Have you ever looked at your CTC (salary) structure and wondered what the Gratuity component sitting at the very bottom is all about? How is this gratuity calculated? What is the Formula used? When would it be paid? In this post answer these questions and also give you an Excel Gratuity calculator. Using the Gratuity calculator you can figure out the amount you would get on retiring or when leaving the company.

What is Gratuity in Salary?

Gratuity is a mandatory retirement benefit an employer (with more than 10 employees) has to provide for all its employees and governed by Payments of Gratuity Act 1972. This is like saying “Thank You” to the employee for providing their long term services to the organisation. Gratuity is paid to the employee on retirement or when they leave their job. To be eligible for Gratuity, the employee should have worked at least for 5-years continuously with the employer. Gratuity is also paid in cases of death or disablement due to accident or disease (even if this occurs before 5 years).

From an employer perspective, they are mandated by the Payments of Gratuity Act 1972 if they have more than 10 employees at any time in the last one year. Also once they are covered by the gratuity act they remain to do so even if the employee count goes below 10.

Gratuity Eligibility Criteria

To summarize employees are eligible to receive gratuity if following conditions are met.

- The employee retires with more than 5 years of continuous service with the employer

- The employee leaves the company after 5 years of continuous service

- The employee dies or is disabled due to accident or disease. In case of death the gratuity is paid to the nominee/legal heir. There is No minimum time of service requirement in this case.

How to do Gratuity Calculation in Excel in 2021?

For calculating Gratuity we need to know two things

- Your continuous period of service in the organisation

- Your last drawn monthly salary along with dearness allowance

The Gratuity Formula for Calculation is as follows:

Gratuity Amount = [(Last Salary * 15)/26] * Years of ServiceHere is an example of Gratuity calculation. In case the last drawn salary (basic salary + Dearness Allowance only) is Rs 1,20,000 and the numbers of years with the employer is 35 years, the gratuity would be

Gratuity = [(1,20,000 * 15)/26] * 35 = Rs 24,23,077The important point to note here is that the formula mentioned here gives the minimum amount of gratuity that has to be paid. However, companies are free to pay more than this.

What is 15/26 in Gratuity Calculation?

In principle Gratuity is supposed to pay you half a month of salary for each year worked. The 15 by 26 formula is used to compute the same. Here 26 is assumed to be the number of working days in a month (considering 4 Sundays) and 15 is half a month. The resultant ratio 15/26 gives the half month salary.

Gratuity Amount = [(Last Salary * 15)/26] * Years of ServiceAre you Paying Too much Taxes? Download your free presentation

Are you worried that you are paying too much in income tax? Are you aware of all the changes in the tax laws? Where should you invest to save taxes? Do you know all tax sections that you can use to save your tax. Download a concise 43 page presentation free to answer all the above questions and save your taxes – legally.

Gratuity Calculation for Employer NOT covered by Gratuity Act

For organisations not covered under the gratuity act can also make gratuity payouts to their employees but it’s voluntary.

The gratuity is calculated using the following formulas:

Gratuity Amount = [(Last Salary * 15)/30] * Years of ServiceIn case the last drawn salary (basic salary + Dearness Allowance only) is Rs 1,20,000 and the numbers of years with the employer is 35 years, the gratuity would be

Gratuity = [(1,20,000 * 15)/30] * 35 = Rs 21,00,000The difference between Organizations NOT covered under the Gratuity Act Vs those covered is for calculation of half-monthly salary, gratuity covered organizations take 26 days as month (4 being Sundays) while those not covered take full 30 days as month.

Gratuity Calculation in event of Death (Death cum Retirement Gratuity)

The calculation of Gratuity in event of death is governed by Payments of Gratuity Act 1972. The amount would be paid to the nominee or legal heir. The maximum amount is capped at Rs 20 Lakh with effect from January 1, 2016.

| Qualifying Service | Gratuity Rate |

|---|---|

| Less than one year | 2 times of basic pay |

| One year or more but less than 5 years | 6 times of basic pay |

| 5 years or more but less than 11 years | 12 times of basic pay |

| 11 years or more but less than 20 years | 20 times of basic pay |

| 20 years or more | Half of emoluments for every completed 6 monthly period of qualifying service subject to a maximum of 33 times of emoluments. |

