March 15, 2019 is the last date to pay last installment of your advance tax. Starting FY 2016-17 advance tax is payable in four installments as follows:

- 15% of total tax by June 15

- 45% of total tax by September 15

- 75% of total tax by December 15 and

- 100% of total tax by March 15 of the respective financial year.

This is based on “Pay Income Tax as you earn” concept and keeps government running!

Who needs to pay Advance Tax?

Advance tax needs to be paid by everyone whose tax liability exceeds Rs 10,000 for the financial year. However Senior citizens with age of more than 60 years who do not have income from business/profession, need not submit advance tax.

Professionals such as doctors, lawyers, architects with annual revenue of Rs 50 lakh or less and who plan to take advantage of newly introduced Presumptive scheme in Budget 2016 can pay advance tax at one go on or before March 15.

Also Read: Everything you wanted to know about Advance Tax Compliance

Steps to Pay Advance Tax Online:

The good news is it’s very easy to pay your advance tax online and can be done using following 5 steps:

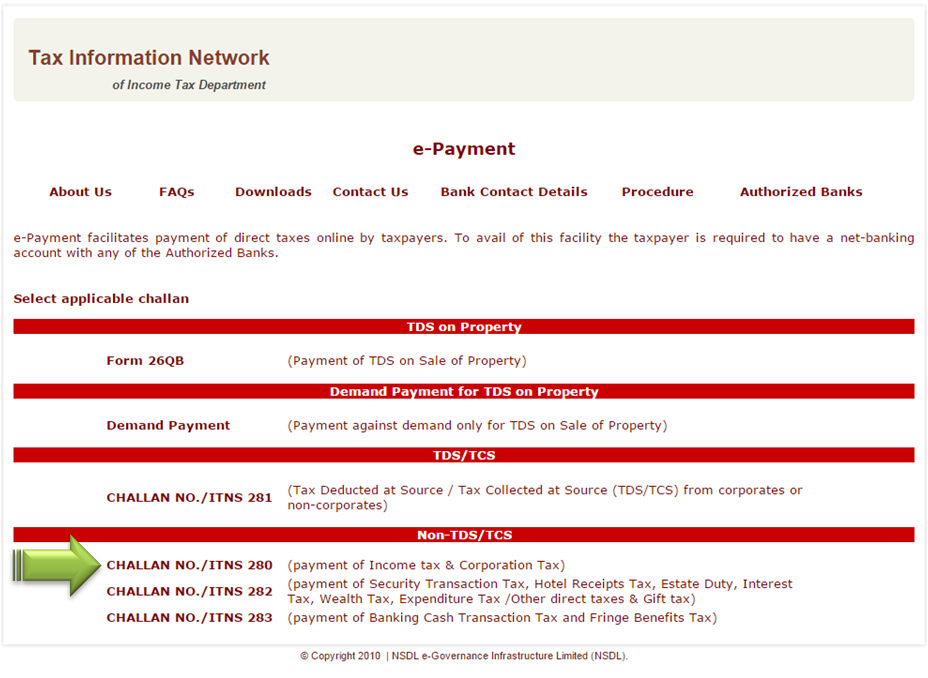

Step 1 – Go to NSDL-TIN website

Step 2.- Select CHALLAN NO. /ITNS 280 (payment of Income tax & Corporation Tax)

