What is the interest rate for Sukanya Samriddhi Yojana for 2019? How and when does the interest rates change? How the interest rate for SSY account has changed historically? This post answers all the above questions.

Sukanya Samriddhi Yojana is a very popular small deposit scheme for girl child guaranteed by Government of India to encourage savings for girl child for their education and marriage.

How and when does the interest rates change?

Starting April 2016, Government of India announces interest rate on small saving schemes including Sukanya Samriddhi Account, PPF, Senior Citizen Savings Scheme, Post Office Fixed and Recurring Deposits every quarter. This is done to keep these interest rates in sync with the market rates.

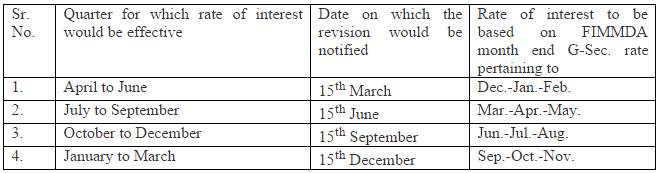

The table below shows the interest reset schedule:

Sukanya Samriddhi Yojana Interest Rate:

Sukanya Samriddhi Yojana was launched in January 2015 and at that time the interest rate was 9.1%. It went up to 9.2% for FY 2015-16 and presently at 8.4%. The table below lists the interest rates:

Based on Financial Year:

| Financial year | Apr – Jun | Jul – Sep | Oct – Dec | Jan – Mar |

| 2019 – 20 | 8.50% | 8.40% | ||

| 2018 – 19 | 8.10% | 8.10% | 8.50% | 8.50% |

| 2017 – 18 | 8.40% | 8.30% | 8.30% | 8.10% |

| 2016 – 17 | 8.60% | 8.60% | 8.50% | 8.50% |

| 2015 – 16 | 9.20% | 9.20% | 9.20% | 9.20% |

| 2014 – 15 | x | x | x | 9.10% |

Based on Calendar Year:

| Year | Jan – Mar | Apr – Jun | Jul – Sep | Oct – Dec |

| 2019 | 8.50% | 8.50% | 8.40% | |

| 2018 | 8.10% | 8.10% | 8.10% | 8.50% |

| 2017 | 8.50% | 8.40% | 8.30% | 8.30% |

| 2016 | 9.20% | 8.60% | 8.60% | 8.50% |

| 2015 | 9.10% | 9.20% | 9.20% | 9.20% |

Sukanya Samriddhi Yojana – Rules:

Below are some basic rules for SSY Account:

- Sukanya Samriddhi Account can be opened in any post office and designated branches of authorized banks.

- This account can be opened only for girl child who is below 10 years of age (as of account opening date) by their natural or legal guardian

- The account can only be opened for 2 girl children. Third account can be opened in exceptional cases where the depositor was blessed with 3 girl children at the first birth or twin girl children at the second birth.

- Only resident Indians are eligible to open Sukanya Samriddhi Account.

- Investment in this scheme is eligible for income tax benefit under section 80C.

- Partial withdrawal up to 50% is allowed for the higher study of girl child after 18 years of age.

Also Read: Everything you wanted to know about PPF

Sukanya Samriddhi Yojana – Investment Rules:

- The deposit has to be made for first 14 years from the year of account opening. The account matures either from 21 years from the date of account opening or when the girl is married, whichever is earlier.

- Maximum Deposit limit per financial year per account is Rs 1.5 Lakh

- You need to deposit minimum Rs 250 per account per year to keep it active

- The interest rate is declared every quarter by Government of India

- The interest is compounded annually

- For calculation of interest only lowest balance from the close of tenth day to end of month would be considered. This means you should deposit money before 10th of month to get interest in that month.

My grand daughter 3 months old , can I sponsor her for Sukanya samridhi?

Will the 8.4% interest rate for the entire 21 years?

Appreciate your kind response.