Several NPS subscribers received SMS on April 27 from NSDL stating – “As a regulatory requirement, submit FATCA self-certification for your PRAN to CRA, else account will be frozen. For more details visit www.npscra.nsdl.co.in”

FATCA declaration for NPS can be done Online now – Click to Read!

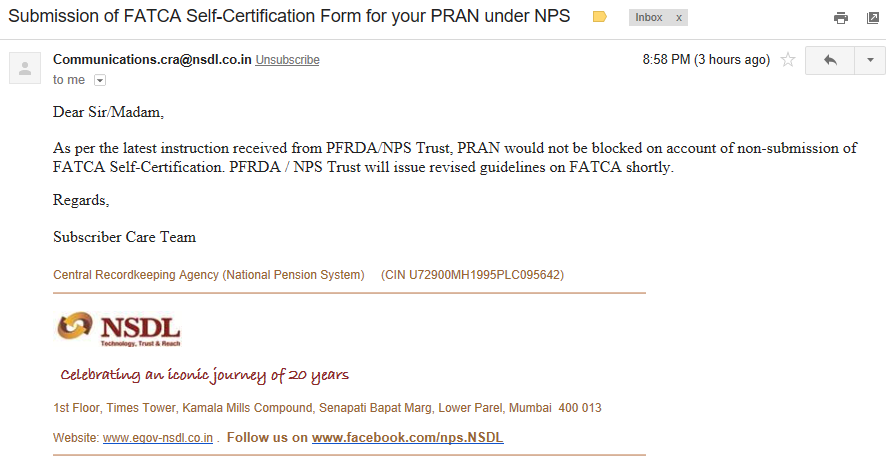

Later in the day subscribers also received from NPS [email protected] on their registered email with Subject: “Submission of FATCA Self-Certification Form for your PRAN under NPS”. Have reproduced the mail below.

New email from NSDL:

A few hours back received below mail from NSDL. The accounts would not be blocked on account of non-submission of FATCA Self-Certification. PFRDA / NPS Trust will issue revised guidelines on FATCA shortly. So NPS subscribers should wait until further instructions.

NSDL handled this entire thing in worst way possible – some heads should roll!

What is FATCA?

FATCA is Foreign Account Tax Compliance Act, a law enacted by USA in 2010. According to this law, any individual who is resident of USA (citizens or green card holders) or financially connected to the US or have any tax residency in US have to declare all their foreign income and investment details to US Tax Authorities. The law was enacted to prevent tax evasion through offshore investments by US residents.

India is signatory of the above law and hence all the financial entities like Banks, Insurance Companies, Mutual Funds, Brokerages, etc have to furnish their client information to the Indian Government, which in turn would share it with US Government. In case you have no income connection with USA, you are not impacted but still need to give the declaration.

NPS FATCA Declaration:

Unfortunately PFRDA the regulator for NPS did not bother to inform its subscribers about the FATCA requirement until the very last minute. But regulations being regulations this is what we need to do.

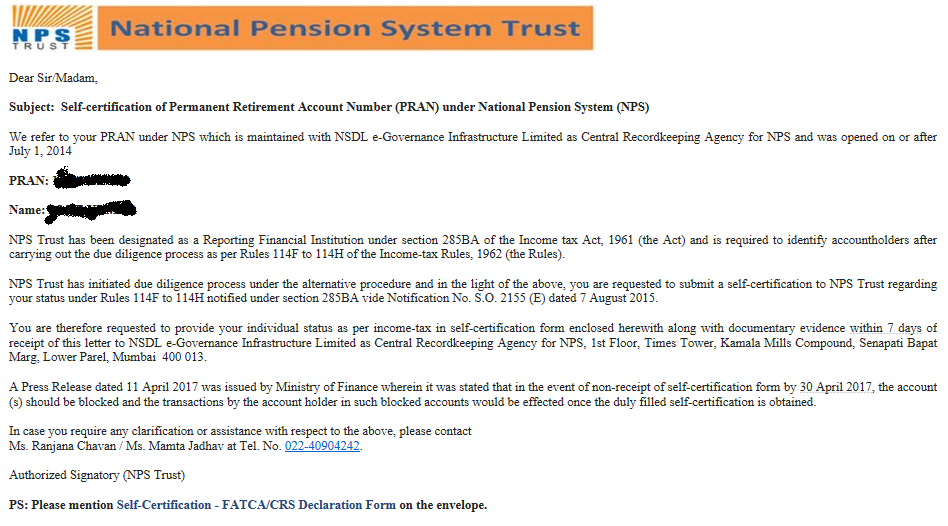

Only people who have opened NPS Account on or after July 1, 2014 are impacted.

