Budget 2015 had introduced a new section 80CCD (1B) which gives deduction up to Rs 50,000 for investment in NPS (National Pension Scheme) Tier 1 account This new deduction can help you save tax up to Rs 15,600 in case you are in the 30% tax slab.

The question is should you take advantage of this new tax deduction and invest in NPS?

NPS has not taken off as expected and finance minister by giving this additional tax saving option is trying to give it a push. We all know how many people invest blindly in poor schemes just to save tax. This post is to analyze if it makes sense for us to invest in NPS to save additional tax.

Assumptions:

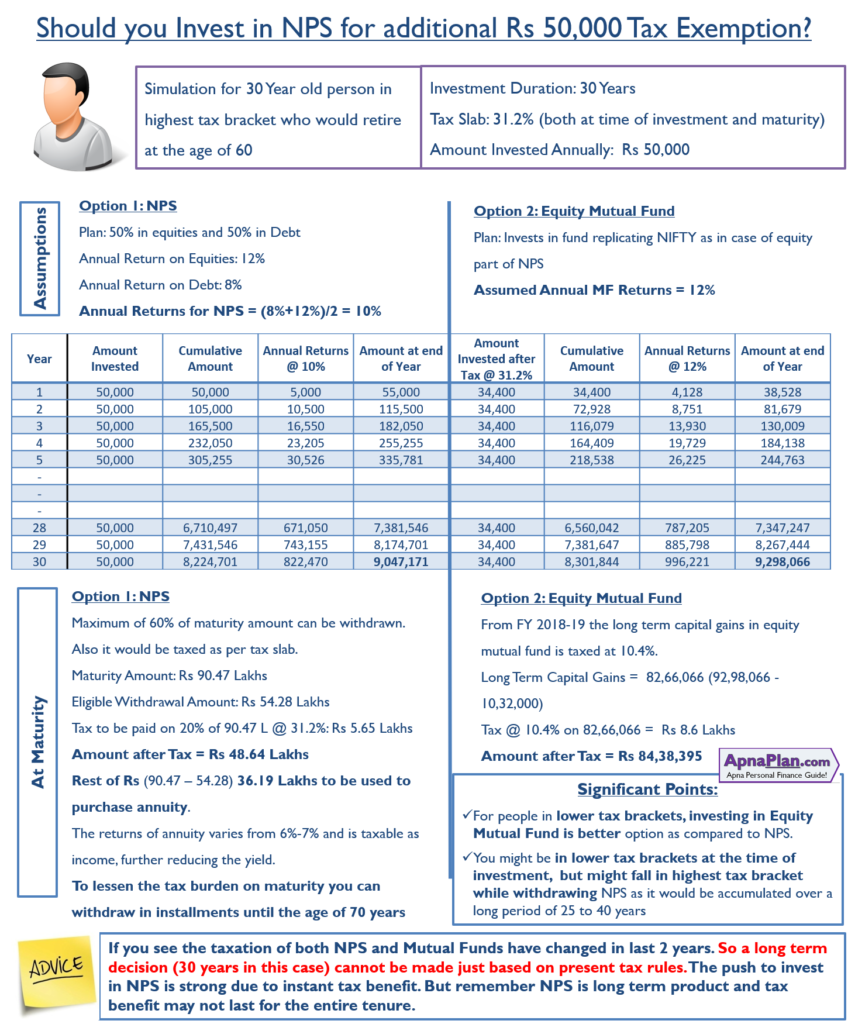

For our calculation we assume that Amit is 30 year old and would retire at the age of 60. So he would make investment for 30 years.

- NPS Investment Option: Most Aggressive i.e. 50% investment in equity and 50% investment in debt

- Amount Invested Annually: Rs 50,000

- Return on Equity: 12%

- Return on Debt: 8%

- Tax Bracket: 31.2% (surcharge revised in Budget 2018)

- Also the tax bracket remains 31.2% at the time of withdrawal at the age of 60.

Alternatively, Amit can pay tax on this Rs 50,000 and invest the remaining amount (i.e. 50,000 * (1-31.2%) = Rs 34,400) in Equity Mutual fund which gives return of 12% annually.

