One of my friends called me in a worrying voice telling me he had received an email from Income tax department with subject “Intimation U/S 143(1) for PAN ABCxxxxx4A AY:2019-20”. As with most of us, any communication from taxmen makes us worried and it was not much different for my friend.

Are you in the same boat and have you also received similar email from [email protected] with similar subject? And are you worried about what it means for you?

Well worry not! Intimation U/S 143(1) is sent by Income Tax department in response to the Tax returned filed by you. As the subject suggests “Intimation” – the communication intimates the tax payer about, any tax and interest payable or if you are eligible for refunds.

Also Read: 23 most common Investments and how they are Taxed?

This is done by the computer without any human intervention and checks for following two things:

- Any mathematical error or

- any incorrect tax claim

What you need to do is open the attached zip file. The zip file contains a PDF file which is password protected. To open this PDF following is your password.

The password is your PAN Number in lower case followed by your date of birth in DDMMYYYY format. So if your PAN Card Number is ABCDE1234A and date of birth is January 1, 1985, then your password would be abcde1234a01011985. The date of birth should be one which is mentioned on your PAN Card.

Download: The ultimate ebook guide to Save Tax

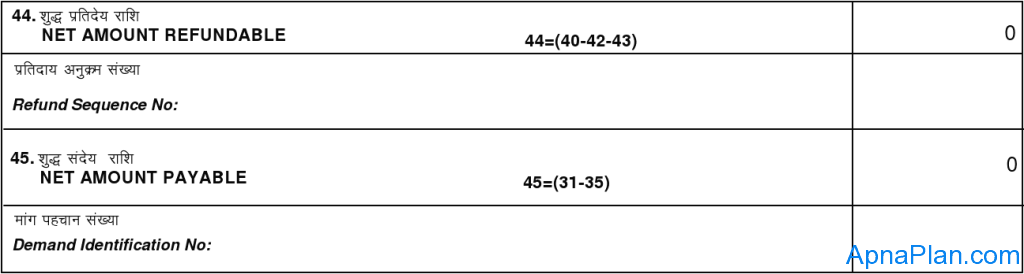

Just scroll down and at the end of all calculations you would see two headings.

- Net Amount Refundable

- Net Amount Payable

In case there is ‘0’ in front of both as in the picture above, it means that your tax return filing was perfect – you neither need to pay any more tax for the year nor you would get any tax refunds.

In case some amount is mentioned for “Net Amount Refundable” then its good news and you would soon get that amount in your bank account. And if “Net Amount Payable” has some amount mentioned, then you need to pay that much tax to Income tax department.

In case you think there is some error in the calculation sheet, you should consult a qualified CA or good tax expert for further action.

very good information for all new tax return filling people.

I filled first time return file for AY 2015-16 & 2016-17. Find that both year I am getting refund. My question is Tax department is able to see all other years tax (to be refund or to be paid by tax payer) than why they are not refunding for all other years if tax detucted is more than tax amount.

Tax department cannot initiate tax refund until you file ITR. This ITR is like a self declaration from your side about your income, TDS etc.

sir, i filed ITR-1 income tax for the assement year of 2015-16 on 11-08-2015 and again filled revised return on 20-08-2016 due to wrongly entered as 80C,80CCD,80D insted of 80C. I have received INTIMATION U/S 143(1) OF THE INCOME TAX ACT, 1961, Net Refundable & Payable amount is 0. May I know what need to be done next.

Sit back and relax 🙂

Dear Sir, Today(09/15/2016) I have received a email from [email protected] with “INITIMATION U/S 143(1) OF THE INCOME TAX ACT, 1961” form.

In this SL.No. 43(REFUND AMOUNT), As Provided by Taxpayer in Return of Income is calculated as 19,400 whereas As Computed Under Section 143(1) is calculated as 19,399.

SL.No. 47(TOTAL INCOME TAX REFUND) As Provided by Taxpayer in Return of Income is calculated as 19,400 whereas As Computed Under Section 143(1) is calculated as 19,882.

SL.No 50(NET AMOUNT REFUNDABLE) is calculated as 19,880 and SL.No 52(NET AMOUNT PAYABLE) is calculated as 0.

