Budget 2015 had introduced a new section 80CCD (1B) which gives deduction up to Rs 50,000 for investment in NPS (National Pension Scheme) Tier 1 account This new deduction can help you save tax up to Rs 15,600 in case you are in the 30% tax slab.

The question is should you take advantage of this new tax deduction and invest in NPS?

NPS has not taken off as expected and finance minister by giving this additional tax saving option is trying to give it a push. We all know how many people invest blindly in poor schemes just to save tax. This post is to analyze if it makes sense for us to invest in NPS to save additional tax.

Assumptions:

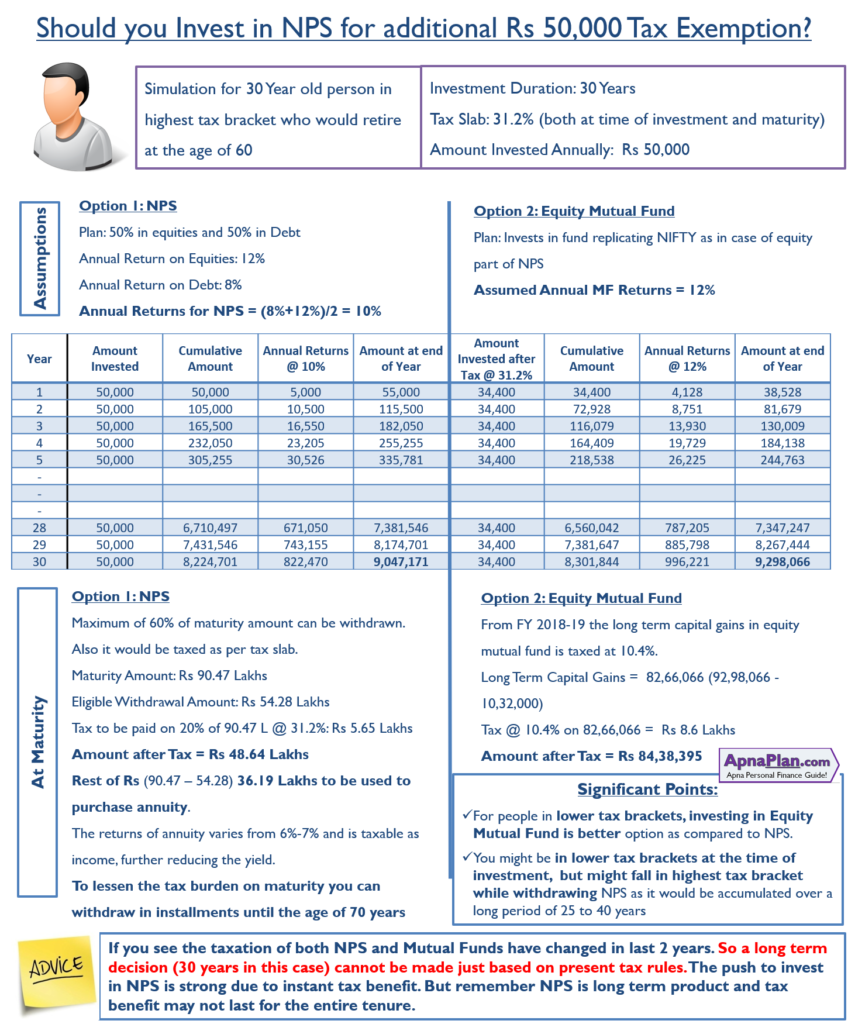

For our calculation we assume that Amit is 30 year old and would retire at the age of 60. So he would make investment for 30 years.

- NPS Investment Option: Most Aggressive i.e. 50% investment in equity and 50% investment in debt

- Amount Invested Annually: Rs 50,000

- Return on Equity: 12%

- Return on Debt: 8%

- Tax Bracket: 31.2% (surcharge revised in Budget 2018)

- Also the tax bracket remains 31.2% at the time of withdrawal at the age of 60.

Alternatively, Amit can pay tax on this Rs 50,000 and invest the remaining amount (i.e. 50,000 * (1-31.2%) = Rs 34,400) in Equity Mutual fund which gives return of 12% annually.

Also Read: NPS Tax Benefit u/s 80CCD(1), 80CCD(2) and 80CCD(1B)

Updated Comparison: After introduction of Long Term Capital Gains Tax on Equity Mutual Funds in Budget 2018

As can be seen in the calculation above, the final amount generated by NPS is 90.47 Lakhs while in case of equity mutual fund its 92.98 Lakhs.