Also Read: NPS Tax Benefit u/s 80CCD(1), 80CCD(2) and 80CCD(1B)

Updated Comparison: After introduction of Long Term Capital Gains Tax on Equity Mutual Funds in Budget 2018

As can be seen in the calculation above, the final amount generated by NPS is 90.47 Lakhs while in case of equity mutual fund its 92.98 Lakhs.

Additionally, in case of NPS you can withdraw maximum of 60% of the total maturity amount which is 54.28 Lakhs. 20% of NPS corpus would be further subjected to 31.2% tax, which means you would be left with net amount of Rs 48.64 lakhs after tax. Rest Rs 36.19 lakhs should be used to purchase annuity.

The proceeds received from this annuity is again considered income and taxed according to marginal tax rate. Also annuities in India have not evolved and the return from varies in the range of 6% – 7%. This makes it a sub optimal investment choice.

In case of investment in equity mutual fund, the long term capital gains in equity mutual fund is taxed at 10.4% (from FY 2018-19). At maturity you have Rs 93.39 Lakhs which after LTCG tax would be Rs 84.38 Lakhs.

If you see the taxation of both NPS and Mutual Funds have changed in last 2 years. So a long term decision (30 years in this case) cannot be made just based on present tax rules.

Significant points:

- For people in lower tax brackets, investing in Equity Mutual Fund becomes much better option as compared to NPS. This is because the tax outgo is lesser and hence more money is invested in MF.

- As the duration of investment goes up the mutual fund option becomes even better due to compounding at higher return rates.

- You might be in lower tax brackets at the time of investment; but might fall in highest tax bracket while withdrawing NPS as it would be accumulated over a long period of 25 to 40 years.

- With the new rules you can split your withdrawal till the age of 70 – lessening you tax outgo.

- You need not purchase annuity if the NPS maturity corpus is less than Rs 2 Lakhs.

Should People nearing Retirement Invest in NPS?

I often get queries by people near retirement that if they can and should open NPS account to get tax benefit u/s 80CCD(1B). Below is my take and you can take your decision accordingly.

- Anyone who is below 65 years of age can open NPS account – so technically you can open your NPS account.

- Assuming you are 62 years or more and the tax exemption stays for next few years. You can invest 50,000 every year for 3 years. With 10% annual returns your NPS maturity amount would be less than Rs 2 lakhs.

- As per rules, you need not purchase annuity if the maturity amount is less than Rs 2 lakhs. So after retirement you can withdraw the amount without much tax burden.

- You can also time the withdrawal to a year (but before reaching 70 yeas of age) when the tax liability is lower or split the withdrawal in 10 installments.

Also Read: NPS – Maturity, Partial Withdrawal & Early Exit Rules

Even for lower age people you can start investing Rs 50K for tax saving until its provided for and keep account active by contributing minimum of Rs 1,000 per year.

Conclusion:

Budget 2016 had brought down the tax liability on NPS maturity to acceptable level while Budget 2018 introduced Long term capital gains on equity mutual funds. You get instant tax saving if you choose NPS. You may look to invest in NPS but keep the following in mind:

- The NPS tax benefit may be done away in future but you are ready to continue the same with minimum annual investment

- Tax on investments keep on changing and tax on both mutual funds & NPS can change in future

- Equity Mutual Funds would outperform NPS in most cases

- NPS would outperform if compared to fixed deposits (in most scenarios)

Very Good Evaluation Report, Sir. Now I understand that the better investment option is in Mutual Funds than in NPS. Thanks for your analysis report

Thanks for your appreciation 🙂

Sir I wish to invest 50000 in NPS and wish to get benefit under sec 80 CCD(1b) kindly tell me the procedure Ajay Nag

I had written about How to Open NPS Account? The whole process takes around 6 weeks from the day you deposit your form, so hurry up if you want to take tax benefit this financial year.

sir,

I am in a govt.job, my employer deducts 62000 p.a total from salary as employee’s contribution (NPS) on which I get tax benefit under 80 ccd(1) and also deposits 62000 p.a. under NPS as employer’s contribution on which I get tax benefit under 80 ccd(2)

I have deposited 1,40,000 under section 80 c

now i want to ask u that may i use 10000 from 62000 in 80 c and 50000 in ccd1 b from rest ammount 52000.

