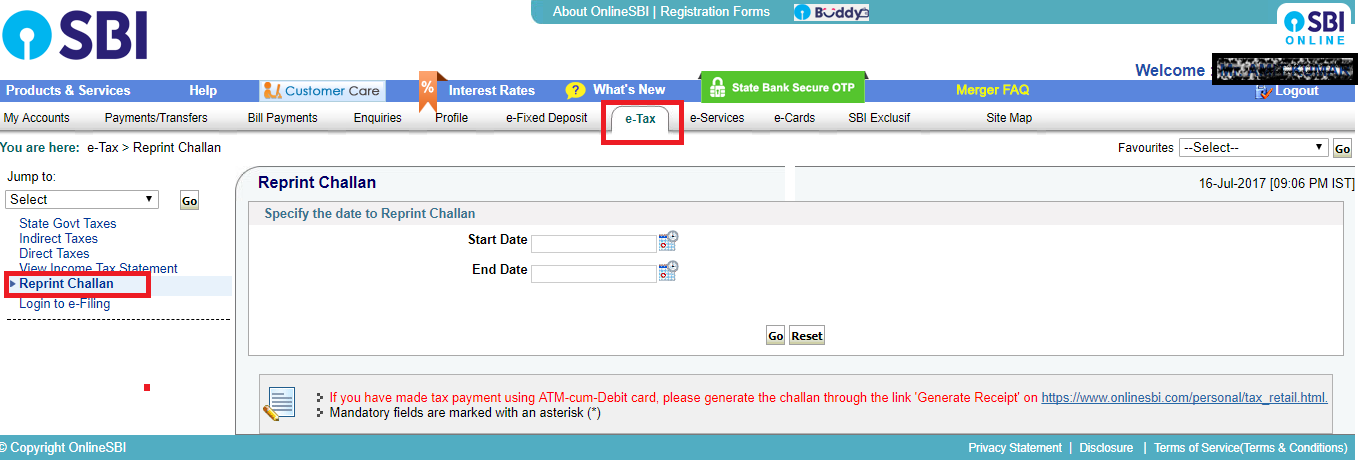

How to Reprint Challan 280 SBI? (using Internet banking)

Its easy to reprint the Challan 280 receipt if you have paid from SBI. Follow the following steps.

- Login to SBI Net Banking

- Select e-Tax and then Reprint Challan

- Specify the Date to reprint Challan

- You’ll get list of all challans, click and download PDF as required

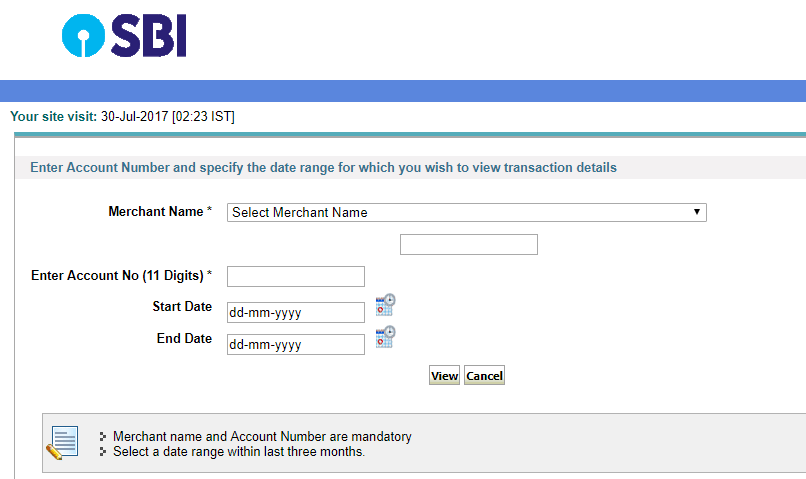

How to Reprint Challan 280 SBI? (using Debit Card)

In case you used SBI Debit card to make the self-assessment tax payment you have to go to SBI Enquiry Transaction Status webpage:

- Select OLTAS (for income tax) as Merchant name

- Fill up the PAN enter PAN Number, Bank Account Number and the dates for transaction

- You will get Transaction details & the following option “Click here to see the challan details” to get your challan

