NSC (National Saving Certificate) is popular tax saving investment under section 80C. It has maturity of 5 years and is guaranteed by Government of India. This post lists the significant features of NSC, tax benefit, taxation, loan available, etc

Interest Rate on NSC:

As of today (for April to June 2019 quarter) NSC gets 8.0% interest compounded annually (Click to check latest & historical NSC interest rates). The interest rates are set every quarter by Government of India and is benchmarked to Government Bond yields. However once purchased the interest rate remain constant for that NSC.

- The maturity period is 5 years from the date of investment.

- 10 Year NSC has been discontinued since December 20, 2015.

Tax Benefit on NSC:

You can claim tax deduction up to Rs 1.5 lakh for investment in NSC under Section 80C. Additionally the interest accrued every year on NSC is also considered for tax exemption u/s 80C.

Download: NSC Calculator in Excel

Here is an example.

| Date | Interest Accrued | Comments | |

| 1-Mar-17 | 1,50,000 (Investment Done) | Purchased to Save Tax | |

| 1-Mar-18 | 12,000 | Interest Accrued would be eligible for tax deduction u/s 80C | |

| 1-Mar-19 | 12,960 | Interest Accrued would be eligible for tax deduction u/s 80C | |

| 1-Mar-20 | 13,997 | Interest Accrued would be eligible for tax deduction u/s 80C | |

| 1-Mar-21 | 15,117 | Interest Accrued would be eligible for tax deduction u/s 80C | |

| 1-Mar-22 | 2,20,395 (Maturity Amount) | 16,326 | Redeem the Maturity Amount. Final Year interest is NOT eligible for tax benefit |

The final year interest is not considered as reinvestment for tax benefit.

NSC in Tax Returns:

To take the tax benefit on accrued interest you should declare the same in your income tax return (ITR) form every year under “Income from Other Sources”.

Download: Excel based Income Tax Calculator

TDS & Tax on NSC:

There is NO TDS on NSC.

The interest earned is taxed according to marginal income tax rates applicable to tax payer.

Investment Limit for NSC:

The minimum investment should be Rs 100.

There is NO maximum limit for investment in NSC. However the maximum tax exemption is Rs 1.5 Lakh u/s 80C.

NSC can be purchased in multiples of Rs 100.

Also Read: PPF – A Must Have Investment

How to buy NSC?

NSC can be bought across counters of most post offices.

You just need to fill up a one page form and attach relevant KYC documents (self-attested ID and address proof).

The payment can be made in any of the following modes:

- Cash

- Cheque or Demand Draft

- Withdrawal form from Post Office Savings Account

- In exchange of Old matured NSC

After due diligence and verification of KYC documents NSC is issued to the investor. The practice of giving NSC certificates have been discontinued since July 2016 and now investors are issued NSC Passbook (similar to bank account passbook) with the investment details.

You can also buy NSC online if you have net banking access of Post Office Savings Account!

Download: Latest Tax Planning Guide eBook

Is NSC available in banks?

Government on October 20, 2017 had notified selling of small saving schemes including National Savings Certificate (NSC), recurring deposits and monthly income scheme (MIS) in all public sector banks and 3 private sector banks – ICICI Bank, HDFC Bank and Axis Bank. Since this is new to banks I cannot find the details on their websites. However you can visit banks to know more.

This was done to increase the reach of small saving scheme to more people!

Also Read: Best Tax Saving Investments

Who can invest in NSC?

Only resident individuals can invest in NSC. You can invest jointly with another adult or purchase it on behalf of a minor.

HUFs and Trusts are NOT eligible to invest in NSC.

Also NRIs cannot invest in NSC. However if NRI can hold NSC if they had purchased it before becoming NRI.

Nomination in NSC:

Nomination facility is available for investors. You can nominate at the time of purchasing the NSC or any time before redemption by filling up this form. If required you can also request for change of nominee.

Also Read: All about Senior Citizens’ Savings Scheme

Transfer of NSC:

The NSC can be transferred from one person by filling up this form. The transfer can be done only once.