You can use your contribution to NPS to claim tax benefit u/s 80CCD(1B) up to Rs 50,000 and the rest u/s 80CCD(1). 80CCD(1) along with 80C has maximum exemption limit of Rs 1.5 Lakhs.

Mr. Amit please differentiate sec. 80CCD(1B) & sec. 80CCD(1) …with an appropriate example.

I m a central govt employee…..to calculate the total income. the contribution from employer will be added or not….if added then under which sec. this contributed amount will be eligible for deduction and what is ceiling amount.

2. simultaneously the amount deducted from salary towards NPS tier – 1, i.e. employee contribution will be eligible for tax exemption or not?..if eligible then under which section and is there any ceiling.?

i have already deposited 1.5 lakh in SBI PPF account.

please tell me how much i can avail for tax exemption.

You can include employer contribution in NPS in your total income but it is anyway exempted from tax u/s 80CCD(2). This would be shown in the Form 16 issued by your employer.

Employee contribution is eligible for tax deduction u/s 80CCD(1) and 80CCD(1B). You can choose which section to take benefit.

For more details read my post on NPS Tax Benefits (scroll to the last paragraph of the post)

Employee contribution to NPS up to 10% of basic salary and dearness allowance (DA) up to 1.5 lakh is eligible for tax deduction u/s 80CCD(1). The overall limit for tax exemption for 80CCD(1) and 80C combined is capped at Rs 1.5 lakh.

Section 80CCD(1B) is the new section introduced in the last budget. In this case you can get tax deduction up to rs 50K by investing in NPS.

Now in cases, where you have forced deduction directly from salary – you can take advantage of any of the above two sections for claiming tax benefit. The ideal way would be to first claim tax benefit u/s 80CCD(1B) and rest u/s 80CCD(1). For remaining part you can do your tax saving investment u/s 80C.

Sir I am a government employees as appointed after 1.1.2004

Q.1 I have not deposit in my nps account as per govt rules Rs 50000

Q.2. Rs 50000 I have deposit any other tax saving scheme

I am sorry could not understand your question. Please rephrase!

Sir,

I am a central govt employee contributing Rs. 55,000/- in the NPS as mandatory employee contribution, Can I claim this amount u/s 80CCD 1B instead of 80CCD(1) and invest in other instruments for completing my limit of Rs. 1,50,000/- u/s 80C. Alternatively is 80CCD 1B valid for mandatory contribution as well?

yes you can show your compulsory investment in NPS u/s 80CCD(1B) and invest Rs 1.5 Lakh in 80C as per your choice.

Sir, I am a govt employee of haryana govt. and I have deposited rupees 119700 in PLI and 37706 in LIC after that I have deposited rupees 44142 in NPS.

sir, tell me on how much rupees i get tax deduction(rebate) ?

All 3 investments – PLI (Postal Life Insurance), LIC and NPS qualify for tax deduction. You’ll get Rs 44,142 tax exemption u/s 80CCD(1B) and Rs 1.5 lakh deduction for investment in PLI & LIC. So in total you would get Rs 1.94 lakh deduction.

Dear sir

My I am government employed and

Investment amount is

PPF 120000 LIC 25000 AND TIER-1 55000 CAN I benefit of section 80ccd(1b) of limit 50000

Yes you can take tax benefit of Rs 50,000 investment in NPS u/s 80CCD(1B)

Sir,

I am a State Government Employee of Andhra Pradesh. A deduction of 10% of Salary (Pay+DA) is being carried out under Contributory Pension Scheme. The total deduction towards CPS is 62,000/-.

