In the last few weeks, I have got queries asking if people can file their last year (AY 2018-19) tax returns? This question makes sense as many people are not aware of the change in rules. Also, when people try to file the last year tax returns, they seen an option to do so in the income tax return filing website.

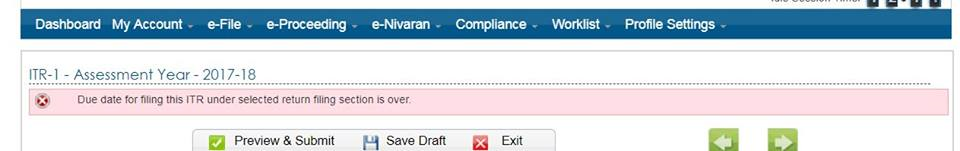

Unfortunately starting last two years, the time to file income tax returns is limited to the March 31 of the relevant assessment year. So, for AY 2018-19 (FY 2017-18), the last date to file returns was March 31, 2019. You cannot file your income tax returns for that year any more. As stated earlier the website does give an option to file last year return but you would get error “Due date for filing this ITR under selected return filing section is over”.

Also starting AY 2018-19, the rules about income tax return deadlines are more stringent. In case you do not file your tax returns by July 31, 2018 but do before December 31, 2018, there would be additional penalty of Rs 5,000 under newly introduced section 234F. in case you delay further, the penalty would increase to Rs 10,000. However, in case the income is less that Rs 5 lakh the penalty is limited to Rs 1,000. After March 31, 2020 you would not be able to file your income tax returns for AY 2019-20.

[box type=”info” size=”large” style=”rounded” border=”full”]

Here are some posts which can help you with e-filing of ITR 2019:

1. 9 Most Important Changes in ITR Forms for AY 2019-20

2. Calculate your Tax liability for FY 2018-19 (AY 2019-20)

3. Download 44 page slideshow showing all tax exemptions

4. Which ITR form to fill for Tax Returns for AY 2019-20?

5. How to Claim Tax Exemptions while filing ITR?

6. Use Challan 280 to Pay Self Assessment Tax Online

7. Form 26AS – Verify Before Filing Tax Return

8. 5 Ways to e-Verify your Income Tax Returns

9. What if You DO NOT file your Returns by due Date?

10. Can I file my Last Year Tax Return?

11. Why and How to Revise Your Tax Return?

12. What does Intimation U/S 143(1) of Income Tax Act mean?

13. What happens after you file your ITR?

[/box]

dear Sir,

my F.Y.2016-17 return pending so please suggest how submit the return

Sorry you cannot file your pending returns online. You may need to contact income tax department for the same.

Sir,can i file my last 3 years tax returns

I have salary income ,one house property and interest from bank deposit. If I get long term capital gain of Rs. 50000 , can I use ITR I for Income Tax.

No, you have to file ITR 2