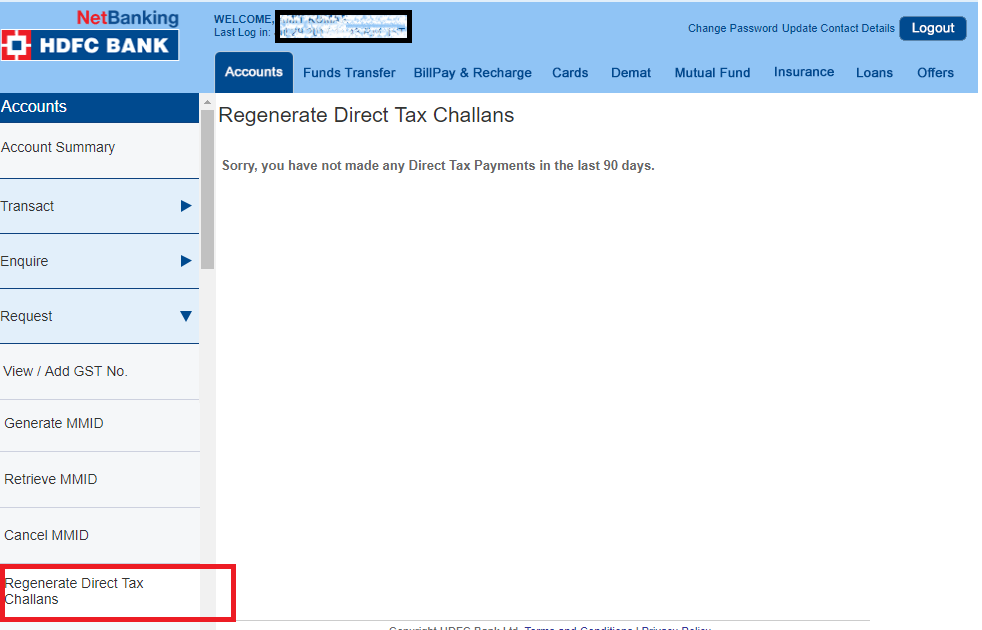

Reprint Challan 280 HDFC Bank

Follow the following steps if you have made tax payment using HDFC Bank in order to reprint the challan 280 receipt.

- Login to HDFC Net Banking

- Go to Accounts and then expand Request

- Scroll and Click to Regenerate Direct Tax Challan

- The challans are listed

- Select and Download as required

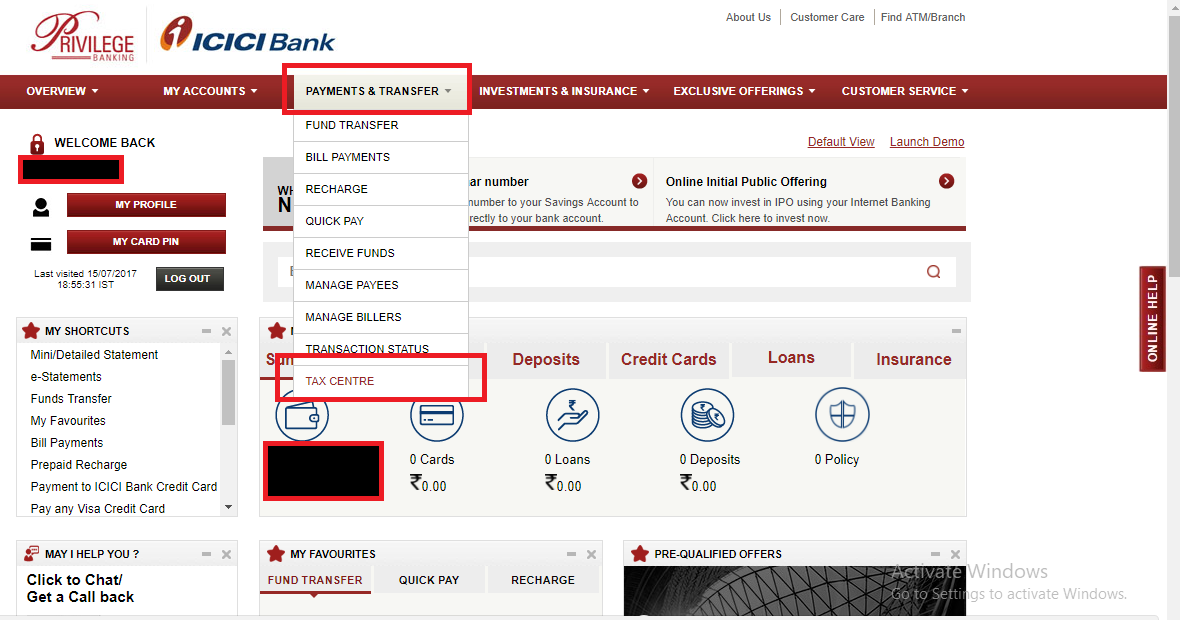

Reprint Challan ICICI Bank

Follow the following steps if you have made tax payment using ICICI Bank in order to reprint the challan 280 tax receipt.

