India is moving towards implementation of GST (Goods and Service Tax). GST is considered one of the biggest indirect tax reforms wherein all the taxes like excise tax, service tax, VAT, etc. would be replaced with one tax. This in turn would help in ease of doing business. GST is effective from July 1, 2017 and so the GST rates on most goods and services have been finalized by GST Council last week. Though the government says that GST would bring prices down, we give a broad overview on how it would impact your household budget.

GST Tax Structure:

GST has 4 tax slabs – 5%, 12%, 18% and 28%. Also there is provision to impose cess above and over this tax.

Download: Ultimate Tax Saving Guide for FY 2017-18

GST on Services:

Education, Healthcare and transport of goods which were exempted from service tax continue to be exempted in GST. But most services like telecom, business class air travel, financial services such as banking and insurance, telecom, information technology would go up from 15% to 18%. Eating out in AC/Non-AC restaurants and watching movies in theaters may become slightly cheaper but five star hotels would become more expensive. Below are the new GST rates Vs exiting tax.

| SERVICES | GST | Existing Tax |

| Telecom, Insurance | 18 | 15 |

| Works contracts | 12 | 15 |

| Non AC/Non alcohol-serving restaurants | 12 | 13-14 |

| AC, alcohol-serving restaurants | 18 | 22 |

| Five-star restaurants | 28 | 18 |

| Airlines (Economy) | 5 | 6 |

| Airlines (Business) | 12 | 9 |

| Railways (AC) | 5 | 5.2 |

| Movie Tickets | 28 | 45 – 100 |

Also Read: Best Tax Saving Investments

GST on common Household Goods

Cereals, Salt, puffed rice, milk, fresh fruits & vegetables etc. would continue to be exempted from taxes. However branded cereals and paneer would attract 5% GST (which had NO existing taxes). Butter, ghee, cheese, Dry fruits etc. would attract 12% tax from exiting 6% making them costlier. Vegetable oil, ice creams, sugar etc. would become cheaper due to reduction in taxes. Below is the comparison of new GST rates to existing taxes.

| CONSUMER GOODS | GST | Existing Tax |

| Aluminium foil | 28 | 18.5 |

| Agarbatti | 12 | 0 |

| Butter, ghee, cheese | 12 | 6 |

| Dry fruits | 12 | 6 |

| Jams, jellies | 18 | 12 |

| Branded paneer | 5 | 0 |

| Branded cereals | 5 | 0 |

| Coffee concentrates, custard powder | 28 | 26 |

| Protein concentrates, sugar syrups | 28 | 26 |

| Cereals | 0 | 0 |

| Puffed rice, papad, bread | 0 | 0 |

| Salt | 0 | 0 |

| Pasta, corn flakes, and cakes | 18 | 19.5 |

| Coffee, tea | 5 | 6 |

| Condensed milk | 18 | 18.5 |

| Toilet paper | 18 | 18.5 |

| Meats & fish preparations | 12 | 19.5 |

| Vegetable fats & oils | 5 | 12 |

| Ice cream, instant food mixes, sharbet | 18 | 26 |

| Refined sugar | 18 | 26 |

| Broomsticks | 5 | 18 |

| Milk beverages | 12 | 26 |

| Ready to eat namkeen/bhujiya | 12 | 26 |

| Beet sugar, cane sugar | 5 | 26 |

| Fresh milk | 0 | 0 |

| Fresh vegetables, roots & tubers | 0 | 0 |

| Fresh fruits | 0 | 0 |

| Fruits & vegetable juices | 12 | 12 |

Also Read: How are Mutual Funds Taxed?

GST on Beauty & Personal Care:

There is marginal increase in taxes from 26% to 28% for most Beauty & Personal Care products.

| BEAUTY AND PERSONAL CARE | GST | Existing Tax |

| Razors | 28 | 26 |

| Toothpaste | 28 | 26 |

| Deodorants | 28 | 26 |

| Aftershave | 28 | 26 |

| Shaving cream | 28 | 26 |

| Soap | 18 | 26 |

| Hair oil | 18 | 26 |

| Manicure, pedicure sets | 28 | 26 |

| Perfumes | 28 | 26 |

| Beauty or makeup preparations | 28 | 26 |

| Shampoos, hair cream, hair dyes | 28 | 26 |

Also Read: Is it mandatory to link Aadhaar to your Bank Account?

GST on Home Appliances:

The GST rates on home appliances such as Air conditioners, Refrigerators, etc. would be marginally higher from 26% to 28%.

| LIFESTYLE AND HOME APPLIANCES | GST | Existing Tax |

| Leather bags | 28 | 6 |

| Cell phones | 18 | 6 |

| Air conditioners | 28 | 26 |

| Refrigerators | 28 | 26 |

| Storage water heaters | 28 | 26 |

| Printer, photocopier, fax machines | 28 | 26 |

| Wristwatches | 28 | 26 |

| Furniture | 28 | 26 |

| Video game consoles | 28 | 26 |

| Exercise equipment | 28 | 26 |

| Sports goods | 12 | 18.5 |

| Spectacle lens | 12 | 18.5 |

| Proteins & fitness supplements | 18 | 26 |

| Steel utensils | 5 | 18.5 |

Also Read: 13 Investments to Generate Regular Income

GST on Construction Material:

Looking to construct your house? The GST rates would have negligible impact as there is slight increase of taxes in some cases while there is reduction in other. So there should be no significant impact on net taxes.

| CONSTRUCTION | GST | Existing Tax |

| Cement | 28 | 30 |

| Wall paper | 28 | 18.5 |

| Paints and varnishes | 28 | 26 |

| Putty, wall fillings | 28 | 26 |

| Plaster | 28 | 26 |

| Ceramic tiles | 28 | 26 |

| Tempered glass | 28 | 26 |

| Sand lime bricks, fly ash bricks | 5 | 6 |

Also Read: Name Mismatch in Aadhaar & PAN – Now you can Link both easily

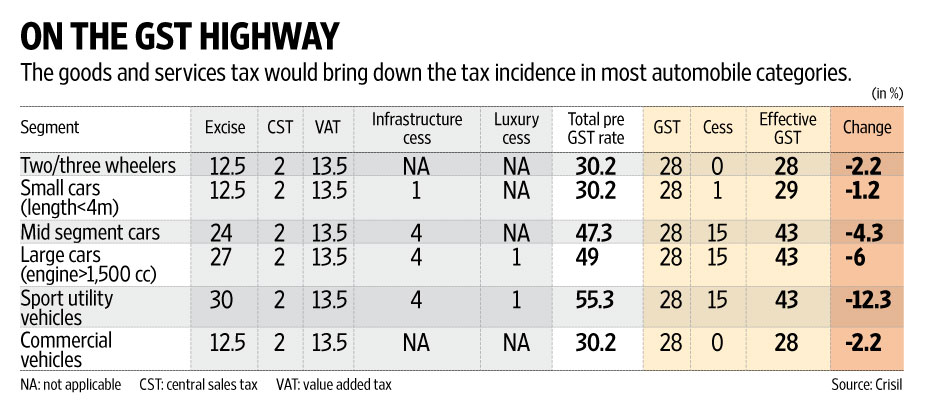

GST on Cars/Two Wheelers:

With GST, most cars would be taxed at lower rates. However the biggest beneficiaries would be expensive cars where the tax would reduce from 55% to 43%. In case of small cars the tax would come down from 30.2% to 29%.

To Conclude:

The GST rates have been fixed so that there is minimum impact on inflation. Its implementation well this might turn out to be a BIG tax reform.

Great article, extremely insightful. I was curious about the impact of GST on higher educational institutes? Would there be a GST-free education?