Download Gratuity Calculator in Excel

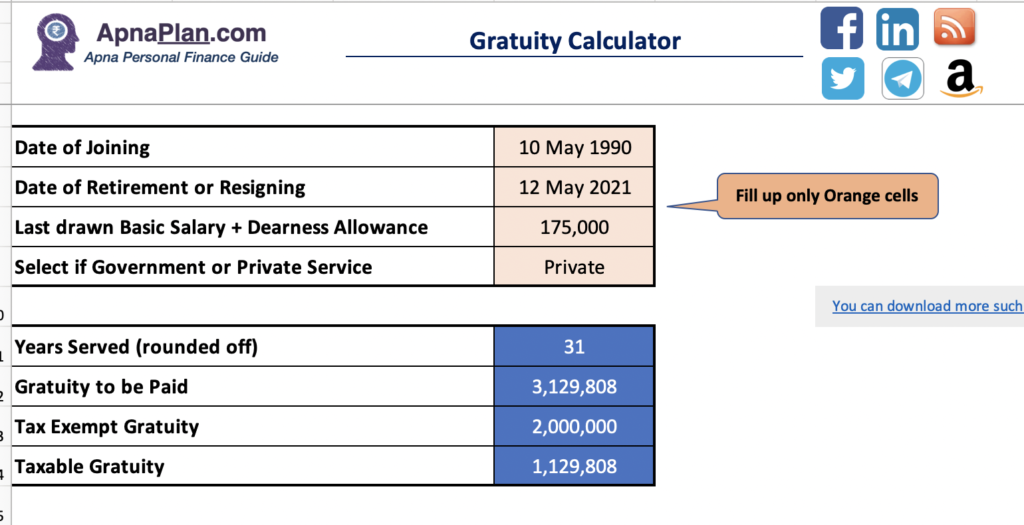

The Gratuity Calculator in Excel gives you the following features as shown in the picture below:

- Calculates the Gratuity

- Calculates the tax exempt & taxable part

- Gives you an estimate on how much you can get on retirement

Download the Gratuity Calculator, fill up the relevant results and you get your numbers.

How to Pay 0 Income Tax on Salary of Rs 20+ Lakh?

Salary components and salary structure plays a very important role in how much income tax you pay. We have come up with some optimised salary structure using which you pay NO income tax even with CTC of more than Rs 20 Lakhs.

How to Calculate Gratuity for Private Sector Employees?

There has been a confusion on if the gratuity calculation is different for private sector employees vs central government employees. The truth is there is no difference in calculation of gratuity for private sector employees or government sector employees.

But, there is a difference in the tax treatment of gratuity received by private-sector employees and government sector employees. For government employees, the entire gratuity received is tax free. However for private-sector employees, gratuity received up to only Rs 20 lakh is tax free. We have described the tax treatment in the next section.

How to Calculate Gratuity for Central Government Employees?

As we mentioned in the earlier section, calculation for gratuity is same for both central government employees and private sector employees. The only difference for central government employees is the gratuity they receive is tax free. This is the exact wording from Government Pension Portal:

A minimum of 5 years’ qualifying service and eligibility to receive service gratuity/pension is essential to get this one time lump sum benefit. Retirement gratuity is calculated @ 1/4th of a month’s Basic Pay plus Dearness Allowance drawn on the date of retirement for each completed six monthly period of qualifying service. There is no minimum limit for the amount of gratuity. The retirement gratuity payable for qualifying service of 33 years or more is 16½ times the Basic Pay plus DA, subject to a maximum of Rs. 20 lakhs.

Government Pension Portal

Essentially, the government computes one fourth basic salary for every 6 months worked, which essentially converts to half salary for every year.

