Budget 2015 had introduced a new section 80CCD (1B) which gives deduction up to Rs 50,000 for investment in NPS (National Pension Scheme) Tier 1 account This new deduction can help you save tax up to Rs 15,600 in case you are in the 30% tax slab.

The question is should you take advantage of this new tax deduction and invest in NPS?

NPS has not taken off as expected and finance minister by giving this additional tax saving option is trying to give it a push. We all know how many people invest blindly in poor schemes just to save tax. This post is to analyze if it makes sense for us to invest in NPS to save additional tax.

Assumptions:

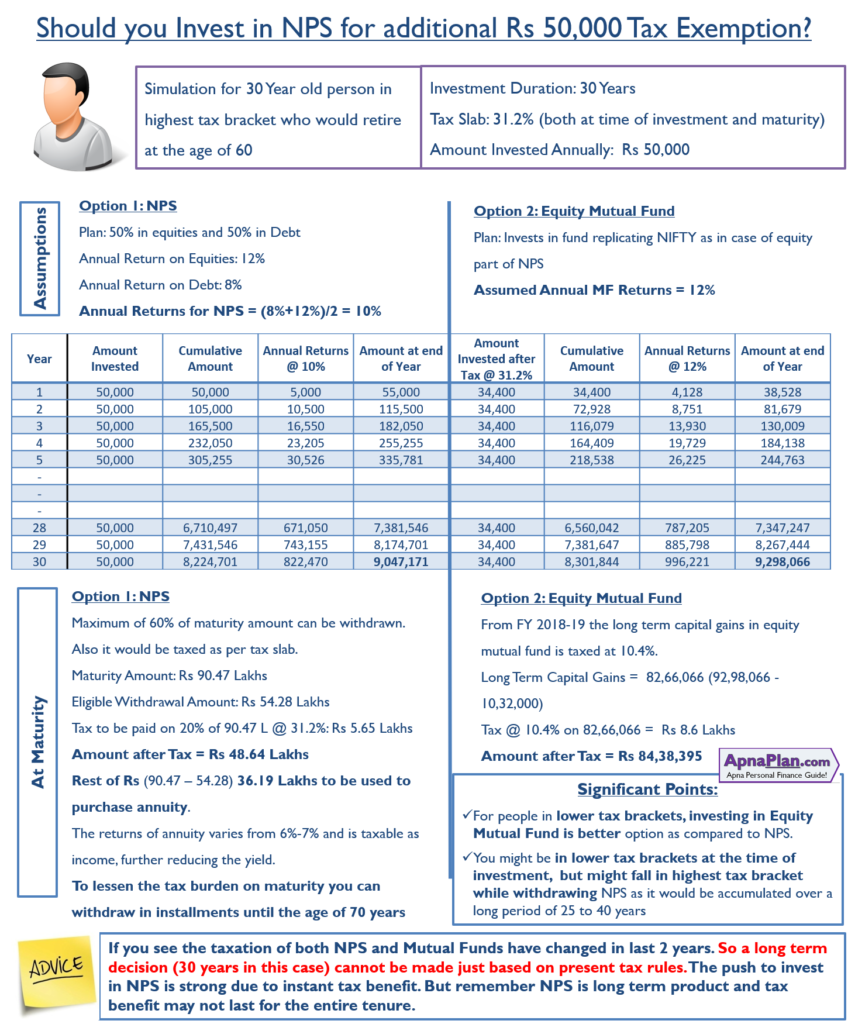

For our calculation we assume that Amit is 30 year old and would retire at the age of 60. So he would make investment for 30 years.

- NPS Investment Option: Most Aggressive i.e. 50% investment in equity and 50% investment in debt

- Amount Invested Annually: Rs 50,000

- Return on Equity: 12%

- Return on Debt: 8%

- Tax Bracket: 31.2% (surcharge revised in Budget 2018)

- Also the tax bracket remains 31.2% at the time of withdrawal at the age of 60.

