Infrastructure Bonds available in February 2012

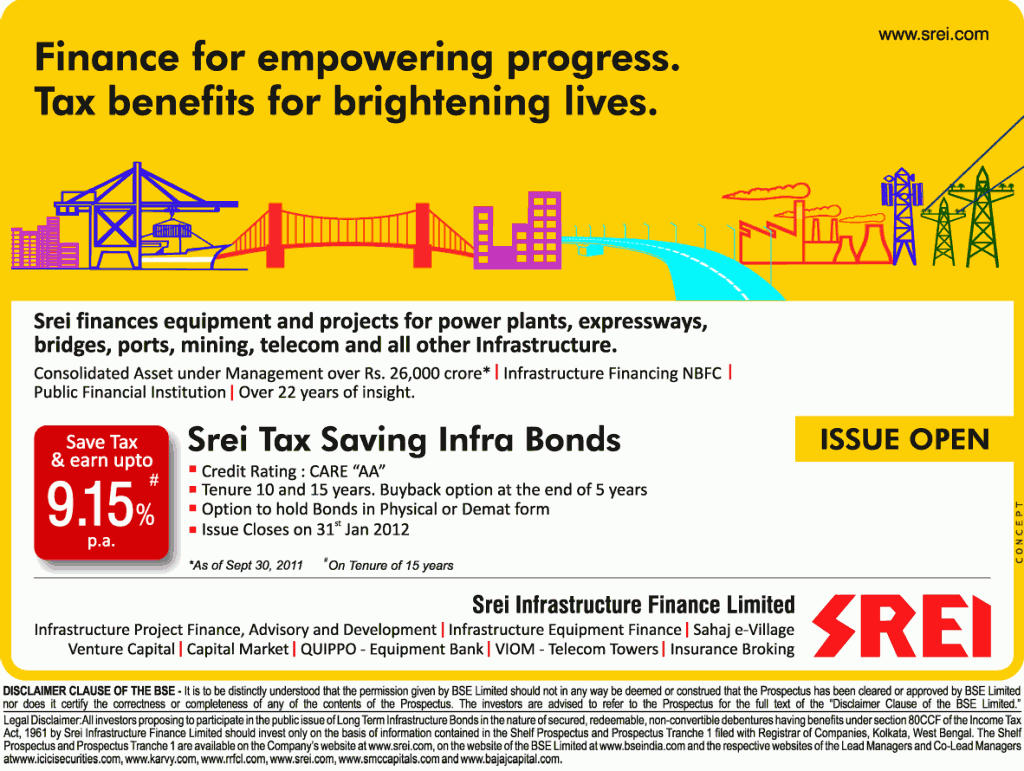

If you still looking for investing in Infrastructure Bonds for saving income tax in February 2012, you have option from five companies. IFCI Rural Electrification Corporation L&T Infrastructure Finance Company Infrastructure Development Finance Company (IDFC) SREI Infrastructure Finance Just in case you missed it, an investment in infrastructure bonds under Section 80CCF is an additional window […]