Please let me know do I need to respond anything back to tax department. Please clarify, thanks for all your support…

No action required

Sir, In my case, Net Amount Payable is Rs. 1/-. Based on your previous comments, Hope i can ignore this. Am i right ?

Yes ignore it

hi.. I have received a notice Intimation U/S 143(1) as per return file by me refundable tax amount is Rs. 50/- but as per notice it is Rs. 45. i have re check all amounts & heads & recalculate as per income tax software but it showing 50. actually it is 45 as per form 16A. is there any problem in IT return software. should i refile it return???

Any difference below Rs 100 does not matter and can be ignored. It would be adjusted in the next ITR filed by you. Also the tax is rounded off to next 10, so in your case Rs 45 has been rounded to Rs 50. So you need to do nothing 🙂

what if a intimation order under 143(1) demands more tax and I know that I had deliberately omitted that while filing return and now they have found out and asking me to ay up….but if I just do Nothing or sit on it….neither paying tax as asked nor contacting my AO……then what further procedure can definitely happen in my case from ITAX department side??……

If the tax amount is substantial, income tax authorities would send you further notices. If you ignore they can file case against you and freeze your bank accounts and even lead to fine and imprisonment.

My advise is obey the laws of the land and pay up. It’s not worth the effort to fight Income tax department especially when you are on the wrong side of the law!

hi ,

I also get email Intimation U/S 143(1) for PAN , under it is show payable amount is 5150 rs , when i calculate it is correct so i did payment using net banking ,self assisment tax , now what i have to do , anything else I have to do.is there is any way to verify it

Check if the same is reflected in Form 26AS (it would in few days). Once it starts reflecting you need to do nothing.

I have received INTIMATION U/S 143(1) OF THE INCOME TAX ACT, 1961, Net Refundable & Payable amount is 0. May I know what need to be done next.

Just relax – IT department has accepted your returns without any flaws!

Hi Amit,

For me I got both but refundable,payable amount but refundable amount is more than payable ,do I need to pay it? can you please suggest me.

Regards,

Sharmila.

If you have still not got your refund, your payable amount would be deducted and the rest refunded to you.

Thank you sooo much Amit for your reply ..I need to recheck it becuase I have submitted 4k as erfund but they are showing that I need to pay 1500 itseems.

Yes you should recheck and in case of confusion consult a tax expert.

Helloo Amit Sir! If u say that this is definitely a spam email! Then why this is Email is send to all of us?

Well spam emails can be sent to any id. Spammers just need email ids and it costs almost nothing to send it.

Thanks Bro… I was worried before reading the article and now it feels so great !!! :))))) you made my day.

Thank you 😉

Hi

I have received an Intimation u/s 143(1) of the income tax act 1961 in response to my e-return filed for FY2013-14.

It states tax payable as Inr. 1,700.

So request you to suggest me what should I do as next step to pay this amount?

Regards

Umesh

If you agree with the calculation provided by IT department, you should pay this amount and close the matter. If not you can contact your IT AO Officer and settle it with him. For payment of tax due follow the steps as in this post.

Some body is taking benifits of indian culture and natural behaviour…

Hi,

I got the following email. i think it’s a spam email. I did not open the attachment assuming it might be containing a virus. Please confirm if this could be an authentic email or spam.

Thanks,

Gagan

Subject: Rs 97,570 Tax Payment was Deducted From Your Account!!

From: “Income Tax Department” Wed, 4 Nov ’15 8:23a

To:

Show full Headers

1 attachment

Income_Tax_Challan.zip

154.31 KB

Download

Dear Sir,

We Have automatically deducted your tax payment from your Bank Account.

Kindly download and view your receipt below attached to this email.

Sincerely,

Income Tax Department

Yes Gagan this is definitely spam mail. Income tax Department cannot deduct taxes directly from bank accounts without any judgement etc. Thanks for sharing – would be helpful for all our readers.

Thanks for clarifying this. I also just received this email with same amount and was searching if the case is true and found your post.

Even we also got the same mail from income tax…

Thank you so much for the article. I received an intimation and when i looked into it i saw a math error. but my total refund and total payable was 0.

I also received a notice u/s 143(1)a and payable amount has been shown rs.57660 after adjusting tax rs.3800. Can I know on what basis IT Deptt has calculated this tax .

If tax is demanded by IT department and you think it’s should not be there you should contact your Assessing Officer or contact a CA