Alternatively, Amit can pay tax on this Rs 50,000 and invest the remaining amount (i.e. 50,000 * (1-31.2%) = Rs 34,400) in Equity Mutual fund which gives return of 12% annually.

Also Read: NPS Tax Benefit u/s 80CCD(1), 80CCD(2) and 80CCD(1B)

Updated Comparison: After introduction of Long Term Capital Gains Tax on Equity Mutual Funds in Budget 2018

As can be seen in the calculation above, the final amount generated by NPS is 90.47 Lakhs while in case of equity mutual fund its 92.98 Lakhs.

Additionally, in case of NPS you can withdraw maximum of 60% of the total maturity amount which is 54.28 Lakhs. 20% of NPS corpus would be further subjected to 31.2% tax, which means you would be left with net amount of Rs 48.64 lakhs after tax. Rest Rs 36.19 lakhs should be used to purchase annuity.

The proceeds received from this annuity is again considered income and taxed according to marginal tax rate. Also annuities in India have not evolved and the return from varies in the range of 6% – 7%. This makes it a sub optimal investment choice.

In case of investment in equity mutual fund, the long term capital gains in equity mutual fund is taxed at 10.4% (from FY 2018-19). At maturity you have Rs 93.39 Lakhs which after LTCG tax would be Rs 84.38 Lakhs.

If you see the taxation of both NPS and Mutual Funds have changed in last 2 years. So a long term decision (30 years in this case) cannot be made just based on present tax rules.

Significant points:

- For people in lower tax brackets, investing in Equity Mutual Fund becomes much better option as compared to NPS. This is because the tax outgo is lesser and hence more money is invested in MF.

- As the duration of investment goes up the mutual fund option becomes even better due to compounding at higher return rates.

- You might be in lower tax brackets at the time of investment; but might fall in highest tax bracket while withdrawing NPS as it would be accumulated over a long period of 25 to 40 years.

- With the new rules you can split your withdrawal till the age of 70 – lessening you tax outgo.

- You need not purchase annuity if the NPS maturity corpus is less than Rs 2 Lakhs.

Should People nearing Retirement Invest in NPS?

I often get queries by people near retirement that if they can and should open NPS account to get tax benefit u/s 80CCD(1B). Below is my take and you can take your decision accordingly.

- Anyone who is below 65 years of age can open NPS account – so technically you can open your NPS account.

- Assuming you are 62 years or more and the tax exemption stays for next few years. You can invest 50,000 every year for 3 years. With 10% annual returns your NPS maturity amount would be less than Rs 2 lakhs.

- As per rules, you need not purchase annuity if the maturity amount is less than Rs 2 lakhs. So after retirement you can withdraw the amount without much tax burden.

- You can also time the withdrawal to a year (but before reaching 70 yeas of age) when the tax liability is lower or split the withdrawal in 10 installments.

Also Read: NPS – Maturity, Partial Withdrawal & Early Exit Rules

Even for lower age people you can start investing Rs 50K for tax saving until its provided for and keep account active by contributing minimum of Rs 1,000 per year.

Conclusion:

Budget 2016 had brought down the tax liability on NPS maturity to acceptable level while Budget 2018 introduced Long term capital gains on equity mutual funds. You get instant tax saving if you choose NPS. You may look to invest in NPS but keep the following in mind:

- The NPS tax benefit may be done away in future but you are ready to continue the same with minimum annual investment

- Tax on investments keep on changing and tax on both mutual funds & NPS can change in future

- Equity Mutual Funds would outperform NPS in most cases

- NPS would outperform if compared to fixed deposits (in most scenarios)

Dear Amit

Thanks for ur valuable information.i m govt employ and my compulsory contribution towards nps tier 1 account is more than 50000. Whether i can invest 1.5 lakh in other instruments to avail benefit of 80c or it is necessary to invest additional 50000 in nps to get benefit of 80ccd (1b).