But with tax incentive on NPS coming in 2014 there would lot of people who opened NPS account and would be impacted!

Also Read: Should you Invest Rs 50,000 in NPS to Save Tax u/s 80CCD (1B)?

To comply subscribers would have to submit a self-certification (i.e. FATCA/CRS Declaration) to NPS Trust.

Step 1: You can download the NPS FATCA Self Declaration Format by clicking here or from the email you received.

Step 2: Fill up the form (How to fill the form has been shown below) and send it to Central Recordkeeping Agency (CRA) for NPS at the following address:

NSDL e-Governance Infrastructure Limited,

1st Floor, Times Tower, Kamala Mills Compound, Senapati Bapat Marg,

Lower Parel, Mumbai – 400 013

Also mention Self-Certification – FATCA/CRS Declaration Form on the envelope

In case the above filled self declaration NPS FATCA form is not received before April 30, 2017 the NPS account would be blocked. The account can be activated only after subscriber submits the above form.

Also Read: 5 Steps to Transfer EPF to NPS

How to fill NPS FATCA Self Declaration Form?

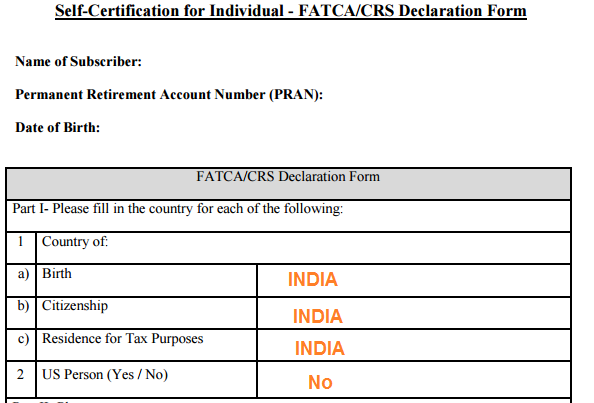

The FATCA form is 3 page form divided in 4 parts.

Part I:

Part 1 asks for following information:

Name of Subscriber:

Permanent Retirement Account Number (PRAN):

Date of Birth:

1. Country of:

a) Birth

b) Citizenship

c) Residence for Tax Purposes

2. US Person (Yes / No)

In case the answer for 1 above Country of Birth, Citizenship and Residence for Tax Purposes is INDIA, you just need to move to Part 3 for signature. This hopefully would cover majority of NPS subscribers.

Also Read: NPS Tax Benefit u/s 80CCD(1), 80CCD(2) and 80CCD(1B)

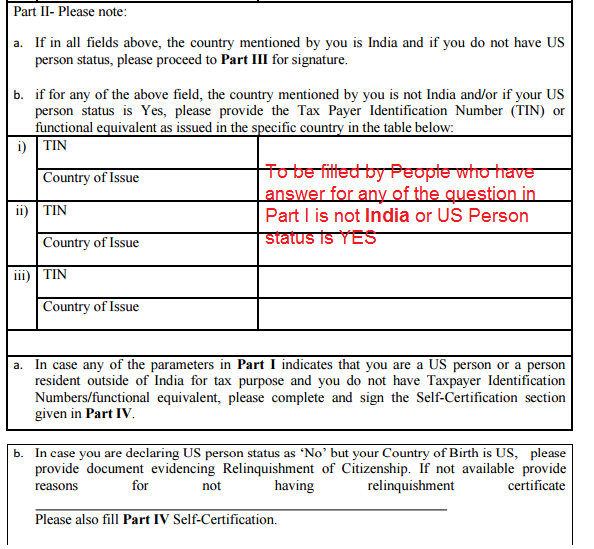

Part 2:

In case the answer for any of the above is not India or US Person status is YES, you need to provide Tax Payer Identification Number (TIN) or functional equivalent as issued in the specific country in the table.

