We love to Save taxes and one of the ways to save on Long term Capital Gains Tax on Real Estate is to invest in Capital Gains Tax Saving Bonds u/s 54EC from NHAI, REC, IRFC or PFC.

Below are few rules to avail this tax exemption:

1. Only Long Term capital gains from Real Estate are eligible to be invested in these bonds

2. You can invest capital gains up to Rs 50 lakhs in these bonds

3. These bonds give interest of 5.75% and have maturity tenure of 5 years [changed from 3 to 5 years in Budget 2018]

4. The tax exemption is covered under section 54EC of Income tax

5. The interest earned on the bonds are taxed according to your marginal income tax slab

Capital Gain Bonds – Should You Invest?

The question now is should we invest in Capital Gains Bond to save tax or pay capital gains tax and invest as per our convenience for higher returns?

Assumptions:

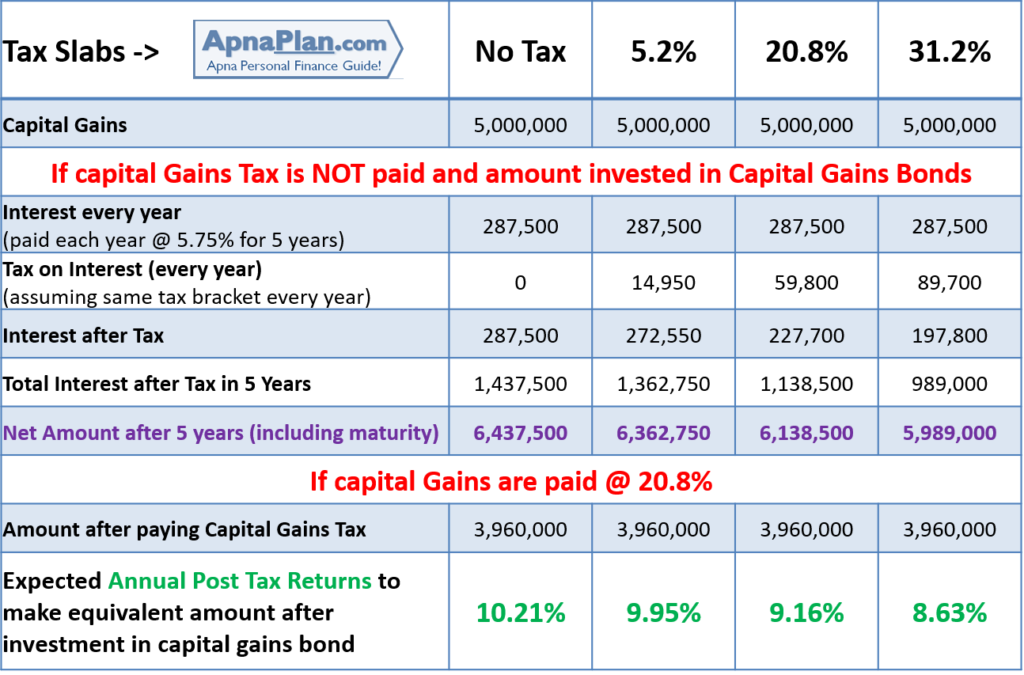

Amit has Long Term Capital Gains on sale of Property of Rs 50 Lakhs and he has two options

- Invest in Tax Saving Bond and Capital Gains OR

- Pay Capital Gains tax and invest the rest

The table below covers both the scenarios

As you can see with people in highest tax bracket of 30%, need to make at least 8.63% returns after tax which may be achievable by investing in right investments. This number would be higher for people in lower tax brackets!

I think investing in capital gains bond is totally your choice – if you think you can generate higher return than that mentioned in the last row of our calculation, then pay your capital gains tax and invest accordingly.

Also Read: How are your Investments Taxed?

To Conclude:

I think investing in capital gains bond is totally your choice – if you think you can generate higher return than that mentioned in the last row of our calculation, then pay your capital gains tax and invest accordingly.

Can 54EC bonds be used to buy a new residence say 4 years after sale of old residence?

Good article, but isn’t the first tax slab 5.20% from last couple years as opposed to 10.40% mentioned in the table?

Thank you for pointing out the error. Have corrected it now 🙂