LIC Plans are one of the most popular investment options in the name of saving tax. Every year LIC comes out with NEW insurance plans especially in the month of December to March for tax savers. But have you ever evaluated if these LIC plans are worthy investment especially for tax saving? We evaluate these plans for you and tell you if you should invest in them and if there are better alternatives.

In 2017 LIC has launched following tax saving plans:

- LIC Jeevan Shiromani

- LIC Jeevan Umang

- LIC Jeevan Utkarsh

- LIC Aadhaar Shila

- LIC Aadhaar Stambh

These plans can be classified as Endowment plans, Single Premium Traditional plan or Whole-life plan. We discuss the plans one by one.

LIC Jeevan Shiromani:

Launched in December 2017 LIC Jeevan Shiromani is Non-linked, Money back, Limited premium payment with guaranteed additions plan targeted for HNIs (High Net-worth Individuals)

Minimum Sum Assured: Rs 1 Crore

Age for Entry: 18 to 55 Years

Maturity Benefit: Sum Assured on Maturity + Guaranteed Additions + Loyalty Addition if any

Death Benefit: Sum Assured on Death + Guaranteed Additions + Loyalty Addition if any. In case death occurs before 5 years only Sum Assured on Death + Guaranteed Additions are paid to the nominees

Expected Returns: The returns could vary from 5% to 7% depending on loyalty bonus rates and your age at entry and premium paying term

Should you Invest? For 1 crore sum assured the annual premium would be more than Rs 7 lakhs depending on the age and term. So this is clearly for HNIs. The expected returns are may vary from 5% to 7% which is low as HNIs can take more risk in their investments. Also from tax saving angle investors would be much better-off with investment in ELSS funds and buying separate term insurance. Our recommendation is to stay away from LIC Jeevan Shiromani.

Also Read: How are ULIP & Life Insurance Policies Taxed on Surrender & Maturity?

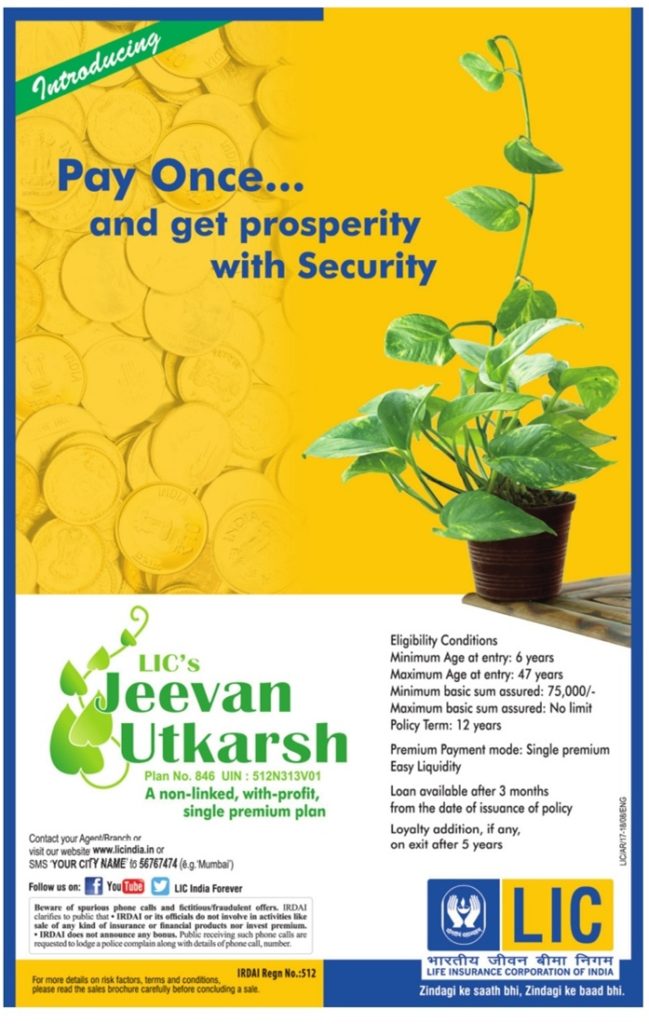

LIC Jeevan Utkarsh:

Launched in September 2017, LIC Jeevan Utkarsh is single-premium traditional, non-linked, with-profits, savings cum protection plan. This plan would close for investment on March 31, 2018.