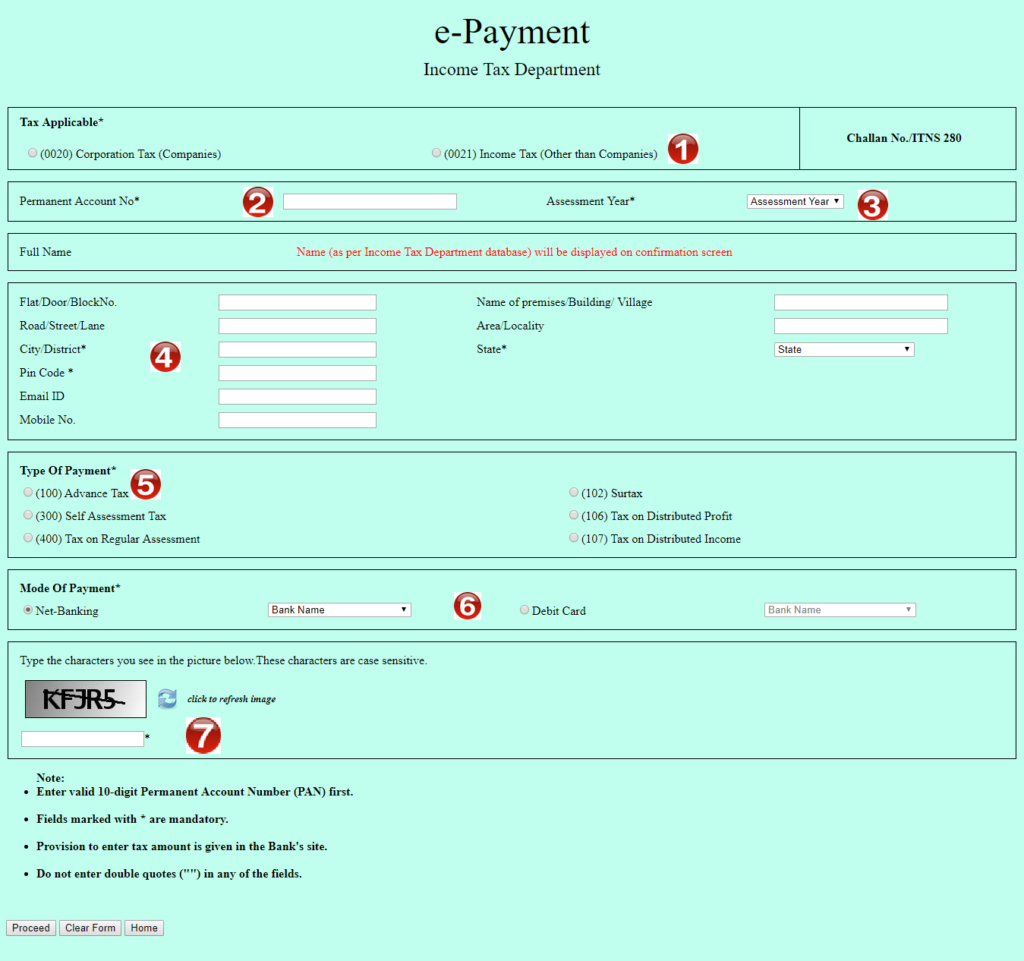

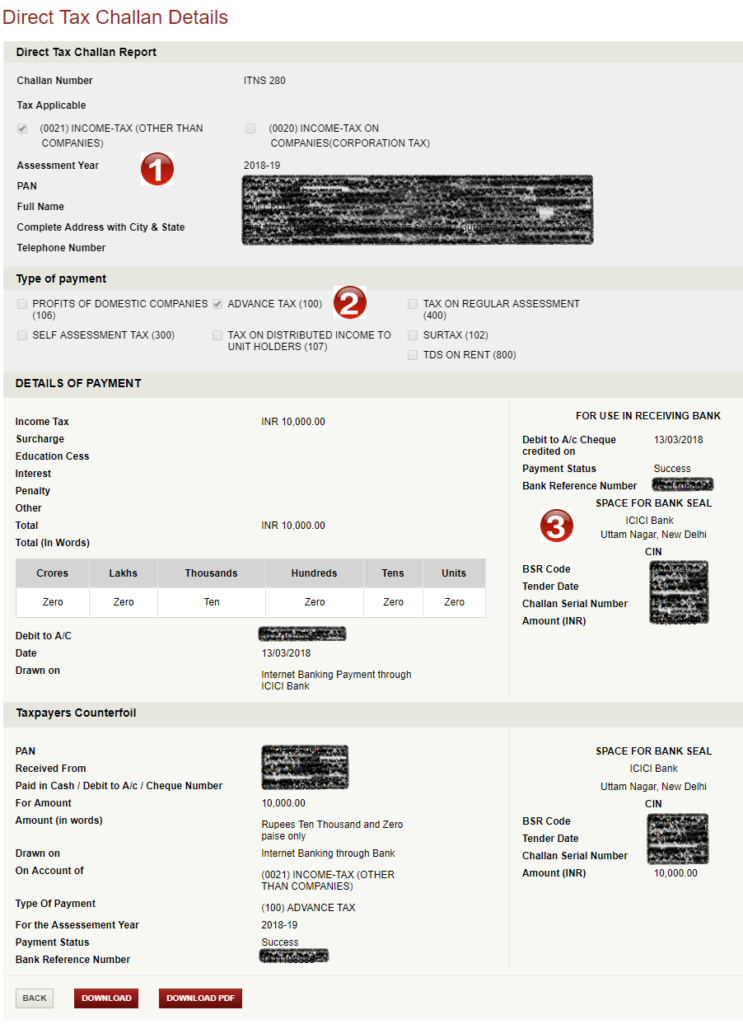

Step 3 – Fill the Challan 280 as below

1 Select (0021) INCOME-TAX (OTHER THAN COMPANIES) for individual tax payers

2 Enter your PAN Card Number

3 Select Assessment Year (2019-20) for this year tax return

4 Fill up your Address, email & phone number

5 Select (100) ADVANCE TAX

6 Select from List of Banks or Debit card as the case may be (I have selected ICICI net banking)

