We have designed the excel based Sukanya Samriddhi Yojana Calculator which calculates the maturity amount and return on investment for your investment. The scheme was launched in 2015 and since then has become is very popular deposit scheme for girl child especially focusing on their higher education and marriage.

Sukanya Samriddhi Calculator Rules

Below are some basic rules for SSY Account:

- Sukanya Samriddhi Account can be opened in any post office and designated branches of authorised banks.

- This account can be opened only for girl child who is below 10 years of age (as of account opening date) by their natural or legal guardian

- The account can only be opened for 2 girl children. Third account can be opened in exceptional cases where the depositor was blessed with 3 girl children at the first birth or twin girl children at the second birth.

- Only resident Indians are eligible to open Sukanya Samriddhi Account.

- Investment in this scheme is eligible for income tax benefit under section 80C.

- Partial withdrawal up to 50% is allowed for the higher study of girl child after 18 years of age.

Sukanya Samriddhi Yojana – Investment Rules

- The deposit has to be made for first 14 years from the year of account opening. The account matures either from 21 years from the date of account opening or when the girl is married, whichever is earlier.

- Maximum Deposit limit per financial year per account is Rs 1.5 Lakh

- You need to deposit minimum Rs 250 per account per year to keep it active

- The interest rate is declared every quarter by Government of India

- The interest is compounded annually

- For calculation of interest only lowest balance from the close of tenth day to end of month would be considered. This means you should deposit money before 10th of month to get interest in that month.

Sukanya Samriddhi Yojana Calculator

Download the excel based Sukanya Samriddhi Yojana calculator to estimate the amount you can expect at the time of maturity. The maturity amount would give you a rough idea as the interest rates change every quarter.

Calculator for Small Saving Scheme – PPF, SCSS, Sukanya Samriddhi, NSC, Post Office FD/RD/MIS

Small saving scheme sponsored by Government of India like Sukanya Samriddhi Account, PPF, Senior Citizens’ Savings Scheme are quite popular and rightly so because of the safety, higher interest rate offered among other things. We have built calculator for each of them where you can check the maturity amount, loan eligibility, partial withdrawal and more. Click on the links to get the relevant calculator

Sukanya Samriddhi Yojana Calculator

Senior Citizens’ Savings Scheme Calculator

Post Office Fixed Deposit (Time Deposit) Calculator

How does Sukanya Samriddhi Yojana Calculator work?

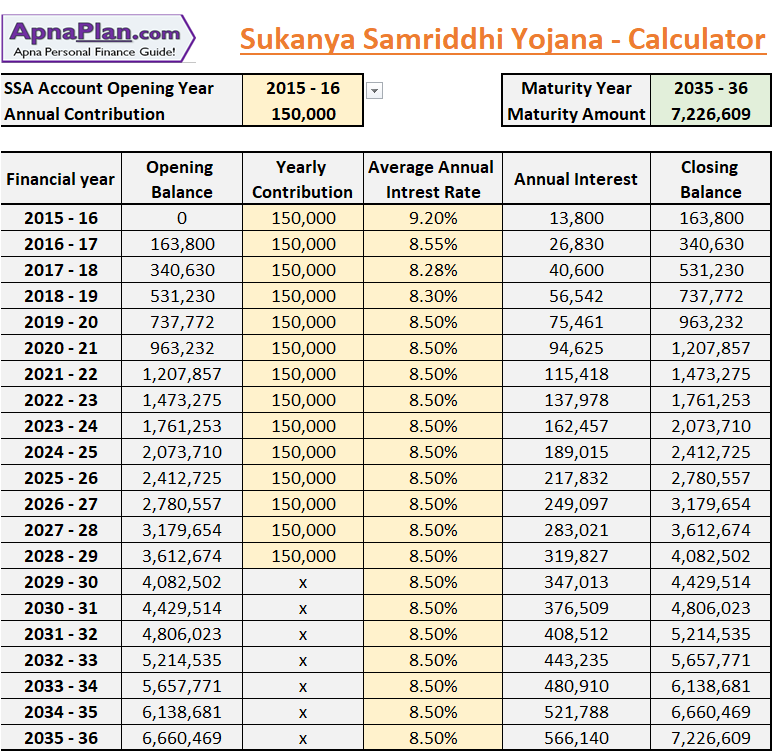

The Sukanya Samriddhi Account Calculator is easy to use. The calculator looks like in the picture below. You can only input orange cells. All you need is to fill up the SSY account opening year and annual contribution.

In case the yearly contribution varies over time, you can edit that too. The interest rate for Sukanya Samriddhi Yojana is revised every quarter. I would recommend taking average for a year and put it in “Average Annual Interest Rate”. This will give you approximate value of the maturity amount. As shown in the example below, if you deposit Rs 1.5 lakhs every year for 14 years, you can expect to get Rs 72 lakhs at maturity (assuming 8.5% interest every year)

Following are the assumptions for the calculator:

- The amount is deposited on start of every financial year.

- The example has 1.5 lakhs contribution every year, but can be edited in the calculator.

- The contribution happens for 14 years and is withdrawn on completion of 21 years

- Interest rate is taken as 8.5% for future years (can be changed in the calculator)

How much Taxes you Need to Pay this Year? Download Our Income Tax Calculator to Know your Numbers

Do you know how much tax you need to pay for the year? Have you taken benefit of all tax saving rules and investments? Should you use the “NEW” tax regime or continue with the old one? In case you have all these questions just Download the Free Excel Income Tax Calculator for FY 2021-22 (AY 2022-23) and get your answers.

Sukanya Samriddhi Yojana Calculator FAQs

✅Who can open Sukanya Samriddhi Yojana Account?

The Sukanya Samriddhi Yojana Account can be opened for a girl child under 10 years of age by their parents or legal guardian. The account can only be opened for 2 girl children. Third account can be opened in exceptional cases where the depositor was blessed with 3 girl children at the first birth or twin girl children at the second birth.

✅How many Sukanya Samriddhi Yojana Account can be opened?

One girl child can have only one account. Also any parents can only open maximum two accounts for each girl.

✅How to use the Sukanya Samriddhi Account Calculator?

Download the Sukanya Samriddhi Yojana Account calculator. You need to just input your annual contribution amount and it gives the maturity amount. You can also edit contribution and interest rate for each year to suit your situation.

✅What is the maturity period for Sukanya Samriddhi Yojana?

The Sukanya Samriddhi Yojana Account matures at 21 years from date of opening. The investor has to invest for first 14 years and can withdraw after 21 years.

✅Does Sukanya Samriddhi Yojana give any tax benefit?

The investment in Sukanya Samriddhi Yojana is eligible for tax deduction under section 80C of Income Tax Act.

✅Is there investment limit for Sukanya Samriddhi Yojana Account?

The minimum deposit amount is Rs 250 for a year and the maximum limit is Rs 1.5 lakhs each year.

✅Is the Sukanya Samriddhi Yojana maturity amount taxable?

The amount received by the girl child at the time of maturity is completely tax free.

✅What is the interest rate on Sukanya Samriddhi Yojana?

The interest rate is 7.6% for the month of April to June 2020. Do remember that the interest rates is revised every quarter by Government of India.

Thanks for the information.. I would like Sushil Finance to make this a part of their excellent the financialy well being.. program. It will surely create awareness.

i would like to go forward about .“Sukanya Samriddhi Yojana pls clarity whether PLI OR “Sukanya Samriddhi Yojana is best for saving girl children

Send details