The Budget 2015 presented on February 28, 2015 which brought the following 8 changes in Income Tax rules for Individual tax payers.

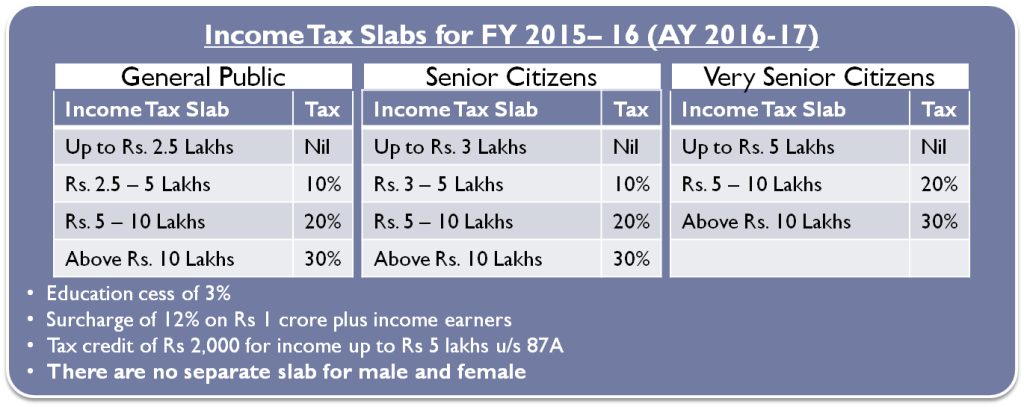

1. Income Tax Slabs:

There is no change in tax slabs for FY 2015-16 people with income of less than 1 crore. However for the super rich (with annual income of more than 1 crore) the surcharge has been increased from 10% to 12% resulting in increased marginal tax rate to 34.6% from 33.99%.

2. Transport Allowance doubled to Rs 1,600 per Month

The transport allowance which is tax free in the hands of employees has been increased from Rs 800 to Rs 1,600 per month. This was last changed in 1997.

3. Deduction for Medical Insurance increased by Rs 10,000

The deduction for payment of medical insurance has been increased from Rs 15,000 to Rs 25,000 for all and Rs 20,000 to Rs 30,000 in case of Senior Citizens.

4. Additional deduction of Rs 50,000 for investing in NPS u/s 80CCD(1B)

Budget 2015 has made additional exemption of Rs 50,000 for investment in National Pension Scheme (NPS). This is in addition to 80C benefit on NPS.

5, Deduction on investment to Pension plans increase to Rs 1.5 lakhs u/s 80CCC

The deduction on investment in approved pension plans has been increased from Rs 1 Lakh to Rs 1.5 Lakhs. This along with 80C investments is limited to Rs 1.5 lakhs exemption.

6. Sukanya Samriddhi Account Scheme eligible for Tax deduction u/s 80C

The Sukanya Samriddhi Account Scheme has been approved as one of the investment choice u/s 80C. Also the scheme has been made tax free at maturity just like PPF.

7. Rs 20,000 increase in deduction for treatment of chronic illness u/s 80DDB

The deduction limit has been increased to Rs 80,000 from Rs 60,000 for treatment of chronic illness such as Cancer, full blown AIDS etc. in case senior citizens.

8. Rs 25,000 increase in deduction for persons with disability

The deduction for person with disability has been increased from Rs 50,000 to Rs 75,000. Similarly this limit has been increased to Rs 1.25 lakhs from Rs 1 lakh for severe disability u/s 80U. This exemption also extends to handicapped dependents u/s 80DD.

9. New Approved organizations added to 80G exemption on account of Donation to Approved Charitable Organizations

100% tax exemption for donation to the following organizations u/s 80G. These 3 funds are addition to the existing list

- National Fund for Control of Drug Abuse (NFCDA)

- Swachh Bharat Kosh and

- Clean Ganga Fund

Income Tax Calculator:

We have come up with Excel based income Tax Calculator for FY 2015-16 incorporating the above changes which you can download free.

Great site!

Thanks 🙂

Hi , l m doing Rajasthan state government job. Live in jodhpur city ,govt dosent give any HRA and Accommodation to me .Can i have any racellaction in income tax.I live in a rented house

Thanks

You can claim tax exemption up to Rs 2,000 per month in case your employer does not give HRA but you pay rent. This is under Sec 80GG of income tax act.

Nice post Sir … Your site always helps me a lot in any problems related to taxation. I also tried to download your Excel based income Tax Calculator for FY 2015-16. This also proved to be a great help to me.