Every budget people hope that the income tax slabs for the year would change for benefit common man. However for most people its not always good news. But we can respite from the fact that not very long ago (FY 1991-92) the minimum tax rate in India was 20% and the maximum 56%. In case you were in the highest tax slab, you would pay more than half of your income to government as tax – a great incentive for not complying with tax laws. Thankfully taxes have been bit rationalized. Below is the tax slabs for different years:

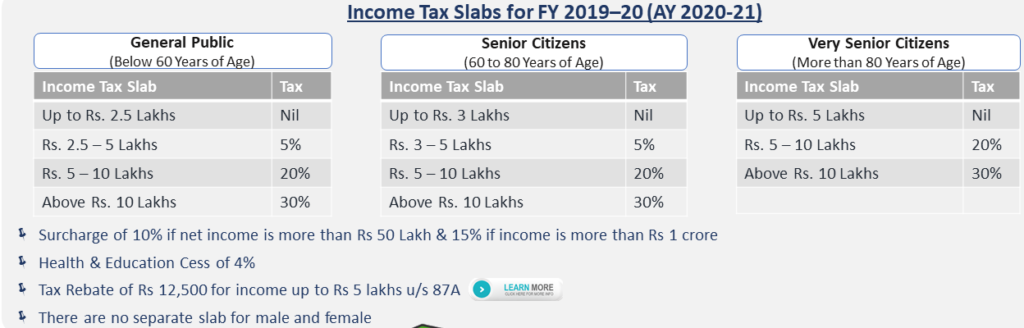

Income Tax Slab for FY 2019-20 (AY 2020-21)

There was no change in the income tax slab for FY 2019-20 (AY 2020-21) as compared to last year. However tax rebate was u/s 87A was changed from Rs 2,500 (for net income less than Rs 3.5 Lakhs) to Rs 12,500 (for net income less than Rs 5 Lakhs). With this change people with net-income of less than Rs 5 lakh have to pay NO taxes.

Income Tax Slab for FY 2018-19 (AY-2019-20)

Budget 2018 has made no change to the tax slab rates for FY 2018-19 (AY-2019-20), however the education cess of 3% has been increased to 4% and renamed as health & education cess. This would increase the tax outgo for all tax-payers. However in marginal relief to salaried & Pensioner tax payers Standard deduction of Rs 40,000 has been introduced.

Income Tax Slab for FY 2017-18 (AY 2018-19)

Budget 2017 has given a major relief to lower tax slab – the tax rates have been reduced from 10% to 5% for Income from Rs 2,50,000 – Rs 5,00,000. Also tax rebate u/s 87A up to Rs 2,500 is applicable for individuals with income below Rs 3.5 Lakhs.

![Income Tax Slab for AY 2020-21 3 Income Tax Slab for FY 2017–18 [AY 2018-19]](https://www.apnaplan.com/wp-content/uploads/2017/02/Income-Tax-Slab-for-FY-2017–18-AY-2018-19-1024x441.png)

Income Tax Slab for FY 2016-17 (AY 2017-18)

Budget 2016 has made No change in the income tax slab for FY 2016-17 (AY 2017-18). However for the surcharge on income above Rs 1 crore has been increased from 12% to 15%.

![Income Tax Slab for AY 2020-21 4 Income Tax Slabs for FY 2016–17 [AY 2017-18]](https://www.apnaplan.com/wp-content/uploads/2016/02/Income-Tax-Slabs-for-FY-2016–17-1024x426.png)