Also Read: 6 Changes in NPS Rules in 2016 & How it Impacts You?

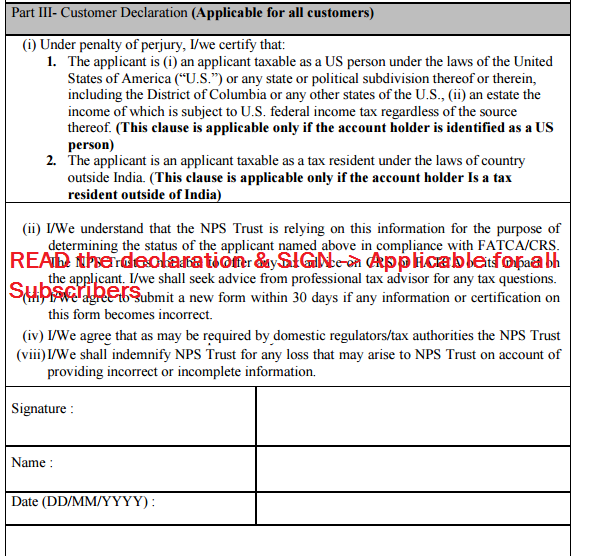

Part III:

Part III just requires your name, signature and date and is to be filled by everyone.

Also Read: NPS – Maturity, Partial Withdrawal & Early Exit Rules

Part IV:

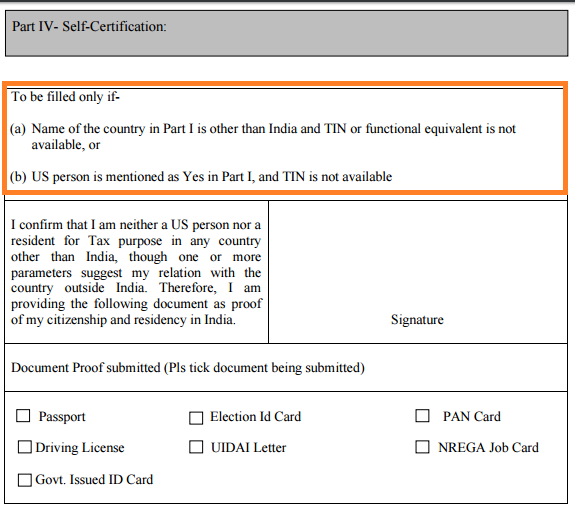

Fill this part only if you satisfy conditions below:

Name of the country in Part I is other than India and TIN or functional equivalent is not available, or

US person is mentioned as Yes in Part I, and TIN is not available

Download: Ultimate Tax Saving ebook with tax calculator FY 2017-18

The subscribers would in this case have to provide any of the below mentioned as proof of citizenship and residency in India.

- Passport

- Election ID card

- PAN Card

- Driving License

- UIDAI Letter

- NREGA Job Card

- Govt. Issued ID card

In case you require any clarification or assistance with respect to the above, please contact Ms. Ranjana Chavan / Ms. Mamta Jadhav at 022-40904242.

The Problems:

The entire approach by NPS/NSDL to obtain FATCA declaration is going to create lot of issues for subscribers. I do not understand why this could not be done online as was done by Mutual Funds earlier. Also there is NO way subscribers would be able to send the FATCA self declaration forms on time. Even in case they do NPS CRA would not have the ability to process the deluge of forms! Anyway as subscriber send this FATCA Self declaration as soon as possible to prevent any problem in future.

very informative Amit. Thank you

Sir one need to send through registered or speed post to the cra

Any mode would do

In Part 1 of the form under the option “Residence for tax purposes, I had filled up “INDIA, MEGHALAYA, SHILLONG”. Will that effect the status of my FATCA self declaration form?