You can invest the way you want. You can claim 80CCD(1B) exemption against the compulsory contribution towards NPS. In case it’s more than 50K, you can also take exemption u/s 80C. For remaining part you can invest according to your will for total exemption of Rs 1.5 Lakh u/s 80C.

Hello Amit,

Well explained and very good information. I was going to invest in this scheme. But after going through your post, will deliberate more over it. Also as the calculations and explanations shown by you, I am almost sure not to invest in this scheme and rather make additional investment of Rs. 50000 in mutual funds.

Thanks for your appreciation 🙂 and glad to know it helped you in your investment decision.

Should I have to show the sorces througwhich I cleared the home loan e. If yes then only agreement of leased document wil be sufficient. And can I deduct hra from the time of closing the home loan

I am sorry could you please rephrase your question – I could not understand.

For NPS the investment definition is:

Employee’s own contribution to NPS upto 10% of fixed salary (Basic+DA)is eligible for deduction within overall limit of 1,50,000 of 80C. Employee can also claim additional Rs 50000 in 80CCD1 in addition to above 80C limit of Rs 1,50,000.

I have already exhausted my 80 C limit of 1.5L. I have not yet invested in NPS. If i invest only Rs. 50K and nothing before that in NPS, can i straightaway clim it under 80CCD1 ?

Yes you can invest 50K in NPS and claim tax exemption u/s 80CCD(1B)

hi amit,

for this FY my gross salary is 675400,

i closed a home loan of 12 lacs by leasing my new constructed house for 9 lacs in nov 2015 and presently staying in a rented house . my nps contribution is 61158.

since the ppl amount of home loan comes in sec 80 c , can i use my nps contribution of 50000 in 80 ccd (1B) and 11158 in 80c

Yes you can take tax advantage of investment in NPS (Tier 1) account in whatever section you want. So yes you can take tax benefit of Rs 50K u/s 80CCD(1B) and rest under sec 80C.

under section 80c 1)LIC =5430 2)KGID 30000 3)GIS 2160 4)PLI 5)principal of home loan 1200000 6) NPS 61158 put togeter amounts to be nearing 1300000 (thirteen Lacs) in this exemption of 1.5 lacs can be availed .

under this .section

my question is,,can i place 50000 of NPS under 80CCD(1b) and only 11158 in 80c..pls clarify

Yes you can place 50000 of NPS under 80CCD(1b) and only 11158 in 80c

I HAVE OPENED AN NPS ACCOUNT ON MY OWN AND INVESTED RS. 150000/- UNDER NPS TIER-II. CAN I CLAIM DEDUCTION UNDER SEC. 80C?

No the tax exemption is only available for investment in NPS Tier – 1 account. Recommend you to shift your investment from NPS Tier – 2 to Tier 1 to get tax benefit.

Good morning

In total I have saved Rs 245498-00

Including Rs 44646-00 in NPS

Can I take benefit of tax deduction on this amount under section 80CCD(1B) on this amount of NPS

Yes you can consider your investment of Rs 44K in NPS – Tier 1 account for tax benefit u/s 80CCD(1B)

Is money deducted from salary every month and govt.contribution in same amount in NPS will be taxable on retirement.

Yes the lumpsum withdrawal part out of total maturity NPS (Tier 1) amount would be added to the income for the year and taxed at marginal tax slab.

One query. Can a person, who will complete 60 years of age before 31/03/2016 open a Tier I NPS account this year & avail additional tax benefit ?

If yes, how will this investment be returned to investor after completion of 60 years ?

Yes any person before completing age 60 can open NPS account and get additional tax benefit. You can read NPS withdrawal rules details here. As the total maturity amount would be less than Rs 2 Lakh you will get lumpsum as maturity amount.

Hi,

I can see that the 15k which is saved by a person in 30% bracket due to the investment in NPS is not factored in the calculation. If the amount of tax saved due to investment is invested into some equity plan, wont the benefit be greater than what you get by investing the after tax amount in MF?

Amount invested in NPS is Rs 50K while in Mutual Fund is Rs 35K (i.e after deduction of 15K tax).

