One of my friends called me in a worrying voice telling me he had received an email from Income tax department with subject “Intimation U/S 143(1) for PAN ABCxxxxx4A AY:2019-20”. As with most of us, any communication from taxmen makes us worried and it was not much different for my friend.

Are you in the same boat and have you also received similar email from [email protected] with similar subject? And are you worried about what it means for you?

Well worry not! Intimation U/S 143(1) is sent by Income Tax department in response to the Tax returned filed by you. As the subject suggests “Intimation” – the communication intimates the tax payer about, any tax and interest payable or if you are eligible for refunds.

Also Read: 23 most common Investments and how they are Taxed?

This is done by the computer without any human intervention and checks for following two things:

- Any mathematical error or

- any incorrect tax claim

What you need to do is open the attached zip file. The zip file contains a PDF file which is password protected. To open this PDF following is your password.

The password is your PAN Number in lower case followed by your date of birth in DDMMYYYY format. So if your PAN Card Number is ABCDE1234A and date of birth is January 1, 1985, then your password would be abcde1234a01011985. The date of birth should be one which is mentioned on your PAN Card.

Download: The ultimate ebook guide to Save Tax

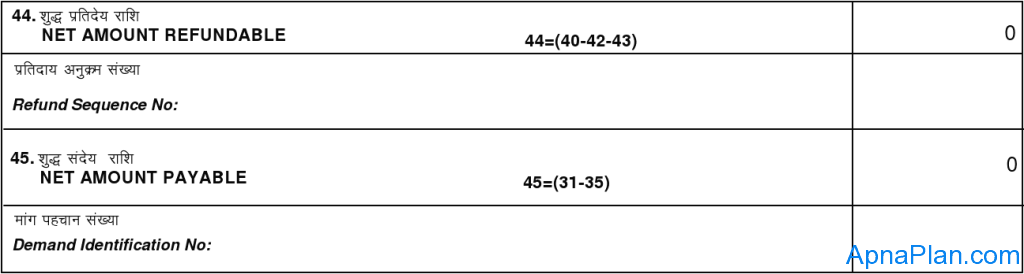

Just scroll down and at the end of all calculations you would see two headings.

- Net Amount Refundable

- Net Amount Payable

In case there is ‘0’ in front of both as in the picture above, it means that your tax return filing was perfect – you neither need to pay any more tax for the year nor you would get any tax refunds.

In case some amount is mentioned for “Net Amount Refundable” then its good news and you would soon get that amount in your bank account. And if “Net Amount Payable” has some amount mentioned, then you need to pay that much tax to Income tax department.

In case you think there is some error in the calculation sheet, you should consult a qualified CA or good tax expert for further action.

Hi, Same query, where it says:

Form 16A/16-Other Income: 0 / 211730 / 211730.

Here I deposited 1.5L cash during demonetization period in my bank a/c.

Bank have already deducted interest on FD/SB gained interest.

How should I proceed further ? Please reply

You can refer to our post on How to Respond to Notice u/s 143(1)(a)?.

Dear Sir,

May I ask you to please do clarify that in ITR Form-1 there is column B1. Income from Salary / Pension where we enter the Chargeable Income of Form 16, is it CORRECT?

Secondly, in Tax Detail page, there is column Income under Salary [(Col 3)] where we put the Chargeable Income, is it CORRECT? or, if we give Gross Salary / Balance then it causes error message like You have declared less income or, income mismatch. So, which is correct to enter.

Last one, where we should put interest income from Saving Account, in Income from Other Source or some where else?

Regards,

Ram

Yes you can put salary income at both places same else it gives error.

Interest in savings account goes in income form other sources. However you can claim tax exemption up to Rs 10,000 u/s 80TTA

I had received 143(3) intimation as below:-

Form 16A-VI Deduction 106758 76754 30004

2 Form 16/16A-Taxable Total Income 519560 549565 30005

The difference in 16A-VI deduction is that my company did not take into account of my wife’s PPF subscriptions for the year in form 16. so i added it on filing the return.

could you advise how to respond to this intimation? where should i attached the proofs for PPF account and form 16?

Regards

Antony

You can refer to our post on How to Respond to Notice u/s 143(1)(a)?.

Hi, I also received the same notice and while checing in E-Proceedings > E-Assessment/Proceedings section, I found message of ‘No recrods found’. I called to Call center no. 18001034455 mentioned in the communication and they told that ignore this communication for now and they will send the revised communication further. I also noted down the complain no. while call. I request you to check E-Proceedings and call to Call Center if that is the case for you.