Earlier I used to show this deduction under 80CCD(1). Additionally, I have LIC premium of 1,50,000/-. My doubt is can i show 1,50,000/- under 80C and get claim tax benefit under CCD1(B) on the additional 50,000 towards Contributory Pension Scheme amount (of Rs. 62,000/- limited to Rs. 50,000/-)

YEs you can now show NPS up to 50K u/s 80CCD(1B) and rest u/s 80CCD(1)

Sir,

Ihave invested Rs. 1,50,000/- in the PPF. My contribution in NPS 10% is Rs.60,000/-.Can I claim deduction of Rs.50,000/- from this amount of Rs.60,000/-, u/s 80 ccd(1b)?. Please reply soon………. Thanks

Yes you can

I M government employee & my nps deduction rs 49648 can I avail tax benefit for this amount under sec 80ccd1b over rs 150000

Yes you can get tax benefit u/s 80CCD(1B)

my investment in lic pli is 150000 deduction of nps 10% of basic is 42350 extra can i take benifit of saving 192350 define please

Yes you can take advantage of both your LIC policy and NPS deduction. Only consider your part and not the employers contribution for NPS.

Hi, Tanks for the explanation.

Two queries:

# With only 6yrs to retirement, will your advice remain same?

# There is an option to withdraw 60% amount in staggered manner over few years after retirement; the amount withdrawn can be kept below taxable limit. As such, one does not need the complete amount immediately after retirement. And with NPS a/c opned as recent as 2014, the corpus will not be very high.

Kindly revert.

Thanks.

Milind

My advise is only mathematical :). The question is what would you do with Rs 50K if you do not invest in NPS? In case you would invest in equity mutual fund, that might offer better returns. In case you would invest in FD, then NPS might be better bet.

Assuming you invest 50K every year for 6 years for tax saving and get 10% returns, the NPS maturity amount would be around 4 Lakhs. You would be able to withdraw around 2.4 lakhs as lumpsum and have to purchase annuity for Rs 1.6 Lakhs. This annuity might pay you around Rs 1,000 monthly.

Thanks.

Can you comment on 2nd point? Is ‘staggered withdrawal of 60% amount for tax planning’ a technically correct possibility? (I also have an amount going into NPS under 80CCD(1)).

Regards.

Yes you can Withdraw the lumpsum amount at NPS maturity in 10 annual installments till the age of 70 years.

Mr. Amit,

I am under 30% tax slab and now 51 years old. Retirement age is 60. Should we go for investing 50K in 80CCD(1B) to get exta tax benifit or we should invest in MF

As per my calculation investing in Mutual fund seems better. Rest it’s personal decision 🙂

My investments are ₹100000 in ppf, 50000 in sukanya smridhi and 28000 in LIC. I also invest 10000 in NPS tier1 and its statement showing investment in 80cce. How I will get benefit of 80ccd 1b. Please clear.

The choice of which section to take advantage for NPS lies with you (80CCE or 80CCD(1B)). So do not worry about the statement as the system might not be updated!

Dear Amit Ji .

Thanks for the valuable suggestions.

Pls. clarrify :

My annual contribution towards NPS Tier -1 is (say) 72000/-

My other investments (say ) 78000/-

If i want to save tax further , i plan to invest further in NPS-80CCD(1B).

1). What is the procedure for that investment?

2). if i invest 20000 in NPS , that will be included in 72000+20000.

or i have to declare that this contribution is towards 80CCD(1B)?

Thanks

Sir,

My query is also the same..

The choice of which section tax payer wants to show his investment in NPS (Tier 1) for income tax exemption is his call. So you can choose weather to claim tax exemption u/s 80C or 80CCD(1B) for NPS. Ideally you should first claim tax benefit u/s 80CCD(1B) for 50K investment in NPS. Whatever is left goes to 80C.

So in your situation you should claim 50 out of 72K NPS investment u/s 80CCD(1B) and 22K u/s 80C. The rest (150K-22K) 128K investment u/s 80C can be made as per choice in PPF, ELSS or NPS – whatever you choose.

Amit ji kya nps t1 ke under govt contribution of 10% gross salary mein include hogi

Only employee contribution is considered for tax benefit. so govt contribution in NPS would not be taken in consideration for tax exemption.