Hi Amit,

Query is how the calculation will be impacted if the 15k saved on tax is also invested. So, 50k is invested in NPS which helps a person to save 15k tax and he decides to invest that 15k into a equity plan as you suggest. I believe that will be a double benefit and so should be factored in the calculation.

🙂 So you essentially mean invest Rs 50K in NPS and Rs 15K in equity Mutual Fund. You can do calculation this way but in that case while comparing with Equity mutual fund the investment has to go up from Rs 35,000 to Rs 50,000! Essentially you would be adding Rs 15K on both side of the calculation and end up with same results!

Hi Amit,

Reason for adding 15k is coz of tax savings due to contribution to NPS. When tax is already paid now in the second case, I will not have the surplus 15k to invest in MF. So 15k can only be added to the NPS side of calculation and not to the other.

Thank you.

Regards,

Radhesh

Sorry I disagree 🙂

great explanation with example. Many thanks

hi.. I m a govt. employee .. i m currently making annual contribution of 108000 in nps as mandatory contribution @10% from my pay and i am also paying 75000 annually to LIC .. My question is can I break this amount of 108000 into 75000 under 80ccd and 38000 under ccd(1B) to avail the additional tax benefit ??

I suggest you to break your NPS investment as Rs 50,000 for CCD(1B) and rest Rs 58,000 for 80CCD. Then you can invest remaining Rs 17,000 in tax saving instrument u/s 80C.

Dear Sir,

I am 55 years old PSU employee and in the tax bracket of 30%. I want to invest 50,000/- ( FY 2015-16) in the following manner:

Tier-I: 6000/- & Tier-II: 44000/ – (Total=50000)

Now I would like to know whether I can do that and will I get tax benefit of 15450/- (50000*30.9%).

In the above scenario what type of result will I get in Tier-II investment i.e. on 44000/- p.a. after completion of 60 yrs. Whether investment in the Tier-II scheme is withdrawable after 60 years and will that be taxable. Please explain more about Tier-II investment.

Thanks and regards

Nayen Kumar

NPS Tax benefit is available only for Tier-1 account. So no point of investing in NPS Tier – II for tax benefit. The returns of both Tiers would be similar as the asset allocation is same for both. The only difference if Tier 2 you can withdraw anytime while in Tier 1 you can withdraw only after you turn 60.

I want to point out a slight flaw in the return calculation of NPS. You can’t just average the return of Equity and Debt components as 10%. Each year the corpus of Equity component of NPS grows at higher rate compared to Dept. Therefore you need to calculate them separately. Equity component of NPS grows to Rs 67,57,315 at 12% return on Rs 25,000 annual contribution. Debt component of NPS grows to Rs 30,58,647 at 8% return on Rs 25,000 annual contribution. Total of these would be Rs 98,15,962 which is almost 8 lakhs higher than your calculation. However, if we consider the tax on withdrawal, Option 2 will still be better.

my wife is state government employee in rajasthan education department. I want to know that she is eligible for additional tax benefit on additional NPS of Rs.50000 or not? She has taken employee contribution deduction u/s 80CCD(1) in limit of Rs.150000 & employer contribution deduction u/s 80CCD(2). She want to invest additional Rs.50000 in NPS to avail additional tax benefit of Rs.5000. Kindly suggest it is advisable or not? – See more at: http://taxguru.in/income-tax/sec-80ccd-additional-deduction-

Yes she is eligible for taking tax benefit u/s 80CCD(1B). It’s advisable to take advantage of already contributed NPS under Sec 80CCD(1B) and do additional investment in ELSS/PPF for section 80C.

National Pension Scheme under section 80 ccd(1B), I want to deposit nps tax deduction and how can do this processes, please explain it. Whether this scheme process in nationalized banks or postal officer, pls. clarify.

Thanking you.

There are several Point of Service locations including banks like HDFC Bank, ICICI Banks, etc where you can open your NPS. Read – How to Open NPS Account? for more details.