This year might have been happy one for you if you received long pending salary dues as arrears. But we know receiving arrears makes everyone happy but pain of paying higher taxes makes them worried? We explain how to calculate tax on arrears and claim tax benefit u/s 89(1) in income tax return with example.

Tax Calculation on Arrears:

We take a simple example. Amit is a government employee and he has received his long awaited salary dues as arrears. Here are the numbers.

- Salary income for FY 2015-16: Rs 9,00,000

- Additional Arrears received: Rs 5,00,000

- Total income: 14,00,000

This arrears was due from last 3 financial years as follows:

- FY 2014-15: Rs 2,00,000

- FY 2013-14: Rs 1,75,000

- FY 2012-13: Rs 1,25,000

We use this example to illustrate tax calculation on arrears. For simplicity we would assume that Amit has not invested for any tax exemption, so his income stated above is “Net Taxable Income”.

Download:The ultimate ebook guide to Save Tax for FY 2018-19

Step 1:

Calculate tax for present year without considering arrears

So for FY 2015-16, the taxable income without arrears = Rs 9,00,000

Income Tax Payable = Rs 1,08,150

Step 2:

Calculate tax for present year after adding arrears payout

So for FY 2015-16, the taxable income without arrears = Rs 9,00,000 + Rs 4,00,000 = Rs 14,00,000

Income Tax Payable = Rs 2,52,350

Step 3:

Subtract income tax payable you get in step 2 from step 1

Additional tax due to arrears: Rs 2,52,350 – 1,08,150 = Rs 1,44,200

Also Read: Best Tax Saving Investments u/s 80C

Step 4:

Allocate the arrears components to the respective financial years. So in our case it’s as follows

FY 2014-15: Rs 2,00,000

FY 2013-14: Rs 1,75,000

FY 2012-13: Rs 1,25,000

Step 5:

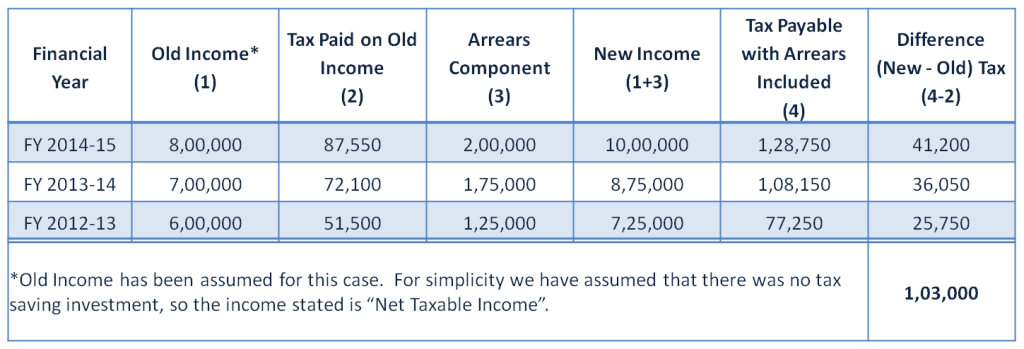

Calculate new tax payable for each financial year where the component of arrears is present i.e. adding arrears to the old income in respective financial years.

Add the excess tax payable across the financial years due to arrears. In our case it comes out to be Rs 1,03,000. This means that had the salary payout been on time you would have paid this amount as tax.

Step 6:

Subtract the excess tax payable due to arrears in Step 3 from the additional tax payable in Step 5.

Tax Difference: Rs 1,44,200 – Rs 1,03,000 = Rs 41,200.

If you consider arrears payment as income for only present financial year, you would be paying Rs 41,200 extra as taxes, without any fault of yours. Government thankfully understands the situation and has provided relief for tax payers under Section 89(1).

Also Read: Submit Income Tax Proof to Employer – How, When and Why?

Step 7:

Calculate your final tax liability for FY 2015-16

So for FY 2015-16, the taxable income with arrears = Rs 9,00,000 + Rs 4,00,000 = Rs 14,00,000

Income Tax Payable = Rs 2,52,350

Tax Deduction u/s 89(1) on account of arrears = Rs 41,200

Net Tax payable = Rs 2,52,350 – 41,200 = Rs 211,150

To claim the above tax benefit u/s 89(1), you need to fill up Form 10E. From FY 2014-15 (assessment year 2015-16), the income tax department has made it mandatory to file Form 10E if you want to claim relief under section 89(1). The form can be filled online on the Income Tax Website.

The question is what would have happened if there was no excess or lower tax as in Step 6?

There would be no special treatment. You just calculate your tax after adding arrears and pay our taxes. Section 89(1) would not be applicable!

Form 10E: How to fill?

The Form 10E can be filled online from Income Tax website. Here are the steps:

- Login to Income Tax efiling website.

- After you have logged in, click on tab named ‘e-File’ and select ‘Prepare & Submit Online Form (Other than ITR)

- On the next screen, select Form 10E and the Assessment Year from the drop down.