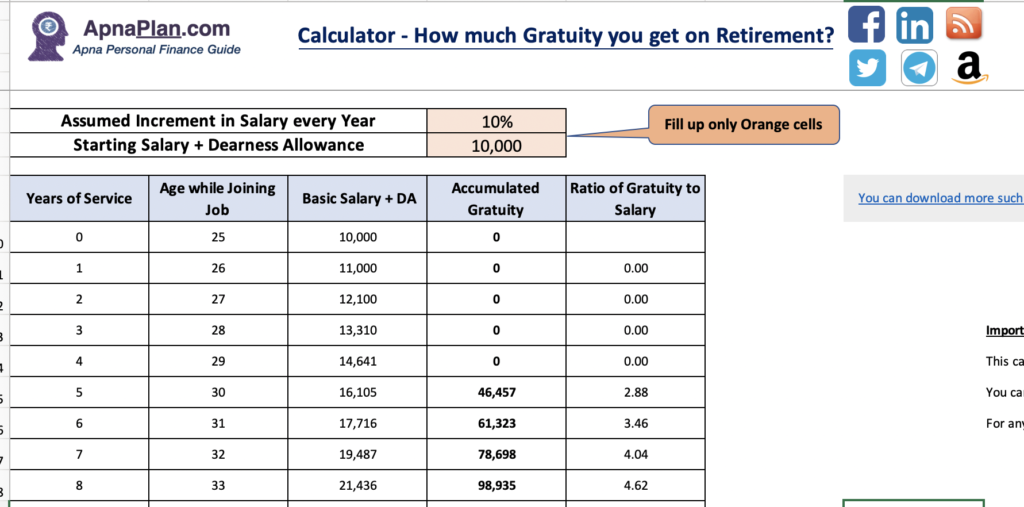

Gratuity Calculation – How much can you expect on Retirement?

As your other retiral benefits like Leave Encashment, Provident Fund, Gratuity too can become a pretty decent amount if you have worked with the same employer for a long time.

Take for example – Amit joined his company at the age of 25 years and continued to work for them till the retirement age of 60 years. At the time of joining his basic salary including DA was just Rs 10,000. He got increment of 10% every year. Do you know how much Amit would receive when he retires at the age of 60 years? We use the Gratuity Calculator and arrive at the following figure:

- By retirement, he would have worked for 35 years

- At the time of retirement his monthly salary would be Rs 2,81,024

- Gratuity Amount received = Rs 56,74,531

You may argue that this amount if looked through time value of money may not be worth it. But look carefully and the Gratuity amount is more than 20 times the monthly basic salary. Even by conservative estimates this is like 1 year income (considering basic salary & other salary components) – which in my opinion is awesome for loyalty to your employer.

This is the reason that most central government employees who don’t change jobs frequently, even though they have started on lower salary – gain a good gratuity amount at the time of retirement.

Is Gratuity Taxable? How much Gratuity shall be exempt from Income Tax?

There has always been a bit of confusion on if the gratuity is taxable and rightly so because the tax treatment is based on if you are a Private sector employee or a Government sector. For Government sector employees, all gratuity they receive is tax free or tax exempt. However they should always report this payout in their Income Tax return forms.

For private sector employees, the tax exemption on gratuity is minimum of following 3:

- Rs 20 Lakh (effective from March 29, 2018)

- Eligible Gratuity as calculated using above formula

- Actual Gratuity received

For e.g. In case the last drawn salary (basic salary + Dearness Allowance only) is Rs 1,20,000 and the numbers of years with the employer is 35 years, the gratuity would be

Gratuity = [(1,20,000 * 15)/26] * 35 = Rs 24,23,077

In case the person is a Government employee, all of his Rs 24,23,077 is tax exempt.

However for private sector employee, the gratuity tax exemption would be minimum of

- Rs 20 Lakh

- Eligible Gratuity as calculated using above formula – Rs 24,23,077

- Actual Gratuity received – Rs 24,23,077

So Rs 20 Lakh would be tax exempt and the rest of Rs Rs 4,23,077 would be treated as taxable income and be taxed at marginal income tax rates.

How much Taxes you Need to Pay this Year? Download Our Income Tax Calculator to Know your Numbers

Do you know how much tax you need to pay for the year? Have you taken benefit of all tax saving rules and investments? Should you use the “NEW” tax regime or continue with the old one? In case you have all these questions just Download the Free Excel Income Tax Calculator for FY 2021-22 (AY 2022-23) and get your answers.

Can employers stop Gratuity?

According to Payment of Gratuity Act of 1972, employers can forfeit gratuity for an employee under only one condition – if the employee has been terminated due to disorderly conduct wherein, he/she tries to physically harm individuals during his/her employment.

Gratuity Forms

Below is the list of Gratuity Forms, you may need.