7 Fill the Captcha code and click Proceed

Download: Income Tax Calculator for FY 2018-19 [AY 2019-20] in Excel

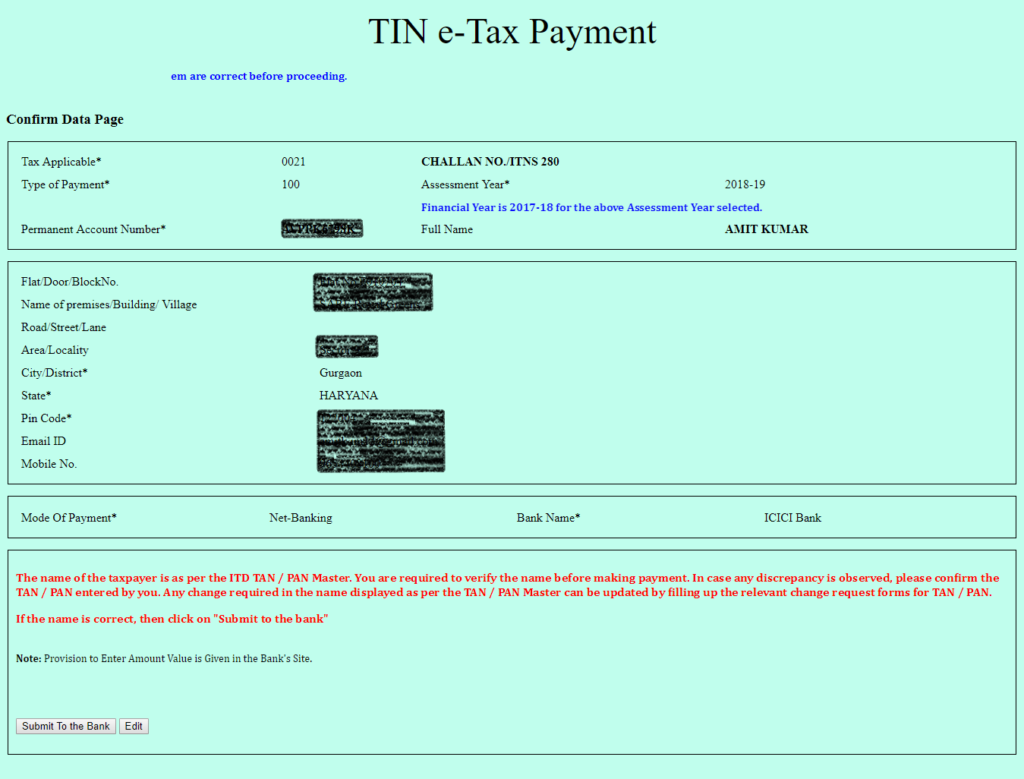

Step 4 – On the next screen Check the details you filled. In case everything is OK select “Submit to Bank” else select Edit. On Selecting Edit will take you to previous screen. On “Submit to Bank” will take to the bank’s net banking login screen.