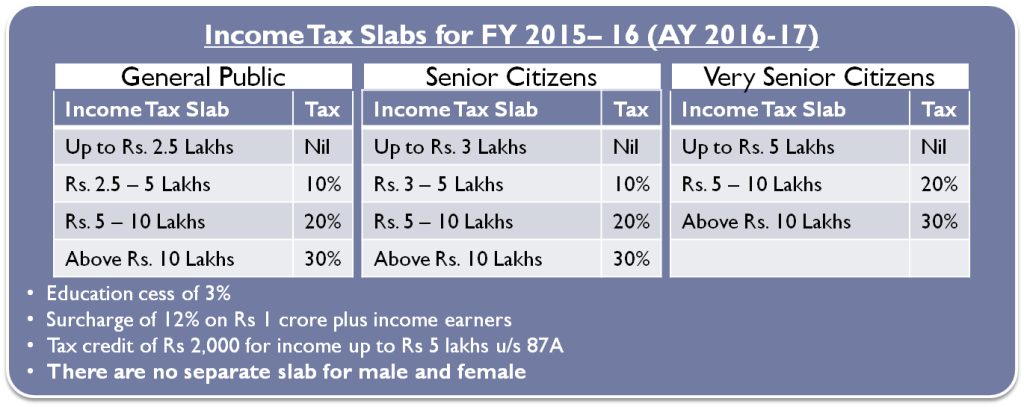

Income Tax Slab for FY 2015-16 (AY 2016-17)

There is no change in tax slabs for FY 2015-16 (AY 2016-17) for people with income of less than 1 crore. However for the super rich (with annual income of more than 1 crore) the surcharge has been increased from 10% to 12% resulting in increased marginal tax rate to 34.6% from 33.99%.

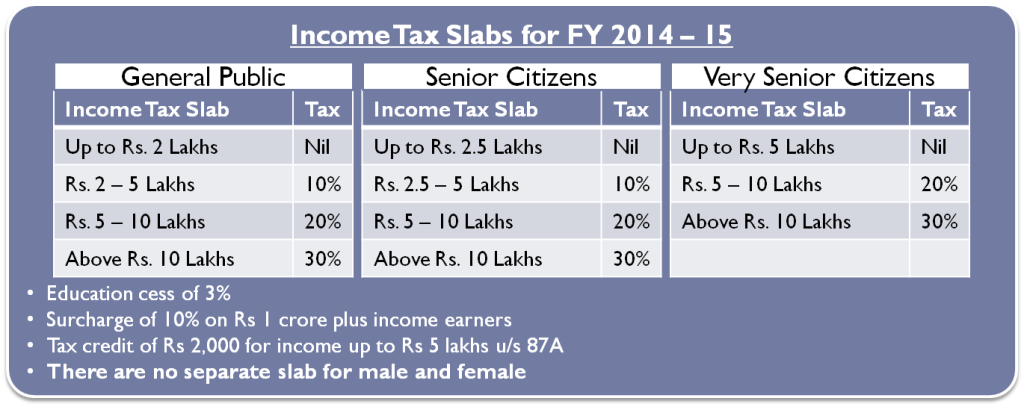

Income Tax Slab for FY 2014-15 (AY 2015-16)

Budget 2014 has modified the income tax slabs for FY 2014-15 (AY 2015-16). Income up to Rs 2.5 lakhs for General Public and up to Rs. 3 lakhs for Senior citizens are now exempted from paying Income tax. Earlier this limit was Rs 2 Lakhs for General Public and Rs 2.5 Lakhs for Senior Citizens. The exemption limit for investments under section 80C has been raised from Rs 1 Lakh to Rs 1.5 Lakhs.

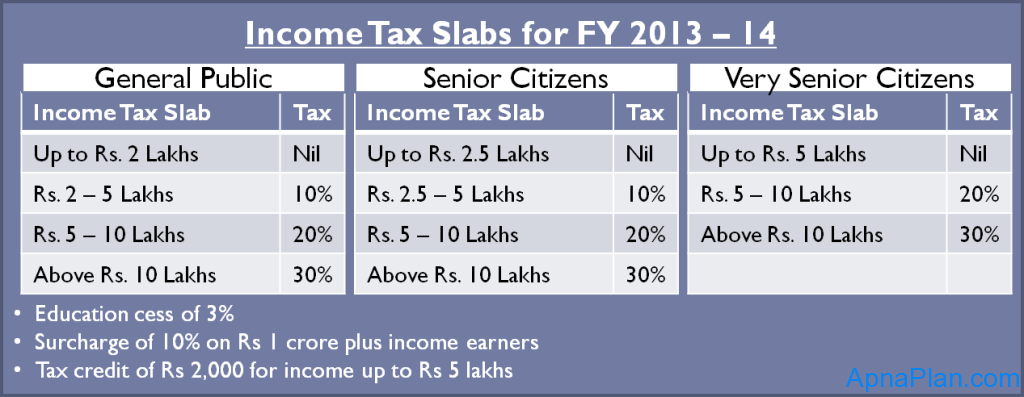

Income Tax Slab for FY 2013-14 (AY 2014-15)

