Filing income tax returns online have gain popularity in recent years. Some estimate that last year (2011) around 16 million tax payers used online option to file their tax returns. It is further estimated that this number would grow to around 25 million this year. With such a growth, there have been a slew of websites offering tax filing service for free to a few thousand rupees depending on your sources of income and ITR form used.

[button link=”http://wp.me/p3hLjG-1o7″ size=”large” style=”tick” color=”green” text=”light”]Click for Updated List of Websites for e-filing Tax Returns for AY 2014-15[/button]

This post covers a few of such websites and their offerings.

Cleartax.in:

Cleartax.in have the following options:

e-Filing for Individuals: Rs. 249

Income from Salary, Interest, House Property and Capital Gains is included. Also, multiple Form-16s, automatic Form-16 PDF reading. Also, all Deductions and all Capital Losses.

e-Filing for Business and Profession: Rs. 749

For filing Business and Profession Income Tax Return. This includes ITR-4S and ITR-4. Ideal for freelancers

Digital Signature Certificate: Rs. 449

you get a Digital Certificate valid for one year and one Income Tax Return filing

Other than the above packages you can get your Income Tax returned reviewed by their charted accountants (CA) team for Rs. 499 to Rs. 1,499

Offer 1: Free e-Filing for Individuals till July 7, 2012

Offer 2: Free -Filing for Women till July 26, 2012

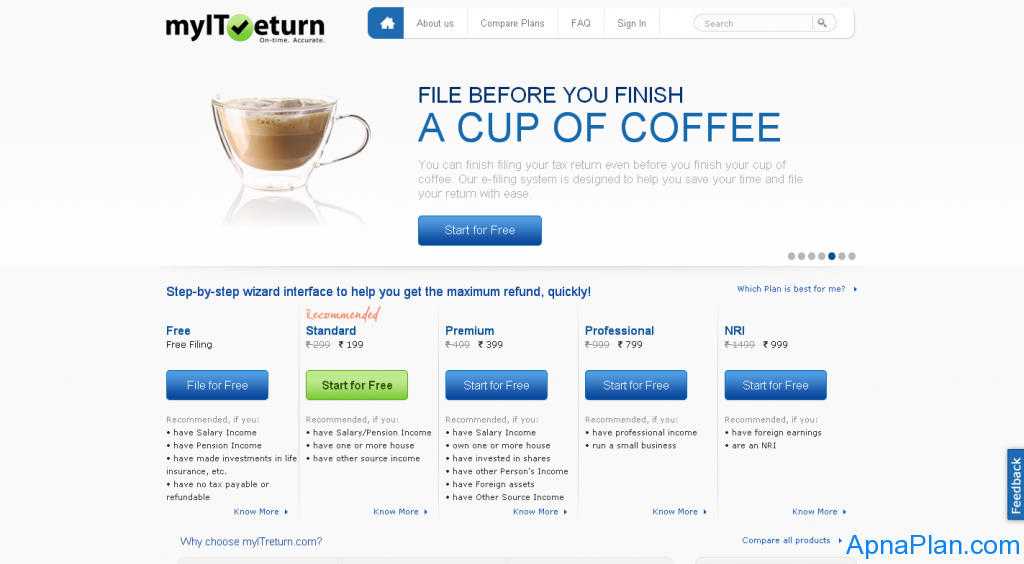

Myitreturn.com

Myitreturn.com has following options:

Free:

Recommended for individuals with Salary/ Pension income and have no tax payable or refundable

Standard: Rs. 199

Recommended for individuals with Salary/ Pension income, have one or more houses and other sources of income.

Premium: Rs. 399

Recommended for individuals with Salary/ Pension income, have one or more houses, other sources of income, invested in shares and have foreign assets

Professional: Rs. 799

Professional Income and those who have small business.