Apurva

Thank you – this was very helpful for our readers!

Hi Amit,

I have also received the similar one, as i forgot to add my pf withdawl money to my salry income. So what should be next step. If i file a new itr again will the old one will be ignored?.

It is also mentioned in that form that we need to submit our respone in the e proceeding where the submit is available ? what it means and what will happen if we click on submit button?

Please clarify

Regards

Venkat

You’ll have to file revised returns including PF withdrawal. Then pay taxes if any. This is easy but do it as soon as possible.

HI Amit,

Thanks for your prompt response. I have gone to e proceedings where i have to submit my response.

There three columns are there for each two options are the agree/disagree for additional income

1) proposed addition of income due to PF 262424 agree/disagree

2) proposed addition in Gross total income 262424 agree/disagree

3) proposed addition in taxable income 262424 agree/disagree

If i have to submit my response i need to select agree/disagree option all options are correct, but if i select all in the bottom all the amounts are becoming cumulative and a note is coming like ” an additional income of 787272 appearig in form26AS/Form16/Form16A shall be added as the samehas not been included in computing the total income in the return”

The amount should be 262424 but instead of it it is getting added for each selection is it a bug in ITR site what should i do for this ? please suggest

There is bug in the module. You can refer to our post on How to Respond to Notice u/s 143(1)(a)?.

Hi Sir

I got the mail from Communication u/s 143(1)(a)

Income as per return : 275630

Income as per form : 281540

Proposed additional of Income : 5010

For that 5000 I invested in PPF for the month of Jan Feb March 2017. So I believe it should be deducted as per 80C

So why they are showing for additional Income Please advise what should be done on this .

Thanks

Please wait for few days at it seems to be some bug from Income tax department.

I had to claim the 45000 under section 80g (donation) which i could not do with my employer. but I got this notice from the dept.

please suggest . . .

Form used for comparison | Income as per Return | Income as per Form | Proposed addition of income

Form 16 -deduction | 295000 | 250000 | 45000

Form 16-Taxable Total Income | 1407470 | 452470 | 45000

Please wait for few days at it seems to be some bug from Income tax department.

Sir,

With due respect, I am to state that communication of adjustment u/s143(1(a) is of I.T.Act, 1961 which indicates comparison, income as per return, income as per form, proposed addition of income, is not understandable.

Please guide me as to what does it mean.

Regards.

Please wait for few days at it seems to be some bug from Income tax department.

Hi! I have also received a similar email. In my case, the mismatch is due to the savings/deductions mentioned.

My company asks for all the proofs of incomes & investments in January itself so that they have enough time to prepare the Form 16 for all the employees and I couldn’t get them all in time so I had provided them directly while filing the ITR. This has caused a mismatch in the taxable income after deductions as it’s different in Form 16 (provided by company) and the details filed in the ITR.

Is this a concern?

Please wait for few days at it seems to be some bug from Income tax department.

Sir

I received a mail like intimation u/S143(1) and there is only four column like

I:-form for comparison

ii:-income as per return

iii :-income as per form

iv :- proposed addition of income

(ii-iii )

And there is no column of net amount payable or receivable

So what is the next process please inform me

Please wait for few days at it seems to be some bug from Income tax department.

I too received the communication from income tax to adjust my income.

I have declared less income from Form 16 because there were few deductions which i made after the due date is passed and my employer did not consider those investments.

So do let me know what information i need to provide Income Tax during response, any sample response if any one have, please do share

Please wait for few days at it seems to be some bug from Income tax department.

I have receive email from income tax dept with details below,

communication on proposed adjustment u/s 143(1)(a) from the Income Tax Department, Centralized Processing Center (CPC) with respect to the return of income filed by you for the PAN and Assessment Year 2017-18.

Part – A

Adjustments u/s 143(1)(a)

***************************

Iv -Addition of income appearing in Form 26AS or Form 16A or Form 16 which has not been included in computing the total income in the return-143(1)(a)(vi)

Sl.no Form used for comparison (i) Income as per Return (ii) Income as per Form (iii) Proposed addition of

income (iv)= (ii) – (iii)

1 Form 16-Salary Income 616668 815925 199257

2 Form 16-Gross Total Income 616668 815925 199257

3 Form 16-Taxable Total Income 381670 580925 199255

what need to do be done for that

The communication tells you that the ITR you filed, you have declared salary income of Rs 6,16,668 while as per Form 26AS or Form 16 the income should have been Rs 8,15,925.

Accordingly your total tax has changed and you would need to pay more taxes if you agree with the new computation.