The income tax slabs for FY 2013-14 (AY 2014-15) have largely remained unchanged for individuals. There are two major changes. People with income less than Rs. 5 Lakhs would get tax rebate of Rs. 2,000 u/s 87A. For people with income of more than Rs 1 crore, a surcharge of 10% has been levied.

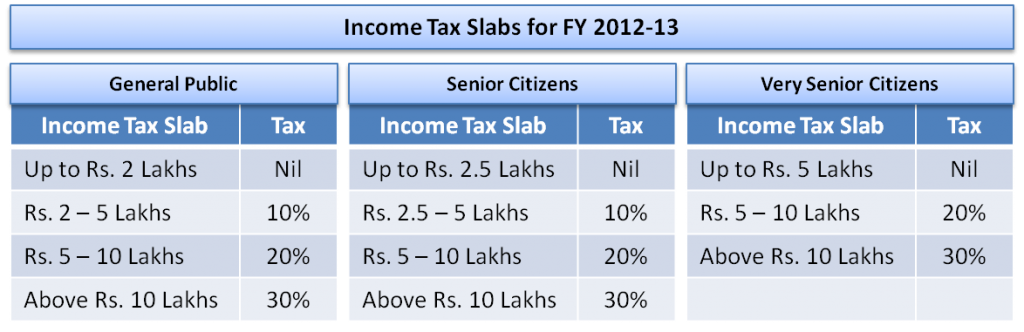

Income Tax Slab for FY 2012-13 (AY 2013-14)

The good news is the Income Tax slabs for FY 2012-13 (AY 2013-14) have been altered by the Finance Minister Pranab Mukarjee in Budget 2012 today. Now people would be able to save upto Rs. 22,600 in income tax depending on which tax slab they fall in. Another significant change in this budget was abolishing lower tax slab for women. Now both men and women would have same income tax slabs.

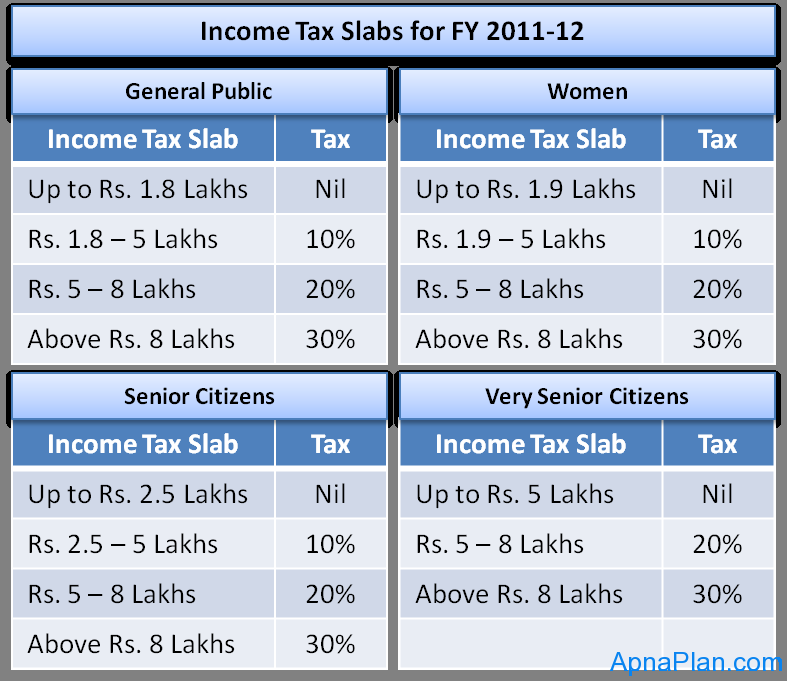

Income Tax Slab for FY 2011-12 (AY 2012-13)