Minimum Sum Assured: Rs 75,000

Age for Entry: 6 to 47 Years

Maturity Benefit: Sum Assured on Maturity + Loyalty Addition if any

Death Benefit: Sum Assured on Death + Loyalty Addition if any. In case death occurs before 5 years only Sum Assured on Death is paid to the nominees

Expected Returns: The returns could vary from 5% to 7% depending on loyalty bonus rates and your age at entry

Should you Invest? Single premium life insurance plans are expensive form of insurance. As can be seen the expected returns are may vary from 5% to 7%. If buying for tax saving you would get better returns by investing in PPF and buying term insurance separately. Our recommendation is to stay away from LIC Jeevan Utkarsh.

Also Read: Single Premium or Yearly Premium for Life Insurance – Which is better?

LIC Jeevan Umang:

Launched in May 2017, LIC Jeevan Umang is a whole life insurance with limited premium payment option plan. It provides annual Survival Benefits after the premium paying term till maturity/death and also lump-sum amount at the time of maturity/death.

Minimum Sum Assured: Rs 2,00,000

Age for Entry: 90 days to 55 Years

Maturity Benefit: Basic Sum Assured + Simple Reversionary Bonuses + Final Additional Bonus (if any)

Death Benefit: Basic Sum Assured + Simple Reversionary Bonuses + Final Additional Bonus (if any) is paid to the nominees

Expected Returns: The returns could vary from 5% to 7% depending on bonus rates and your age at entry

Should you Invest? As can be seen the expected returns are may vary from 5% to 7%. If buying for tax saving you would get better returns by investing in PPF and buying term insurance separately. Our recommendation is to stay away from LIC Jeevan Umang.

Also Read: 9 Tips to Buy the Right Life Insurance

LIC Aadhaar Stambh Plan:

Launched in April 2017, LIC Aadhaar Stambh is with profit, non-linked regular premium paying Endowment insurance plan for males with Aadhaar number.

Minimum Sum Assured: Rs 75,000

Age for Entry: 8 to 55 Years

Maturity Benefit: Sum Assured on Maturity + Loyalty Addition if any (if any)

Death Benefit: Sum Assured on Death + Loyalty Addition if any. In case death occurs before 5 years only Sum Assured on Death is paid to the nominees

Expected Returns: The returns could vary from 4% to 5% depending on bonus rates and your age at entry

Should you Invest? This is a regular endowment plan with no other USP. The plan is just riding on the Aadhaar popularity. The returns are may vary from 4% to 5%. If buying for tax saving you would get better returns by investing in PPF and buying term insurance separately. Our recommendation is to stay away from LIC Aadhaar Stambh Plan.

Also Read: 15 Investments to Save Tax u/s 80C – Which is the Best?

LIC Aadhaar Shila Plan:

Launched in April 2017, LIC Aadhaar Shila is with profit, non-linked regular premium paying Endowment insurance plan for females with Aadhaar number.

Minimum Sum Assured: Rs 75,000

Age for Entry: 8 to 55 Years

Maturity Benefit: Sum Assured on Maturity + Loyalty Addition if any (if any)

Death Benefit: Sum Assured on Death + Loyalty Addition if any. In case death occurs before 5 years only Sum Assured on Death is paid to the nominees

Expected Returns: The returns could vary from 4% to 5% depending on bonus rates and your age at entry

Should you Invest? This is a regular endowment plan with no other USP. The plan is just riding on the Aadhaar popularity. The returns are may vary from 4% to 5%. If buying for tax saving you would get better returns by investing in PPF and buying term insurance separately. Our recommendation is to stay away from LIC Aadhaar Stambh Plan.

Also Read: How to Save Income Tax for FY 2017-18 – Download Complete Tax Planning Guide

LIC Plans for Tax Saving? My recommendations:

LIC stands for Life Insurance Corporation – which means it primarily is in insurance business and NOT investment.

Most insurance plans with investment component (like endowment plan, Money back plan, etc) offer low returns in the range of 4% to 7%.

Due to high premium, investors neither get adequate insurance nor good returns. Its good idea to buy pure term life insurance and invest rest in PPF (if you are conservative) or ELSS (if you are aggressive) to save tax.

Also Read: Best ELSS (Tax Saving Mutual Fund) to Invest in 2018

Generally December to March is the time when LIC and other insurance companies launch new tax saving investment plans and insurance agents are out in full force to sell these as tax saving investments. Be cautious and select the right investment or you may regret later!

Very apt explanation Amit Sir.

Which term plan will you suggest?