I am facing a similar issue. So what needs to be done for that? How to rectify this?

You’ll need to pay additional taxes and file revised return.

Sir, I just got one similar to that of Mr.Malay Dasgupta. The difference in taxable income in my case is because bank interest report. As per the interest statement by the bank, the actual interest paid is Rs.19674/-. But there is another entry in the statement which shows “interest accrual” and the figure is Rs.85880/-. (I think this is the overall interest accrued on fixed deposits hitherto.) 26AS shows this amount as “amount paid/credited”. So the system finds a mismatch between 26AS and return filed and proposes adjustment. They have given a 30 day response period. An online response is advised under the “e-proceeding” section of the tax site, but I see nothing listed there. When I try the “rectification” section, it returns an “invalid intimation reference number” error. How should I proceed online/offline?

Please wait for few days at it seems to be some bug from Income tax department.

Dear Tax payer,

Please find attached the communication on proposed adjustment u/s 143(1)(a) from the Income Tax Department, Centralized Processing Center (CPC) with respect to the return of income filed by you for the PAN BYRxxxxx2Q and Assessment Year 2017-18.

The attachment is password protected. To open the attachment, please enter your PAN in lower case and date of birth in case of individual tax payers / date of incorporation for non-individual tax payers in DDMMYYYY format without any space between the PAN and date fields. For example, if your PAN is ABCDE1234A and date of birth /incorporation is January 1, 1985 then the password will be abcde1234a01011985. The date of birth / incorporation should be same as furnished to the Department and available in the Income Tax Department PAN master (as printed on the PAN card).

The digital communication is authenticated by a digital signature obtained from a certifying authority under the Information Technology Act, 2000. To know the process of validation of digital signature, please click here https://incometaxindiaefiling.gov.in/portal/downloads10-11/cpc/DigitalSignatureValidation.pdf.

Deputy Commissioner of Income Tax,

CPC, Bengaluru

Note: Income Tax Department does not seek any tax payer information like user name, password, details of ATM, credit cards, etc. Tax payers are advised not to part with such information on the basis of emails.

This Email is system generated. Please do not reply to this email ID. For any queries, please call CPC on telephone number 1800-4252229, 1800-1034455 (Toll Free) and quote the Communication Reference Number mentioned in the attachment.

Hi got a message like above one and I did not get pdf when I clicked on above link please let me know whether it s a genuine one or fake

Thanks in advance

Its difficult for me to guess if the email is genuine or fake without viewing it. Ideally 143(1) is attached in form of PDF and the mail comes from [email protected]. Check these features in email to determine if its fraud!

I am an IT guy and this thing is not enough to check if the mail is coming from proper source or not. I can send you mail from Donald Trump and can multiple pdf to it. So just check the content and even if its demanding any money than use the income tax department site to validate it.

This is genuine email as the link takes to the income tax return filing website!

Sir , I received an intimation from ITAX Dept under Communication of proposed adjustment u/s 143(1)(a) of Income Tax Act, 1961. where in it is mention as follows-

form used for comparison

1 Form 16- deduction

2 Form 16-Taxable Total Income

Income as per return

150000

0

Income as per form

0

801911

proposed addition in income

150000

150011

I am a senior citizen ,deposited Rs 150000 under 80C and claimed deduction under 80C ,I failed to understand why deduction shown nil in as per form column.

Please recheck your ITR form. This can only happen if there was error in your ITR.

Sorry but the query is not entirely clear to me!

Sir , I received an intimation from ITAX Dept under Communication of proposed adjustment u/s 143(1)(a) of Income Tax Act, 1961. where in it is mention as follows-

form used for comparison Income as per return income as per form proposed addition in income

1 Form 16- deduction 150000 0 150000

2 Form 16-Taxable Total Income 651900 801911 150011

I am a senior citizen ,deposited Rs 150000 under 80C and claimed deduction under 80C ,I failed to understand why deduction shown nil in as per form column.

Please sugegst me as i have received the below info from income tax dep

Adjustments u/s 143(1)(a)

1 Form 16-Taxable Total Income 255910 | 455914 | 200004

2 Form 16-Gross Total Income 419882 | 619882 | 200000

Addition of income appearing in Form 26AS or Form 16A or Form 16 which has not been included in computing the total

income in the return-143(1)(a)(vi)

(vi)

Sl.No Form used for comparison Income as per Return Income as per Form Proposed addition of income

(i) (ii) (iii) (iv)= (ii) – (iii)

Page

You can refer How to Respond to Notice u/s 143(1)(a)?