NRI: Rs. 999

For those who have foreign earnings and are NRIs

Other than these packages this website provides for following additional value added services:

- Get your IT Return Reviewed by an Expert – Rs. 199 to Rs. 599

- Get yourself ‘Assessment Protection’ – Rs. 299 to Rs. 799

- ITR-V Submission Service – Rs. 99

- Track your Refund Status – Rs. 199

- ITR-V Receipt Status – Rs. 99

- Know your Return Processing Status – Rs. 99

- Tax planning for 2012-13 – Rs. 199 to Rs. 999

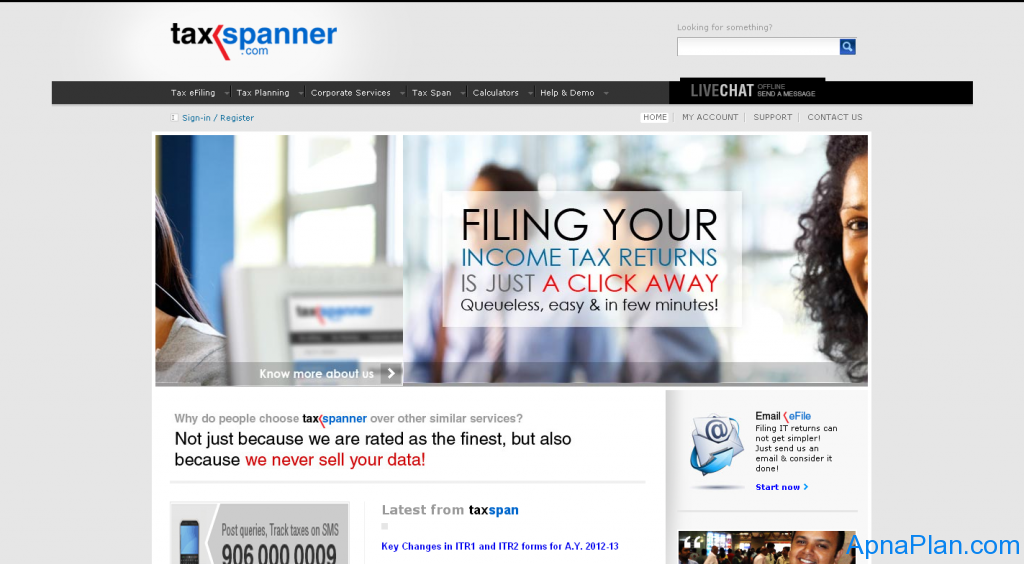

Taxspanner.com

Taxspanner.com has the following options:

Salary Standard: Rs. 249

ITR-1 or ITR-2. Income from salary, house property, capital gains or other sources, except income from business or profession

Salary e-plus: Rs. 499

Same as Salary Standard along with review and assistance of a tax professional

Salary Premium: Rs. 749

All the benefits of Salary Standard and Salary e-plus and add on feature of tracking of your refunds and tax assessment order.

Business Standard: Rs. 749

To file Sugam or ITR-4 form. For agents, consultants, professionals and contractors.

Business e-plus: Rs. 1,499

Same as Business Standard along with review and assistance of a tax professional

Business Premium: Rs. 2,499

All the benefits of Business e-Plus with a tax vault, a secure online space to store your tax and accounting documents