It should have been “India” only. I think it should be accepted. If not send a new form

Shall i sign in part 4 of fatca self declaration form

Hii amit,i got msg yesterday to fill the form. How it is possible to deposit it till 30 april? M living in chandigarh

Not possible. But send as soon as possible. The account would be temporarily blocked. You should not worry if you had not planned any transactions from account in this time period. Once they receive the form they would activate the same.

So we don’t need to send any proof if in part 1 we have mentioned we are from India only? We don’t have to sign part 3? Please reply asap. Thanks

FOr Indians fill part 1 & 3 only.

Last date sir

April 30 2017

I am not us citizen and part IV is not applicable for me. Do I need to send the citizenship proof still?

no

Can I submit any mail

no

Sir, Please sent me the site link to online FATCA submission

There is No online submission for FATCA

Hello Amit, Thank you for such a detailed clarification of the situation. I gladly agree they should have made such things online which would have been easier for them and so for us. I will use the speed post to send the details and that too stapled. I have some questions, it would be great if you have any info about it.

1) How long does the speed post takes to reach the destination mentioned? If not then our accounts will be blocked until they receive and check them.

2) Our accounts once blocked, what problem shall one face until it is unblocked?

I have an Atal Pension Yojana (APY) activated. Other than that, no schemes.

The contact number mentioned is always on a busy line so its useless calling them for clarifications.

It would be great if you can share your Facebook page to keep in touch. Take care.

Hello Amit, Would be great if you can reply to me here.

Speedpost may take 2-3 days depending on your location. Even if the APY account is deactivated it would be active again as they receive the FATCA declaration. So if you have no planned transactions in this period it does not matter.

You can like/follow Apnaplan page on Facebook.

Hello, Thanks for your reply and help over here. I have liked and sent you a message on your facebook page. I would like to know if there is any way we can get a confirmation from them whether they have received our letter and our account is Active again?

NPS had mailed again that account would not be suspended for the time being and they would come out with new FATCA guidelines. You can read more here https://www.apnaplan.com/nps-fatca-declaration/

I don’t think they would send any confirmation!

I think there is an error in the FATCA Form.

Part IV mentions :

To be filled only if-

(a) Name of the country in Part I is other than India and TIN or functional equivalent is not available, or

(b) US person is mentioned as Yes in Part I, and TIN is not available

But in the next para, it is mentioned :

I confirm that I am neither a US person nor a resident for Tax purpose in any country other than India, though one or more parameters suggest my relation with the country outside India. Therefore, I am providing the following document as proof of my citizenship and residency in India.

Both these are contradictory. How can a “US Person” in first para of Part IV be “neither a US person” in second para of Part IV ?

Part IV seems to be applicable for Indian residents and not Part III.

Please clarify.

I have the same question but I am not sure where I can get the answer. Do let me know if you come to know!

sir

all dcps employee complessri submitted fatca

I am not sure if government employees with NPS need to submit this FATCA form. The reason being as they are employed by Government, they are bound to be Indian citizens. You may want to ask the same in your office from accounts or HR department.

Hi Amit

I have opened the NPS account in India in 2014 and I came to US on deputation in 2016 and still in US. I have received an email from NPS to send the self declaration form. I would like to know what does Part1, 1C “Residence of Tax purpose” mean. Do I need to enter as Indian.

If you have stayed for more than 183 days in US in 2016 your tax status would be US

Hi thanks for your extensive article. I have just moved to Indonesia and still don’t have my Tax number here. Now how do I answer the TIN number etc… or should I just send this form late by a month or so?

It would be Indian if you have moved recently

Thanks Amit

My son is a subscriber for APY scheme. He was studying in BE in india when he opened account. Since August 2016 he moved to US under F1 study visa as a graduate student to US. should he mention in FATCA as ‘ NRI’. Doubt is because he is not having his won earning in the US. please advise.

I am not sure on this but if his stay is less than 183 days in India in last financial year, he is NRI for tax purpose. YOu may want to consult a CA for the same.

Thanks for your response, Amit

Sir,

We are an Indian Company and having an account with a Foreign Bank ( CC Account) … they ask us to provide information FATCA ? I s that applicable to us … We have no Income from US … How to file the Form . Pl guide.

B.L. Sharma

Sorry, I am not sure about this.