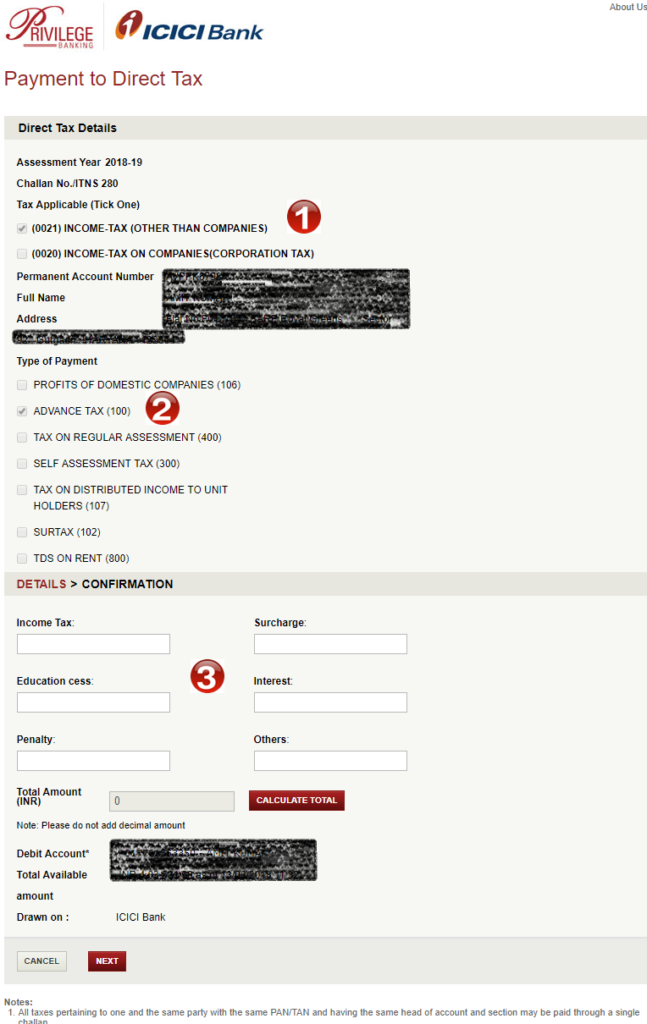

Step 5 – Login to your net banking. In the example we have shown ICICI Bank screen, it would be similar in all banks.

1/2 – Check the details already pre-filled as in the form

3 – Fill the details of the tax to be paid

- Income Tax – the amount of tax due (excluding education cess)

- Surcharge – applicable for income more than Rs 50 lakhs. For all others keep it as 0

- Education cess – the education cess on the above amount

- Interest – Any interest payable for late tax payment. You can keep it as 0 and add the amount in the “Income Tax” above

- Others – fill it as 0

Note: Even if you are not sure of the above breakup it does not matter as this can be taken care while filing your tax return. The important thing is to pay the advance tax due.

Also Read: How to Reprint or Regenerate Challan 280 Receipt?

On successful transaction, a challan counterfoil is generated as shown below. This contains CIN, payment details and bank name which would be required while filing income tax return. You should save it as it is the proof of payment being made.

The above challan payment can be verified in “Challan Status Inquiry” at NSDL-TIN website using CIN within a week of making payment.

Paying Advance Tax Offline:

For paying offline, you need to download challan 280, fill it and submit it to the authorized bank branch with accompanying cheque.

In the above, the Assessment Year(Item # 3 in Chalan 280) has to be 2019-20 and not 2018-19. Right ?

You are right and thanks for pointing this out. Have corrected this.