- The Form 10E would be displayed with instructions and annexure. Fill the relevant details and submit.

In case you do not submit Form 10E to take advantage of Sec 89(1), you might receive notice from income tax department saying: The relief u/s 89 has not been allowed in your case, as the online form 10E has not been filed by you. The furnishing of Online form 10E is required as per sec.89 of the Income Tax Act

Tax Calculators:

You can download the income tax calculator for past financial years here. Use them to calculate your taxes for the respective years.

Dear Mr. Amit

Thanks for explaining in an easy manner about calculation of tax on arrears

Further, I would like to know if I have recieved arrears in FY 2018-19 as a single payment, I have to calculate income tax to pay as described above, if I am not wrong.

Also please clarify whether Form 10E has to be filed for AY 2019-20 only or not?

regards

Praveen

Sir,

I am a Govt.Servant. The Income- Tax is calculated from March to February for a salaried person.

I have received arrears for the relevant past 3 financial years from 2014-15 to 2016-17.

Please tell me how to distribute these arrears for past F.Y. for filling form 10(E) …I mean should I make them from March to Feb like we do in calculating income tax or should I make them from April to March for A Financial year.

Sir I have claim relief under 89 but I didn’t filed ITR for that for which I have claim

But I can do now

Dear Amit,

Could you please let me know if PF received as arrears and deposited in GPF account are exempt from tax or not? Consider that the PF arrears for 20 years (1992 -2002) have been received by me from government and directly deposited in my account in 2016-2017. Also my institution is termed as semi-government.

Dear sir,

I received salary advance in f.y 2017-18 for two successive year so which slab rate shall i use for calculate tax for A.Y 2018-19.

If you treat it as arrears you need to use tax slab of respective financial years.

Hi Amit, thanks for your elaborate explanation on form 10e under us 189.

My doubt is – I have been using ITR 1 form for all these years. There was no need of using ITR 2. I have received my pension arrears for the last 8 years in Nov 2017. I am filling Form 10 e on incometaxefiling website. For filing the return for Ay 2018-19 which ITR form 1 or 2 (because Iam claiming the relief us 189) to use. I do not have income from 2nd house property. If I use form 2 instead of form 1, is it acceptable for the refund under us 189. Kindly clarify this and help me. Thanking you in advance. Kittur

yes you can file your returns using ITR 1

If arrear also includes NPS, then should be deduct

corresponding NPS amount while adding this arrears to that financial year?

For example, in FY15-16, I got 2lakh salary, now in FY 17-18, I got 2lakh arrear for FY15-16, which includes 1Lakh DA+1Lakh NPS.

Now what should be my net income includong arrears for FY15-16, 3 Lakh or 4Lakh? Can I get 1Lakh NPS as deduction under 80C?

Dear Amit, I did not have to pay tax in financial year 2016-2017 but i am now falling in the 5% tax bracket with the arrears. Can i claim relief u/sec. 89 (1) in respect of arrears received in financial year 2017-2018 but which pertain to financial year 2016-2017 and spread it over both these financial years. Kindly advise.

yes that is the right way to claim arrears

My total taxable income for financial year 2017-2018 is rs. 368000 including arrears. The arrears received in respect of financial year 2016-2017 amount to rs. 34736. For the financial year 2016-2017 i did not have to pay tax. Can i avail of the relief u/sec. 89 (1) and can i spread the arrears over these two financial years.

FY 2016-1017

Taxable income 287534

FY 2017-2018

Taxable income 291896

I got arrear Rs. 90766 in FY 17-18 which include Rs. 49489 for FY 16-17 and 41277 for FY 17-18

please help me to fill form 10 e and income tax return

Sir, I am a Lecturer , i received Rs 8 lakhs arrears for the period of 2010 Nov to 30 June 2018 as a part of salary fixation . Please enlighten me with illustrations to split my Income Tax during this span .

10e ke annexue 1 KE FIRST COLUMN ME AY DALA JATA HAI YA FY

FY

In previous year column FY dalna hai ya AY.

For example mujhe AY 2018-19 ke salary me FY 2015-16 ka Arrears mila hai , to Form 10e me Table A me previous years column me FY 2015-16 likhu ya AY 2016-17.

I received arrear 50000 2017-18.nps is 5000.

10E FORM IN ARREAR COLOUMN I SHOULD FILL 50000. OR AFTER DEDUCTION 45000.

WHILE FILLING TABLE A IN 10E CALCULATION WHETHER WE HAVE TO FILL TOTAL INCOME OF PREVIOUS YEAR OR NET TAXABLE INCOME?

I have claimed a tax relief of Rs.3505 under section 89(1) for AY 2018-19 and also have filled form 10E online. But in the intimation order under section 143(1) , section 89(1) relief not given. Kindly let me know what to do now? My ITR processing is completed but refund has not been credited in my bank account.

Hello

The income to be mentioned here of previous years and current year should be ‘Net Taxable Income’ (after all deductions) or “Gross Income”