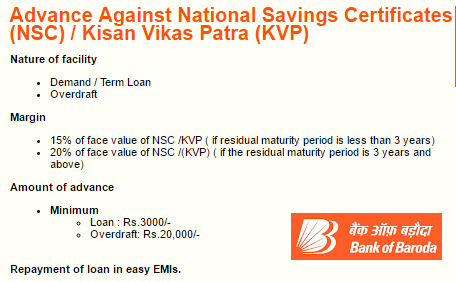

Loan against NSC:

NSC can be kept as collateral security to get the loan from banks & financial institutions. Fill up this form. Below is screenshot from Bank of Baroda for Loan against NSC/KVP. You can check terms and conditions here.

Also Read: Does Your Life Insurance Offers Tax Benefit?

Transfer NSC between Post Offices:

NSC purchased from a post office has to be redeemed in the same post office. In case you are moving places its good idea to transfer the NSC to a post office near to your new area. You can do so by filling out the prescribed forms. The good thing is the transfer application form can be submitted in either of the post offices.

Interest on NSC after maturity:

If you do not redeem your NSC on maturity the amount would earn interest of just 4%. This is applicable for two years from maturity. After 2 years there would be no further interest paid.

Also Read: 25 Tax Free Incomes & Investments in India

Premature Encashment of NSC:

NSC cannot be enchased mid-way before maturity under normal circumstances. However there are certain exceptions:

- On death of holder

- On order from court

In case the redemption happens within one year of investment, NO interest is paid.

NSC a GOOD Tax Saving Investment?

NSC as of today offers 8% interest while Bank Tax Saving Fixed Deposits offer 6.5% to 7.5%. So NSC is clearly better than Bank fixed deposits. Additionally the interest accrued every year in NSC is eligible for tax benefit. The only drawback for NSC is ease of investment – you can invest in tax saving fixed deposit online while in case of NSC its offline. However going forward banks have been allowed to sell NSC and we can expect online transactions in NSC in coming future.

I have purchased NSC on 22.12.2021. Whether I will be entitled to interest investment in the Assessment Year 2023-24 ,interest received and investment ?

if so, how much interest for adding inthe income and investment?

Sir,

I filled the NSC Application form(writing -NA- for agent related entries in the form ) on my own, submitted the same with required documents at the counter of the post office to the concerned officer and got acknowledge slip for the same .

Sir,

I filled the NSC Application form(writing -NA- for agent related entries in the form ) on my own, submitted the same with required documents at the counter of the post office to the concerned officer and got acknowledge slip for the same . In this process no agent was involved.But in the NSC passbook I can the

entry “Through Agent :YES “Does that mean agent name is added later on by the post office Staff.

Is it a legal practice?.

Thanks

My NSC of Rs. 60000/- matured on 18.03.18. I wish to redeem it on 02.04.18. For which year ITR I have to show it as income in FY 2017-18 or in FY 2018-19 as the NSC matured in FY 2017-18 but my redemption is in FY2018-19.

Kindly clarify.

Although decuction under 80C has been claimed in FY 2012-13 as the NSC purchased on 18.03.13. But, I have neither shown its interest as income nor exemption under 80C. What interest should be payable now ?

The NSC interest would be income for the year it matures. So you’ll have to pay tax on the entire interest earned during investment tenure in FY 2017-18

Dear sir,

Thank you so much for the quick response. According to you, I have to pay tax only for the interest earned in FY 2017-18, means for the last year interest only.

But, I want to know if there is any problem for the rest of the interest amount earned during the last 4 year but neither claimed under 80C nor shown as “Income from other source” ? Can it be ignored now or there is any solution still available ?

Thanking you.

Sorry I think there was misunderstanding, you will have to pay tax on entire interest earned from the time of investment till maturity.

Sir,

I have nsc bonds worth 70,000/-. I want to transfer those to my wife. After transfer, those are finally belongs to my wife or to me?. Are they are wiped off from my account?. Are they taxable for my wife or to me?

Thanking you

After transfer the NSC would belong to your wife and she would have all the right on it. As per tax on interest received is concerned, clubbing of income would apply and it would be taxable in your hands & not your wife!

sir

iam pent . i want to invest 500000/- in POST OFFICE NSC.IS IT GOOD FOR ME FOR 5 YRS INVESTMENT

nsc purchased in Assesee’s name with joint2nd name of married daughter – if eligible under sec-80C investment /exemption of taxable income?

yes if first name is for assesse, he/she can take tax exemption