Additionally, in case of NPS you can withdraw maximum of 60% of the total maturity amount which is 54.28 Lakhs. 20% of NPS corpus would be further subjected to 31.2% tax, which means you would be left with net amount of Rs 48.64 lakhs after tax. Rest Rs 36.19 lakhs should be used to purchase annuity.

The proceeds received from this annuity is again considered income and taxed according to marginal tax rate. Also annuities in India have not evolved and the return from varies in the range of 6% – 7%. This makes it a sub optimal investment choice.

In case of investment in equity mutual fund, the long term capital gains in equity mutual fund is taxed at 10.4% (from FY 2018-19). At maturity you have Rs 93.39 Lakhs which after LTCG tax would be Rs 84.38 Lakhs.

If you see the taxation of both NPS and Mutual Funds have changed in last 2 years. So a long term decision (30 years in this case) cannot be made just based on present tax rules.

Significant points:

- For people in lower tax brackets, investing in Equity Mutual Fund becomes much better option as compared to NPS. This is because the tax outgo is lesser and hence more money is invested in MF.

- As the duration of investment goes up the mutual fund option becomes even better due to compounding at higher return rates.

- You might be in lower tax brackets at the time of investment; but might fall in highest tax bracket while withdrawing NPS as it would be accumulated over a long period of 25 to 40 years.

- With the new rules you can split your withdrawal till the age of 70 – lessening you tax outgo.

- You need not purchase annuity if the NPS maturity corpus is less than Rs 2 Lakhs.

Should People nearing Retirement Invest in NPS?

I often get queries by people near retirement that if they can and should open NPS account to get tax benefit u/s 80CCD(1B). Below is my take and you can take your decision accordingly.

- Anyone who is below 65 years of age can open NPS account – so technically you can open your NPS account.

- Assuming you are 62 years or more and the tax exemption stays for next few years. You can invest 50,000 every year for 3 years. With 10% annual returns your NPS maturity amount would be less than Rs 2 lakhs.

- As per rules, you need not purchase annuity if the maturity amount is less than Rs 2 lakhs. So after retirement you can withdraw the amount without much tax burden.

- You can also time the withdrawal to a year (but before reaching 70 yeas of age) when the tax liability is lower or split the withdrawal in 10 installments.

Also Read: NPS – Maturity, Partial Withdrawal & Early Exit Rules

Even for lower age people you can start investing Rs 50K for tax saving until its provided for and keep account active by contributing minimum of Rs 1,000 per year.

Conclusion:

Budget 2016 had brought down the tax liability on NPS maturity to acceptable level while Budget 2018 introduced Long term capital gains on equity mutual funds. You get instant tax saving if you choose NPS. You may look to invest in NPS but keep the following in mind:

- The NPS tax benefit may be done away in future but you are ready to continue the same with minimum annual investment

- Tax on investments keep on changing and tax on both mutual funds & NPS can change in future

- Equity Mutual Funds would outperform NPS in most cases

- NPS would outperform if compared to fixed deposits (in most scenarios)

sir i m govt employee, with gross income of about 6.25 lakhs , nps own contribution of about 55000 and nps employer’s contribution of about 55000. am i eligible for extra 50000 tax benefit(under section 80ccd(1b)) above 1.5 lakh tax deduction limit

Yes if you want you can invest additional 50,000 in NPS Tier 1 to get tax benefit u/s 80CCD(1B)

sir if a govt. employee is having annual gross income of about 6.25 lakhs. is he eligible for deduction under section 80ccd(1B)

Yes there is no criteria of income for investment in NPS for getting tax benefit u/s 80CCD(1B)

Sir

Actually i have gone through the G connect site and have uploaded the details as share with you.

The Tax calculator has given the Only benefit of PPF under 80 C. The Employee contribution has not been allowed as 80 CCD (1B).

So kindly get confirmed sir, whether the Contribution for NPS deducted from Salary is eligible for 80 CCD (1B) as additional Tax Benefit or new investment is to made

I too have come across confusion if NPS tax advantage u/s 80CCD(1B) can be from employee contribution or it is to be necessarily contributed separately. But most publications and experts are of the view that even employee contribution in NPS qualifies for tax deduction u/s 80CCD(1B).

The problem is there are lot of areas where income tax rules are ambiguous and experts have different view. Unfortunately we have to wait for clarification from the tax department, if it comes ever!

Dear Sir, if I am a small salary earning employee and I have already invested in NPS up to 10% of salary. Now I want to invest additional 50,000/- Is this additionally allowed ? apart from 10% of salary ? Regards SSRao

Yes there is no limit on how much you can invest in NPS. However the tax exemption is limited to Rs 2 lakhs (own contribution) for investment in NPS Tier 1.