Digital Signature Certificate: Rs. 599

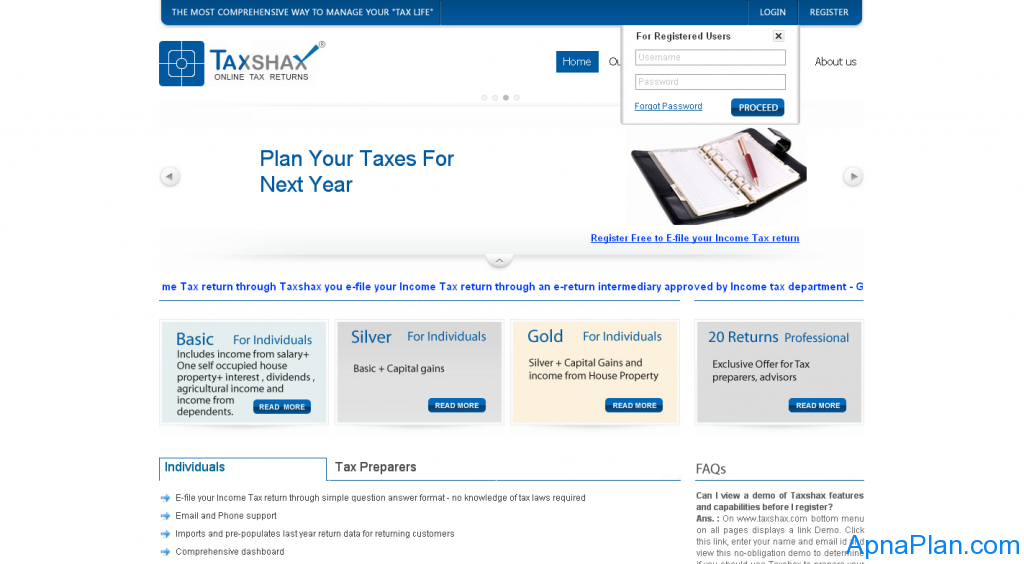

Taxshax.com

Taxshax.com has the following packages:

Basic: Rs. 181

Income from salary, dividends, one self occupied house and agriculture income

Silver: Rs. 324

Basic package along with Capital gains

Gold: Rs. 524

Silver Package with income from one house property.

Taxsmile.com

Taxsmile.com has following packages:

Silver: Rs. 250

ITR-1 and ITR-2. Salary, House property (i.e. Housing loan and rented income), Capital gain (Sale of shares and mutual funds, property and other asset), Business income (Consultancy, Professional Services, Speculation, Derivatives and Contract Employment) and Other Income (Interest, Dividends, Gifts, Winnings etc).

Gold: Rs. 400

Silver Package along with digital signature

Premium: Rs. 2,000

Gold Package along with virtual tax expert help for a year

Income Tax Department:

Website Link

Free: Covers all forms

The above list of websites are some of the random picks there are scores of other websites with similar offerings. I would be adding more and more of them in this post in near future. If you want to recommend or review any of these websites, you are welcome. Also please share your experiences about filing income tax returns online.

Hey!

This list is very helpful. Thanks so much for sharing this important information regarding filing itr online

I think Tax2win is not mentioned here. It is the easiest way to file your ITR online .

I have observed that big sites like hrblock, cleartax are more oriented towards bulk business customers and the user experience may not be accurate or satisfactory when it comes to tax computation and filing. I will put my bet on small, customer oriented sites like https://hamaratax.com, taxmanager etc which are here from 2011 and onwards and remains persistent in their work unlike the new blocks.

Taxchanakya.com is another comprehensive portal for filing your income tax returns It has Silver plan for individuals. It is ideal if your income includes efile salary.

I use Taxshax.com. My experience with the site is very good.

I would personally advise taxpayers to use the Income Tax Portal as Income Tax efiling can be very easily done through this portal and it is self-explanatory

I haven’t used it myself so cannot comment. But I am sure it should not be difficult.

I am one of the partner of http://www.chaireturn.com We have been started Chaireturn in the year 2011 and filing income tax return with Rs. 179/-. Client just need to upload his form-16 in our website then we do rest for him. Appreciate if could include Chaireturn also in the above list.

Please google more about the Chaireturn for reviews, comments and market.

Regards,

Saran

Last 2 years I am filing tax returns from I.T. Department site. I have no problem. Even Refund for the last year has been received.

I hope your comment would inspire our readers to use the Income tax department website for filing their IT return

Perfios.com is one other best platform to file tax return. Esp if u also manage the finance with the system. Their tax wizard for premium users is a breeze to work with. I filed my first tax filing using tax spanner. Perfios is much more organized to use.

I never used Perfios.com personally, but I an sure it would be good