- Form A – For opening Gratuity

- Form B – For changes of details

- Form C – Gratuity Closure Form

- Form F – Gratuity Nomination Form

- Form H – Gratuity Modification of Nomination

- Form I – Application for gratuity payment by an employee

- Form J – Application for gratuity payment by a nominee

- Form K – Application for gratuity payment by a legal heir

- Form L – Notice for payment of gratuity

- Form M – Notice rejecting claim for payment of gratuity

- Form N – Application for direction Before the Controlling Authority

- Form T – Application for recovery of gratuity

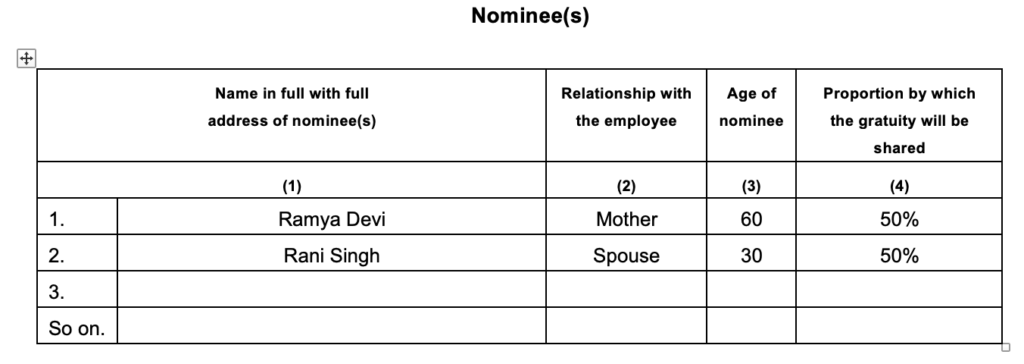

Nomination: proportion by which the gratuity will be shared

A question often asked while filling up “Gratuity Form F” related to nomination is what does “proportion by which the gratuity will be shared” mean. This column in the Form F for Gratuity nomination becomes relevant when you want to distribute your gratuity payout between multiple nominees (in event of your death). You could distribute the amount in any manner you want. For e.g. you have nominated your mother and spouse as gratuity nominee. You can give 50% to each or 25% to your mother and 75% to your spouse or vice-versa. Make sure all the percentages add to 100%. If you just have one nominee then mention 100% in “proportion by which the gratuity will be shared” column.

The Form F below gives the example

Who can be a nominee in Gratuity?

Employees can nominate any family member as a nominee in gratuity. The nominee can be changed anytime by submitting a fresh form. You need to submit Form H to your employer for the same. It’s the employer’s responsibility to keep a record of the changes made to nominee details.

How can Nominees or Legal heir claim Gratuity?

In case of death of the employee, the nominee would need to fill up Form J and submit the same to the employer. If the employee had nominated multiple nominees, each one needs to fill the form J separately. Along with the Form J, each nominee has to submit the following supporting documents: ID proof (like Aadhar), address proof, bank passbook copy or cancelled cheque.

Once the employer verifies the claim they would pay each nominee in proportion by which the gratuity will be shared.

In case a Legal heir wants to file a claim, they have to fill up Form K. All other process remain the same.

Gratuity FAQs

✅ Is gratuity payable if service tenure is in between 4 to 5 years?

The employee would not receive gratuity in case he resigns from his job before 5 years. However, a judgement from Madras High Court says that an employee would be eligible if he has served the company for more than 4 years 240 days.

✅ Is the 5-year service rule applicable for all cases?

In case the employee dies while he was on the rolls of the employer, the legal heirs are eligible to receive gratuity irrespective of the working tenure. Also, in case an employee has become disabled due to an accident or a disease, the employer is mandated to pay him/her gratuity irrespective of the tenure of service.

✅ Are contractors eligible for Gratuity?

Contractors are not eligible for gratuity.

✅ Is there a cap to the amount that can be paid as gratuity?

There is No cap on the gratuity amount paid. All amounts in excess of Rs 20 Lakh for private sector employees would be taxed at marginal income tax rates.

✅ How much time does it take to receive Gratuity Payment?

In most cases, gratuity payment is received by the full and final settlement done by the company after you resign or retire from the company. The government has mandated that the payment of gratuity should be done within 30 days. In case the employer exceeds this timeline, they are liable to pay simple interest until the settlement is done.

✅ Is gratuity part of CTC?

Yes, gratuity forms part of the CTC (cost to company) in all private companies. And this is the right thing to do because, it cost company the money and finally gratuity is paid back to you if you fulfil the eligibility criteria.