More over I would like to mention that I have invested Rs. 1,50,000/- in PPF.

72000/- has been deducted as NPS Employee Contribution.

So how much amount i have to invest to take the maximum tax benefit.

You have already invested more than required. You will get Rs 1.5 Lakh tax exemption for investment in PPF u/s 80C and Rs 50,000 tax exemption for investment in NPS u/s 80CCD(1B).

Sir

I am Govt employee having NPS account. I would like to know the following clarification

1.What is the ceiling limit of Employers Contribution in Income Tax ?

2. I would like to take the benefit of 80 CCD (1B) of Rs. 50000/- and already having NPS account . So whether it is compulsory to open new account of i can invest the 50000 in my exsiting account?

Here are your answers:

1. Employer’s contribution up to 10% of basic plus DA in NPS is eligible for deduction u/s 80CCD(2).

2. You can contribute in the existing account. In fact no subscriber should have more than one NPS account.

Read more details about NPS tax benefit here.

Where else we can invest to save 50000 under 80ccd 1b

Tax benefit u/s 80CCD(1B) is available for investment in NPS Tier-1 account only.

A bank employee aged 59 yrs already in pension scheme of bank. whether he can enjoy pension separately under NPS upon contribution u/s 80CCD(1B)?

Yes person aged 59 years and covered by bank pension scheme can open NPS account and make deposit for getting tax benefit u/s 80CCD(1B). But you’ll be able to make only deposit until you reach the age of 60. If the maturity amount in NPS is less than Rs 2 lakhs you can withdraw the entire amount and there is no need to purchase annuity.

But remember when you withdraw, entire maturity amount would be added to your income and taxed accordingly. You can read more about the NPS withdrawal rules and the expenses of NPS. Do your calculation and take your call.

Personally I do not see much benefit in going for NPS at this age.

sir

i am a state govt employee in Punjab . i hv deposited rs 150000in ppf.

department has deducted rs 45566 as compulsory nps deduction. can i avail rebate on that nps contribution?? can i fill 196566 as my total savings

yes you can do so provided the NPS contribution of Rs 45566 is from your side and not employer side.

sir i am a govt employee can i share my nps amount 66000 rupees in both 80ccd and 80ccd(b1)

Yes you can allocate only your contribution to NPS between 80CCD(1B) and 80CCD(1)

Bhawan

Sir my CPSN is 61000 and my another saving is 150000 can i get 80CCD(1b)??

Yes – you can read the details about tax benefit on NPS.

Sir

I am coming under state govt. pension cover left 10 years for retirement. Can i elligible to open a NPS account Tier 1 to get additional Rs.50000/- tax rebate.

Asit Kumar Acharya

Yes if you are below 60 years of age you can open NPS account for saving tax.

Sir,

Actually this is not a question related to this topic. Excuse me. From your experience and knowledge in the related field, can you suggest a mutual fund for me (planning to invest on SIP mode for the next Financial Year) which is providing better returns on long term perspective.

You can choose from any of the funds listed in Mint50 list as per your choice. In case you have doubts, would strongly recommend to visit financial planner.

hello mr. amit i think there is misunderstanding regarding sec. 80 ccd(1B)

as per income tax law. the employee deduction towards NPS fund will fall u/s 80ccd1 and it will be 10% of salary (basic + DA for central govt. employee). this 10% amount will constitute with other component of 80C i.e it will remain included in 1.5 lakh.

if you want advantage of sec 80 ccd (1b) you have to enhance your contribution in NPS tier 1 account which facility is started from FY 2015-16. as per definition of this section this eligible amount is otherthan employee contribution of 10% of salary.

U/c 80ccd(ib) investment as eligible Over ad above Rs.150000 Savings 80C Salary employee

Yes so in total 80CCD(1B) and 80C can give you tax exemption up to Rs 2 lakhs

You had mentioned that ‘long term capital gain from investment in equity mutual funds is tax free’. Kindly inform what is the minimum time period required for getting tax free capital gain from investing in long term equity mutual funds?

For equity mutual funds – your holding time period should be more than 1 year to qualify for long term capital gains – which is tax free.

Sorry.. As per my knowledge, the minimum time period to avail the tax benefits from an equity mutual fund is minimum 3 years from the date of investment i.e ELSS funds. Please refer ELSS funds for more info. However it is not 1 year for sure.

@Amit Praveen is asking about tax on equity mutual fund and not about tax saving mutual fund. You are right the minimum holding period for ELSS is 3 years. But for other equity mutual funds the gains are tax free if held for more than 1 year.