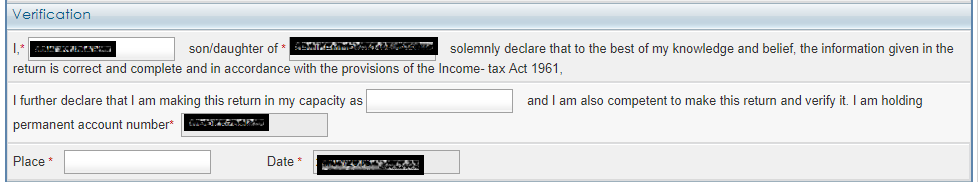

After you fill up your income tax return forms, the last section asks for Verification. The statement reads as:

I, (full name in block letters), son/ daughter of solemnly declare that to the best of my knowledge and belief, the information given in the return and the schedules thereto is correct and complete and is in accordance with the provisions of the Income-tax Act, 1961.

I further declare that I am making returns in my capacity as and I am also competent to make this return and verify it. Many tax payers are confused on what should the enter in my capacity as?

The problem is income tax department has left the form open ended although there are just a few options that can go here. Ideally, they should have provided with drop down options. The capacity depends on the person signing and verifying the ITR and can be as follows:

- Self if you are an individual (most of return filers would choose this)

- Karta if you are a HUF (Hindu Undivided Family)

- Legal Heir in case return is being filed for a deceased person

- Partner or Designated Partner in case of partnership firm/LLP

- Managing Director or Director in case of the company

- Managing Trustee or Trustee or Designated person for filing the return in case of Trust

- Power of attorney holder or Authorized Signatory in case the return is filed by POA holder

Here are some posts which can help you with e-filing of Income Tax Return:

- Calculate your Tax liability for AY 2021-22 (FY 2020-21)

- How to Claim Tax Exemptions while filing ITR?

- Use Challan 280 to Pay Self Assessment Tax Online

- Form 26AS – Verify Before Filing Tax Return

- 5 Ways to e-Verify your Income Tax Returns

- What if You DO NOT file your Returns by due Date?

- Can I file my Last Year Tax Return?

- Why and How to Revise Your Tax Return?

- What does Intimation U/S 143(1) of Income Tax Act mean?

I hope this resolves the doubt about what to fill in the my capacity as in the ITR Forms.

I have tried all the options but the XML fails to upload because of the error in this field. it is not accepting any value and I am stuck up. Please help.

I was also facing same issue.

Download the excel new utility PR4 from income tax website. Earlier excel utility had a problem that it always converted the value entered in capacity to capitals whereas income tax website expects “Self” word. New utility has dropdown so you will be able to generate XML with this change and upload.

Also there is option in excel utility to import from previous version which you can use to import your details from PR3 version to PR4 which will save your time for reentry.

Thank you very much for the information.