- Login to ICICI Net Banking

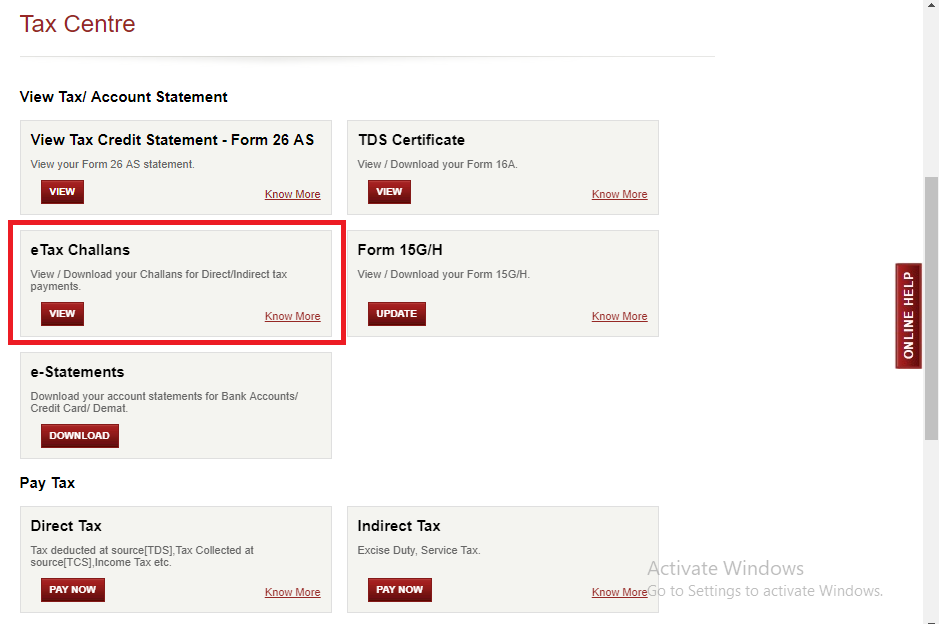

- Go to Payments and Transfer menu select Tax Center

In the Tax Center Click on eTax Challans

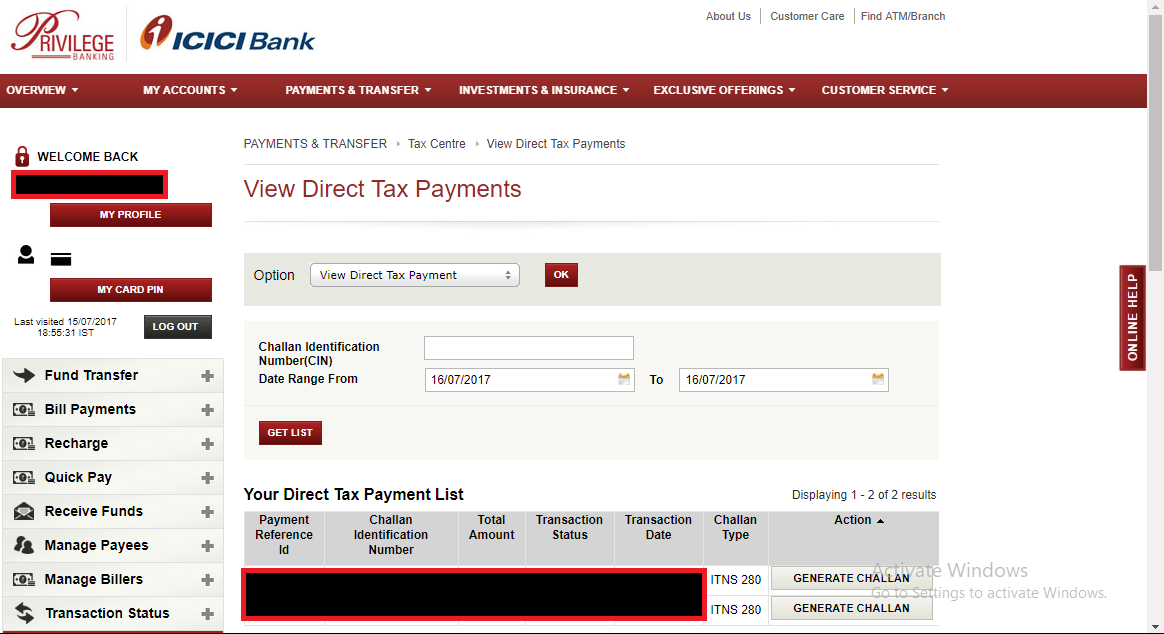

The challans are listed

Select and Download as required

We hope this step by step instruction to reprint challan 280 from SBI, ICICI Bank, HDFC Bank would help you to fie your tax returns real quick – without waiting for it to be reflected in Form 26AS.

how to re print TDS paid challan 280 from ICICI Corporate login

Sir,

I pay self Assessment Tax an amount of Rs- 1042.00 through SBI Txn Ref No. IK0BKGOIA6 for OLTAS is sheduled on 05/12/2021. Debited Account no. 40015480378 of SBI Buniadpur Branch IFSC SBIN0006795 through Net Banking.

I have paid tax by sbi debit card. But I couldn’t generate challan receipt

I searched a multiple places but here was the actual solution I needed.

Thanks for this help.

CHALLAN 280 PAYMENT RECEIPT

Thank you SIr, Very Helpful

As I release from previous company on 12 June 17, when I asked company accountant for FORM 16 he replied company cannot provide Form 16 for only two-three month left employees, he denied to give it and I have to submit cumulative IT return of both employers. Pl advice how to submit IT – return and about document necessity if IT officer inquired for the same.