Income Tax Slab History:

The table below shows how the tax slabs in India have changed over years since FY 1990-91. It has following columns:

- Minimum Income for Tax

- Lowest Tax Rate

- Income at Which Highest Tax Rate Starts

- Highest Tax Rate

- Highest Tax Rate Including Surcharge

| Financial Year | Minimum Income for Tax | Lowest Tax Rate | Income at which Highest Tax Rate Starts | Highest Tax Rate | Highest Tax Including Surcharge |

| 1990 – 91 | 22,000 | 20% | 100,000 | 50% | 56.00% |

| 1991 – 92 | 22,000 | 20% | 100,000 | 50% | 56.00% |

| 1992 – 93 | 28,000 | 20% | 100,000 | 40% | 44.80% |

| 1993 – 94 | 30,000 | 20% | 100,000 | 40% | 44.80% |

| 1994 – 95 | 35,000 | 20% | 120,000 | 40% | 44.80% |

| 1995 – 96 | 40,000 | 20% | 120,000 | 40% | 40.00% |

| 1996 – 97 | 40,000 | 20% | 120,000 | 40% | 40.00% |

| 1997 – 98 | 40,000 | 10% | 150,000 | 30% | 30.00% |

| 1998 – 99 | 50,000 | 10% | 150,000 | 30% | 33.00% |

| 1999 – 00 | 50,000 | 10% | 150,000 | 30% | 34.50% |

| 2000 – 01 | 50,000 | 10% | 150,000 | 30% | 30.60% |

| 2001 – 02 | 50,000 | 10% | 150,000 | 30% | 31.50% |

| 2002 – 03 | 50,000 | 10% | 150,000 | 30% | 33.00% |

| 2003 – 04 | 50,000 | 10% | 150,000 | 30% | 33.60% |

| 2004 – 05 | 50,000 | 10% | 150,000 | 30% | 33.60% |

| 2005 – 06 | 50,000 | 10% | 150,000 | 30% | 33.60% |

| 2006 – 07 | 50,000 | 10% | 150,000 | 30% | 33.60% |

| 2007 – 08 | 110,000 | 10% | 250,000 | 30% | 33.90% |

| 2008 – 09 | 110,000 | 10% | 250,000 | 30% | 33.90% |

| 2009 – 10 | 160,000 | 10% | 500,000 | 30% | 33.90% |

| 2010 – 11 | 160,000 | 10% | 500,000 | 30% | 30.90% |

| 2011 – 12 | 180,000 | 10% | 800,000 | 30% | 30.90% |

| 2012 – 13 | 200,000 | 10% | 1,000,000 | 30% | 30.90% |

| 2013 – 14 | 200,000 | 10% | 1,000,000 | 30% | 33.99% |

| 2014 – 15 | 250,000 | 10% | 1,000,000 | 30% | 33.99% |

| 2015 – 16 | 250,000 | 10% | 1,000,000 | 30% | 34.61% |

| 2016 – 17 | 250,000 | 10% | 1,000,000 | 30% | 35.54% |

| 2017 – 18 | 250,000 | 5% | 1,000,000 | 30% | 35.54% |

| 2018 – 19 | 250,000 | 5% | 1,000,000 | 30% | 35.88% |

| 2019-20 | 250,000 | 5% | 1,000,000 | 30% | 35.88% |

- Highest Tax Rate Including Surcharge has come down from 56% in FY 1990-91 to 30.9% since 2010-11 and has again gone up from FY 2013-14 (for income above Rs 1 Crore)

- The exemption limit for Income Tax has also increased more than 10 times from Rs. 22,000 in 1990-91 to Rs. 2.5 Lakhs in FY 2014-15

- Even the lowest tax rate has gone down from 20% to 5%